Fifty traders who use Indian crypto exchange Instashift have shared their thoughts on the current crypto environment in India. Most of them said that they “hodl” and would continue to invest in crypto despite regulatory uncertainty.

Also read: RBI Argues Supreme Court Should Not Interfere With Its Crypto Decision

Most Respondents Are Hodlers

A survey was conducted in the first week of October by Indian cryptocurrency exchange Instashift exclusively for news.Bitcoin.com. Launched in March, Instashift offers the buying and selling of over 80 cryptocurrencies.

A survey was conducted in the first week of October by Indian cryptocurrency exchange Instashift exclusively for news.Bitcoin.com. Launched in March, Instashift offers the buying and selling of over 80 cryptocurrencies.

Fifty active traders in India participated. The goal of the survey was to find out what they think about various crypto-related issues including their investment concerns, the crypto banking ban by the Reserve Bank of India (RBI), and whether they will keep investing in crypto despite regulatory uncertainty.

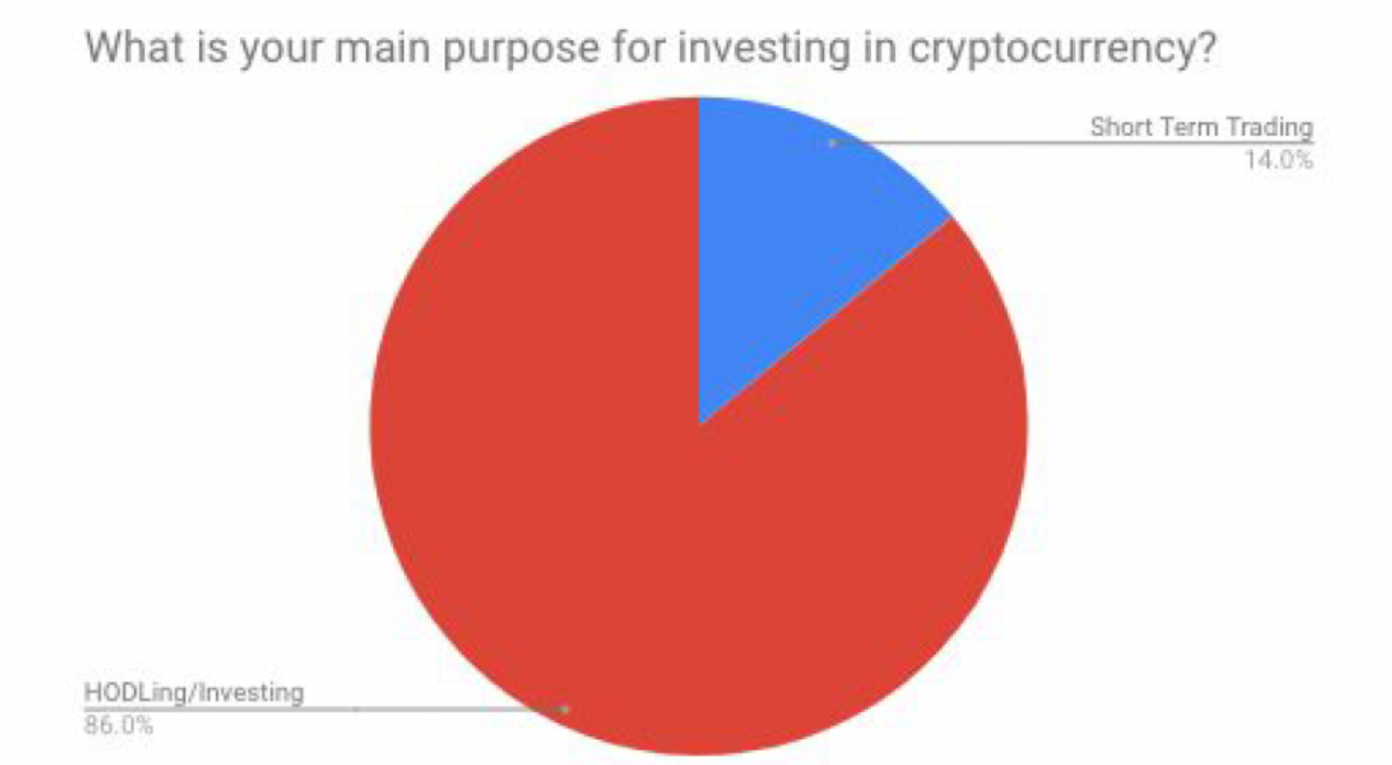

Among the 50 traders who responded, 43 said that they hodl while seven revealed that they invest short-term.

