The first quarter of 2018 dealt heavy losses to the cryptocurrency markets, with Coinmarketcap data indicating that the capitalization of the combined crypto markets has dropped by 59% since the start of January. Q1 2018 has also been among the bloodiest quarters in recent memory for the bitcoin markets – with BTC suffering an approximately 50% loss in value since the start of 2018. Despite bitcoin’s heavy drop, it has performed better than many leading altcoins – many which have slumped by over 70% since January.

Also Read: Eight Ways to Profit in a Crypto Bear Market

Q1 Produces Extreme Volatility for Bitcoin Markets

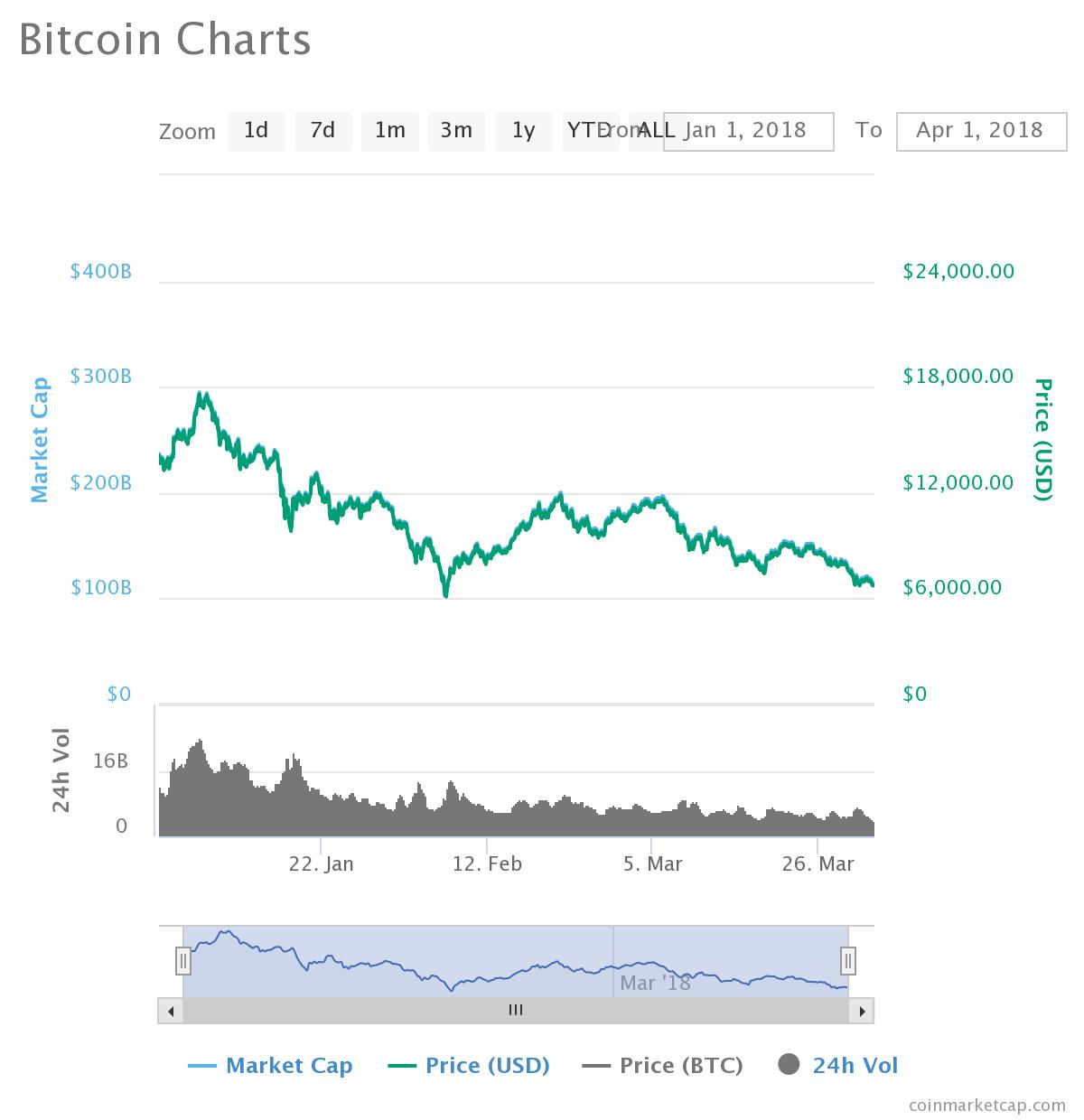

According to price action on Bitstamp, BTC opened the quarter trading between $13,000 and $14,000 on the first of January. Over the course of the following week, BTC made quick gains of more than 20% to establish 2018’s price high of roughly $17,500.

After the high of $17,500, the BTC markets slumped by approximately 66% in a single month, establishing 2018’s current low of roughly $5,900 on the 6th of February. The price then almost doubled in just two weeks, before failing to break above resistance at just below the $12,000 area twice. The failure to break resistance precipitated a drop of approximately 40% during March, with BTC prices currently hovering at approximately $6,500.

