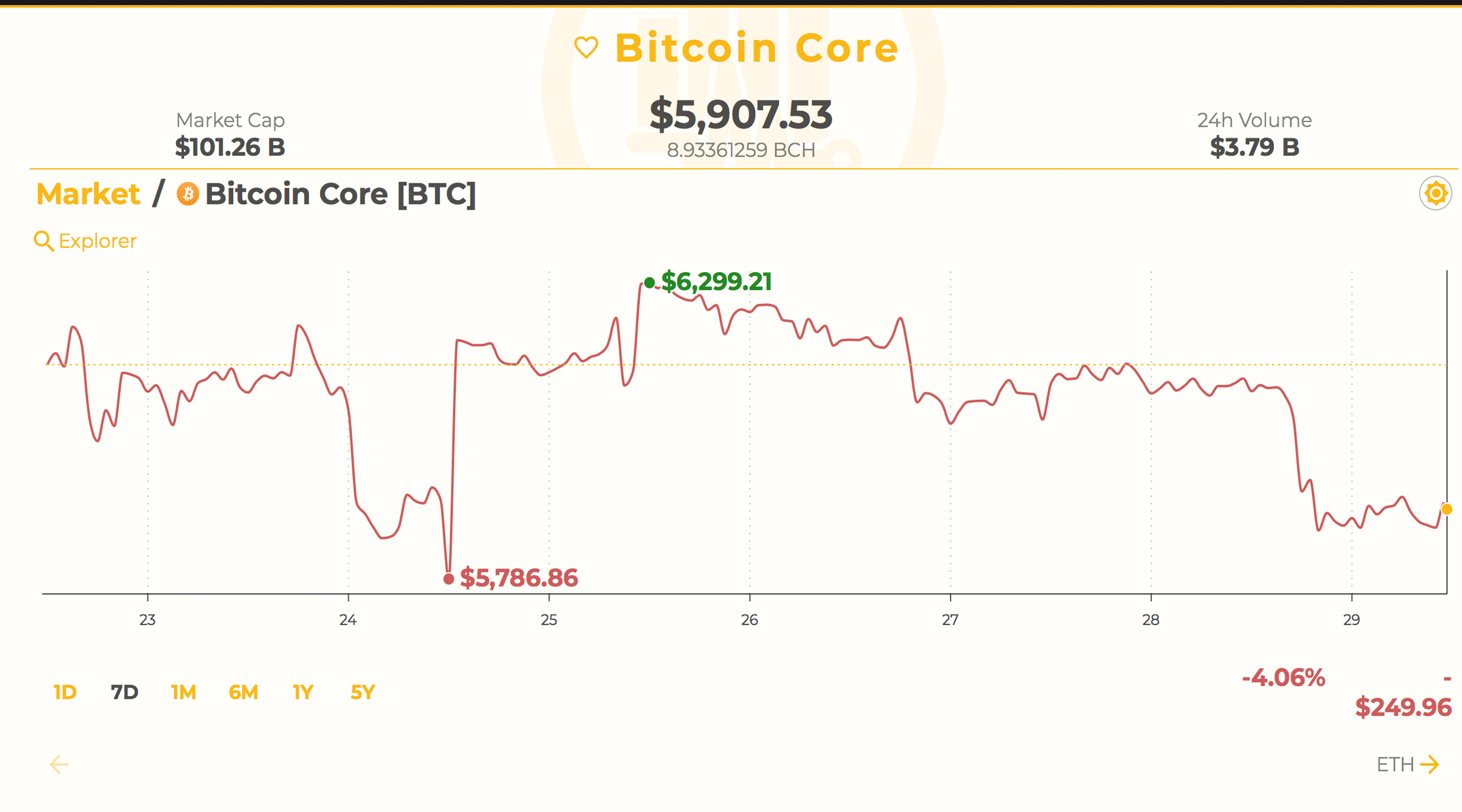

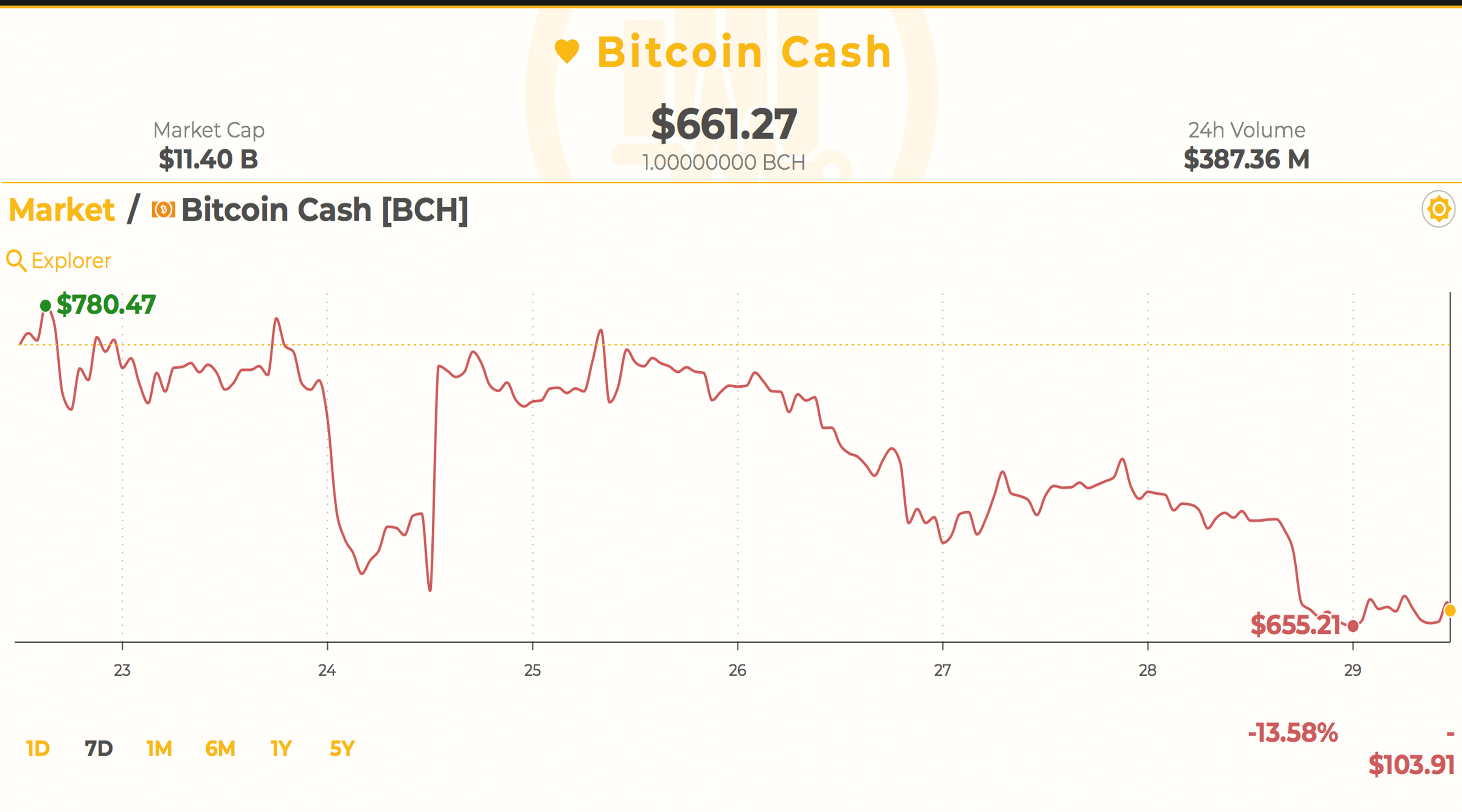

Cryptocurrency prices have once again dipped some more as most digital assets are seeing 24-hour losses of around 2-10 percent today. Bitcoin Core (BTC) markets have dipped below the $6K region to a low of $5,774 per coin but have since rebounded a hair to $5,907. Bitcoin Cash (BCH) markets dropped to a low of $630 per coin but are now averaging $661 per BCH on June 29, 2018.

