In the cryptocurrency ecosystem, the concept of prediction markets is a topical subject. There are a few projects in the works hoping to build decentralized prediction markets such as Augur and Hivemind. One particular project, although not fully ‘trustless’ at the moment, Fairlay, has been moving a staggering amount of volume over the past few months with over 100 to 150 BTC per day at times.

Also Read: OTC Cryptocurrency Desks Trade Billions Over Skype

Aggregating the Wisdom of the Majority

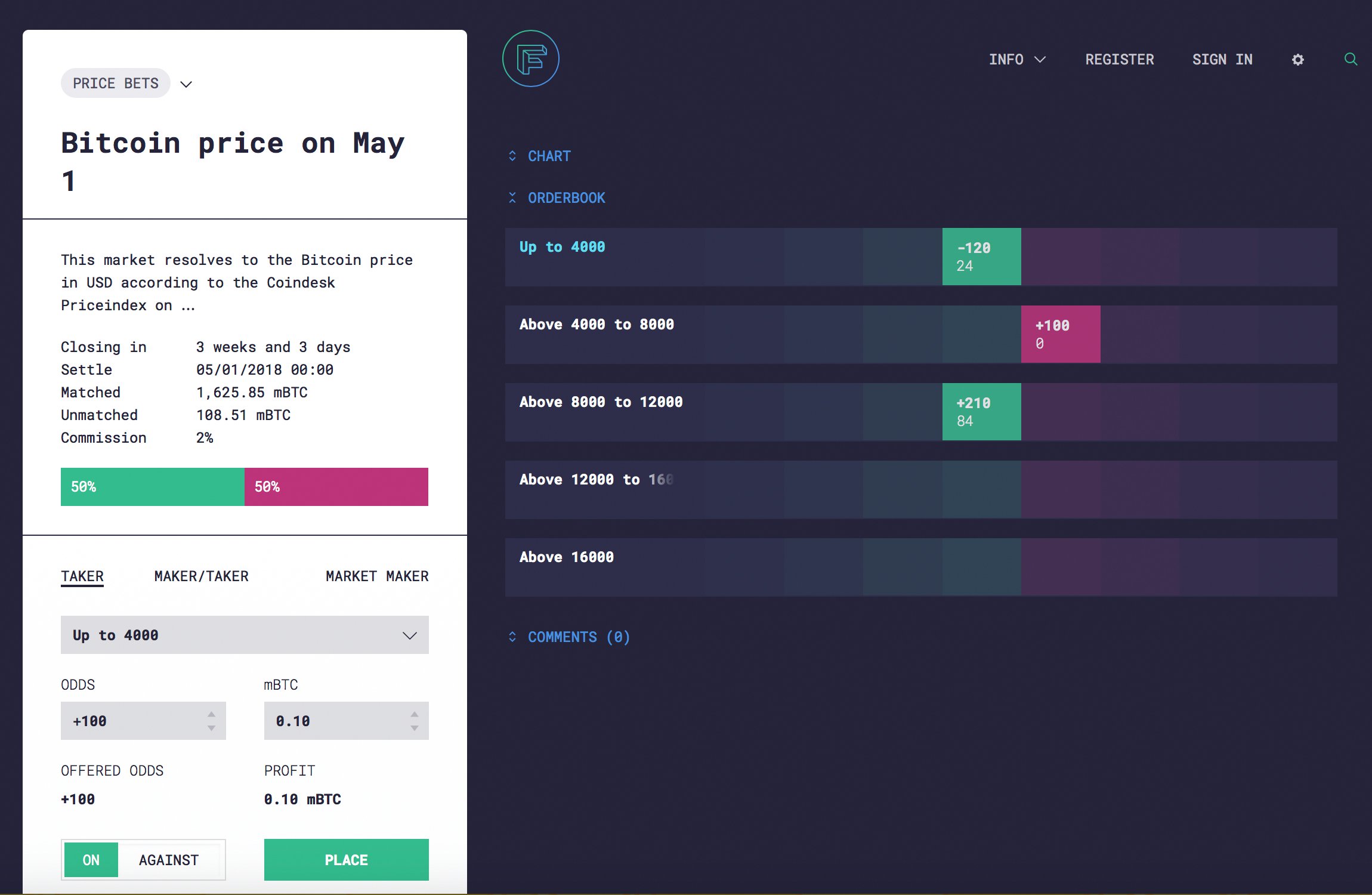

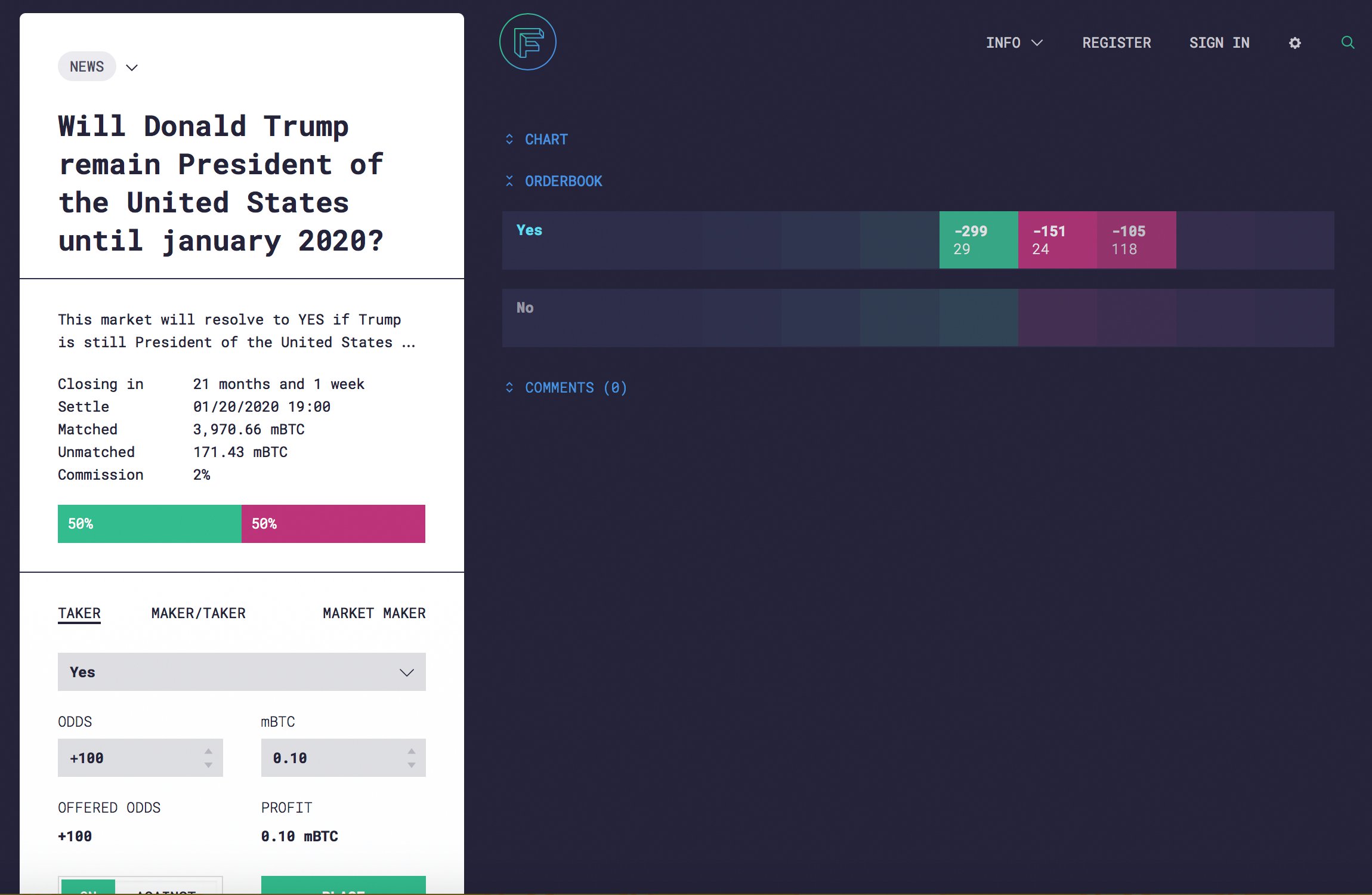

This week news.Bitcoin.com spoke with the Fairlay CEO Gabriel Oliveira about the bitcoin prediction market and exchange he operates. The marketplace got its origin around three years ago. Oliveira tells us that Fairlay is basically a cryptocurrency infused prediction marketplace that allows sports betting in a digital asset environment. Users can create their own markets, bet on any event, and create insurance instruments and trade financial derivatives such as CFD and binary options, Oliveira emphasizes.

This week news.Bitcoin.com spoke with the Fairlay CEO Gabriel Oliveira about the bitcoin prediction market and exchange he operates. The marketplace got its origin around three years ago. Oliveira tells us that Fairlay is basically a cryptocurrency infused prediction marketplace that allows sports betting in a digital asset environment. Users can create their own markets, bet on any event, and create insurance instruments and trade financial derivatives such as CFD and binary options, Oliveira emphasizes.