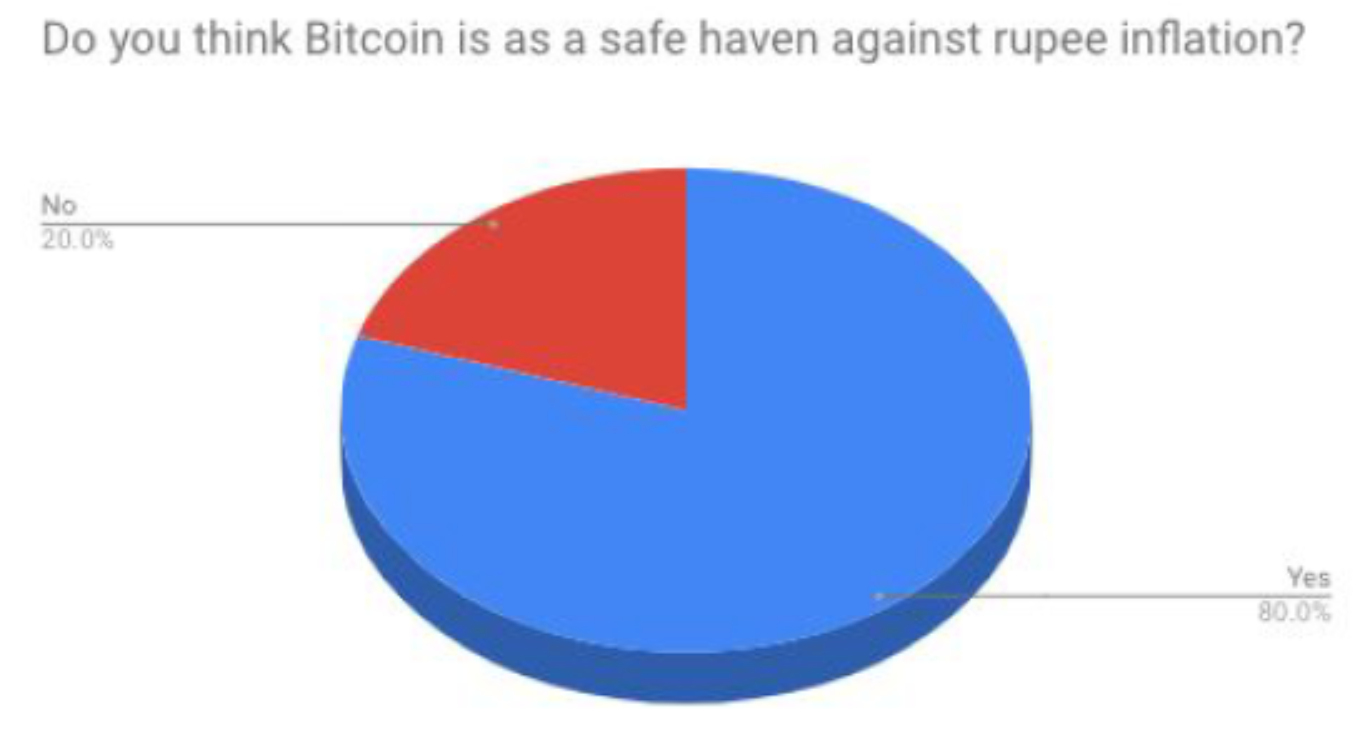

Furthermore, 40 traders believe bitcoin is a safe haven against rupee inflation while 10 traders disagree.

Crypto Investing Despite RBI Ban

India is currently drafting crypto regulations which were supposed to be ready in September but have been delayed. Meanwhile, RBI, the country’s central bank, has banned financial institutions under its jurisdiction from providing services to crypto businesses. A number of petitions have been filed against the ban. The country’s supreme court has been trying to hear them since Sept. 11, but the hearing has continually been postponed.

