As an emerging asset class, cryptocurrency and blockchain technology related investments are gaining begrudging respect among finance professionals. Market slides aside for the moment, a study released by Grayscale Investments attempts to make the case investors should seriously consider adding crypto to their respective portfolios, as they bring better returns and, counterintuitively, reduce risk and volatility.

Also read: Crypto and Virtual Reality Meet in Ken Liu’s Science Fiction

Grayscale Urges Modern Investors to Incorporate Crypto into Portfolios

Granted, it’s a strange time to be making such an argument: crypto markets as of this writing are bloody, and one only need cruise over to Satoshi Pulse in order to see the carnage. Nevertheless, Grayscale Investments (GI), a major player in the ecosystem as it relates to mainstreaming crypto in the broader world of finance, released, A New Frontier:

How Digital Assets Are Reshaping Asset Allocation by Matthew Beck.

It’s a bold attempt to persuade modern investors of the need for cryptocurrency, and their related offspring, in any balanced portfolio. They “view digital assets as a brand new asset class that can enhance strategic asset allocation and help investors build portfolios with higher risk-adjusted returns. We will provide a few different lenses through which the reader can gain a deeper understanding of the role that digital assets may play in building more efficient portfolios.”

Throughout the paper, Mr. Beck refers to the crypto phenomenon as “digital assets,” which he believes “provide exposure to unique market opportunities and risks, thus creating a diversifying return stream for investors. As such, they should be considered a component of the optimal beta portfolio alongside traditional assets such as equities, bonds, and real estate.”

GI is a subsidiary of Digital Currency Group (DGC), a venture capital firm based in New York City. Grayscale actually precedes DGC by a couple of years, begun and maintained by Barry Silbert, a noted finance figure in the crypto space. DGC’s umbrella includes GI, of course, but also Coin Desk as its independent media arm. Grayscale itself is considered a leader in the purgatory between spot markets and over-the-counter so-called fringe investing and traditional equities. GI manages Bitcoin Investment Trust (GBTC), the first of its kind to offer accredited investors publicly traded shares measured in the price of bitcoin core (BTC). Accredited investors have earned more than $200K the last two years, with assurance s/he will do the same this year, or has over $1 million in net worth.

A Well Argued Reminder

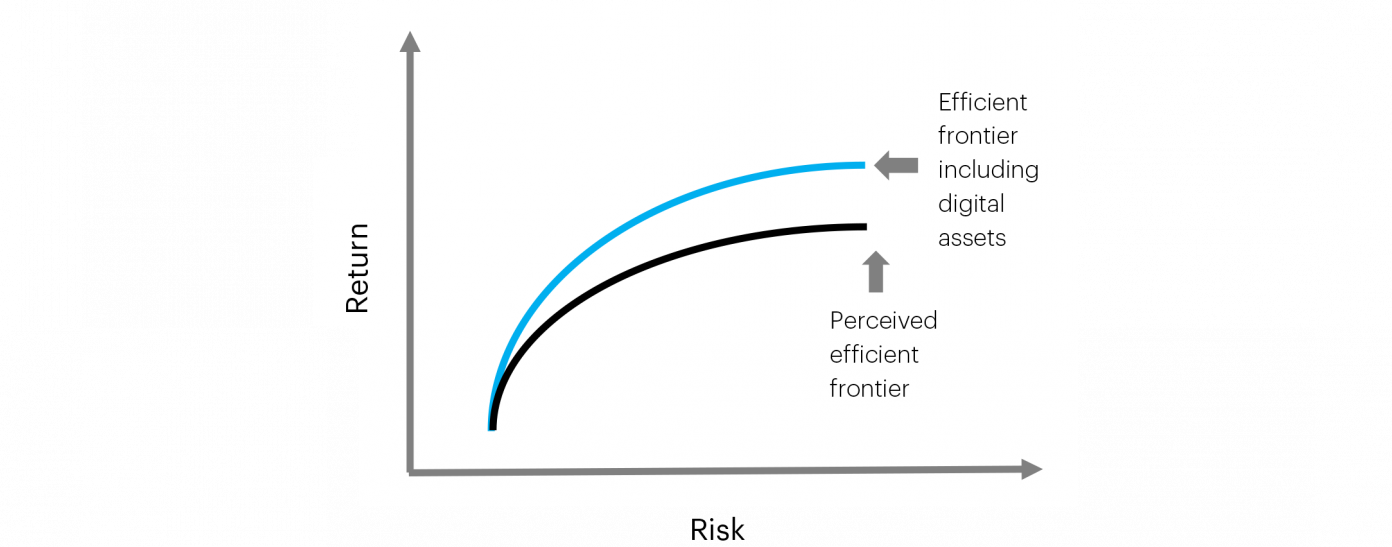

Fundstrat’s Tom Lee lauded A New Frontier, tweeting, “This report is a well argued reminder that adding crypto to a portfolio enhances return while reducing overall portfolio risk/volatility. Not sure there are any other emerging asset classes that benefit a balanced portfolio this way.” And at the outset, Mr. Beck’s attempt is to first square digital assets with Modern Portfolio Theory (MPT). In short, he believes “many of today’s asset allocators are missing out on a ‘free lunch.’ That’s because (i) digital assets represent a brand new investment opportunity that is uncorrelated to other asset classes and (ii) investors are generally under-allocated to this sector. It is our view that the optimal beta portfolio lies somewhere higher than what was previously believed to be the efficient frontier, and digital assets are the proverbial ‘missing piece of the puzzle.’”