Crypto Market Capitalization Shrinks

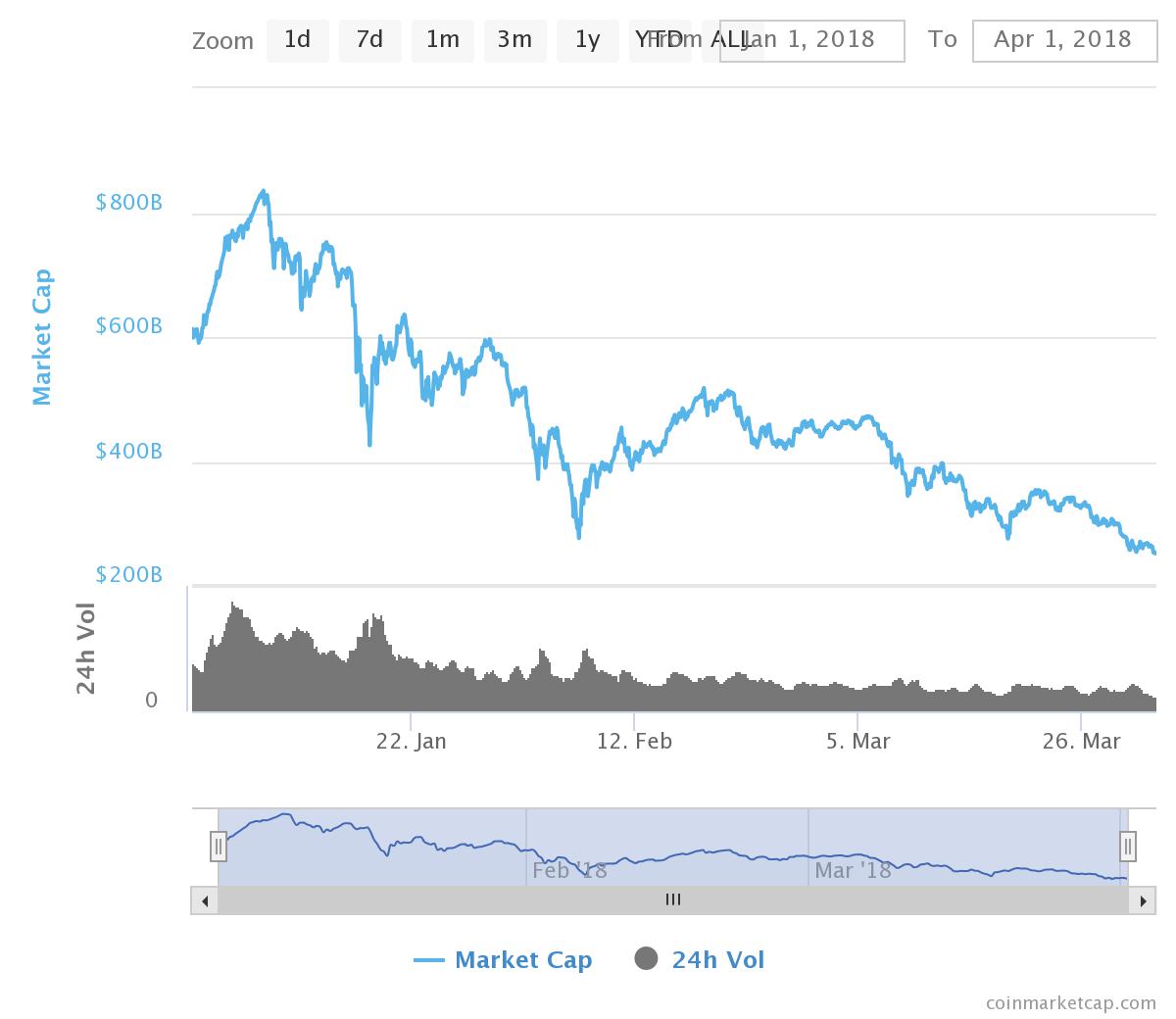

According to Coinmarketcap, which excludes data from Korean exchanges, the total market capitalization of the combined cryptocurrency markets was approximately $610 billion at the start of January, before quickly ballooning to roughly $820 billion on January 8th. Since the high of $820 billion, the capitalization of the crypto markets has dropped by almost 70% and is currently establishing a low of $250 billion for 2018.

The market capitalization of bitcoin was approximately $236 billion at the start of January, and has since fluctuated within a range of between $300 billion, and $100 billion. The total capitalization of bitcoin is estimated to be $115 billion as of this writing.