India is currently drafting crypto regulations which were supposed to be ready in September but have been delayed. Meanwhile, RBI, the country’s central bank, has banned financial institutions under its jurisdiction from providing services to crypto businesses. A number of petitions have been filed against the ban. The country’s supreme court has been trying to hear them since Sept. 11, but the hearing has continually been postponed.

The banking ban by the central bank has adversely impacted some exchanges. One of the country’s largest crypto trading platforms, Zebpay, recently shut down its exchange operations due to the banking problem.

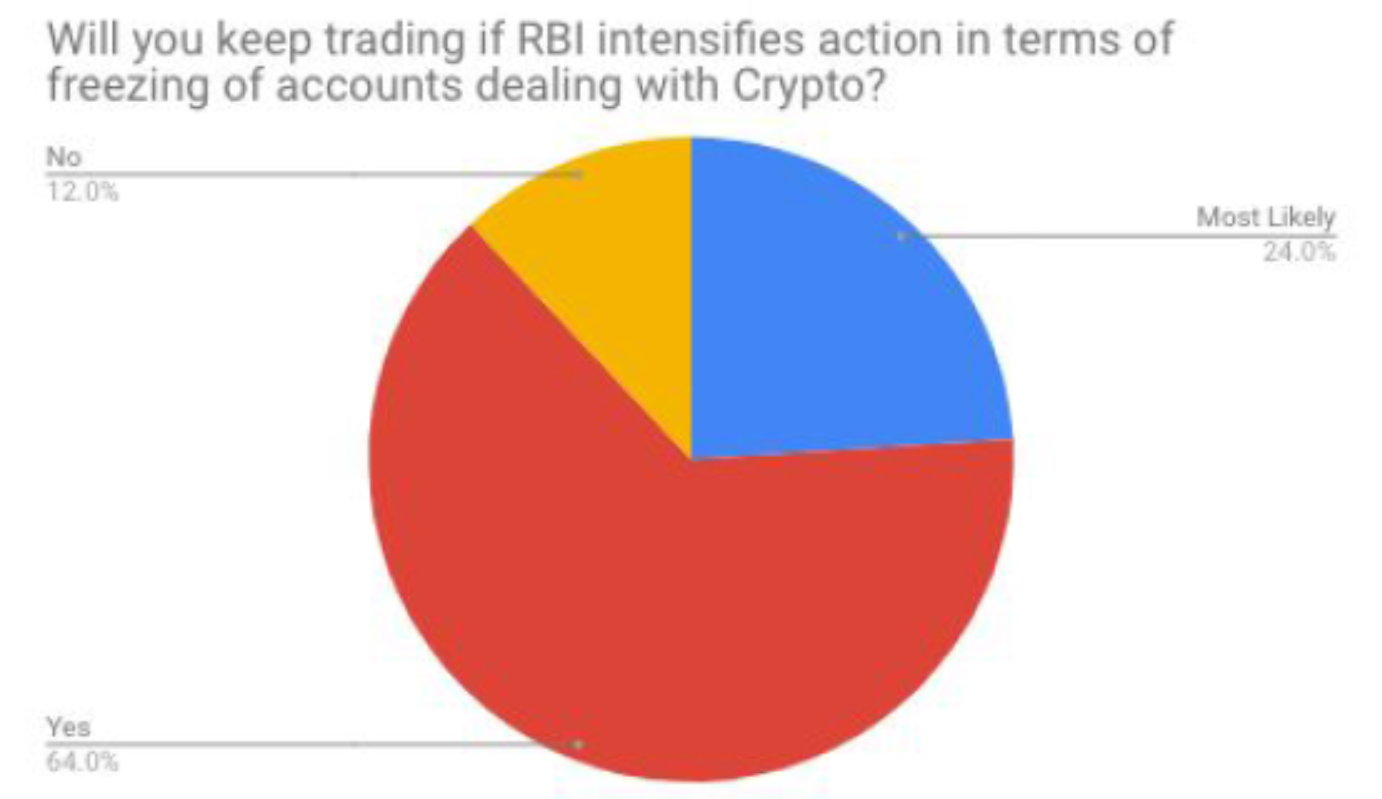

Despite the ban, 32 Instashift traders said that they would continue to invest in crypto even if the RBI intensifies its crackdown such as freezing crypto accounts. Another 12 traders noted that they are also likely to continue trading while six respondents said they would discontinue crypto trading.

