BTC prices and a vast majority of other cryptocurrencies have taken a significant dive over the past 24-hours as the entire crypto-economy shaved $75Bn from its recent highs this week. BTC/USD markets dropped to a low of $9,730.

Also Read: China Censors Cryptocurrency Ads on Search Engines and Social Media

Crypto-Markets See Losses Between 3-20 Percent

Two days ago BTC/USD markets reached a high of $11,780 across global trading platforms, but bulls seem to have lost some of the momentum. Presently bulls are trying to get the price back above the $10K region after dipping well below that range on February 22. Trade volume is a bit thinner today as $8.5Bn has been traded over the past 24-hours. The top five exchanges swapping the most BTC today includes Binance, Bitfinex, Okex, Upbit, and Bithumb. All of these trading platforms are trading less than $1Bn in trade volume per exchange. The Japanese yen is still leading the pack when it comes to currency by volume with the nation’s money dominating by 39 percent. This is followed by the USD (28%), tether (USDT 17%), the Korean won (5.9%), and the euro (5.4%).

Technical Indicators

Technical indicators show some differences since our last markets update. For instance, the two Simple Moving Averages (SMA) have crossed paths earlier this morning. The 200 SMA is now above the short term 100 SMA, indicating the current bearish sentiment may last a bit longer before a rebound. However MACd, RSI, and Stochastic are all heading northbound after the price touched the $9,700 region.

Order books show bulls have to break the $10,200 territory in order to continue climbing upwards smoother. There will also be pitstops around $10,500-10,700. On the back side, support has increased since the dump, and solid foundations can be found between $9,700-9,100. If the price breaks the Displaced Moving Average (DMA) at $9,100, there is still a lot of foundational support between $8,700 through $8,200.

Overall Digital Asset Market Performances

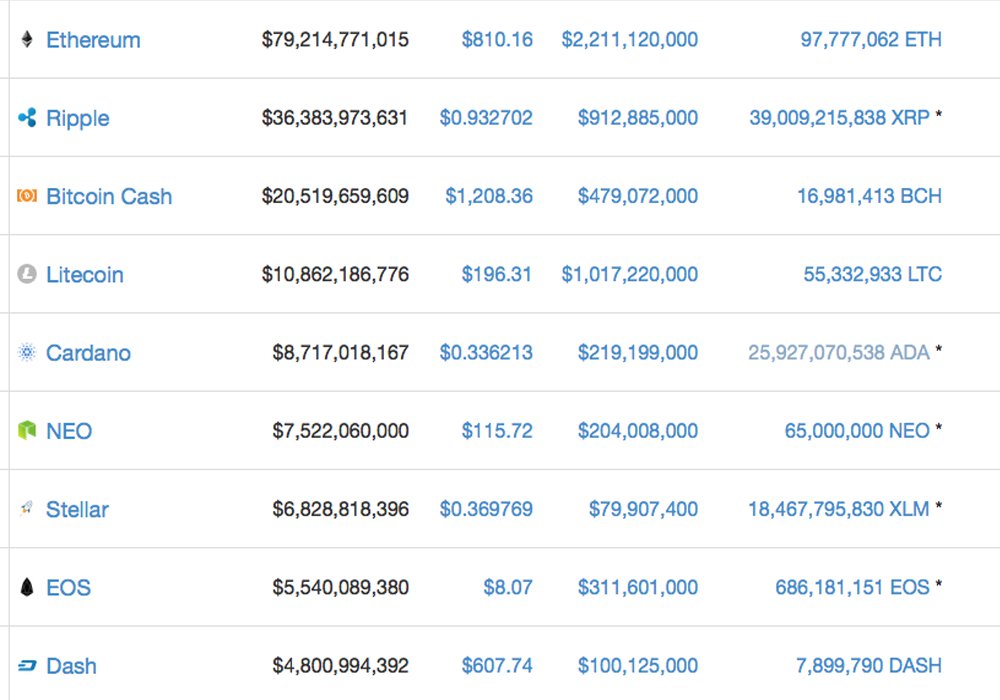

In general, the entire cryptocurrency ecosystem is suffering from losses between 3-20 percent. Ethereum (ETH) markets are down 3.9 percent today with a price of around $810 per ETH. The third highest capitalization held by ripple (XRP) is down 8.8 percent as one XRP is trading for $0.93. Bitcoin cash (BCH) prices are seeing markets lose 7.9 percent and the price per BCH is roughly $1,208. Lastly, the fifth highest market valuation held by litecoin (LTC) is down 7.6 percent. Litecoin’s price is hovering around $196 per LTC at the time of publication. The entire cryptocurrency market cap is about $430Bn with bitcoin core (BTC) markets dominating by 39 percent.

The Verdict: Crypto Traders Are Still Optimistic

Currently, traders and enthusiasts in chat rooms and forums are discussing how far this dip will go after experiencing a significant downturn over the first five weeks of the new year. Some believe the current correction may just be a ‘bear trap’ where the price pulls down low enough to where traders can get better entry points. Typically a trap doesn’t last long and reverses soon after the lowest or highest (bull trap) price point. Some speculate crypto-prices are being affected by the tumultuous global stock markets. There’s been some recovery in traditional stock and equities markets today, so some traders may have moved from digital assets to different markets. Prior to the recovery stock markets suffered a lot yesterday after a six-day winning streak. Stocks worldwide dropped significantly in value especially in the U.S. For instance, well-known companies like Walmart suffered from the most profound price declines since 1988. Overall even with the current dip, cryptocurrency traders are optimistic the bull run is just getting started.

Where do you see the price of BTC and other digital assets heading from here? Do you think cryptocurrencies will see more gains? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Bitstamp, Bitcoin Wisdom, AP, and Coinmarketcap.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: BTC Prices Dip Below $10K appeared first on Bitcoin News.

Powered by WPeMatico