New research shows that one out of five hedge funds launched thus far this year has been a cryptocurrency-focused hedge fund. This is a surprising statistic in light of the 2018 bear market, but it may indicate that managers and investors are still optimistic about the long-term outlook and want to capitalize on current low prices.

Also Read: Report: Barclays Drops Plan for Cryptocurrency Trading Desk

Rapid Expansion by Segment

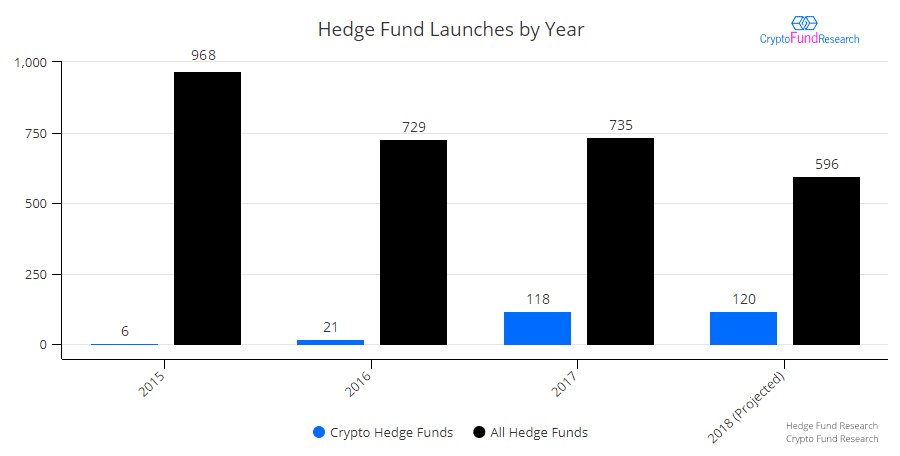

A total of 90 cryptocurrency hedge funds were launched in the first three quarters of 2018, according to data from Crypto Fund Research. Extrapolating a similar rate for the final quarter of the fiscal year, 120 crypto hedge funds will likely be launched in 2018, or exactly 20 percent of the 600 hedge funds that will probably start operating by the end of this year.

This is a rapid expansion of relative market share by segment, as crypto hedge funds accounted for just 16 percent of launches in 2017 and less than 3 percent of new hedge funds in 2016. And as the report notes, two-thirds of all currently operational crypto funds have been launched within the past seven quarters (January 2017 to September 2018).

The research also shows that about half of the crypto hedge funds launched this year were based in the U.S. However, Australia, China, Malta, Switzerland, the Netherlands and the U.K have all seen multiple cryptocurrency hedge fund launches in 2018, too.

Drop in the Bucket

It is also important to remember that while crypto funds are growing quickly, they still account for a small fraction of the overall industry. There are currently only 303 crypto hedge funds in operation, accounting for just 3 percent of more than 9,000 hedge funds that exist around the world. Crypto hedge funds also have less than $4 billion in assets under management, which is a drop in the bucket compared to the wider hedge fund industry, which manages more than $3 trillion in assets.

These figures do not include crypto venture capital and crypto private equity funds. Adding those to the total, there are currently 622 crypto funds of all types now in operation, according to Crypto Fund Research.

“In the midst of 2018’s decline in traditional hedge fund launches, crypto hedge funds are a notable aberration. Cryptocurrency prices have been in a bear market for the better part of the year and regulatory uncertainty persists in much of the world,” said Joshua Gnaizda, founder of Crypto Fund Research. “Yet these seemingly unfavorable market conditions have not deterred managers from launching new crypto hedge funds at a record pace. While we don’t believe the rate of new launches is sustainable longer-term, there are currently few signs of a significant slowdown.”

Why are so many crypto hedge funds being launched in the current market? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

The post Research: 1 of 5 New Hedge Funds in 2018 Is a Crypto Fund appeared first on Bitcoin News.

Powered by WPeMatico