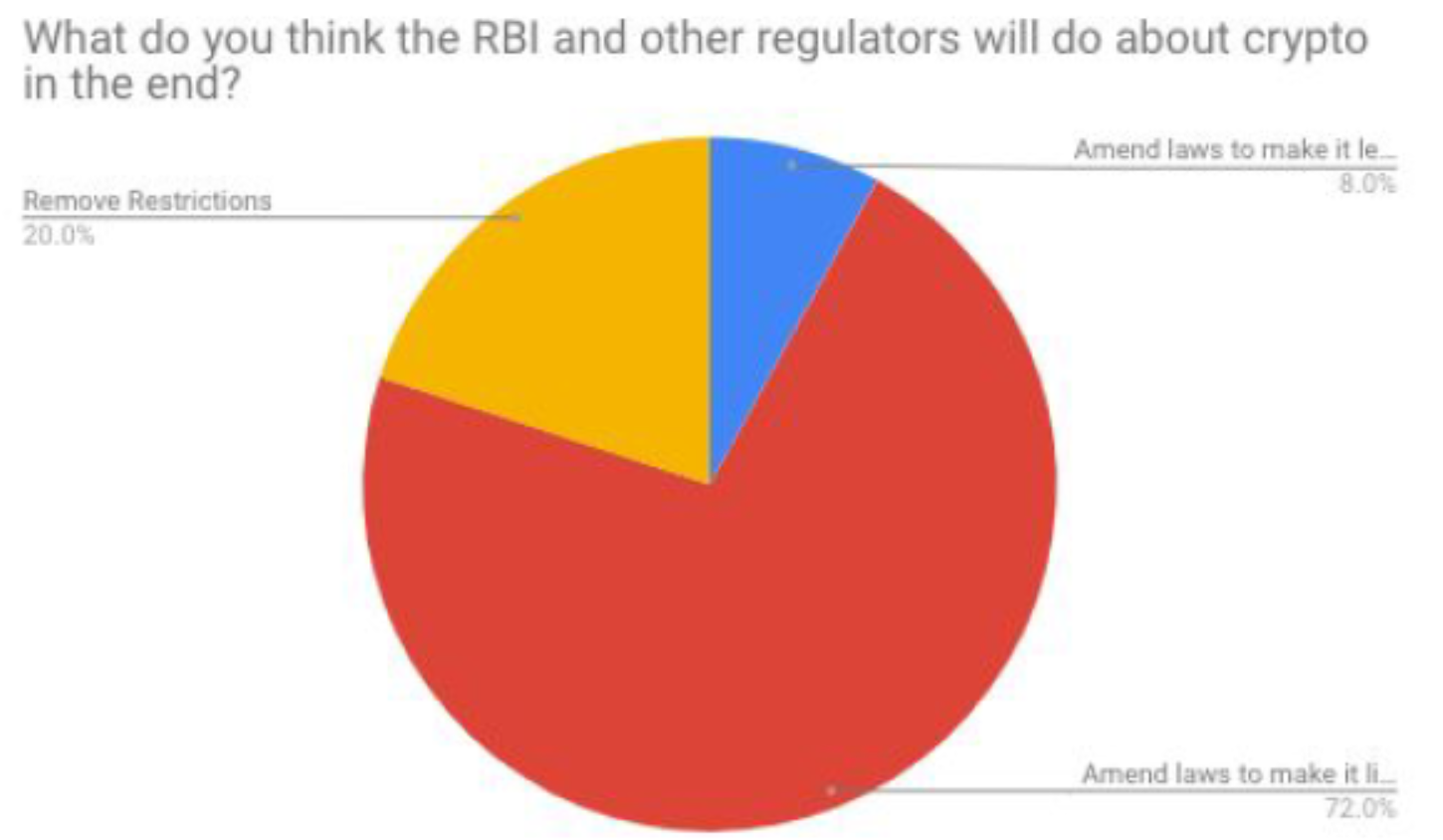

In addition, 36 traders believe that the Indian government will amend existing laws to accommodate cryptocurrencies. Ten respondents believe that the regulators will remove restrictions on crypto. However, only four traders believe that crypto will be legalized and regulated in India.

