This week bitcoin cash (BCH) prices touched a low of $850 per coin, after following suit with the majority of other digital assets taking losses over the past five days. The price started to reverse yesterday evening and has climbed 11 percent in value touching $992 during the March 19 afternoon trading sessions (EDT).

Also Read: Wirex to Launch Cryptocurrency Debit Cards in Asia During Q2 2018

Bitcoin Cash Markets Show Some Recovery

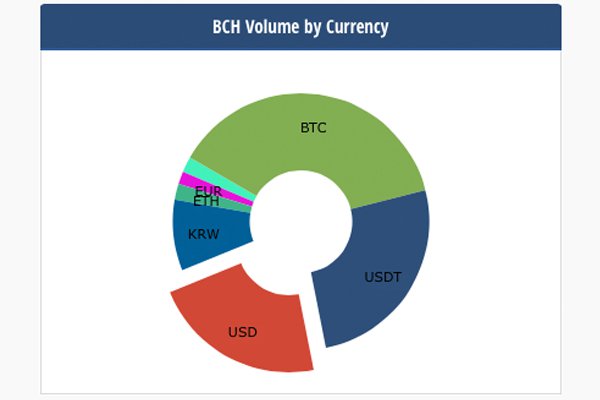

Bitcoin cash markets are looking better on Monday, March 19, as the price has lifted from its $850 dip back towards the $1K zone. BCH global trade volume has increased since the weekend, as it commands $449Mn in global trade volume over the past 24-hours. Bitcoin cash markets also hold the sixth highest trade volumes today just under litecoin and ripple. The top exchanges trading the most BCH include Okex, Huobi, Lbank, Hitbtc, and Bitfinex. Looking at the statistical data for BCH volume-by-currency the most traded currency with bitcoin cash right now is BTC. BTC/BCH swaps represent 38 percent of the market, and this is followed by tether (USDT 26%), USD (22%), the South Korean won (8.9%), and ethereum (ETH 2.1%).

The BCH chain is over 7800 blocks ahead of the core network, but the BTC chain is still 28.5 GB larger. The bitcoin cash difficulty is operating at 10.8 percent of the core chain’s difficulty, and BCH is 4.2 percent more profitable to mine at the time of publication. There are roughly 13 mining pools processing BCH blocks including Antpool, SBI Crypto, Coingeek, Bitcoin.com, Viabtc, BTC.top, Bitclub, BTC.com, and roughly three unknown mining pools. BTC.top has the largest slice of the BCH network hashrate capturing 25 percent today.

Technical Indicators

Looking at charts show that bulls have taken charge for the time being, and BCH/USD prices have spiked considerably since yesterday. Looking at the two Simple Moving Averages both short and long-term show a gap between the 100 SMA and 200 SMA on the 4-hour chart. The longer-term 200 SMA is above the short-term 100 trendline indicating the path upwards towards resistance will be difficult. At press time bulls are attempting to break the $1K price per BCH marker.

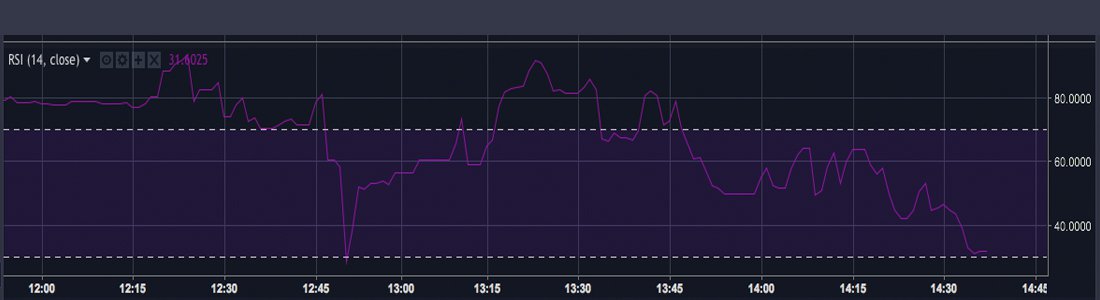

MACd is on heading southbound as bulls are being pressed backward at the moment by resistance. Relative Strength Index (RSI) levels have bottomed out temporarily, and the indicator looks to be poised for another upswing.

Order books looking northbound have stiff resistance from the $1K zone all the way to the $1,050 before opposition starts to taper. On the back side there’s a strong foundation all the way back to the $930 zone through the $850 region.

Infrastructure and Support

This week saw some new bitcoin cash infrastructure and support for the nascent cryptocurrency. For instance, a point-of-sale bitcoin cash payment processor called Mini-POS announced its pre-order phase for brick n’ mortar terminals. A popular Japanese app producer Mikan announced the beta launch of ‘Yenom’ a BCH-centric mobile wallet. The Bittorrent application Joystream announced it would go live on the bitcoin cash mainnet and revealed yesterday the protocol would launch this Monday.

Another announcement came from the project Cointext, an application that allows BCH payments across SMS. The texting application has started beta testing, and BCH supporters seem very pleased with the trials. Cointext’s protocol enables basic commands like “send, withdraw, deposit, and balance” and transactions are settled on-chain. One native from South Africa was thrilled about the SMS texting options as he’s been able to receive BCH without an internet connection.

“Bitcoin cash goes live in south Africa through Cointext,” he explains.

Finally, we can send and receive BCH in Africa without internet and with any type of mobile phone, Hurray!! This is a big win for the crypto universe. BCH and Cointext just broke a record in history.

The Verdict: Optimism is in the Air

The BCH community was also pleased with the recent 0-confirmation test against the firm Cryptonize.it. According to the company, an unknown person lost $2,000 when buying a $1,000 gift card in a failed ‘double spend’ attack. The test created by Cryptonize has solidified the argument that 0-confirmations are safe, a firm belief held by on-chain scaling supporters. Cryptonize says they plan to launch other challenges soon as well so people can attempt to double spend on the BCH chain.

Overall the bitcoin cash community seems confident and positive about the future. Markets look more favorable for the week ahead, and there have been lots of new BCH announcements over the past seven days.

Where do you see the price of bitcoin cash heading from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Bitstamp, Trading View, Cointext, and Cryptocompare.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post BCH Markets & Infrastructure Roundup: Optimism in the Air appeared first on Bitcoin News.

Powered by WPeMatico