The demise of Tether has been a car crash in slow motion. An unswervable event that has played out over the course of months, it has reached a crescendo in the past 24 hours, with tether slipping significantly from its dollar peg. It is possible, perhaps even probable, that it will regain parity with the U.S. dollar. But by then, the damage may have already been done.

Also read: The Daily: Tether Sheds Its Peg

The Beginning of the End

or the Start of a New Dawn?

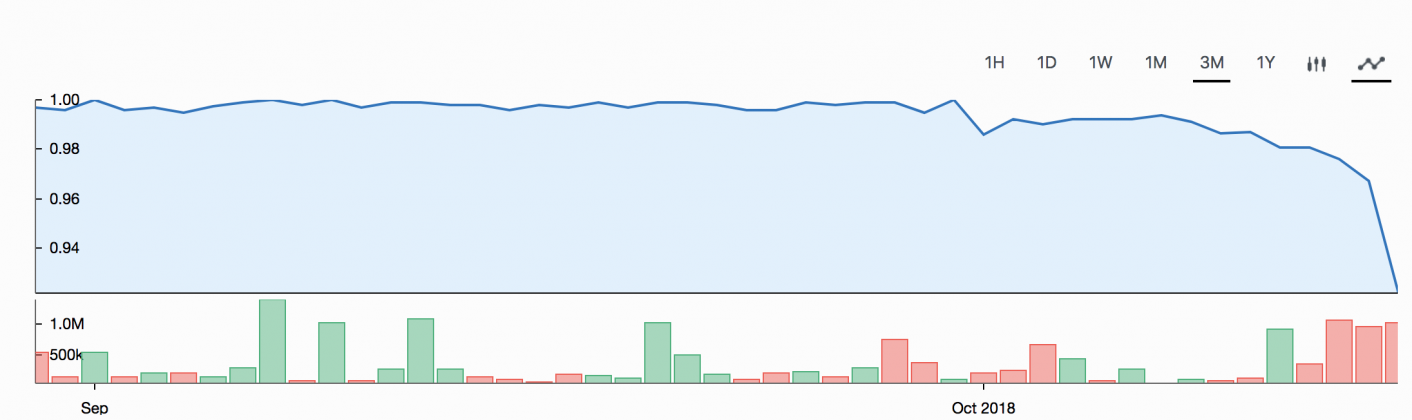

A cryptocurrency losing 10 percent of its value in a week would not normally be news. But when that cryptocurrency is a supposedly “stable” coin — and one whose very stability is relied on by a huge tranche of the market — its slippage is big news. One small slip for tether can result in a giant leap for other cryptocurrencies; it is no coincidence that BTC’s climb to $7,500 in the past 12 hours, as well as its subsequent decline, was triggered by tether’s instability.

A cryptocurrency losing 10 percent of its value in a week would not normally be news. But when that cryptocurrency is a supposedly “stable” coin — and one whose very stability is relied on by a huge tranche of the market — its slippage is big news. One small slip for tether can result in a giant leap for other cryptocurrencies; it is no coincidence that BTC’s climb to $7,500 in the past 12 hours, as well as its subsequent decline, was triggered by tether’s instability.

A precis of the events that led to this state of affairs goes as follows:

- Tether’s trading volume has built up over time, leading to it becoming the second most traded crypto after BTC (USDT 24-hour volume currently stands at $4.8B)

- Bitfinex’s failure to publish an audit has led to fears that tether could be backed by nothing, or at least not enough to cover the 2.5 billion tethers in circulation

- Bitfinex’s struggle to obtain a banking partner has exacerbated the problem

- Rumors of Tether/Bitfinex being subpoenaed and potentially shut down have swirled for months

- Last week Bitfinex lost its latest bank, HSBC, forcing it to suspend fiat deposits

- A steady stream of criticism has poisoned the Tether brand, leaving confidence in the stablecoin at an all-time low

- Wary of being trapped in an asset that’s a prime target for FUD (both real and false), traders have exchanged USDT for BTC or other stablecoins

- This has caused the price of tether to slip and other stablecoins to trade at a premium

Which leads us to where we are today, which is a cryptocurrency market that doesn’t know what’s going on. Tether bears are loving the collapse of USDT, other stablecoins are relishing their time to shine, memers are meming, arbers arbing, and BTC is leading the market on a merry dance from the low $6000s to the high sevens.

On cryptocurrency forums, traders shared apocalyptic predictions of what tether’s demise might do for the ecosystem, and whether it would presage Mt Gox 2.0. Hyperbole reigned supreme. “It took almost four years for people to regain some kind of confidence after Gox,” wrote one. “This is far worse than Gox, and will hurt crypto immensely in the eyes of even the bagholders and basic bitches.” They continued:

Without dumb money entering the system, you can’t offload your shitcoins, thus you’ll all be sitting on bags, and the market will become inert. It’s gonna be a bad, bad turn, regardless of what happens.

I hope some Tether person writes up an insider’s description of what is happening behind the scenes right now as the peg fails; I’m sure there are lessons other “stablecoins” can learn.

— Gavin Andresen (@gavinandresen) October 15, 2018

Exchanges Rush to Introduce New Stablecoins

With tether’s card marked, so to speak, cryptocurrency exchanges have sought to expedite the introduction of alternative stablecoins. Today (Oct. 16), Okex went stablecoin crazy, adding TUSD, USDC, GUDC, and PAX. On Binance, meanwhile, TUSD is trading at $1.12 against tether, having reached a high of $1.24 at one stage. At the time of publication, tether was averaging $0.93 across exchanges, but with some marked disparities between platforms. On Binance and Bittrex, for example, where there is a greater choice of stablecoins, tether has fared worse. On Kraken and Bitfinex, on the other hand, traders have little option but to trust in tether.

With tether’s card marked, so to speak, cryptocurrency exchanges have sought to expedite the introduction of alternative stablecoins. Today (Oct. 16), Okex went stablecoin crazy, adding TUSD, USDC, GUDC, and PAX. On Binance, meanwhile, TUSD is trading at $1.12 against tether, having reached a high of $1.24 at one stage. At the time of publication, tether was averaging $0.93 across exchanges, but with some marked disparities between platforms. On Binance and Bittrex, for example, where there is a greater choice of stablecoins, tether has fared worse. On Kraken and Bitfinex, on the other hand, traders have little option but to trust in tether.

It’s time to reflect on all the people that were telling you that the Tether situation is all FUD and that it’s perfectly normal. Countless of people reached out to me in the past week and criticized me for covering what’s going on and calling me a conspiracy theorist

— Larry Cermak (@lawmaster) October 15, 2018

Should Bitfinex succeed in restoring its banking arrangements this week, as the exchange has promised, it is conceivable that the move could restore faith in tether, which may regain the $1 peg it has adhered to so faithfully until this week. Whether tether is backed or unbacked, audited or unaudited, its status — from a technical perspective — has not changed in the past seven days. Psychologically, though, everything has changed. Like a cheating spouse, a stablecoin that’s been caught out once will always be suspected of straying again. While the markets will weather this period of uncertainty, for tether there may be no way back. Where tether and Bitfinex go from here is anyone’s guess.

Do you think this is the end for tether, or will the stablecoin recover? Let us know in the comments section below.

Images courtesy of Shutterstock, 4chan and Twitter.

Need to calculate your bitcoin holdings? Check our tools section.

The post The Fall of Tether and What It Means for the Cryptocurrency Markets appeared first on Bitcoin News.

Powered by WPeMatico