Preferred Cash-Out Methods

A number of crypto exchanges in India have come up with their own solutions to the RBI ban. Some have introduced exchange-escrowed peer-to-peer trading services, which they claim have gained much popularity.

A number of crypto exchanges in India have come up with their own solutions to the RBI ban. Some have introduced exchange-escrowed peer-to-peer trading services, which they claim have gained much popularity.

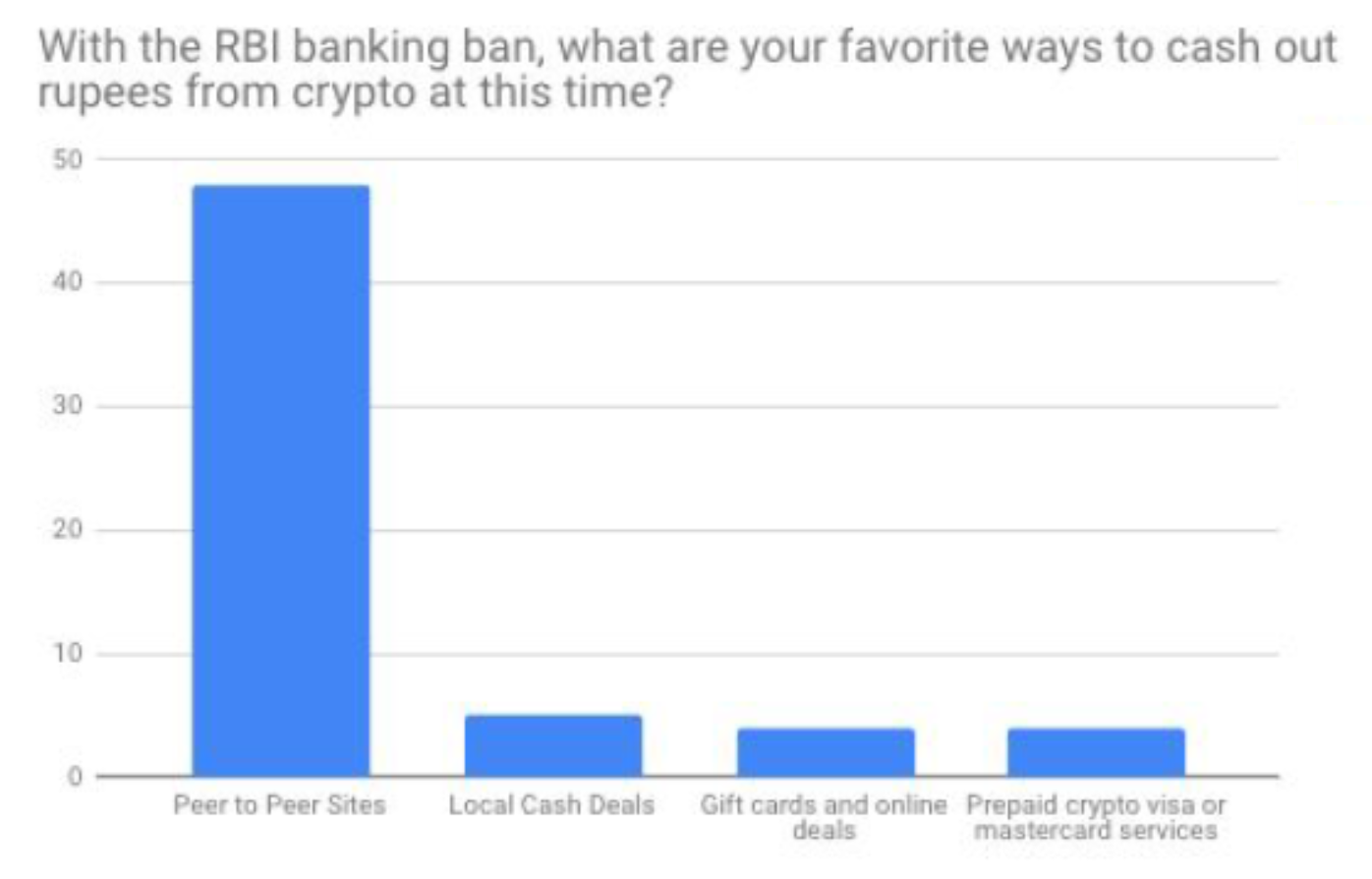

Respondents were asked about their preferred methods of cashing out cryptocurrencies into rupees. Forty-eight traders said they prefer to cash out using peer-to-peer sites. Five traders prefer to use local cash deals, four prefer to use gift cards and online deals, and four others prefer to cash out using prepaid crypto Visa and Mastercard services.

On Sunday, another cash-out method was introduced by one of India’s largest crypto exchanges, Unocoin. The company has launched crypto ATMs to bypass the RBI ban and allow its users to deposit and withdraw rupees. This option was announced after the Instashift survey had concluded, so it was not included in the survey.