Also read: Japanese Economist Explains Why Another Bitcoin Price Surge Is Unlikely

Cryptocurrency Markets Drop a Hair Lower

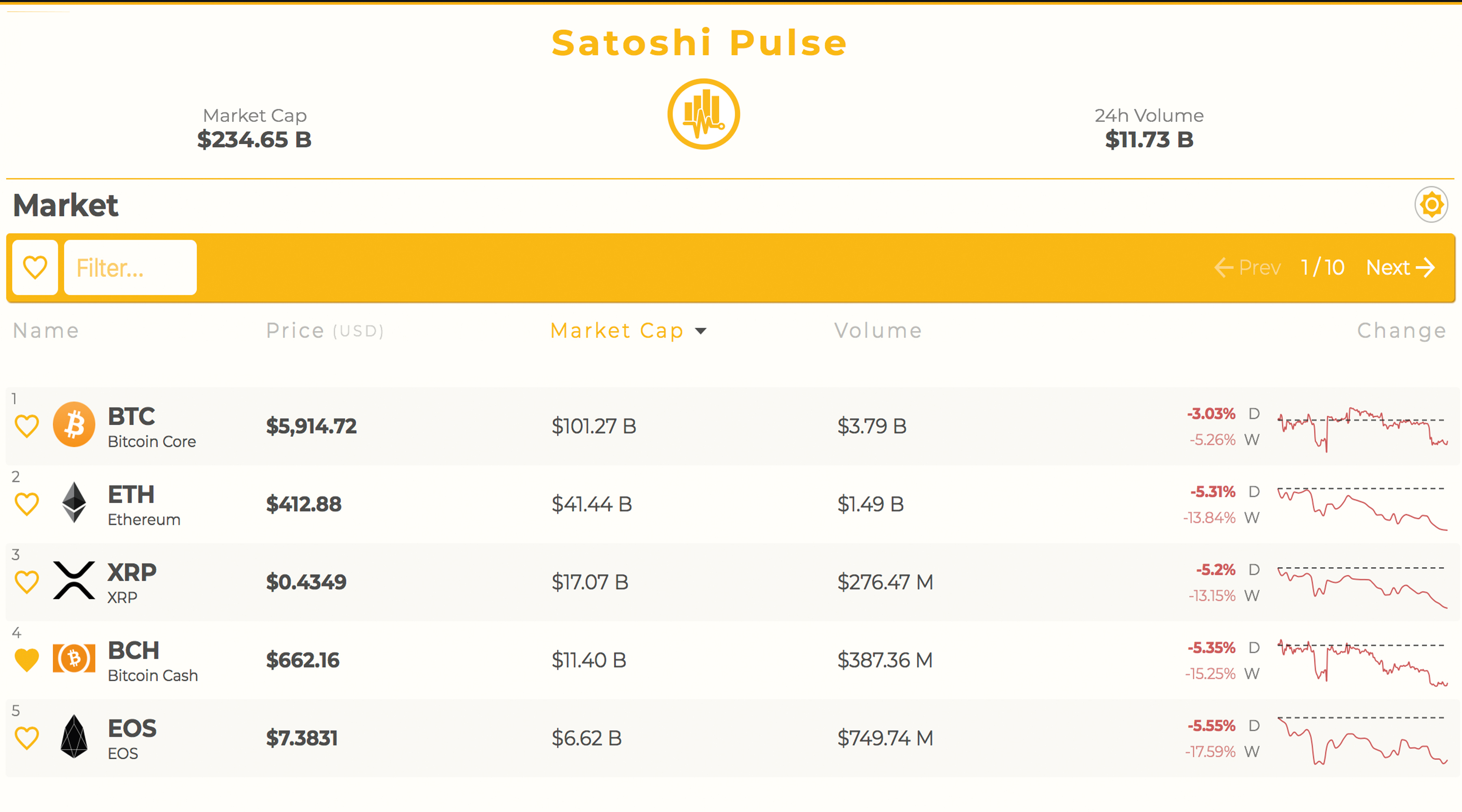

Digital currency markets are at a turning point today as most cryptocurrencies have lost quite a bit of value erasing nearly all the gains achieved since last October 2017. Since Bitcoin Core’s (BTC) all-time high (ATH) at $19,600, the cryptocurrency has lost 70 percent of its value. The entire cryptocurrency capitalization of all 1600+ coins is $234Bn as it has lost nearly ⅔ of value since December 2017. Today, on June 29, there’s been an 11.7Bn worth of digital currencies traded as trade volumes continue to grow weaker. On the other hand, there’s been a lot of development taking place behind the scenes, and big crypto-focused firms like Coinbase, Blockchain, Circle, and others are now enticing institutional investors from venture capital firms.

