Stablecoins aren’t exciting. They don’t pump, moon, or 10x. And yet they have the potential to make traders more money than any other cryptocurrency. These stabilized tokens – usually pegged to the US dollar – scarcely move in price, and yet they’re pivotal in anchoring the crypto markets. Here’s everything you should know about the new class of stablecoins.

Also read: Bitmex Research: We Doubt Ethereum’s Ability to Reduce Reliance on PoW

The Price of Stability

Tether, the best known stablecoin, is often the second most traded crypto asset after bitcoin. Traders routinely trade in and out of it as they attempt to outmaneuver bitcoin’s price swings. When the markets are down, some will remain in the safety of tether for weeks, venturing back into “proper” crypto only when there are signs of recovery.

Tether, the best known stablecoin, is often the second most traded crypto asset after bitcoin. Traders routinely trade in and out of it as they attempt to outmaneuver bitcoin’s price swings. When the markets are down, some will remain in the safety of tether for weeks, venturing back into “proper” crypto only when there are signs of recovery.

Tether is a highly controversial stablecoin, not because of how it works, but due to questions over whether it’s actually dollar-backed with fiat reserves, but that’s a debate for another time. What’s undisputed is that over-reliance on a centralized coin that accounts for $4 billion of daily trade volume is a bad thing. Competition for tether is to be encouraged, and was welcomed by Ethfinex no less – whose parent exchange Bitfinex effectively owns Tether.

Last week, Ethfinex introduced dai, a decentralized tether alternative. Here’s how it, and the rest of the current crop of stablecoins, work:

A Brief Guide to Stablecoins

Dai: A decentralized dollar-pegged stable coin from Maker DAO that operates as an ethereum token. The buyer places ethereum in the Maker core smart contract and receives a dollar equivalent of dai in return. It’s tradable on the likes of Bibox, Ethfinex, IDEX, and Bancor Network. It will also soon be available on Omisego’s DEX.

TrueUSD: A collateralized stablecoin backed by USD held in escrow accounts. It’s basically a more transparent tether and is available on Upbit and Bittrex – where it’s even tradable against tether.

Stably: Another USD reserve-backed stablecoin that will work on multiple blockchains when it launches including ethereum and stellar. Stably just raised $500,000 in a seed round.

Bitshares: Usable on the Bitshares exchange only, Bit USD is another dollar-pegged coin, implemented using “smartcoins” to collateralize the currency held against it, typically Bitshares.

Havven: A payment network which also has its own stablecoin. e USD is the first of these, which can be exchanged for ether, though nomins (n USD), the official Havven stablecoin, will launch soon to replace e USD.

New Stablecoins Are Incoming

Several other stablecoins are on their way including kowala, basecoin, augmint, and carbon. Each of these coins has their own means of achieving – or at least attempting – stability. Kowala’s k USD for example is an “anonymously stabilized cryptocurrency” whatever that means, and carbon uses “algorithmically adjusted coin supply based on demand” to ensure it closely matches the USD. VC firm General Catalyst has just led a $2 million round to invest in carbon and basecoin raised $125 million via a SAFT. Stablecoins are big business.

