Cryptocurrency attracts a diverse crowd, from speculators to scammers, and from financiers to gamblers. These groups, and their often opposing aims, are what make the cryptoconomy such a strange yet compelling place. In today’s edition of The Daily, for instance, we’ve got stories pertaining to a Wall Street-funded futures exchange, another US platform ending its margin trading, a company that will trade your token to simulate demand for it, and an obligatory new stablecoin.

Also read: Six of the Best Cryptocurrency Calendars

Wall Street-Backed Crypto Exchange Erisx Announced

Nebraska-based brokerage firm TD Ameritrade is making a move into the cryptocurrency exchange game with a little help from its Wall Street friends. The brokerage big shot revealed Erisx on Wednesday, the name for the platform being spearheaded by trading veteran Thomas Chippas. Regulatory approval is being sought to list bitcoin core, bitcoin cash, ether, and litecoin futures. Chippas left his job at Citigroup to head up the project, a trend that’s been observed repeatedly in the cryptocurrency space, with traditional financiers being lured into the realm of crypto by the promise of a fresh challenge and potentially big payday.

Nebraska-based brokerage firm TD Ameritrade is making a move into the cryptocurrency exchange game with a little help from its Wall Street friends. The brokerage big shot revealed Erisx on Wednesday, the name for the platform being spearheaded by trading veteran Thomas Chippas. Regulatory approval is being sought to list bitcoin core, bitcoin cash, ether, and litecoin futures. Chippas left his job at Citigroup to head up the project, a trend that’s been observed repeatedly in the cryptocurrency space, with traditional financiers being lured into the realm of crypto by the promise of a fresh challenge and potentially big payday.

Having closed a fundraising round backed by DRW and Virtu Financial, in addition to TD Ameritrade, the venture has attracted attention, fueled by its intention to position itself as a direct rival to Bakkt, the forthcoming cryptocurrency platform from the NYSE’s parent company. Erisx will begin by offering spot trading for cryptocurrencies before venturing into derivatives, all going well. It should be noted, however, that the “new” exchange is in fact a revamp of Eris Exchange, a derivatives platform that has failed to achieve anything of note in its eight years of operation.

Circle Drops Margin Trading

While one US exchange is dreaming of derivatives, another is shunning them. The Circle-backed Poloniex exchange has revealed that it is removing margin and lending products for its US customers. “These changes are part of our ongoing commitment to ensure that Poloniex complies with regulatory requirements in every jurisdiction,” explained Circle. In the same announcement, it was revealed that three assets will be delisted from Poloniex on October 10: AMP, EXP, and, perhaps surprisingly, gnosis (GNO).

Market Making as a Service

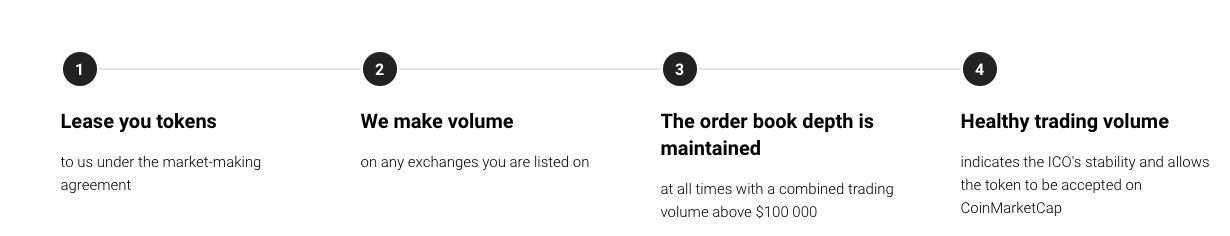

“What is the biggest trouble for every ICO?” asks Tokenboost. No, the answer isn’t creating a token that has genuine utility, developing a vibrant community, or devising a sound business strategy. The biggest problem, apparently, is getting listed on Coinmarketcap (CMC). That’s right: the holy grail for ICOs, apparently, is to have their token listed on a market tracker website. According to Tokenboost, CMC mandates at least $100k of daily trading volume before it will list a coin (though a quick check shows this claim to be inaccurate).

Tokenboost’s solution to this problem is to engage in market making on behalf of projects – or wash trading as some might call it. “We can take your token to the top,” they boast. “High volumes and listing on Coinmarketcap make your project more noticeable and trustworthy, attracting more partners, investors and traders. This will create a higher demand for the token and drive its price up.” At least they’re honest.

Ho Wah Genting Group Enters the Stablecoin Game

Scarcely a day goes by without a business announcing its intentions to issue a stablecoin. Ho Wah Genting Group (HWGG), an investment holding company focused on entertainment gaming, is to issue a fiat-backed stablecoin. HWG Cash will be pegged to $500 million in bank deposits and used to facilitate transactions within its entertainment business. Based on the Everitoken blockchain, the $1 coins will be exchangeable for fiat in Malaysia, where HWGG has a money broker license, and will also be accepted at a range of partner businesses including travel, retail, and cruise services.

What are your thoughts on today’s news tidbits as featured in The Daily? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post The Daily: Wall Street-Backed Crypto Futures, Market Manipulation as a Service appeared first on Bitcoin News.

Powered by WPeMatico