One of the main selling points of decentralized exchanges (DEXs) is that tokens can be traded almost instantly. There’s no lengthy sign-up process and no interminable wait for know your customer (KYC) checks to be performed. But then IDEX, the leading Ethereum DEX, announced that it would be emulating centralized exchanges by introducing KYC. Thankfully, there are still plenty of DEXs that don’t follow this model and have no intention of doing so.

Also read: Review: A Side-by-Side Comparison of Decentralized Exchanges

Ethfinex Trustless

Trustless stands primely positioned to fill the void left by IDEX’s departure from the permissionless trading game. The exchange benefits from the liquidity provided by Ethfinex and Bitfinex, facilitating the trading of ERC20 tokens without the need to undergo KYC. News.Bitcoin.com spoke to Ethfinex project lead Will Harborne to determine whether the company’s Trustless DEX may be forced to go down the same route as IDEX and begin verifying traders.

“We will do everything within our power not to introduce KYC on Ethfinex Trustless now or ever,” he explained. “I believe Open Access is one of the core innovations of this space, and what makes cryptocurrencies so powerful, and as an exchange is something we have a duty to protect.” He also pointed out that users of decentralized exchanges already undergo a greater degree of scrutiny than their centralized counterparts, pointing out that “using Ethfinex Trustless, it is genuinely impossible to successfully obscure the source of a person’s funds: every transaction is visible and recorded forever on the blockchain. The trail of funds is linked, and unbroken, from the user’s Ethereum address at the time of acquisition of funds, to final disposal.”

“We will do everything within our power not to introduce KYC on Ethfinex Trustless now or ever,” he explained. “I believe Open Access is one of the core innovations of this space, and what makes cryptocurrencies so powerful, and as an exchange is something we have a duty to protect.” He also pointed out that users of decentralized exchanges already undergo a greater degree of scrutiny than their centralized counterparts, pointing out that “using Ethfinex Trustless, it is genuinely impossible to successfully obscure the source of a person’s funds: every transaction is visible and recorded forever on the blockchain. The trail of funds is linked, and unbroken, from the user’s Ethereum address at the time of acquisition of funds, to final disposal.”

Openledger DEX

Openledger’s DEX is a little different in that it isn’t Ethereum-based – instead it’s built around Bitshares. This yields a number of benefits, including the ability to trade assets like BTC and EOS, which are paired with the bitshares token, in a decentralized fashion. Like Ethfinex Trustless, Openledger DEX has some way to go before it can reach IDEX’s trading volume, but it’s got a number of attributes in its favor. In addition to boasting a clean and intuitive trading platform, the exchange benefits from a range of stablecoins developed by Openledger that are pegged to various national currencies. The latest of these, bitcny, is pegged to the Chinese Yuan and available on a handful of other DEXs in addition to Openledger DEX.

