General Manager of the Bank for International Settlements (BIS), Agustín Carstens, gave a talk at Goethe University in its House of Finance, Tuesday, 6 February in Frankfurt. Titled Money in the Digital Age: What Role for Central Banks?, the talk saw Mr. Carstens acknowledge “We have seen a bit of a shift, to issues at the very heart of central banking. This shift is driven by developments at the cutting edge of technology. While it has been bubbling under the surface for years, the meteoric rise of bitcoin and other cryptocurrencies has led us to revisit some fundamental questions that touch on the origin and raison d’être for central banks.”

Also read: Market Risk Advisory Committee: Bitcoin Futures Self-Certification Works

World’s Central Banker: Bitcoin Challenges Heart of Central Banking

As the central banker to the globe’s central banks, the BIS special drawing rights balance nears a quarter trillion in reserves. The body is made up of 60 member states, heavily weighted toward Europe with over half its membership. The Depression-era organization in its current incarnation is a collaborative body issuing stress tests, acting as a prime counterparty, and a trustee to the world’s central banks.

Mr. Carsten’s appearance is part of a lecture series sponsored by Sustainable Architecture for Finance in Europe, the Center for Financial Studies, and the Deutsche Bundesbank. At issue to the GM were three principal questions: “What is money? What constitutes good money, and where do cryptocurrencies fit in? And, finally, what role should central banks play?,” he asked.

Money, he asserts, is flatly connected to government, “an indispensable social convention backed by an accountable institution within the State that enjoys public trust.” Setting the tone, he immediate claims, “Private digital tokens posing as currencies, such as bitcoin and other crypto-assets that have mushroomed of late, must not endanger this trust in the fundamental value and nature of money.”

After a brief discussion of money’s history, he stumbles upon what amounts to patting himself on the back, insisting “laissez-faire is not a good approach in banking or in the issuance of money. Indeed, the paradigm of strict bank regulation and supervision and central banks overseeing the financial and monetary system that has emerged over the last century or so has proven to be the most effective way to avoid the instability and high economic costs associated with the proliferation of private and public monies,” which sets up a dramatic conflict with cryptocurrency such as bitcoin.