“With our platform, we specialise in getting reliable information for everyone by crowdsourcing predictions on a totally open market,” Oliveira explains to news.Bitcoin.com. “You can foresee the public confidence on various events such as crypto, economics, politics and general news — By using bitcoin we empower users to demonstrate where their confidence lies regarding a specific event by aggregating the wisdom of the majority.”

Our volumes have been rising substantially this year and it’s about 100 to 150 BTC per day.

90% of Volume Stems from Sports Betting

At the moment, unlike projects in the works like Augur, the Fairlay model is currently fully centralized. Oliveira details that Fairlay provides proof of reserves so users can rest assured they are solvent and that assets are held in a cold wallet. Still, Fairlay is a betting exchange that’s between peers and bets are not against the house as users bet against other users and the exchange acts as an intermediary for those bets.

Oliveira says that 90 percent of the volume is all sports betting and the second biggest market is politics and anything related to Donald Trump. In order to use the Fairlay platform all a user has to do is deposit some BTC and select a market. Users can then choose the outcome, odds, and the volume arrangement within the terms of the bet.

Aspirations to Decentralize With Rootstock

The Fairlay CEO says down the line they intend to use Rootstock’s side chain implementation to better decentralize the platform.

“We like RSK because we see it as the best compromise between ethereum and bitcoin, it’s EVM compatibility is amazing — We can take advantages of the resources already developed for ethereum and at the same time have a defined inflation cap,” Oliveira explains. “Also we see it as more secure in the medium to long-term, as there’s some uncertainty regarding casper feasibility and migration.”

If there’s a bug on ethereum the whole networks can get compromised and may require a hard fork. That’s not necessarily easy to coordinate, we are not fundamentally against hard forks and network splits, but we are not the biggest fans either.

Oliveira notes, however, nothing is set in stone and his team looks forward to seeing how decentralized infrastructure continues to build. “We’ll first see how the networks plays out and how decentralised exchanges overcome the issues that currently inhibit fast and reliable order-books and matchmaking systems,” the Fairlay executive adds.

What do you think of the Fairlay prediction market platform? Let us know what you think about this subject in the comments below.

Images via Shutterstock, and the Fairlay prediction markets platform.

Have you seen our new widget service? It allows anyone to embed informative Bitcoin.com widgets on their website. They’re pretty cool and you can customize by size and color. The widgets include price-only, price and graph, price and news, forum threads. There’s also a widget dedicated to our mining pool, displaying our hash power.

The post Bitcoin Prediction Market Fairlay Sees Sizable Volumes appeared first on Bitcoin News.

Powered by WPeMatico