It’s no secret that token sales have grown exponentially since the start of last year. The extent to which the industry has mushroomed, however, can be hard to visualize in a space where figures referencing billions in capital are casually tossed around. Newly released data reveals the astronomical growth of ICOs and shows the rise in securitized token sales.

Also read: Philippines Welcomes Crypto Economic Zone

Token Sales Are Showing No Signs of Slowing Down

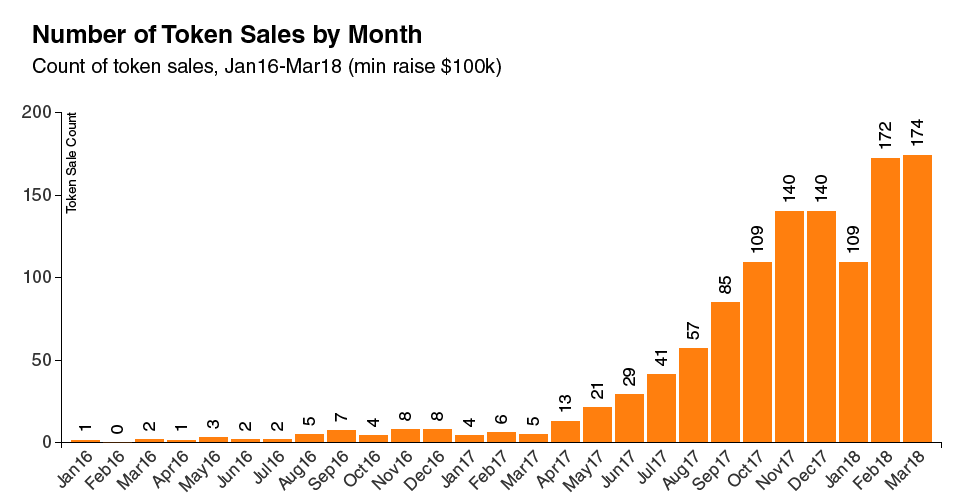

Whatever way you measure it – dollars raised; ETH raised; number of projects per month – token sales are proliferating. They’ve been on the up for some time and setting records with every passing month. Newly crunched data by Elementus, which derives its information from blockchain records rather than ICO self-reports, sheds light on the rise of crowdsales. It’s created a visualization that shows the slow and humble beginnings of ICOs, back in 2014, and the explosion which subsequently detonated in mid-2017.

The visualization shows three crowdsales in particular which tower over the rest, each of which is controversial for its own reasons. The Petro is a contentious project to put it mildly, and its reported $5 billion raised is hard to verify with absolute certainty given investors’ reluctance to comment publicly on their involvement, and an absence of information on the discounts that were provided. Telegram’s crowdsale has taken place without the crowds, meanwhile, going entirely to private investors, and “Ethereum killer” EOS’ $2.5 billion ICO has amassed over 5 million ETH, which exceeds 5% of the total supply.

The Number of Monthly Token Sales Keeps Rising

Elementus has also recorded the number of token sales to have raised at least $100k, and found them to have grown every month save for a slight dip in December. In March, 174 token sales were completed, which works out as an average of six a day, and just two more than February’s total of 172.

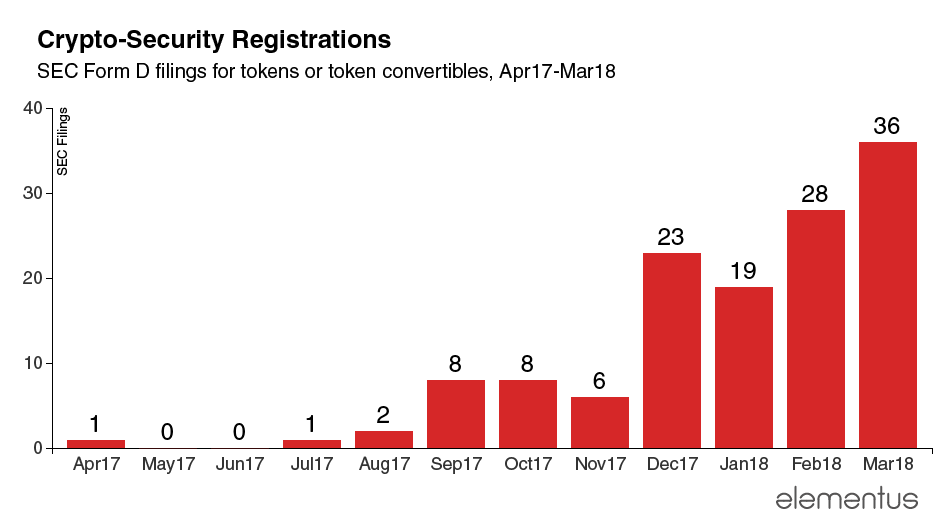

One of the most interesting graphs, arguably, is the one showing the rise of security tokens and SAFTs (Simple Agreement for Future Tokens). A year ago, Reg D token sales were virtually unheard of before suddenly jumping from six in November to 23 in December, and 36 in March. Reg D enables crowdsales to raise funds from accredited investors and has no cap on the amount that can be raised. The drawback of course is that these fundraisers technically aren’t crowdsales as the public are unable to participate.

The next explosion that’s being predicted is that of Reg A+ token sales. These are more like a mini IPO and enable projects to raise up to $50 million in a year. Numerous applications have been made to the SEC for Reg A+ accreditation, but due to the time it takes for an offering placement memorandum (OPM) to be scrutinized and approved, the floodgates have yet to open. Once they do, securitized crowdsales will officially be open to the crowds, whereupon U.S. investors will be free to join the march to tokenization.

Do you think Reg A+ token sales will eventually become the norm? Let us know in the comments section below.

Images courtesy of Shutterstock, and Elementus.io.

Need to calculate your bitcoin holdings? Check our tools section.

The post New Data Depicts the Explosion in Token Sales appeared first on Bitcoin News.

Powered by WPeMatico