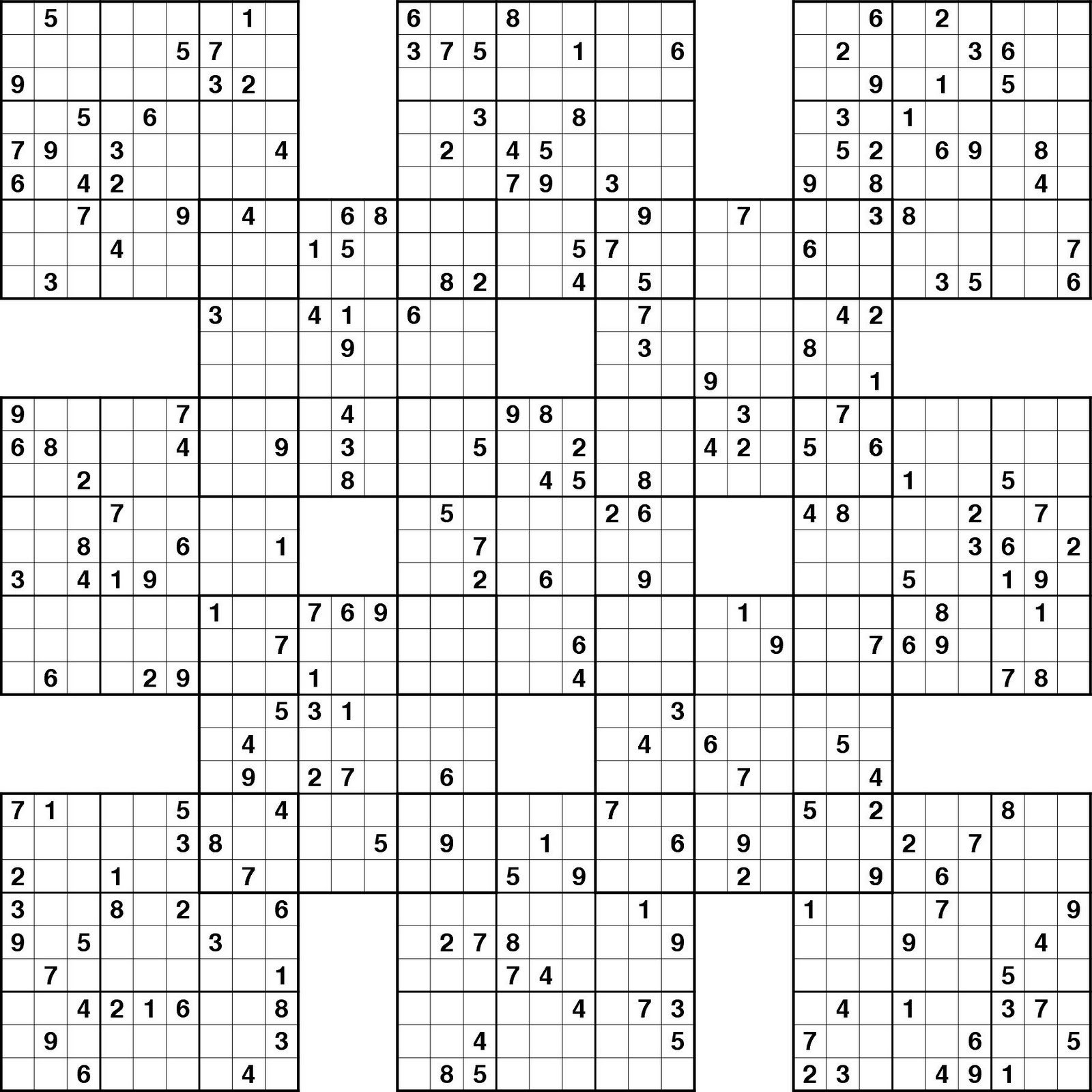

Basically Just Mega-Sudokus

Dismissing almost out of hand the distributed ledger technology undergirding bitcoin, he waxes, “Who would have thought that having people guessing solutions to what was described to me by a techie as the mathematical equivalent of mega-sudokus would be a way to generate consensus among strangers around the world through a proof of work? Does it thus provide a novel solution to the problem of how to generate trust among people who do not know each other?,” he asked rhetorically.

He then characterizes bitcoin as having three “obvious flaws.” Debasement, trust, and inefficiency are hallmarks of what Mr. Carstens views as “novel technology.” Debasement, he contends, happens through forks, creating seemingly endless versions of bitcoin which he believes are essentially inflationary, contrary to its claim of being scarce. “After all, it just takes a bunch of smart programmers and a catchy name. As in the past, these modern-day clippings dilute the value of existing ones, to the extent such cryptocurrencies have any economic value at all,” he warns.

Any trust crypto has garnered has come through centralization, through trading with fiat currencies on exchanges, he argues. “More generally,” Mr. Carstens continues, “they piggyback on the same institutional infrastructure that serves the overall financial system and on the trust that it provides. This reflects their challenge to establish their own trust in the face of cyber-attacks, loss of customers’ funds, limits on transferring funds and inadequate market integrity.”

Bitcoin in particular seems wholly inefficient as he understands it, and “while perhaps intended as an alternative payment system with no government involvement, it has become a combination of a bubble, a Ponzi scheme and an environmental disaster,” he urged. “Accordingly, authorities are edging closer and closer to clamping down to contain the risks related to cryptocurrencies. There is a strong case for policy intervention. As now noted by many securities markets and regulatory and supervisory agencies, these assets can raise concerns related to consumer and investor protection. Appropriate authorities have a duty to educate and protect investors and consumers, and need to be prepared to act,” he said ominously.

What do you think about the General Manager’s talk? Let us know in the comments section below.

Images courtesy of Pixabay, BIS.

The Bitcoin universe is vast. So is Bitcoin.com. Check our Wiki, where you can learn everything you were afraid to ask. Or read our news coverage to stay up to date on the latest. Or delve into statistics on our helpful tools page.

The post World Central Banker to Central Banks: Bitcoin Is a Bubble, Ponzi, and Disaster appeared first on Bitcoin News.

Powered by WPeMatico