Breathlessly, Mr. Beck insists “digital assets are squarely at the intersection of some of the most significant trends reshaping the global economy, including: A new market paradigm, characterized by slow economic growth, low interest rates, and divergent central bank policies. Rapid advancements in financial technologies and payment infrastructure, which now make it possible to move, settle, and clear value/assets at the same speed as information in a digital format. Regulatory shifts, altering financial industry economics and significantly increasing the cost of compliance and financial operations. Demographic shifts, driven by (i) the next generation of investors entering their prime earning years (i.e., millennials) and (ii) baby boomers entering retirement and tapping underfunded pension plans,” and this last part Tom Lee hit on a few months back in his own presentation.

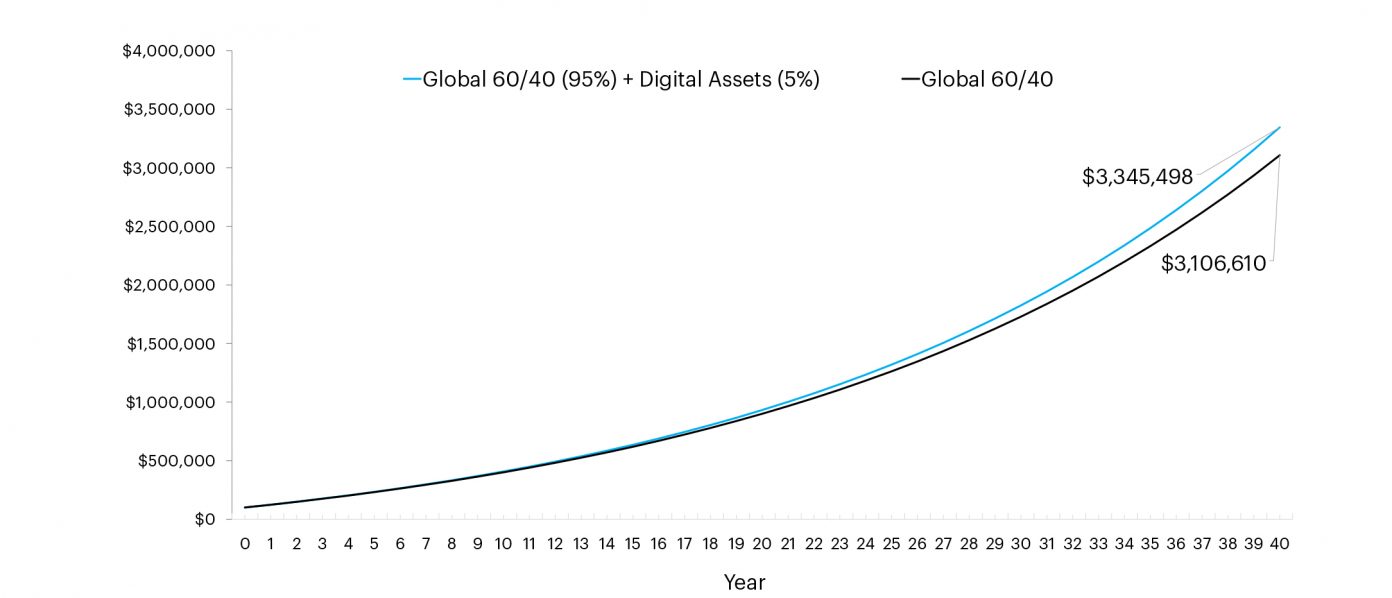

Regarding diversification and adding digital assets, A New Frontier stresses “the average rolling one-month correlations range from slightly negative to slightly positive, with an average correlation of zero. This provides evidence that digital assets can be considered a diversifying component in multi-asset portfolios. Moreover, many digital assets are imperfectly correlated to one another, which means there may even be diversification benefits within the asset class itself.” A healthy chunk of the paper runs through hypothetical investment scenarios, and while they’re ‘mathy’ and graph-laden, they’re somewhat less convincing.

A general good rule of thumb when thinking about cryptocurrencies is how no one, not one person, understands them. Sure, they’ve got parts of the equation, and that can be very powerful, but ultimately digital assets still face giant hurdles with regard to mainstream adoption, the kind Grayscale hopes. Regulation, which they’re on record as inviting, could strangle the golden goose, as was empirically the case with New York’s Bit License. Add to the above whether institutional money will finally find its way into the space with the liquidity long dreamed by the likes of GI, and conservative mom and pop investors probably won’t be so keen on incorporating crypto long term. Mr. Beck concludes, acknowledging it is “still early in the lifecycle of digital assets, but we believe our multifaceted approach to assess their investability makes a compelling case for investors to have some portion of their portfolio allocated to this new asset class. A lot can happen over the next few years, but remember: diversification is a ‘free lunch’ and asset allocation is all about the long-game.”

Do you think crypto enhances return and reduces risk? Let us know in the comments.

Images via the Pixabay, Grayscale.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

Disclaimer: Bitcoin.com does not endorse nor support this product/service.

Readers should do their own due diligence before taking any actions related to the mentioned company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

The post Add Crypto to Investment Portfolio: Enhance Return, Reduce Risk/Volatility appeared first on Bitcoin News.

Powered by WPeMatico