BTC Market Action

BTC market action has been tough on bulls as bears continue to wreak havoc and shorting every chance they can get. However, many short positions on exchanges like Bitfinex are being liquidated and dwindling down as long positions are starting to grow. At press time, BTC has a market capitalization of a little over $100Bn and 24-hour trade volume of around $3.7Bn. The top exchanges today swapping the most BTC include Binance, Bitfinex, Okex, ZB.com, and Bitstamp. The Japanese yen is capturing 59 percent of today’s BTC trade volume which is followed by tether (USDT 17.4%), USD (16.2%), EUR (2.5%), and KRW (1.5%).

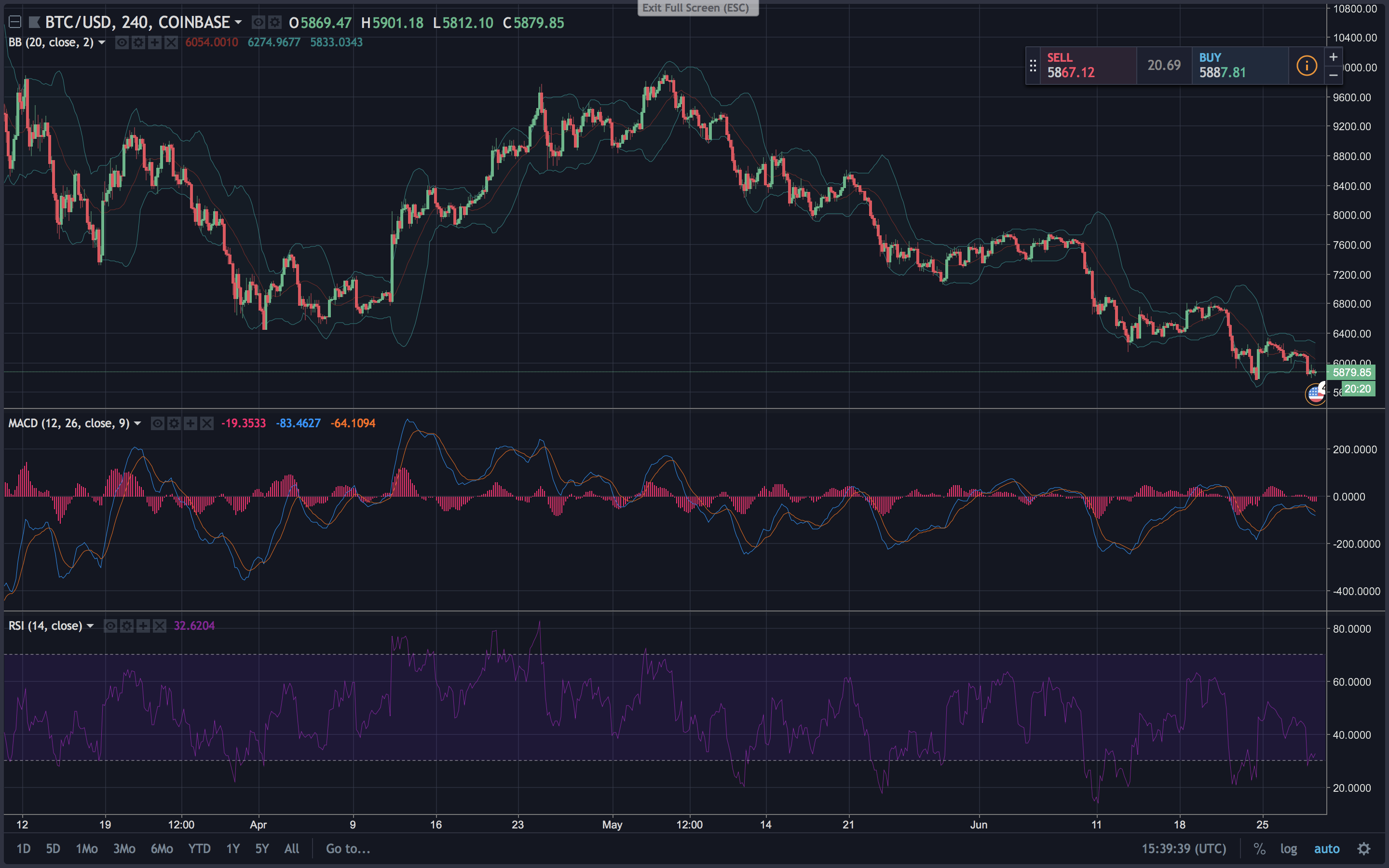

BTC/USD Technical Indicators

Looking at the 4-hour and daily BTC/USD charts on Coinbase and Bitstamp shows bulls are exhausted after pushing back to the $6,200 range and losing it. Just like our last markets update, right now the long-term 200 Simple Moving Average (SMA) is well above the short-term 100 SMA. This indicates the path to least resistance will be towards the downside. MACd levels look as they’ll be heading southbound after seeing a slight lift during the early morning trading sessions. The Relative Strength Index (RSI) oscillator is showing oversold conditions at the moment (32.04) which means we could see a slight increase northbound in the short term. Looking at order books shows that bulls need to get past the $6K region but bigger resistance is above the $6,200-6,400 zone. The walls looking northbound are not that tall and things could change directions in an instant. On the backside, there are mountains of buyers between now and $5,000.

BCH Market Action

BCH Market Action

BCH action shows bulls are struggling to hold current market spot prices as well. Today the Bitcoin Cash market capitalization is resting at $11.4Bn with around $390Mn in 24-hour trade volume. BCH is holding the 5th highest trade volume today out of all 1600+ cryptocurrencies in existence. The top exchanges trading the most BCH on the last week of June are Okex, Bitfinex, Huobi, Hitbtc, and EXX. Data collected from Crypto Compare shows BTC commands roughly 40 percent of today’s BCH trades. This is followed by tether (USDT 29%), USD (17%), KRW (6.3%) and JPY (1.8%). The addition of the yen joining the top five is interesting and ETH trades account for 1.59 percent of BCH swaps as well.

