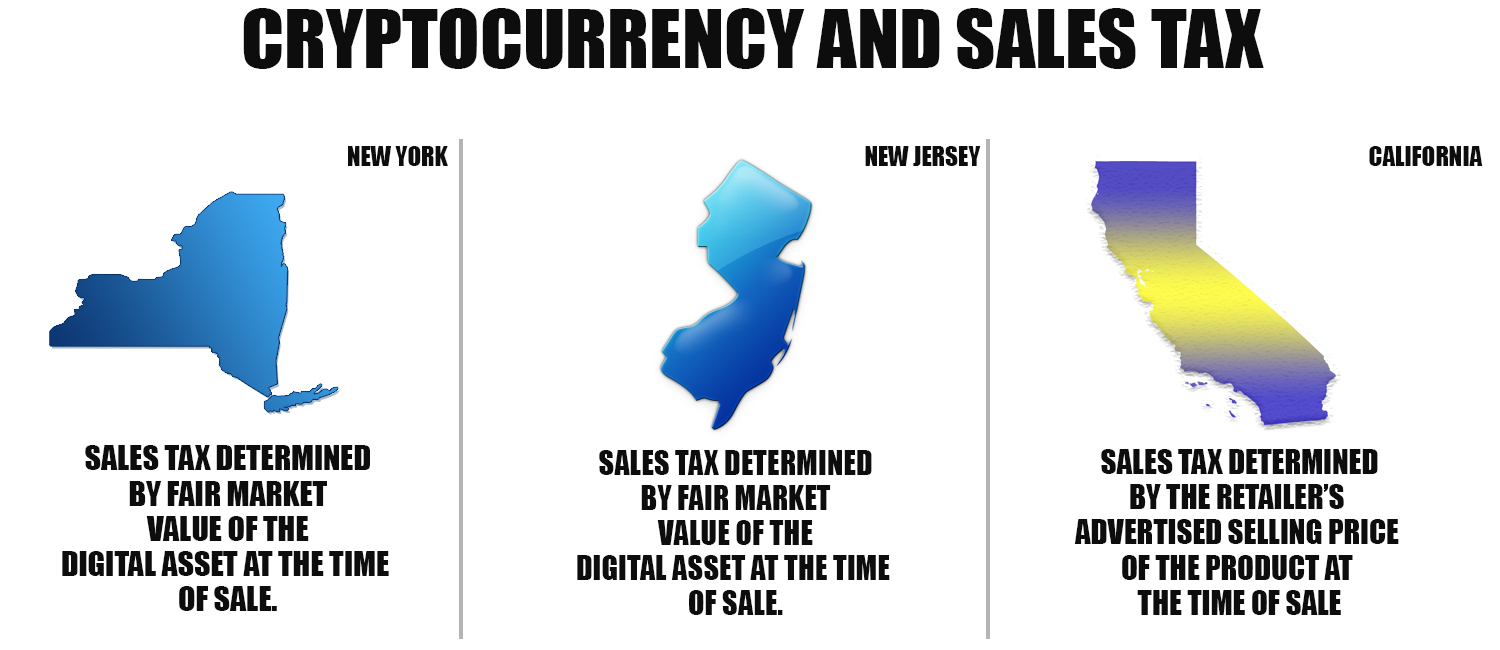

Over the last two years in the US, the federal government and states have been trying to grasp the concept of cryptocurrencies and apply them to traditional finance laws like taxes. The task has proven to be extremely difficult for federal agencies and officials however. One confusing issue is the application of state sales tax towards a purchase made with bitcoin. A great majority of states across the US have zero guidance on this issue and some states like New York, New Jersey, and California have entirely different ways of handling digital currency purchases and sales tax.

Also read: Bitcoin Cash Hard Fork Debate Reconvenes After the Stress Test

Sales Tax and Bitcoin

Bitcoins and taxation is not the most popular topic, and both topical conversations seem to mix like oil and water these days. In the US, most cryptocurrency enthusiasts understand that according to the Internal Revenue Service (IRS), digital currencies like bitcoin are considered property for Federal tax purposes. Essentially this means that current property transaction laws apply to transactions using virtual currencies. The US taxpayer is required to report the character of gains or losses from the sale or exchange of a cryptocurrency from the value it was acquired for at the time and for the value of the final sale. Additionally, the IRS treats cryptocurrencies like a ‘convertible virtual currency’ (CVC) which means theoretically if merchants accept a currency like bitcoin the state tax could be applied to both the merchant and customer.

However, only a few states offer clarification on the issue of sales tax and bitcoin purchases. Most US states have absolutely no guidance whatsoever on how a merchant and customers should handle sales tax. The few states that do offer some descriptive laws on state sales tax and cryptocurrencies also provide two different methods of applying sales tax to digital currency purchases. The subject was covered in a recent BNA tax report this week and the topic has been discussed in great detail over the last five years.