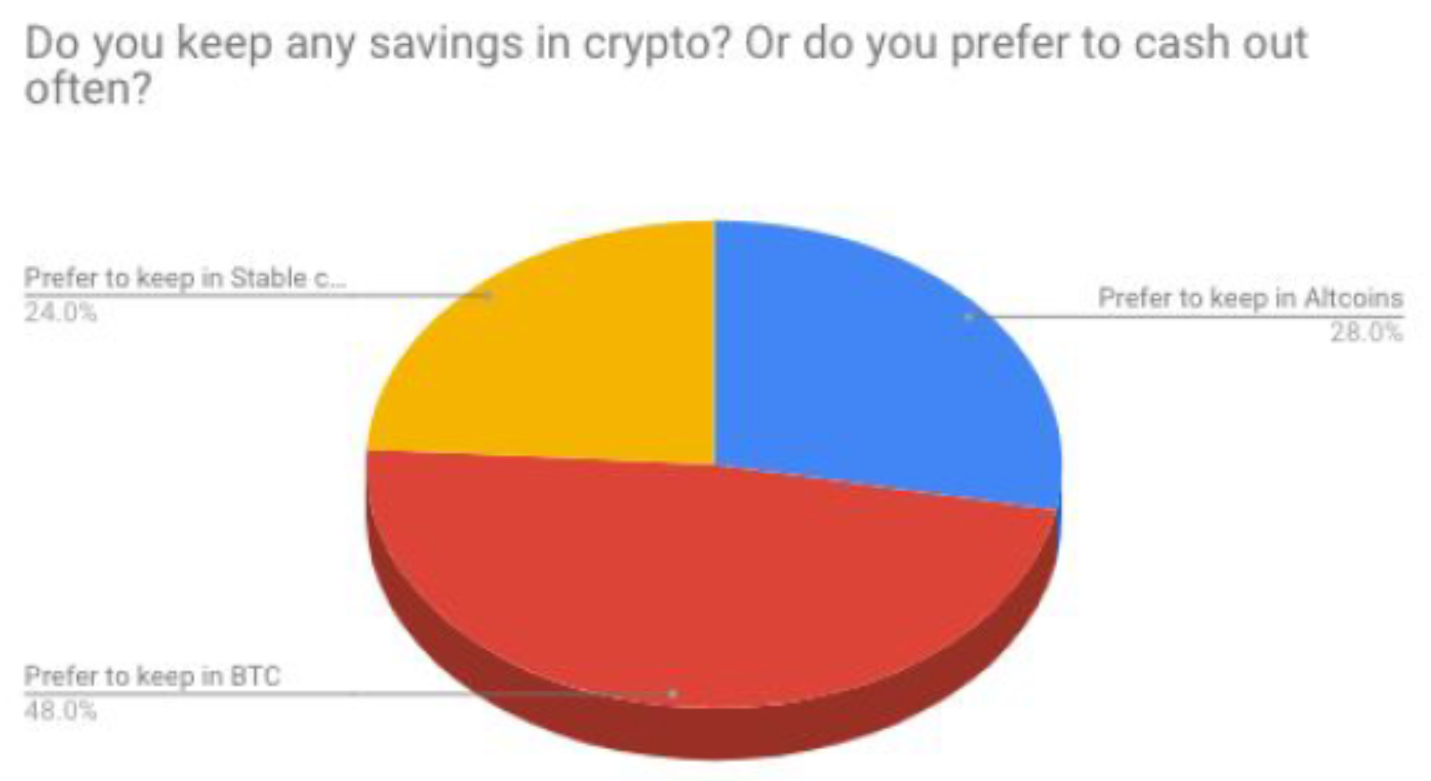

As for where to keep their funds, 24 traders prefer to keep them in BTC, 14 prefer altcoins, and 12 specifically prefer stablecoins. Recently, an increasing number of crypto exchanges in India have started listing stablecoins such as tether (USDT) and trueusd (TUSD).

Future Prospects of Crypto Ecosystem in India

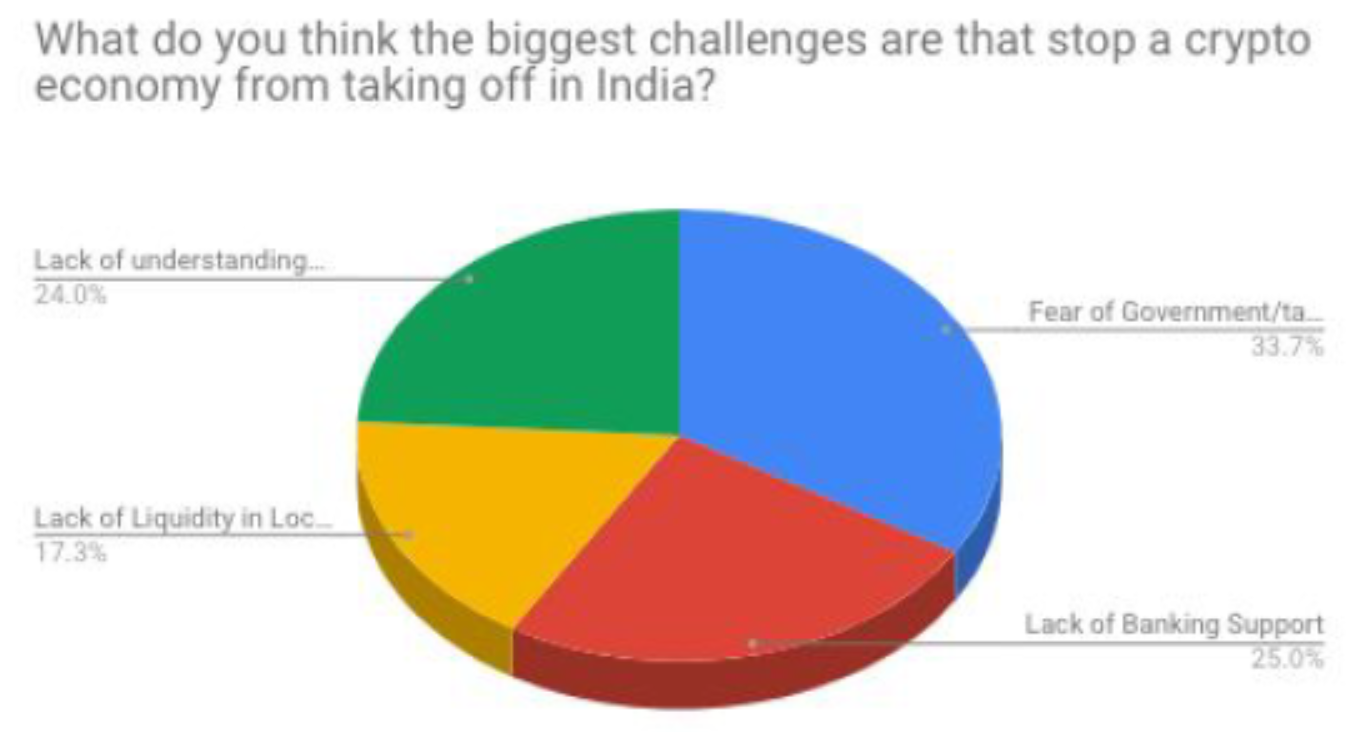

Amid the banking ban, 35 respondents believe that the fear of regulatory uncertainty is the biggest hurdle stopping the Indian crypto economy from flourishing. Twenty-six traders believe that the lack of banking support is the biggest challenge. Twenty-five traders put the lack of understanding of the crypto industry as the most important factor, while 18 traders attributed the lack of liquidity in the market as the top reason.