BCH/USD Technical Indicators

Looking at the BCH/USD charts on Bitfinex indicates BCH bulls have their work cut out for them. The 200 SMA is above the short term 100 SMA but the gap is smaller than the 4-hour BTC/USD chart. However, this still indicates that the least resistance is the downside if any uptrends are squashed along the way today. MACd is meandering in the middle as we speak and could head in one of two directions. RSI levels (31.7) are similar to the BTC/USD charts as the oscillator on the BCH/USD 4-hour is also showing oversold conditions. Bulls need to press past $685 to find smoother seas ahead and at the moment that’s still attainable in the short term. Looking at the backside shows bears will see pit stops between the current vantage point and $620 through $590 because of extremely large buy walls.

The Top Crypto Markets Today

The second largest market cap belonging to Ethereum (ETH) is down 5.3 percent over the last 24-hours. ETH markets are also down 13 percent over the last week with a price average of around $412 per token. Ripple (XRP) markets are down 5.2 percent today and 13 percent over the last seven days as one XRP now trades for $0.43 cents. Lastly EOS still commands the fifth position but EOS markets have dropped 5.5 percent over the last 24-hours. EOS charts show seven-day losses of around 17 percent with one EOS priced at $7.38 per coin.

The Verdict: Cryptocurrency Markets Are at the Crossroads

Today’s verdict is still filled with uncertainty and skepticism on whether or not we will see a bear market reversal soon. There has been a triple bottom and so far most cryptocurrency prices have remained above these key areas for now. People are still in the midst of coordinating newer positions like a game of musical chairs in search of the next wave up or even down.

Where do you see the price of BCH, BTC, and other coins headed from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Cryptocurrency Prices at the Crossroads appeared first on Bitcoin News.

Powered by WPeMatico