The Thai central bank has prohibited financial institutions in the country from five key cryptocurrency activities, including banning customers from buying cryptocurrencies with credit cards.

Also read: Japan’s DMM Bitcoin Exchange Opens for Business With 7 Cryptocurrencies

Banks Banned From 5 Crypto Activities

The Bank of Thailand (BOT) issued a circular on Monday asking “financial institutions not to get involved in cryptocurrency transactions for fear of possible problems from the unregulated trading,” Reuters translated.

The Bank of Thailand (BOT) issued a circular on Monday asking “financial institutions not to get involved in cryptocurrency transactions for fear of possible problems from the unregulated trading,” Reuters translated.

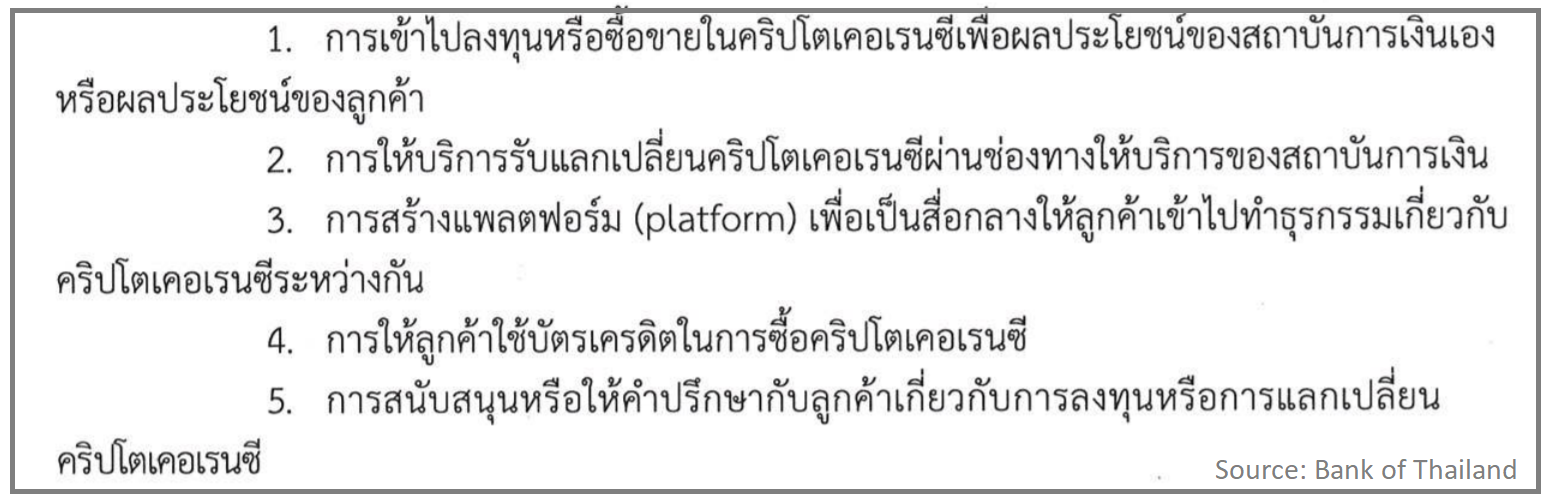

Mr. Wisit Santiprabop, the central bank’s governor, signed the circular which outlines five key cryptocurrency activities banks are banned from:

Investing or trading in cryptocurrency, exchanging cryptocurrencies, creating platforms for cryptocurrency trading, allowing clients to use credit cards to buy cryptocurrencies, and from advising customers on cryptocurrency investing or trading.

The central bank stated that “cryptocurrencies were not legal tender in Thailand,” the publication conveyed, adding that “it was worried that they may be used in illegal activities such as money laundering or supporting terrorism.”

Recently, the Thai government announced that it will not ban cryptocurrencies and is developing a regulatory framework for them.

Banks Complying

Ms. Prasanee Auiyamaphan, a Bangkok Bank Executive Assistant, was quoted by Voice TV saying that the bank has “no policy to provide [crypto] exchange services,” emphasizing that cryptocurrencies cannot be exchanged for cash at her bank.

Ms. Prasanee Auiyamaphan, a Bangkok Bank Executive Assistant, was quoted by Voice TV saying that the bank has “no policy to provide [crypto] exchange services,” emphasizing that cryptocurrencies cannot be exchanged for cash at her bank.

Mr. Thana Thienachariya, Senior Executive VP and Chief Marketing Officer at Siam Commercial Bank said that its subsidiary, Digital Ventures Co. Ltd., has previously formed a strategic alliance with Ripple to offer a payment service between Japan and Thailand. He added that his bank will be discussing this issue with the central bank.

Mr. Thana Thienachariya, Senior Executive VP and Chief Marketing Officer at Siam Commercial Bank said that its subsidiary, Digital Ventures Co. Ltd., has previously formed a strategic alliance with Ripple to offer a payment service between Japan and Thailand. He added that his bank will be discussing this issue with the central bank.

Mr. Thakorn Piyapan, Head of Krungsri Consumer Group and an executive of Digital Banking and Innovation at Bank of Ayudhya said, “although the bank will use the transfer service across the country through Ripple,” it is cooperating with the BOT and “does not provide any [cryptocurrency] services at all.”

Mr. Thakorn Piyapan, Head of Krungsri Consumer Group and an executive of Digital Banking and Innovation at Bank of Ayudhya said, “although the bank will use the transfer service across the country through Ripple,” it is cooperating with the BOT and “does not provide any [cryptocurrency] services at all.”

He explained that there are some areas that banks need to examine before being able to comply. For example, to prevent customers from buying cryptocurrencies using credit cards, he elaborated:

In Thailand, people are buying digital currency. So the bank is asking for time to check the type of transactions that customers [make when they] swipe cards that are associated with digital currency. If applicable, the bank may have to suspend the service.

Recently, banks in the US and well as the UK have also banned their credit card customers from buying cryptocurrencies.

As for cryptocurrency traders, Poramin Insom, managing director of the Thai crypto exchange TDAX, said that “there is no impact on people who are investors of cryptocurrencies,” the news outlet quoted him. However, he explained, “TDAX is affected by this announcement, which makes the process of opening an account with the bank take longer. Bank of Thailand requests more documents.”

What do you think of the Bank of Thailand’s action? Let us know in the comments section below.

Images courtesy of Shutterstock, Bangkok Bank, SCB, Krungsri, and Bank of Thailand.

Need to calculate your bitcoin holdings? Check our tools section.

The post Bank of Thailand Bans Banks From Cryptocurrency Activities appeared first on Bitcoin News.

Powered by WPeMatico