BTC Market Dominance Strengthens

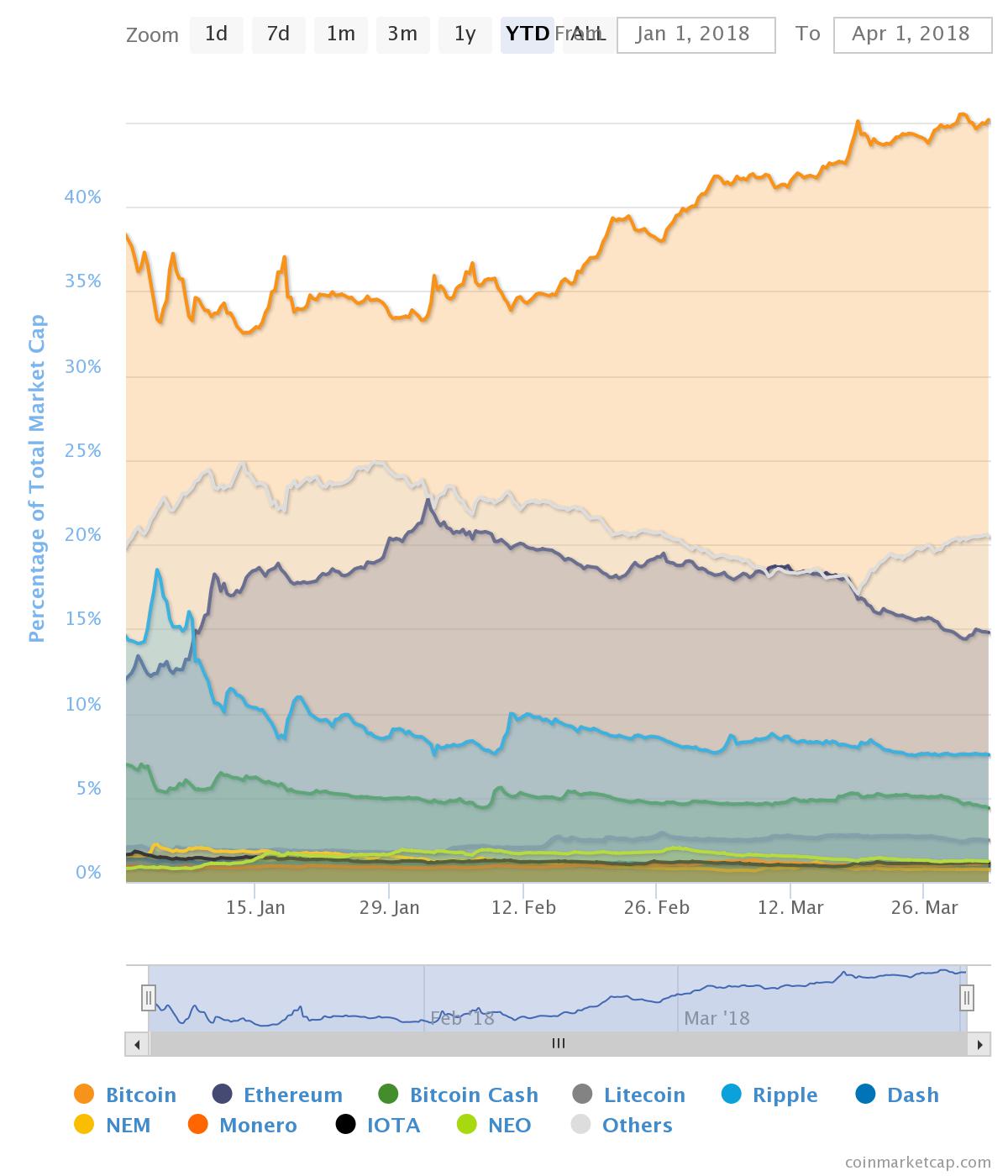

Despite the heavy losses, Q1 also saw bitcoin recapture a market dominance of over 40% – with bitcoin boasting a market dominance of approximately 45% as of this writing.

At the start of January, BTC accounted for approximately 38%, before dropping to establish a historic low of almost 32% during the following fortnight. Throughout February and March bitcoin made consistent gains in market share over altcoins, regaining approximately 10% in relative market share in just two months.

ETH Reclaims Position as Second Largest Crypto by Capitalization

2018 opened with Ripple ranked as the second largest cryptocurrency by total market capitalization, with XRP boasting a market dominance over 14%. On the 4th of January, Ripple reached an all-time high for market dominance of over 18% whilst establishing record price highs over $3.

On the 8th of January, Ethereum reclaimed its position as the second largest cryptocurrency by market capitalization, with ETH growing to hold a market dominance over 14% at the same time as XRP fell to comprise 13% of the markets. Since early January, XRP’s market dominance has oscillated between approximately 7.5% and 10%, steadily holding the position of the third largest crypto by market cap. As of this writing, Ripple’s market capitalization is $18.2 billion (down from over 75% from $80 billion at the start of the year), with XRP currently trading at $0.455.

