Cryptocurrency markets have started to rebound in value as the spring begins in 2018, but one particular cryptocurrency — bitcoin cash — has been on a relentless upswing as the network approaches another hard fork this May. This year traders and bitcoin cash (BCH) proponents believe the decentralized digital currency and the BCH network has a lot of innovation forthcoming which will propel its adoption to new heights.

Also read: Play Music on Jukebox.cash – a Bitcoin Cash Infused Global Playlist

Bitcoin Cash is Poised for a Massive Breakout

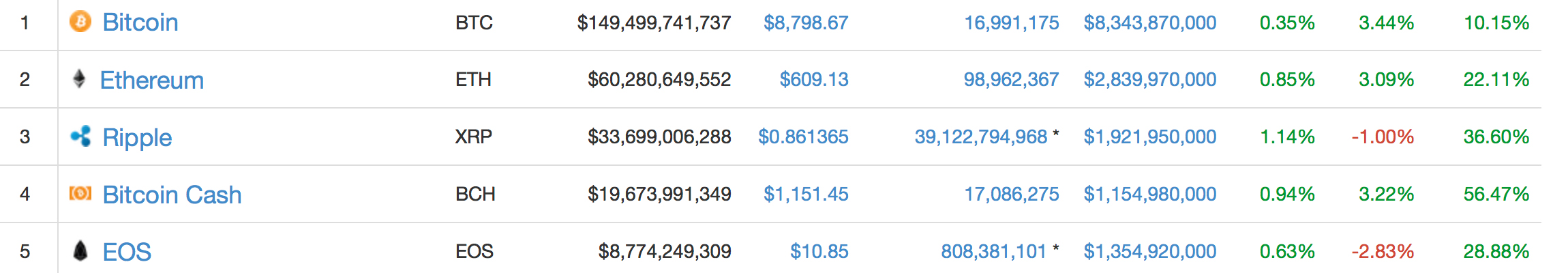

Over the past few weeks, bitcoin cash has become a highly sought-after digital currency within the cryptocurrency economy. There is a lot of demand for BCH during the past seven days as the currency’s markets have seen weekly gains of over 56 percent at the time of publication. Moreover, on the peer-to-peer trading platform Shapeshift, the most popular trade today by a landslide is bitcoin core (BTC) for BCH.

Over the past few weeks, bitcoin cash has become a highly sought-after digital currency within the cryptocurrency economy. There is a lot of demand for BCH during the past seven days as the currency’s markets have seen weekly gains of over 56 percent at the time of publication. Moreover, on the peer-to-peer trading platform Shapeshift, the most popular trade today by a landslide is bitcoin core (BTC) for BCH.

The Bitcoin Cash network has managed to accumulate a massive amount of infrastructure and support over the last nine months, and more so than any cryptocurrency launched to-date. Today we’re going to discuss the top five reasons why the decentralized cryptocurrency bitcoin cash is headed for a massive breakout in adoption and valuation this year. Lots of individuals and organizations believe BCH is a serious contender in the world of cryptocurrencies, and the past nine months is just the beginning. This week, the Bitmain Technologies operated mining organization, Antpool, had similar words to say about the bitcoin cash ecosystem.

“The Bitcoin Cash blockchain is at the tipping point of becoming a widely used public blockchain,” explains the mining operation Antpool this past Friday.

