It’s been a horrible year for cryptocurrency. Assets down an average of 90 percent, constant despair and each new day bringing fresh horror. Who’d want to be a bitcoin trader? But when you zoom out beyond the cryptosphere to gain some perspective, it turns out that crypto’s not doing so badly after all. With trillions of dollars wiped off major tech stocks, 2018 has been unkind to investors across all asset classes.

Also read: Fear, Loathing and Opportunity: How Crypto Traders Are Handling the Drop

Bear Market Takes a Bite out of FAANGs

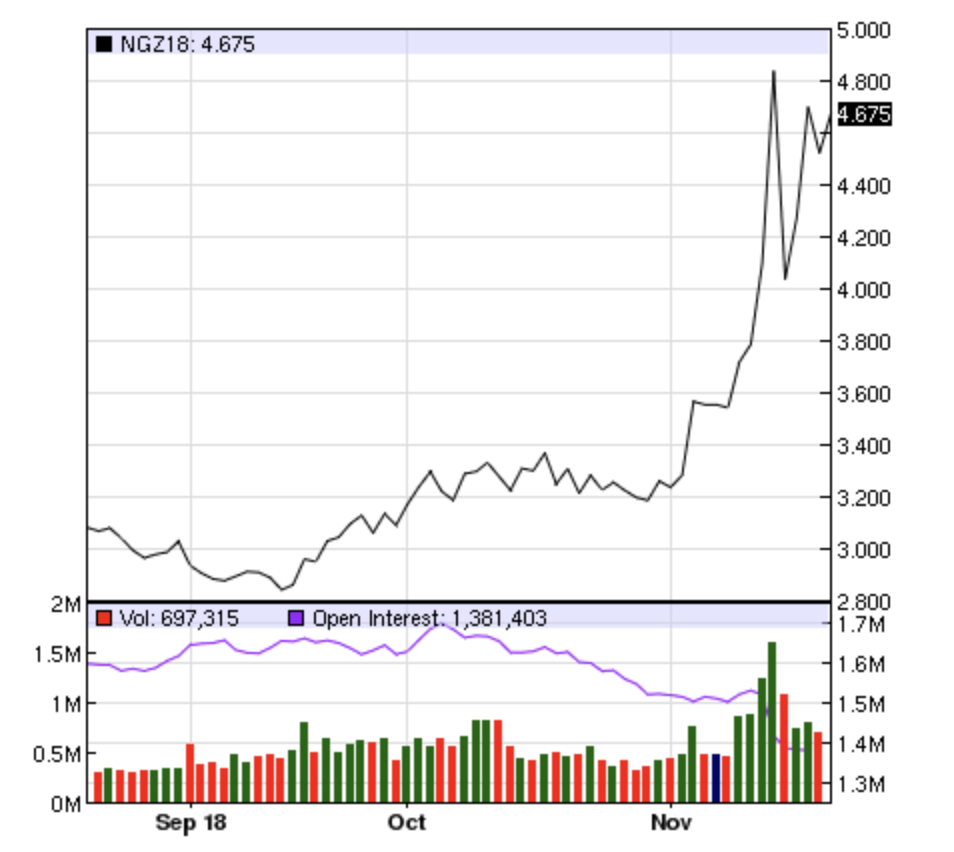

“I’m sorry,” repeated the apology for the umpteenth time. “I’m sorry that this rogue wave capsized our boat.” The wave in question was a spike in the price of natural gas that wrecked the account of options seller James Cordier and his 290 clients. The rambling 10-minute apology video, which instantly went viral, demonstrates the dangers of selling naked call options — essentially bets on securities you didn’t own. When natural gas spiked by 20 percent in a matter of hours, the author of “The Complete Guide to Option Selling” was, to use crypto parlance, rekt. “Putting it simply — he had to buy very high and sell really low,” explained Palisade Research.

While the case of Cordier is extreme, it demonstrates that sudden swings and crushing losses are not the preserve of the crypto space. In fact, it’s been the norm for most asset classes this year. In the past two months, the so-called FAANGs — Facebook, Apple, Amazon, Netflix and Google — have seen more than $1 trillion wiped from their valuations, while the Nasdaq is down 15 percent from its Aug. 30 peak. Oil prices have also slumped, down more than $20 per barrel from their October high. On Nov. 20, all 11 sectors of the S&P 500 index recorded a deficit, including energy and technology, which lost 3.5 percent and 2.4 percent, respectively. Facebook is down 39 percent from its all-time high, Amazon is down 25 percent, Apple and Google are down 20 percent, and Netflix 36 percent.

Volatility Is All Part of the Circle of Life

When viewed in a broader context, cryptocurrency volatility is merely part of a larger boom and bust cycle that has defined markets ever since the dawn of civilization. From 18th-century Isaac Newton FOMOing back into the tulip bubble and getting rekt to 1930s Wall Street traders losing their shirts, epic losses are all part of the human struggle. Acknowledging this may not directly benefit bitcoin traders in the here and now, but it does help to contextualize their losses.

“Thank you so much for the barbecue sauce,” trembled Cordier in a barely audible voice as he expressed gratitude to his many clients over the years. “I will enjoy it … To Larry and Rex, looks like I owe you a Cuban sandwich.” The bizarre nature of the fund manager’s parting video likely contributed to its virality. For crypto investors, it provided some relief from their own financial worries, and highlighted that catastrophic losses are not unique to their sector. Volatility isn’t a bitcoin thing — it’s a global thing.

Do you think market volatility is inevitable? Let us know in the comments section below.

Images courtesy of Shutterstock and Nasdaq.com

Need to calculate your bitcoin holdings? Check our tools section.

The post Bitcoin Isn’t Volatile – the World Is appeared first on Bitcoin News.

Powered by WPeMatico