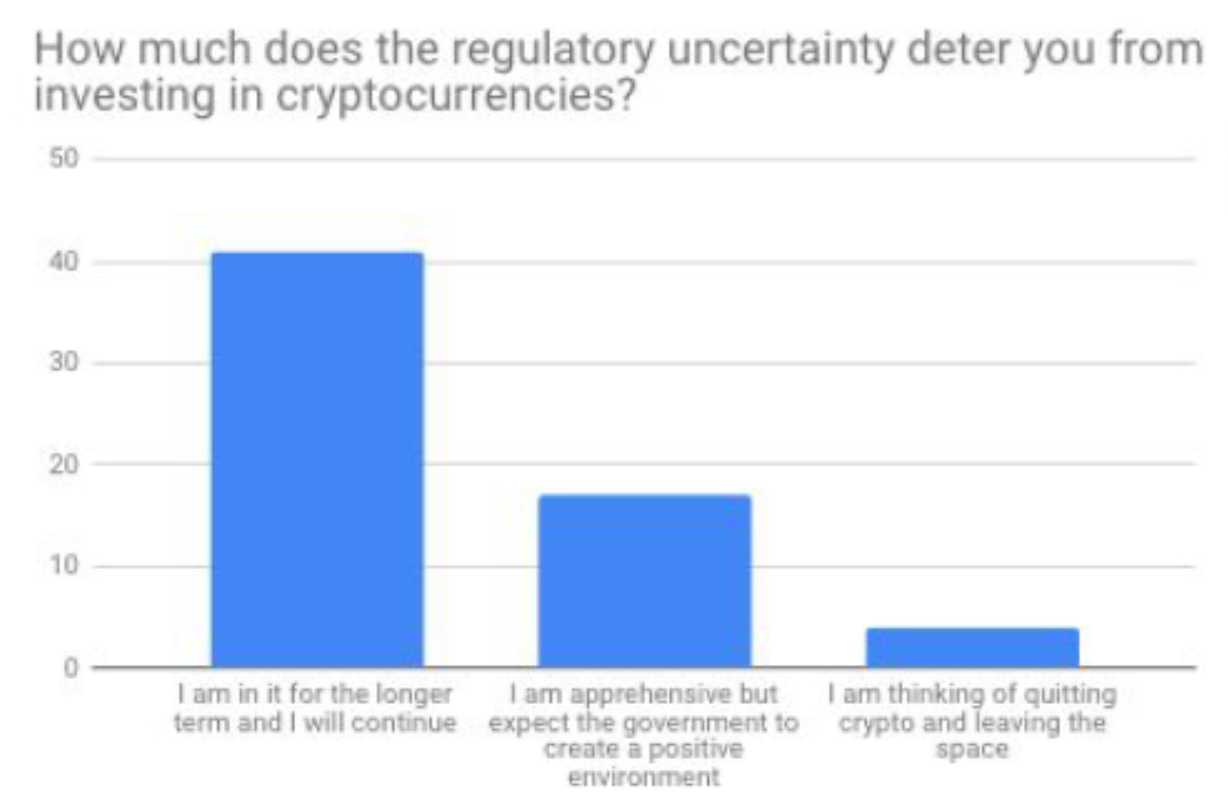

Despite all the hurdles, 41 traders said that they are long-term investors and will continue to invest in crypto. Seventeen traders admitted that they are apprehensive but expect the government to eventually create a positive environment for cryptocurrencies. However, four respondents are entertaining the idea of exiting the crypto space altogether.

What do you think of the current crypto environment in India? Let us know in the comments section below.

Images courtesy of Shutterstock and Instashift.

Need to calculate your bitcoin holdings? Check our tools section.

The post 50 Indian Traders Share Thoughts on Investing, RBI Ban, Future of Crypto in India appeared first on Bitcoin News.

Powered by WPeMatico