Kyber Network

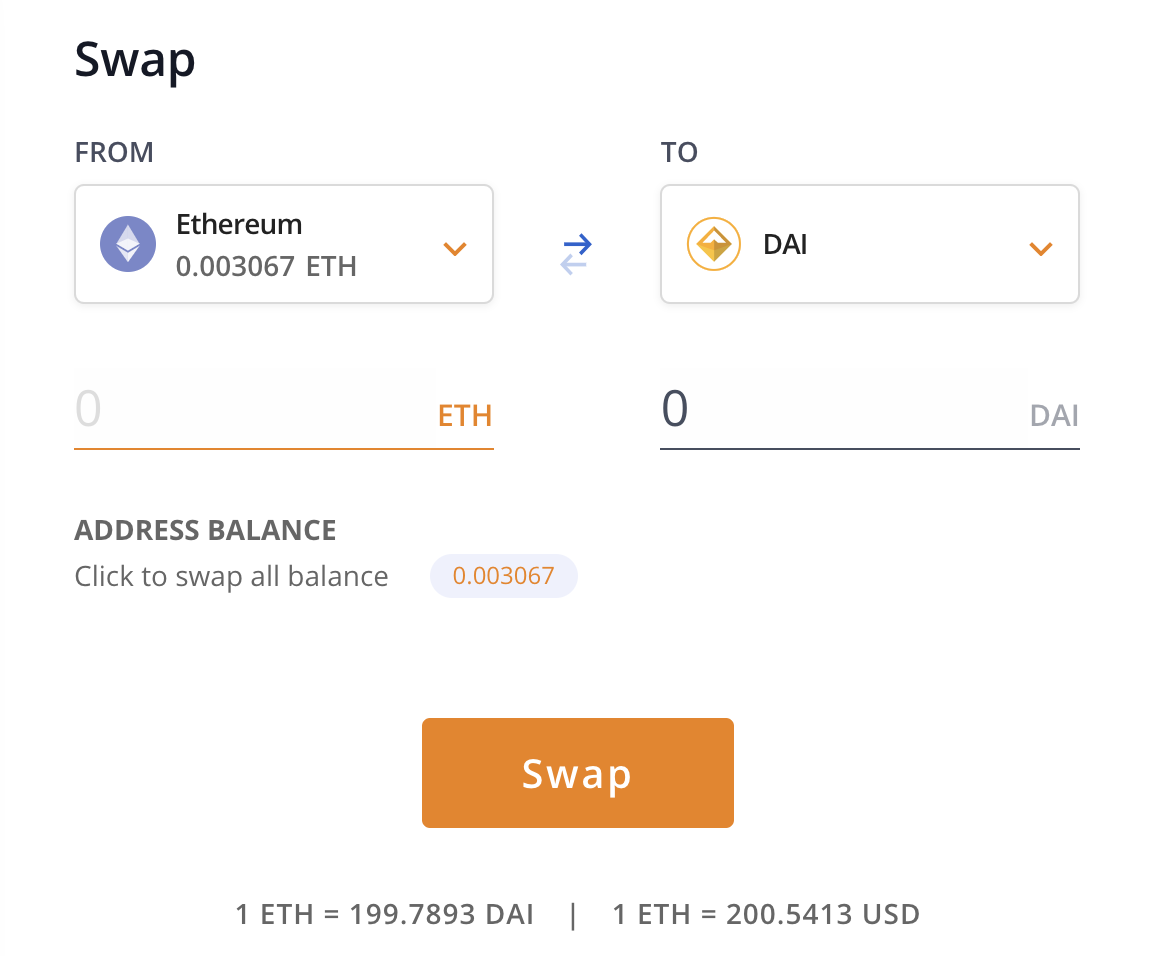

Kyber Network doesn’t look like a conventional DEX because it isn’t, but for the purposes of trading tokens in a decentralized fashion, it performs a similar role. Using an onchain liquidity protocol, Kyber enables the swapping of tokens through connecting an Ethereum interface such as Metamask.

There are no order books with Kyber Network: instead you select the asset you’re seeking from a dropdown menu, adjust a slider to set a minimal acceptable conversion rate, and then the order will be fulfilled onchain. Kyber’s volume, at less than $150,000 a day, is around half that of other DEXs featured here, but its implementation is arguably more decentralized and resistant to the sort of pressures that might compel a platform to introduce KYC.

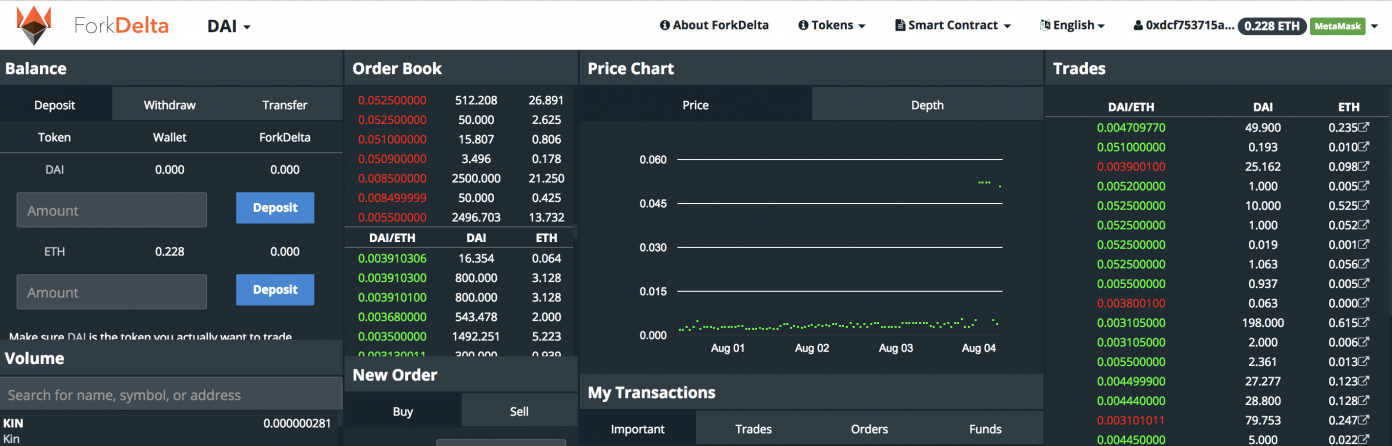

Forkdelta

Forkdelta, which is reviewed in more detail here, was the dominant Ethereum DEX before IDEX came along. Now that the latter is changing to a full verification model, Forkdelta has an opportunity to claw back some of the market share it’s lost. Its 24-hour trading volume and number of active users, according to Dappradar, suggest that it’s catching up fast. Low liquidity is one of the biggest pitfalls to using a decentralized exchange, and thus Forkdelta, despite its mediocre UX and checkered reputation, has a key advantage over the likes of Kyber Network.

With new hybrid and decentralized exchanges under development from the likes of Binance, and interoperability standards improving, it will soon be easier to trade a wide range of digital assets in a trustless setting. It will be a long time, if ever, before DEXs can match the liquidity, choice and user experience of centralized exchanges. So long as the majority of DEXs remain free of KYC, however, they will perform a valuable role within the cryptocurrency ecosystem.

What’s your favorite decentralized exchange to trade on? Let us know in the comments section below.

Images courtesy of Shutterstock, Ethfinex, Openledger, Kyber Network.

Need to calculate your bitcoin holdings? Check our tools section.

The post Four IDEX Alternatives That Don’t Require KYC appeared first on Bitcoin News.

Powered by WPeMatico