New Jersey’s Technical Assistance Memorandum

For instance, back in 2015 the state of New Jersey published a Technical Assistance Memorandum (TAM-2015-1 -R) which explains bitcoin and other cryptocurrencies are to be treated as a CVC. If a customer purchases an item from a New Jersey merchant who accepts bitcoin, the purchase or use is not subject to the state’s sales/use tax. Merchants in New Jersey, on the other hand, are subject to sales tax laws and the percentage of sales tax is based on the fair market value of the cryptocurrency used. Of course, the merchant is required to pay the tax in US dollars as well. According to New Jersey law merchants must:

For instance, back in 2015 the state of New Jersey published a Technical Assistance Memorandum (TAM-2015-1 -R) which explains bitcoin and other cryptocurrencies are to be treated as a CVC. If a customer purchases an item from a New Jersey merchant who accepts bitcoin, the purchase or use is not subject to the state’s sales/use tax. Merchants in New Jersey, on the other hand, are subject to sales tax laws and the percentage of sales tax is based on the fair market value of the cryptocurrency used. Of course, the merchant is required to pay the tax in US dollars as well. According to New Jersey law merchants must:

- Register for sales tax purposes;

- Record in their books and records the value of the convertible virtual currency accepted at the time of each transaction, converted to US dollars;

- Record in their books and records the amount of sales tax collected at the time of each transaction, converted to US dollars; and

- Report such sales and remit any sales tax due in US dollars when filing their periodic sales tax returns.

The New York State Department of Taxation and Finance Rules

The State of New York’s law towards bitcoin and sales tax is quite similar to New Jersey’s sales tax guideline. New York defines bitcoin sales tax the same way by finding the value of the cryptocurrency or CVC used at the time of purchase and applying that to the value of the CVC amount spent determines the tax. Because the prices of digital assets fluctuate so much, merchants will have a difficult time formulating their revenue books with New York and New Jersey’s sales tax perspective.

The State of New York’s law towards bitcoin and sales tax is quite similar to New Jersey’s sales tax guideline. New York defines bitcoin sales tax the same way by finding the value of the cryptocurrency or CVC used at the time of purchase and applying that to the value of the CVC amount spent determines the tax. Because the prices of digital assets fluctuate so much, merchants will have a difficult time formulating their revenue books with New York and New Jersey’s sales tax perspective.

“If the party that gives convertible virtual currency in trade receives in exchange goods or services that are subject to sales tax, that party owes sales tax based on the market value of the convertible virtual currency at the time of the transaction, converted to US dollars,” explains the New York State Department of Taxation and Finance.

If the party that trades property or services in exchange for receiving convertible virtual currency gives the other party a sales slip, invoice, or receipt, the first party must separately state the sales tax due in US dollars on the sales slip, invoice, or receipt.

California Uses the Advertised Selling Price of the Product for Sales Tax

However, another state with a powerful economy like New York has an entirely different way of handling state sales tax and bitcoin. The state of California has applied a sales tax law to virtual currencies as well, but instead of using the CVC value, the sales tax is only applied to the products sold. The California Board of Equalization explains that sales tax applies to bitcoin just like fiat and a tangible item of personal property. However, the measure of sales tax stems from the price of the product at the time of sale and has no correlation to the CVC’s value at the time. Just like New York and New Jersey, sales tax in California must be paid in US dollars.

However, another state with a powerful economy like New York has an entirely different way of handling state sales tax and bitcoin. The state of California has applied a sales tax law to virtual currencies as well, but instead of using the CVC value, the sales tax is only applied to the products sold. The California Board of Equalization explains that sales tax applies to bitcoin just like fiat and a tangible item of personal property. However, the measure of sales tax stems from the price of the product at the time of sale and has no correlation to the CVC’s value at the time. Just like New York and New Jersey, sales tax in California must be paid in US dollars.

“The measure of tax is the total amount of the sale or lease, whether received in money or other consideration,” the California Board of Equalization details.

Therefore, if a retailer enters into a contract where the consideration is virtual currency, the measure of tax from the sale of the product is the amount allowed by the retailer in exchange for the virtual currency (generally, the retailer’s advertised selling price of the product.)

There are a few other states in the US including Vermont, Illinois, Arizona, Wyoming, and Georgia that have cryptocurrency laws either being drafted or being reviewed by governors, senators and house representatives in those regions. Internationally sales tax law in other countries such as Germany, Denmark, Belarus, and Slovenia are far friendlier than the US but also use entirely different methods of taxation. Then there are a few regions that don’t apply a capital gains tax to virtual currencies like Mauritius, Hong Kong, New Zealand, Switzerland, and Barbados.

It doesn’t seem like the US or the IRS will be defining bitcoin in a different way and will continue to be treated as a property rather than a currency. As far as state sales tax is concerned, a large majority of merchants from different states are still very much in the dark when it comes to sales tax and bitcoin.

What do you think about applying sales tax to bitcoin and how each state is taking different measures? Let us know what you think about this subject in the comment section below.

Images via Shutterstock, Bitcoin.com, and Pixabay.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH, and other coins, on our market charts at Satoshi Pulse, another original and free service from Bitcoin.com.

The post Sales Tax and Bitcoin in the United States Can Be Confusing appeared first on Bitcoin News.

Powered by WPeMatico