Infrastructure and Support

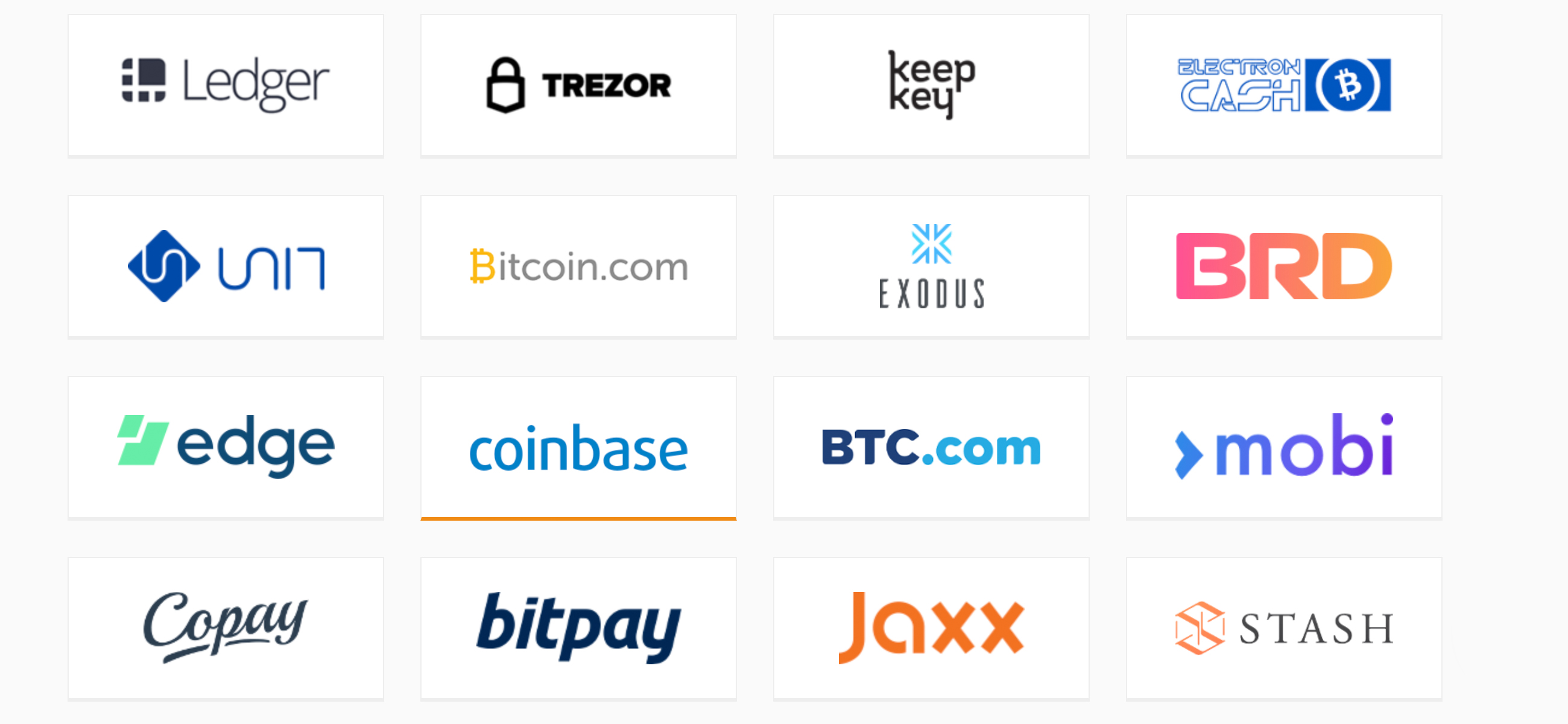

It’s been close to nine months since the August 1 hard fork, and since then the digital currency bitcoin cash has received a ton of infrastructure support from wallet providers and exchanges. No other cryptocurrency has received the support that BCH garnered so quickly in such a little time frame. For instance, BCH is supported by the major exchanges Bitstamp, Coinbase, Kraken, Bithumb, GDAX, Binance, Poloniex, Bittrex, and more. Bitcoin cash also has a slew of well-known wallet providers supporting the chain such as Edge, Bread, Jaxx, Copay, Exodus, Ledger, Trezor, Stash, Mobi, and many more. Moreover, BCH has six full node implementations including Bitcoin ABC, Unlimited, XT, Parity, Flowee, and Bitprim. These teams alongside the blockchain firm Nchain are all contributing to the permissionless and open development environment tied to the BCH project.

Alongside those specific infrastructure providers, BCH merchant acceptance is massive compared to any other cryptocurrency out there besides BTC. Due to integrations with Bitpay’s payment processor services, thousands of merchants now accept bitcoin cash including well-known companies like Microsoft, Newegg, and more. Additionally the “Accept Bitcoin Cash Initiative” has an online compendium of merchants who accept BCH as well. Soon with initiatives like Openbazaar now utilizing BCH and Purse.io support on the way, bitcoin cash will cover nearly everything BTC does as far as infrastructure.

A Passionate Grassroots Community

Similarly to the bitcoin cash blockchain sharing the same history as the BTC chain, there are a large amount of BCH supporters that have been around since the early days when there was only one chain. Many BCH proponents supported BTC until the scaling debate showed Core developers would continue to be stubborn and unwilling to compromise. Lots of these former BTC supporters started forming an alternative community well before the August 1 hard fork. Many of them were banned from the Reddit forum /r/bitcoin for merely trying to discuss increasing the block size. Others realized earlier on that Bitcoin Core developers were stagnating the project and started working on separate software clients because the Core team created a development technocracy. The original Satoshi reference client was suddenly used in a genius ‘PR stunt’ and was gifted the name ‘Core’ when the client was never called that name in the early days. Suddenly there was a team of ‘Core’ developers advertised on a ‘Core’ website, even though ironically most of them dislike being referred to as ‘Core’ developers.