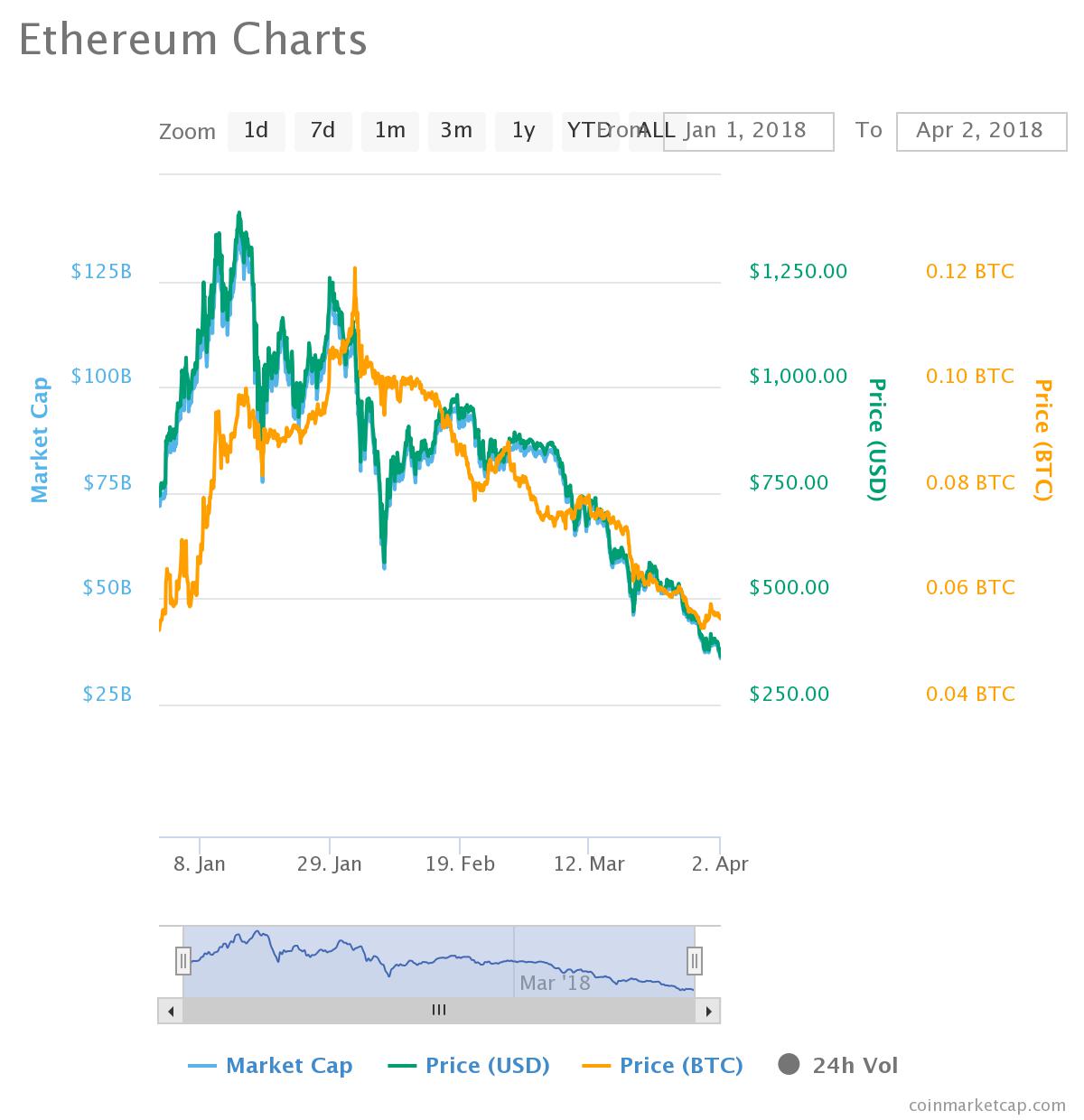

By contrast, Ethereum’s market dominance grew from roughly 12% to over 20% during early January. On the 14th of January, ETH boasted a record price of over $1,400 and a market capitalization of $137 billion. Since then, Ethereum’s market dominance has gradually fallen to current levels of approximately 15%.

Ethereum’s current market capitalization is $37.3 billion (down by nearly 45% from over $73 billion at the start of the year, and 73% since the 2018 high), with ETH trading at $360.

Bitcoin Cash Holds Steady as Fourth-Largest Crypto Market

Bitcoin Cash has consistently been the fourth largest cryptocurrency during 2018, with BCH’s market dominance oscillating between 4.5% and 7% throughout the first quarter. BCH has experienced losses over 70% during Q1, dropping from $42 billion to $11 billion in market capitalization, and from a price of $2,500 to $680.

Since February, Litecoin has consistently comprised the fifth largest crypto market by capitalization. Since the start of January, LTC price and market cap have approximately halved, with Litecoin’s market cap current sitting at $6.2 billion and LTC/USD pairing currently trading at $110.

What is your response to the performance of the cryptocurrency markets during Q1 of 2018? Share your thoughts in the comments section below!

Images courtesy of Shutterstock, Coinmarketcap

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Capitalization of Cryptocurrency Markets Loses 59% in Q1 2018 appeared first on Bitcoin News.

Powered by WPeMatico