Bitcoin was born on the internet but destined to end up in court. Where there’s money, there’s a trail of gold-diggers, scammers, and slighted plaintiffs, and as bitcoin has risen in value, so have the court cases. With lawsuits, threats of litigation, subpoenas, and regulators sending gavels slamming in courtrooms across the land, this week’s got it all. Get your popcorn at the ready as we prepare to chew over the highlights from This Week in Bitcoin.

Also read: Highly Organized Crime Blamed for $2mil Bitcoin Mining Burglaries

Crypto Goes to Court

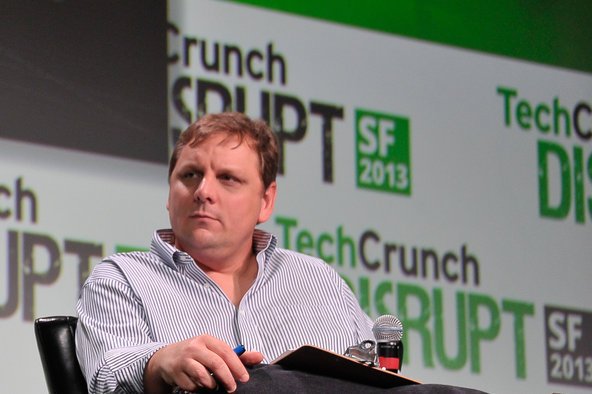

The biggest winners in cryptocurrency this week seem to be the lawyers – unless you’re one of the attorneys the SEC is reportedly chasing for issuing dubious advice to ICOs. The number of crypto startups subpoenaed by the SEC could be anywhere from a dozen to 80 depending on who you believe. The truth is, no one, outside of the Securities and Exchange Commission, seems to know. Techcrunch founder Michael Arrington is confirmed to be one of the lucky winners of an SEC subpoena; the remainder are keeping schtum for now.

Rarely a week goes by when the SEC doesn’t loom large the cryptocurrency news cycle, which has more to do with the spate of dodgy ICOs than it does with the agency’s love of the limelight (though it’s certainly not publicity shy). This week’s second most popular story also involved the SEC, indirectly at least: Poloniex exchange is being bought by Circle – possibly with the approval of the SEC, if the contents of a leaked slide from a Circle employee is accurate.

Craig Wright Goes to Court

The other legal bombshell that dropped is of the salacious kind. The Craig Wright case has got it all – stolen bitcoins, billions of dollars at stake, Satoshi Nakamoto, forged signatures, fake wallets. The lawsuit, should it come to court, is sure to provide high entertainment for everyone captivated by the sideshow that is Craig Wright and his claim to have been Satoshi Nakamoto, even though technically that’s not what this case is about. We wrote:

It is put forward that Mr. Wright conspired against the ignorance of Mr. Kleiman’s family after his death in 2013. Because Mr. Kleiman’s heirs were unaware of their family member’s bitcoin efforts and potential bounty, “Craig perpetrated a scheme against Dave’s estate to seize Dave’s bitcoins and his rights to certain intellectual property associated with the Bitcoin technology”.

There’s a very high chance this case won’t proceed any further, in which case the juicy morsels to be found in the 38-page lawsuit are the closest we’ll ever get to the truth; i.e not very. We now live in a time where blockchain governance is possible, and while the likes of Kleros can’t intermediate in real world disputes, it will be interesting to see whether the crypto community can eventually deal with its dirty laundry in-house.

As the value of crypto assets continues to escalate, it’s inevitable that there will be more cases of this nature, and indeed of every conceivable nature: if it’s not early adopters suing the living daylights out of one another, it’s federal agents indicting bitcoin sellers for the “crime” of operating an unlicensed money transmitting business. Bitcoin is as great as ever, but humanity could seriously use a better algorithm. Proof of Heart.

As the value of crypto assets continues to escalate, it’s inevitable that there will be more cases of this nature, and indeed of every conceivable nature: if it’s not early adopters suing the living daylights out of one another, it’s federal agents indicting bitcoin sellers for the “crime” of operating an unlicensed money transmitting business. Bitcoin is as great as ever, but humanity could seriously use a better algorithm. Proof of Heart.

File Under WTF

If the Craig Wright story wasn’t weird enough for you, get a load of Bill Gates and his damning indictment on Killer Crypto. Or how about the hacker who stole 37,000 ETH from Coindash last year…and has now given most of them back? Curiouser and curiouser. Not so much weird as odd is the story of Bitpay banning the sale of “explicit sexual content”. We wrote: “Bitcoin was originally created to free people’s money from the control and censorship of regulators, banks and governments. Companies in the ecosystem are supposed to be infused with this ethos, but as they strive to become more mainstream some, like Bitpay apparently, adopt the more prevailing standards in the business world.”