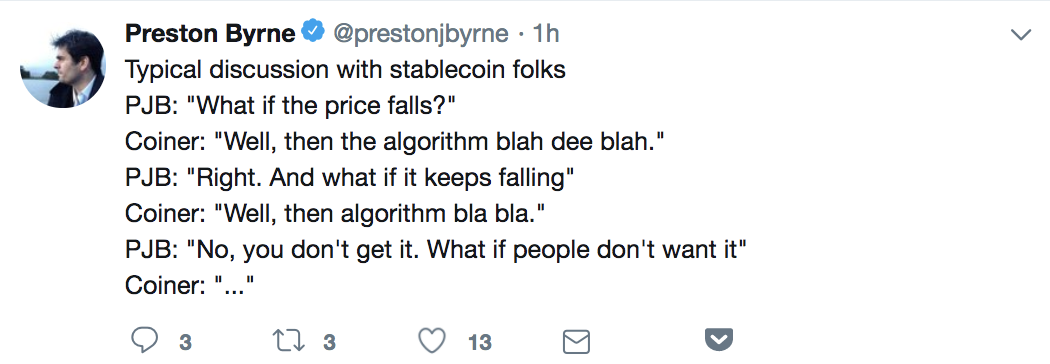

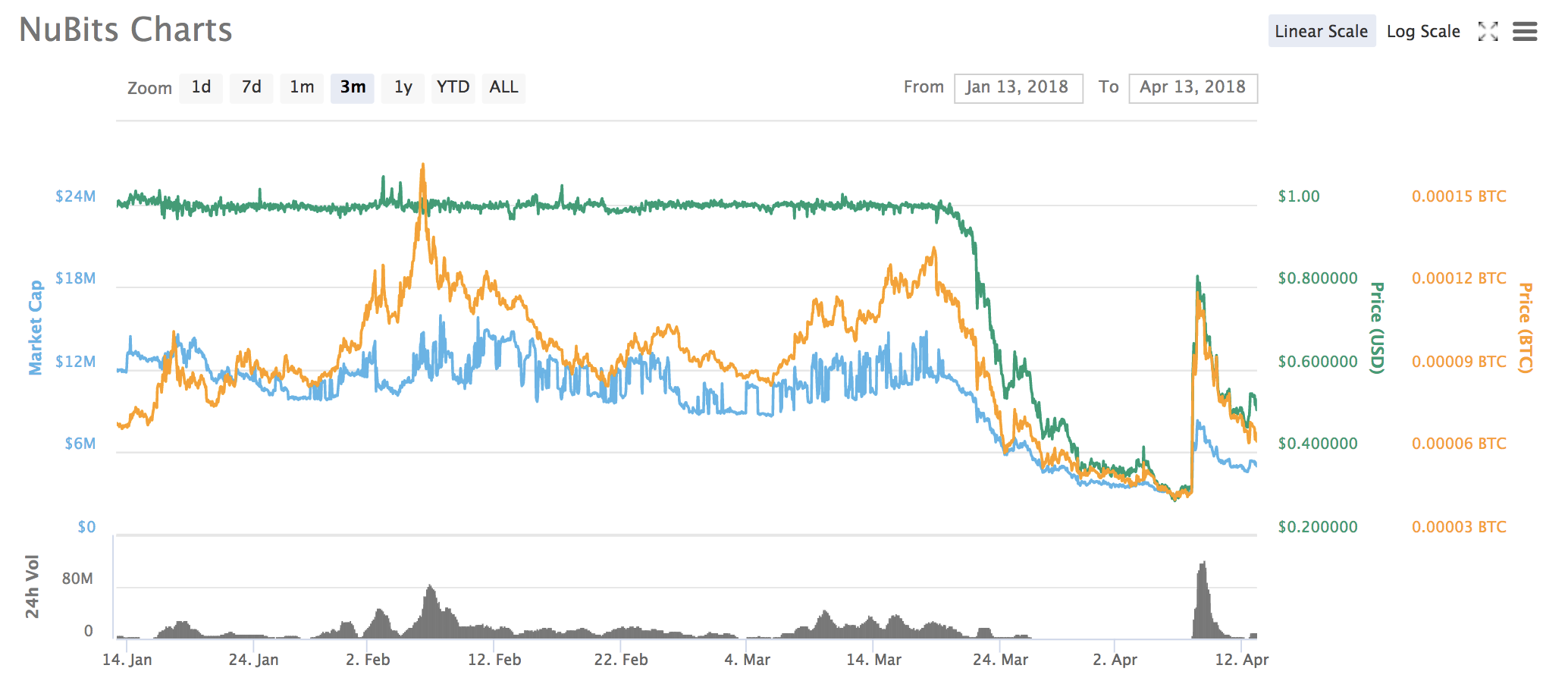

Not everyone is impressed with stablecoins, and specifically their ability to maintain relative stability. Perennial bitcoin bear Preston Byrne has made it his duty to rail against them, and recently highlighted nubits, a lesser known stablecoin, whose value has been anything but stable.

Creating a coin that can stubbornly cling to the US dollar through thick and thin is a lot harder than it sounds; even tether’s prone to wobbling. But for as long as demand for a hedge against crypto volatility persists, stablecoins will perform an essential job. And with so many new entrants poised to launch, the battle for stablecoin supremacy has only just begun.

Do you think other stablecoins can overtake tether, and if so which? Let us know in the comments section below.

Images courtesy of Shutterstock, and Coinmarketcap.

Need to calculate your bitcoin holdings? Check our tools section.

The post Meet the Stablecoins Taking on Tether appeared first on Bitcoin News.

Powered by WPeMatico