The talk of exchange listings with certain cryptocurrencies is always big in cryptocurrency circles across the internet. But how important are they and how much do they cost?

Why Are Listings So Important?

Getting listed on a large cryptocurrency exchange is a big deal for any project. These listings can often be what makes or breaks the levels of adoption and market impact of a specific cryptocurrency.

Having a listing on one exchange compared to another might mean the difference between one hundred thousand and ten million customers. That is why it is of utmost importance cryptocurrency projects, new and old alike, seek for the highly coveted listing spots on the world’s largest crypto exchanges. A project may have a lot of potential but may not be able to reach that potential due to a lack of exchange listings.

In addition to getting listed on crypto exchanges, getting listed on an exchange which directly supports fiat on/off ramps can be even more essential in the game of adoption. The listing of Bitcoin Cash on GDAX and Coinbase made the cryptocurrency almost double within 24 hours. Also, the volume for Bitcoin Cash grew over tenfold on the day it became publicly listed. Gaining access to liquidity is vital for any cryptocurrency to become successful. If you can’t trade it, why bother having it?

It would be foolish to say that exchange listings like the one mentioned above do not help the health and market impact a certain cryptocurrency may have.

Getting Listed: Watch the Wallet

However, these exchange listings, which mean so much to projects, often do not come without a cost. Most exchanges, both small and large, often charge for projects to have tokens and coins listed. It has been suggested that a standard rate for a large exchange can be one million USD.

Some could argue that the funds contributed by exchange listings are paramount in making sure that the exchange is run smoothly and efficiently. Exchanges such as Binance or Bittrex may use these funds to hire more employees, increase server capacity, or to look into new ventures which will aid in the success of these businesses. Proponents of listing fees could also say such fees are also essential in making sure that a large amount of coins/tokens are not getting listed left and right as this would create problems in the API of many exchanges.

However, it could also be argued that exchanges have little need to charge for virtual currencies or tokens to be listed. An exchange makes money whenever a transaction takes place. Bloomberg reports that the largest exchanges can make up to $3 million a day from transaction fees.

Although most large exchanges keep their listing costs behind closed doors, there have been rumors floating around that these costs can often range in the hundreds of thousands to millions for the largest of exchanges.

When you sign up to get listed on Binance, you are required to sign a non-disclosure agreement. Although there is no clear proof that this NDA has anything to do with the fees required for the listing, the topic of listing fees has always been rather hush-hush in the cryptocurrency community.

Projects may often find it hard to procure the necessary funds for the big payout when needing to get listed on exchanges. This can often be a big roadblock which projects may struggle with when looking for large growth and adoption in the form of exchange listings

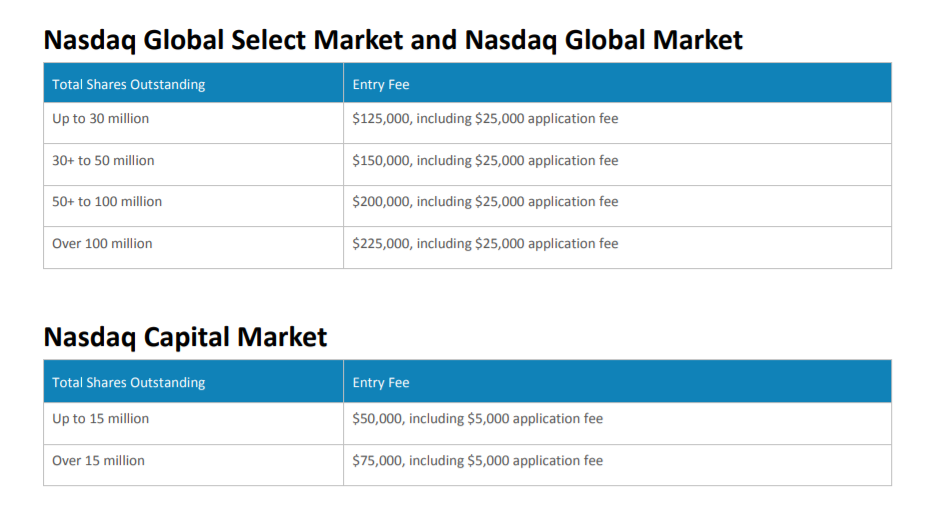

These fees are similar to those seen in traditional equity markets with listings on big stock market makers like the NASDAQ and the NYSE, which require an application and entry fee along with continual maintenance fees. However, stock market fees are noticeably lower than the rumored crypto exchange fees that can reportedly reach as high as three million USD.

Alternative Listing Options

Contrary to popular belief, there are alternative ways where you can get listed on large exchanges. Take the well known example of Binance’s monthly community coin vote. During this vote, users can use their Binance tokens to cast one vote on a preselected list of coins/tokens.

Each user can only submit one vote at the cost of 0.1 BNB, or the equivalent of approximately $1.25 USD at the time of writing. This helps to limit the amount of vote manipulation which devious projects may employ when voting results seem dire.

When this monthly vote begins and the coins are chosen, cryptocurrency projects and their respective communities then show up en-masse to cast their votes on the Binance platform.

To entice users and to minimize personal cost for voters, some projects offer to transfer BNB to the wallets of potential voters. This practice has been put under fire by some in the cryptocurrency community and rightfully so. Some believe that this act of transferring BNB to the wallets of voters is, in some sense, an act of voter manipulation. However, the rules around practices like this are quite blurry and have not been directly addressed by Binance.

Even if this practice is allowed, this cost may add up and may become harmful to the finances of certain projects, but the payout, if voted onto exchanges, potentially outweighs the costs of the BNB needed to satisfy the vote.

It is important to realize how important exchanges are in the big scheme of the cryptocurrency market. It is the exchanges which directly interact with the end consumer and allow for a new level of adoption and market impact. Evert virtual currency wants to be listed as having access to liquidity is as vital to them as breathing is to humans. That being said, it usually isn’t cheap for this to happen.

Do you think that large exchanges should charge such large amounts for coins/tokens to get listed? Tell us in the comments below.

Images Courtesy of Nasdaq, Adobe Stock, Shutterstock, and Bitcoinist archives.

The post Getting Listed on a Cryptocurrency Exchange: How Vital Is It? appeared first on Bitcoinist.com.

Powered by WPeMatico