Because of the blatant reference client coup d’état after the August hard fork, a strong community had already formed with an uncensored forum and a community willing to discuss upgrades and protocol changes. Last November just a few months after the blockchain split, the BCH community performed a successful hard fork which fixed the network’s Difficulty Adjustment Algorithm (DAA). The fork led to a favorable outcome where the profitability between BCH and the BTC chain has remained perfectly consistent. Over the past nine months, the BCH community has rallied behind the project pushing adoption and resurrecting applications neutered by the Core development team’s high fees and unreliable transfer times. So far the BCH community has been relentlessly passionate, moving past the trolling and concentrating on making bitcoin cash a cryptocurrency that works. In addition to the strong adherence to principles, there are many other facets of the BCH community that show like-minded passion such as the Bitcoin Cash Fund a nonprofit initiative dedicated to spreading BCH adoption. Then there’s @eatBCH, the outpost that feeds low-income Venezuelan citizens with food paid for with donated bitcoin cash.

Low-Cost Transaction Fees

Let’s face it bitcoin cash network fees are cheaper than most blockchain networks, and with improved scaling the fees should always remain relatively low. For instance on April 20, 2018, the Bitcoin Core (BTC) median network fee was $0.20 cents per transaction. Even though people think that the BTC network fee is low, compared to the Bitcoin Cash (BCH) median network fee it is huge, as BCH fees are $0.0028 — that’s less than a third of a U.S. penny. Further, BCH network fees have remained consistent and should stay low as the protocol upgrades to a 32 MB block size leaving plenty of room for massive amounts of cheap transactions.

