In this edition of The Daily, we detail the reduced role that tether is playing at the world’s leading cryptocurrency exchange and the progress being made in adding bitcoin futures to the world’s second largest stock exchange. We also round up the latest progress being made in the security token space.

Also read: Petition to Free Ross Ulbricht Gathers 100,000 Signatures

Binance Tiptoes Away From Tether

Like many exchanges, Binance has sought to reduce its exposure to tether (USDT) in recent months by introducing a range of alternative stablecoins. Binance has now moved to further distance itself from tether by removing it as the reference BTC/USD pair on the platform. In its place will come “USDⓈ.” This is not a new stablecoin, but rather the name Binance has assigned to the combined stablecoins it will use to derive its BTC/USD price.

Like many exchanges, Binance has sought to reduce its exposure to tether (USDT) in recent months by introducing a range of alternative stablecoins. Binance has now moved to further distance itself from tether by removing it as the reference BTC/USD pair on the platform. In its place will come “USDⓈ.” This is not a new stablecoin, but rather the name Binance has assigned to the combined stablecoins it will use to derive its BTC/USD price.

“This is to support more trading pairs with different stablecoins offered as a base pair,” explained the cryptocurrency exchange, the world’s largest by trading volume. The website untether.space, which records the so-called “tether risk premium,” notes that on USDT exchanges, BTC is currently trading at a premium of 3.67 percent.

Nasdaq Moving Ahead With Bitcoin Futures

It’s being reported that Nasdaq is pressing ahead with its plans to list bitcoin futures, with BTC’s current downtrend doing little to diminish its desire to add the trading option. The U.S. Commodity Futures Trading Commission is currently finalizing the details ahead of a scheduled launch on the world’s second-largest stock exchange in Q1 of 2019. The Nasdaq will take its BTC spot price from a selection of cryptocurrency exchanges, and is seeking to differentiate its futures contracts from those offered by CME and Cboe.

Security Token Infrastructure Is Growing

2019 is shaping up to be the year when much of the building work performed in 2018 bears fruit. In addition to Nasdaq’s futures and the widely anticipated approval of the first bitcoin ETF, security token offerings (STOs) are predicted to take off. A number of recent developments in the security token space are helping to lay the groundwork for major growth within the next 12 to 18 months. Security token platform Securitize has just completed a Series A raise of $12.75 million from the likes of Blockchain Capital, Coinbase Ventures and Ripple.

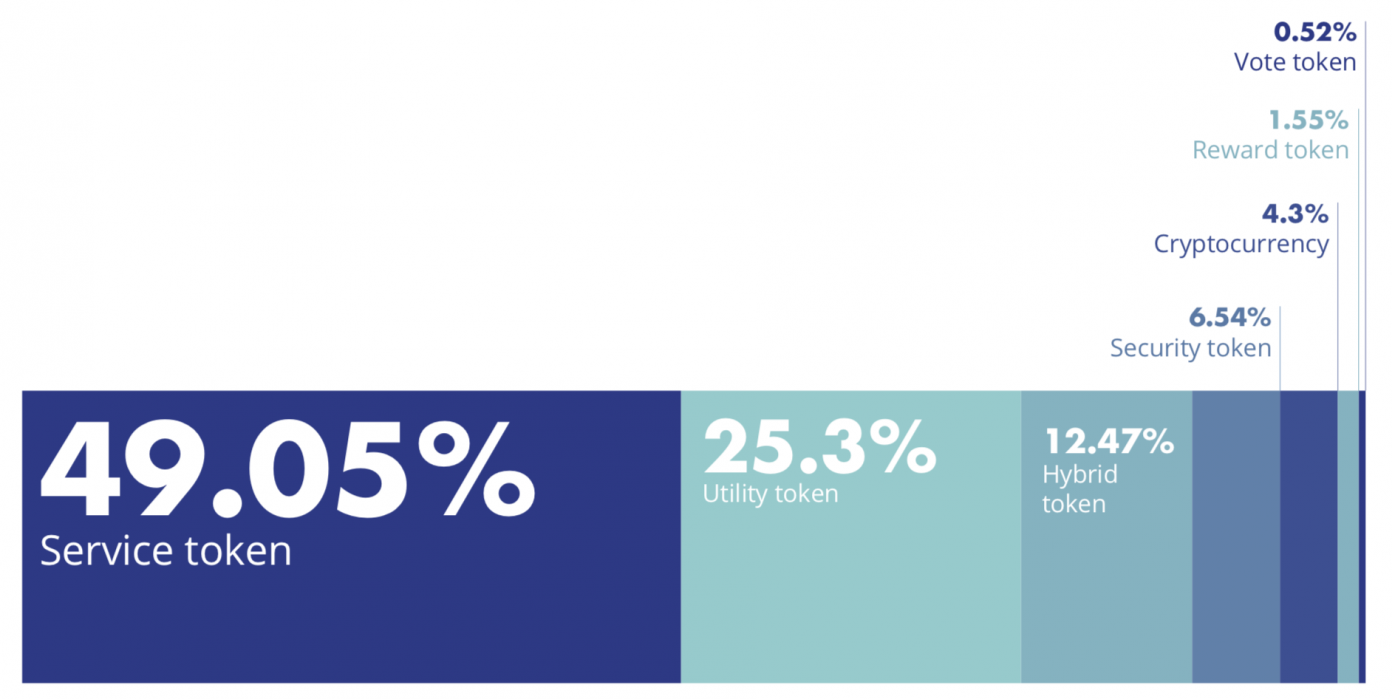

Meanwhile, ICOrating.com has inked a partnership with Chinese security token platform Proof Global to assist with STOs. Proof’s forthcoming security token issuance platform will use ICOrating’s research and analytics related to security tokens, market data and research. Rating reports on startups raising funds by STOs will be available to investors, enabling them to make decisions based on data and analysis. According to research by ICOrating, security tokens accounted for just 6.5 percent of ICOs in Q3 of this year, but that figure is projected to increase significantly in the next quarter.

What are your thoughts on today’s news tidbits as featured in The Daily? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post The Daily: Binance Moves Away From Tether, Nasdaq Moves Closer to BTC Futures appeared first on Bitcoin News.

Powered by WPeMatico