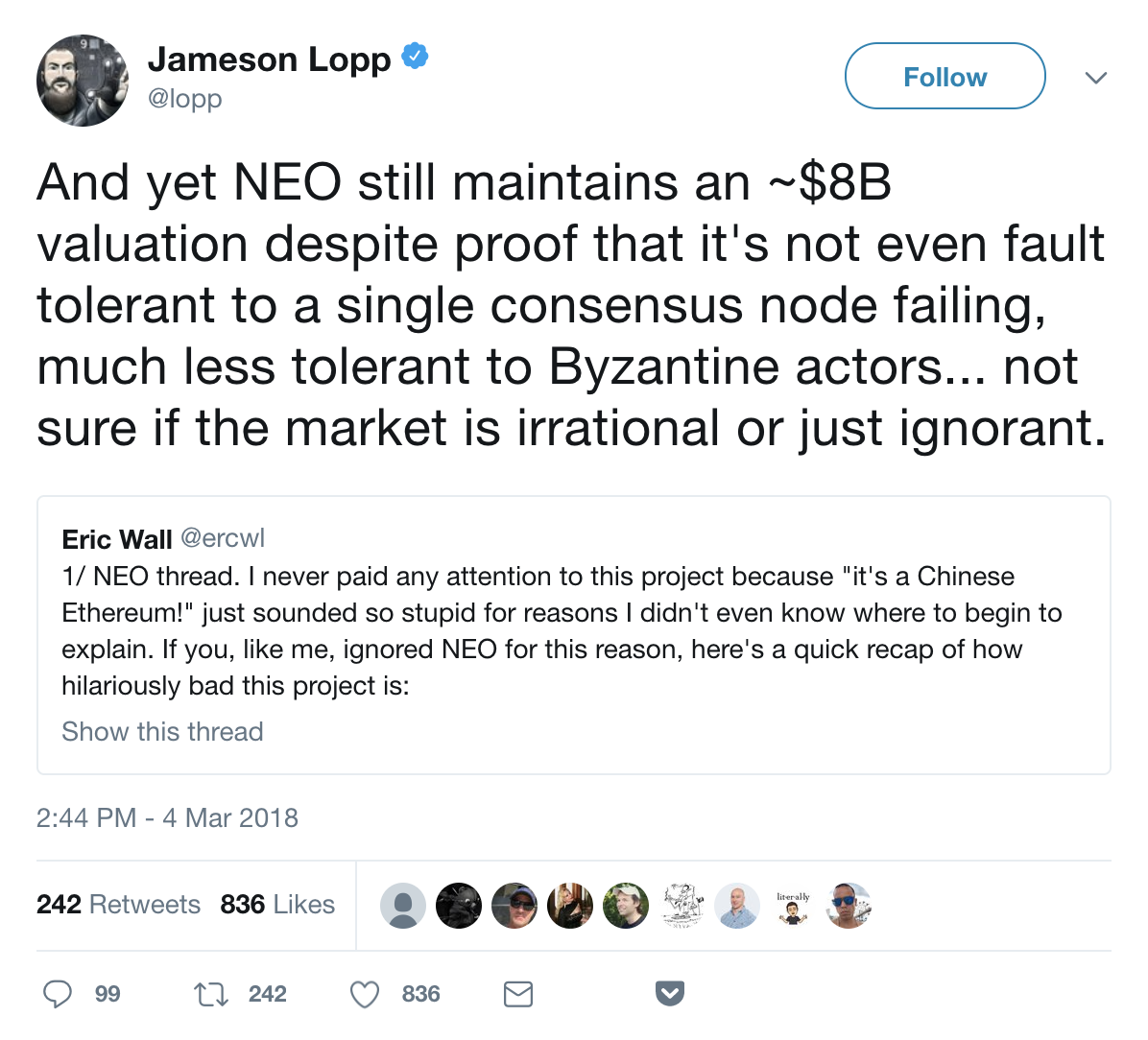

Speaking of vice, this week’s most popular story concerns Las Vegas strippers getting bitcoin tattoos. Because your spouse might explore your credit card statement, but she’s never gonna explore the blockchain. The final story we’ll squeeze in from this week’s roundup concerns NEO. Beating up on IOTA is so passe – this week everyone’s taking shots at NEO, and unlike IOTA, it doesn’t fight back. The Chinese blockchain is either the best thing ever or the worst thing ever, we reported. Then Bitcoin.com’s trading tip columnist Eric Wall waded in. Then Jameson Lopp got involved.

Which altcoin will be next in the firing line? Submit your suggestions below and we’ll reconvene next week in This Week in Bitcoin to find out.

What was your favorite story from this week? Let us know in the comments section below.

Images courtesy of Shutterstock, and Twitter.

Need to calculate your bitcoin holdings? Check our tools section.

The post This Week in Bitcoin: Courtroom Drama appeared first on Bitcoin News.

Powered by WPeMatico