In theory, hedge funds employ complex investment strategies that should allow them to achieve high returns both in bearish and bullish markets. In practice many fail due to short term thinking and over-leveraged trading. These can be especially costly and not suitable for the young and volatile cryptocurrency market as any long time bitcoin HODLer can tell you.

Also Read: Indian Exchange Takes Central Bank to Court Over Bank Ban

Barclay Cryptocurrency Traders Index

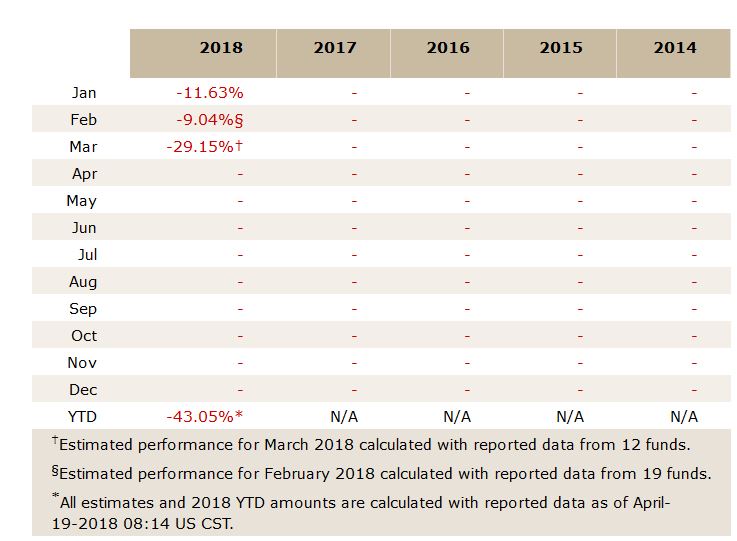

Hedge fund data specialist Barclay Hedge released its newest index, the Cryptocurrency Traders Index, showing that players in the field dropped 29.2% in March 2018. And year to date, it is down 43.1% after three consecutive monthly losses. The researchers explain that the new tool is an equal-weighted index of the monthly returns of a representative universe of 19 constituent funds that trade bitcoin and other cryptocurrencies, starting Jan 1st 2018.

Hedge fund data specialist Barclay Hedge released its newest index, the Cryptocurrency Traders Index, showing that players in the field dropped 29.2% in March 2018. And year to date, it is down 43.1% after three consecutive monthly losses. The researchers explain that the new tool is an equal-weighted index of the monthly returns of a representative universe of 19 constituent funds that trade bitcoin and other cryptocurrencies, starting Jan 1st 2018.

Founded in 1985 and formerly known as The Barclay Group, Barclay Hedge serves institutional investors around the world in the field of hedge fund and managed futures performance measurement and portfolio management. In addition to 25 proprietary indices, it maintains 148 hedge fund indices for financial institutions in North America and Europe in its role as an independent index calculation agent.

“Based on the knowledge gained from our 32 years of experience in collecting, compiling, analyzing, and indexing performance data from alternative investment funds, we wanted to minimize statistical biases which can distort historical index returns,” said Sol Waksman, president and founder. “We chose a January 2018 start date to avoid survivorship bias, backdating and selection bias.”

Cryptocurrency Funds Struggling to Survive

The massive 2017 price rally saw an explosion in the number of crypto hedge funds, with a whopping 167 estimated to have launched during the year. However many are struggling to survive the current market as we have previously reported, with at least nine crypto hedge funds having ceased operations.

The massive 2017 price rally saw an explosion in the number of crypto hedge funds, with a whopping 167 estimated to have launched during the year. However many are struggling to survive the current market as we have previously reported, with at least nine crypto hedge funds having ceased operations.

“The ability to trade Bitcoin futures on exchanges such as CME and Cboe, which are respected worldwide, provides a much-needed level of transparency, investor safety, and credibility to the price–discovery process and creates a level of institutional legitimacy that is crucial for growth in this sector. Within days of the launch of Bitcoin futures, Bitcoin rose to its all-time high of just under $20,000 on December 18 last year. Today’s prices are just over $8,000. Folks have their opinions, but no one really knows if it’s a bubble or a correction,” commented Waksman.

Would you consider investing with a cryptocurrency hedge fund in this market? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Do you agree with us that Bitcoin is the best invention since sliced bread? Thought so. That’s why we are building this online universe revolving around anything and everything Bitcoin. We have a store. And a forum. And a casino, a pool and real-time price statistics.

The post Crypto Funds Drop 29.2% in March Reveals Hedge Fund Data Specialist appeared first on Bitcoin News.

Powered by WPeMatico