The South Korean government is mulling over how to cash out the cryptocurrency it recently confiscated. While the most likely option is to auction the coins off using the government-owned auction platform, various concerns have been raised.

Also read: Yahoo! Japan Confirms Entrance Into the Crypto Space

Cashing Out BTC

The South Korean government is contemplating how to best cash out its recently-acquired cryptocurrency. As part of a criminal case, the government has seized 191.32333418 BTC belonging to “Ahn,” the convicted operator of a porn site. The country’s Supreme Court recently judged that cryptocurrency is a property that the government can confiscate.

The South Korean government is contemplating how to best cash out its recently-acquired cryptocurrency. As part of a criminal case, the government has seized 191.32333418 BTC belonging to “Ahn,” the convicted operator of a porn site. The country’s Supreme Court recently judged that cryptocurrency is a property that the government can confiscate.

“The prosecutor is facing a decision of how to dispose of the BTC and give the proceeds to the treasury,” Yonhap reported, elaborating:

The most likely option would be auctioning off through the asset disposal system of the Korea Asset Management Corporation (KAMCO), ‘Onbid’.

KAMCO is South Korea’s government-owned asset management company that manages Onbid, a system which facilitates the online trading of property owned by public-sector entities. The platform has been used to sell other items confiscated by the government such as securities. “Securities auctions have been actively conducted on Onbid,” Etoday noted.

BTC’s Price Fluctuation Is a Problem

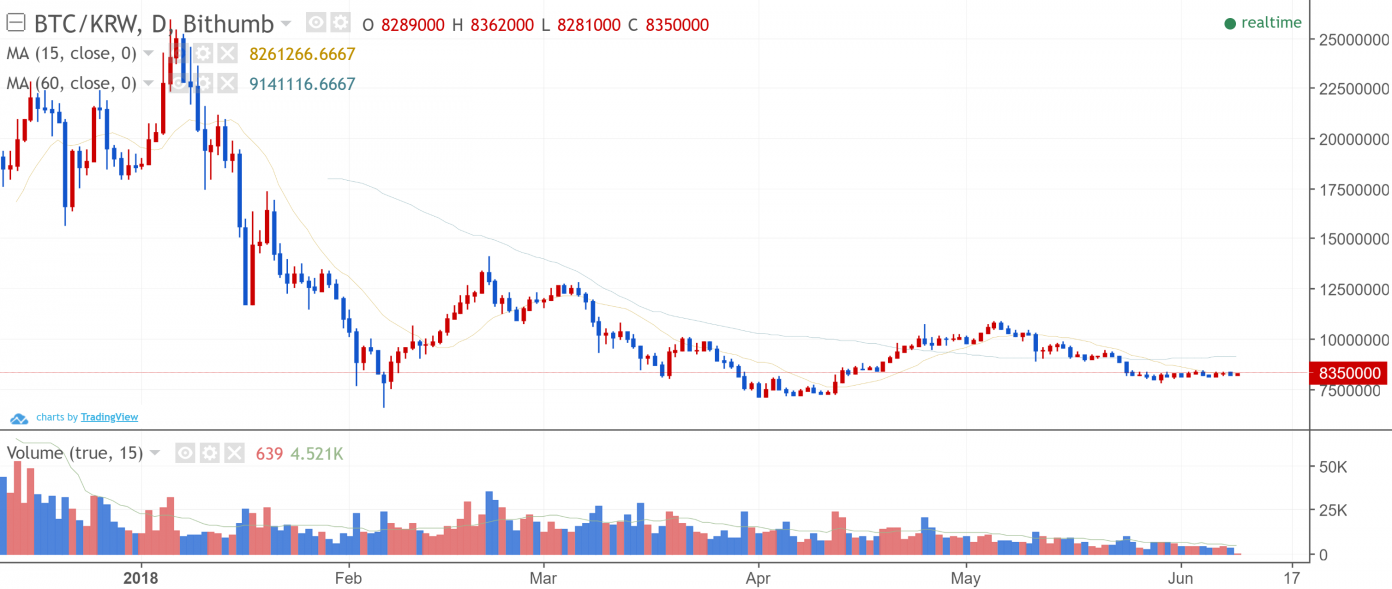

According to Yonhap, “the prosecutor’s biggest concern is the price fluctuation of bitcoin.” The price of BTC reached over 25 million won on January 7 but has now dropped to 8.3 million won, according to data from Bithumb, one of the largest crypto exchanges in the country.

“Onbid sets the date of public announcement, the date of public sale, and the lowest price. However, because of price volatility, the [price of] bitcoin may be larger between the announcement date and the bid date,” the news outlet described. “For example, if prosecutors set a minimum price of 8.3 million won on the 8th and receive a bid on the 13th, if the price of 1 bitcoin surges to 10 million won on the 13th, it becomes a ‘lottery auction’.”

An official of the legal department was quoted by the Seoul Newspaper as saying:

Unlike artwork, bitcoin has a daily market price…and the auction price can be changed in seconds.

Citing that “if the prosecution seizes foreign currencies, it will sell them to a foreign exchange bank…as if it were paid in the national currency,” therefore, the seized BTC could be similarly sold “directly to the market instead of an auction.” The prosecutor is now studying how to process the confiscated BTC.

Potential Conflict With Crypto Regulations

In addition, “It is also pointed out that it is not appropriate for the prosecutor to sell [BTC] to the market without the government’s position on virtual currencies being fixed.” Since the ruling of the Supreme Court, the country’s top financial regulator, the Financial Services Agency (FSC), has confirmed that its view on cryptocurrency remains unchanged, crypto is not a financial asset, and there is no change in the regulations.

In addition, “It is also pointed out that it is not appropriate for the prosecutor to sell [BTC] to the market without the government’s position on virtual currencies being fixed.” Since the ruling of the Supreme Court, the country’s top financial regulator, the Financial Services Agency (FSC), has confirmed that its view on cryptocurrency remains unchanged, crypto is not a financial asset, and there is no change in the regulations.

A KAMCO official commented that “Even if the bidding is conducted…there is no problem with the regulation,” the news outlet elaborated and quoted an official at the prosecution, emphasizing:

The first case is important, because [more] virtual currencies will be forfeited in the future.

What do you think the Korean government should do with the seized coins? Let us know in the comments section below.

Images courtesy of Shutterstock, Bithumb, and the Korean FSC.

Need to calculate your bitcoin holdings? Check our tools section.

The post South Korea Mulls Over How to Cash Out State-Owned Cryptocurrency appeared first on Bitcoin News.

Powered by WPeMatico