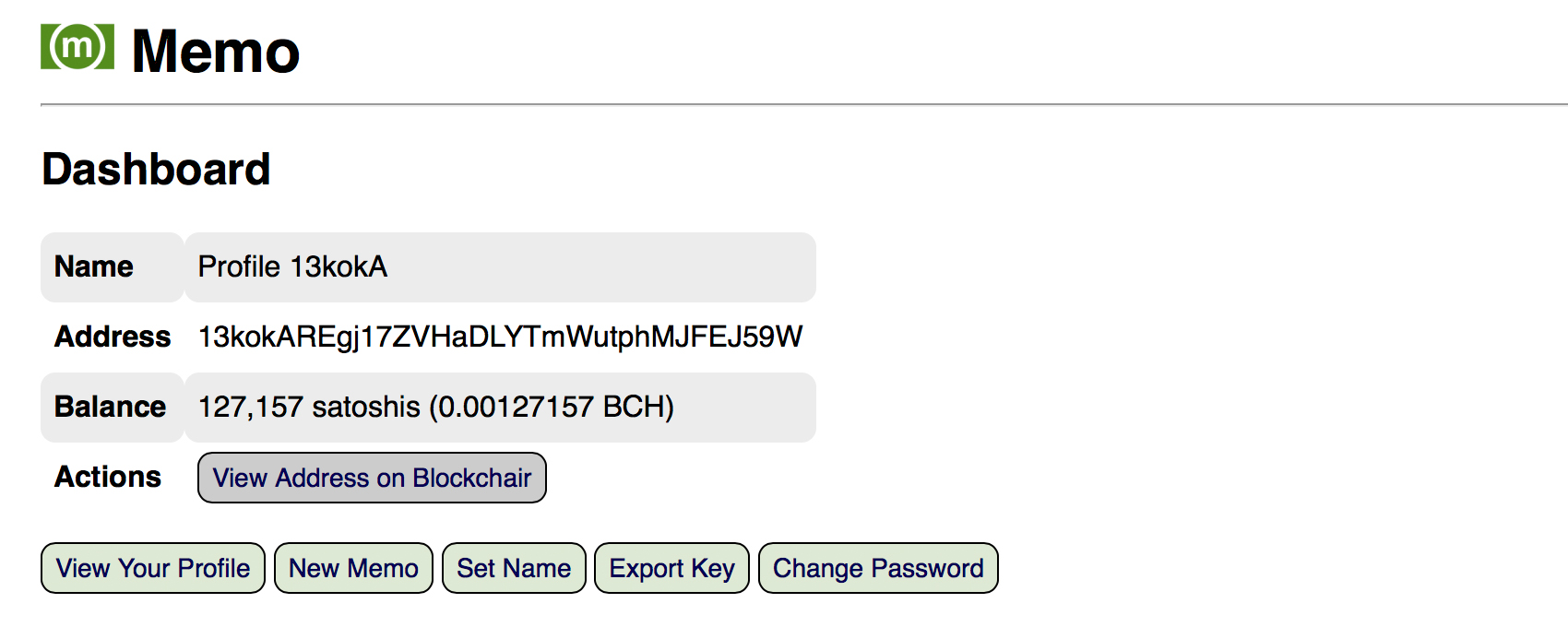

Moreover, BCH network users don’t need to rely on privacy-invasive techniques like ‘transaction batching.’ Bitcoin Core network fees are lower than a few months ago, but are still unreliable as fees were upwards of $40 per BTC transaction just a short time ago. Last year’s rising BTC fees have led to many companies being forced to drop the cryptocurrency as a payment network. Applications like tumblers, tipping applications, and any platform attempting to utilize microtransactions found BTC network fees and confirmation times completely unsustainable. Bitcoin cash fees, on the other hand, have created a large resurrection of all kinds of cool apps that let people swap small fractions of cryptocurrency over the web. Privacy enhancing tumblers are returning to the bitcoin environment, Bittorrent applications, Tip Bots, and social media platforms that incentive users for sharing content.

More Features

Besides all the applications being built by reviving microtransaction features in bitcoin, there are other attributes connected to the BCH network which sets it apart from its BTC sibling. After the network upgrades on May 15, users will be able to fit a vast amount of transactions within a block allowing even more on-chain activity so there are no quarrels about what kind of transactions are considered “spam.” Secondly, the upcoming network upgrade will reinstate and add new operating codes (OP Codes) and scripting abilities to the BCH chain which will enable tokenizing methods and the ability to code smart contracts within the BCH network. Additionally, the bitcoin cash community has invoked the spirit of zero-confirmation transactions as many infrastructure providers have opted to make instant transactions a reality using BCH. Meanwhile, bitcoin cash developers are planning to make instant transactions even more secure for the community as well.

The Closest Bitcoin to Satoshi’s Vision

The Closest Bitcoin to Satoshi’s Vision

Bitcoin cash developers and the community want the BCH network to adhere as closely as possible to Satoshi Nakamoto’s original whitepaper. This means everyone involved will continue to bolster bitcoin as a “peer-to-peer-electronic cash system” as it was intended. BCH proponents intend to scale the BCH chain for the entire world so anyone can use the cryptocurrency. Fees will remain low so not just early adopters and the affluent can afford to use the network, but those who live in third world countries and individuals who need it most — the people BTC supporters forgot, the unbanked. After years of teaching people how to use bitcoin, BCH proponents are not going to attempt to push users towards a proprietary toll road, but rather onramp them towards reliable and cheap on-chain transactions. True ‘censorship resistance’ means allowing the whole world to use the platform, and even today’s $0.20 cents per BTC transaction fee is too costly for residents living in developing nations. A network fee of less than a penny is more suitable for promoting the remittance applications cryptocurrency enthusiasts once dreamed of just a few short years ago.

The Technocrats Have Lost Their Shirts

Those are just five clear and concise reasons why bitcoin cash is set to continue its tear throughout 2018 and will be one currency to keep an eye on. Finally, this fork has given bitcoin investors a say in how they want to see the cryptocurrency progress in the future, instead of the decision making of 30 some-odd technocratic developers in control of one reference client. The founder of the Satoshi Nakamoto Institute Daniel Krawisz says, “forks are good because they put the investors in control.”

Investors are given a choice and they choose which one they like better. One thing that I don’t like in bitcoin is when developers have a higher social status than investors. It should be the other way around, developers should be below investors.

Bitcoin cash is about to break out into a massively used cryptocurrency that is ready to be adopted by the masses. Further, the BCH chain is cemented in time as the longest running blockchain dating all the way back to the Genesis block in 2009, and it continues to maintain its strong SHA-256 proof-of-work algorithm. BCH proponents aim to make sure bitcoin cash is the most used network with no limit to its use cases and no censorship towards who can use it. As Satoshi Nakamoto once stated:

I’m sure that in 20 years there will either be very large transaction volume or no volume.

What do you think about the five reasons why bitcoin cash will likely see a massive breakout this year? Let us know what you think about this subject in the comments below.

Images via Shutterstock, Pixabay, Crypto-graphics.com, Memo, Coinmarketcap, bitcoincash.org, and Twitter.

At news.Bitcoin.com all comments containing links are automatically held up for moderation in the Disqus system. That means an editor has to take a look at the comment to approve it. This is due to the many, repetitive, spam and scam links people post under our articles. We do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post Five Reasons Why Bitcoin Cash is About to Win Big appeared first on Bitcoin News.

Powered by WPeMatico