From mining virtual currencies to purchasing virtual land, Monday’s episode of The Daily spans very different regions of the cryptosphere. We begin with an examination of how the latest bitcoin crash has affected miners, and then follow up with a look at the second Decentraland virtual land auction, which commences at 10 a.m. EST today.

Also read: Trace Mayer Draws Support for Proof of Keys — Celebrating Genesis Block Day

Miners Struggle to Keep the Lights on in Bitcoin’s Darkest Hour

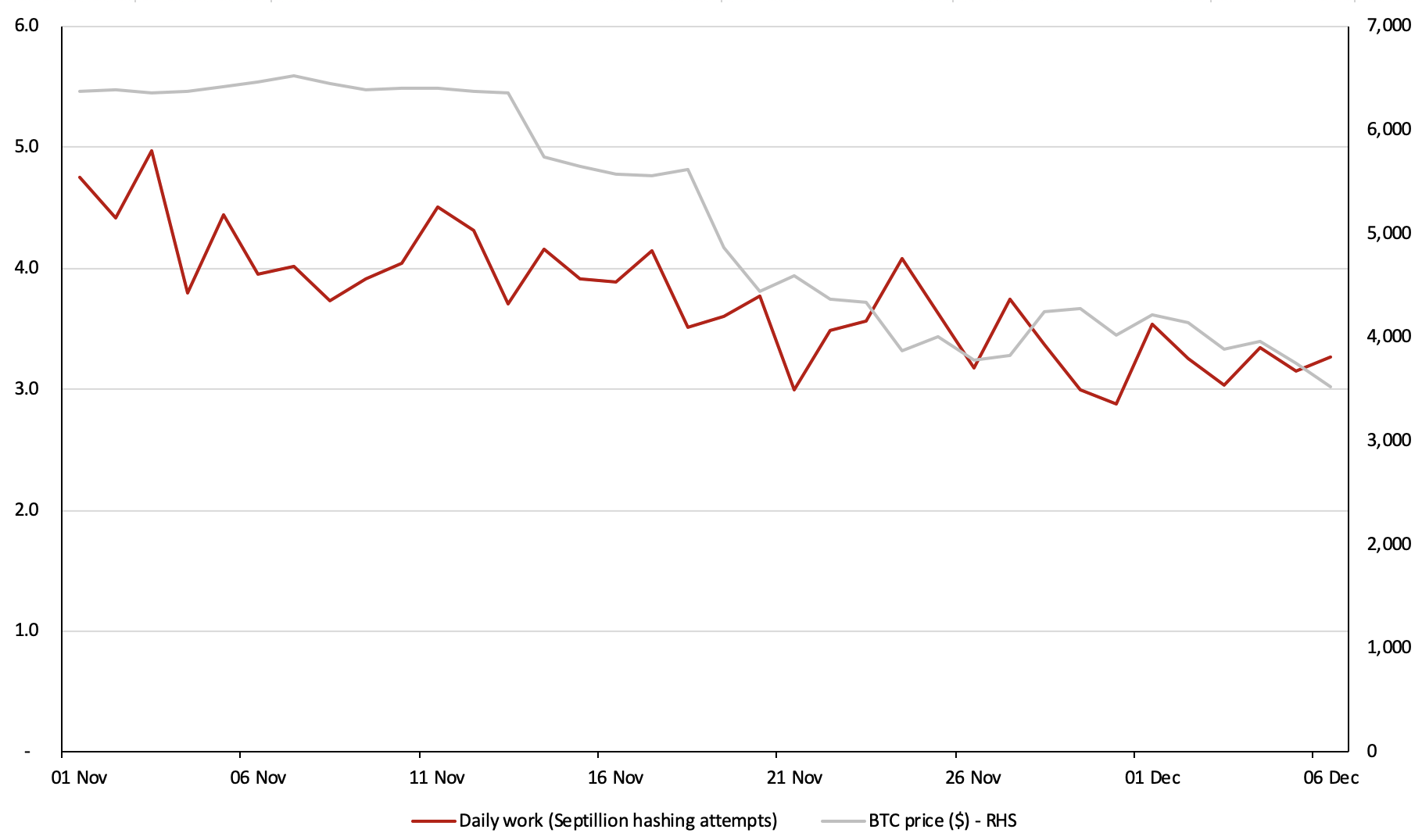

It isn’t easy being a bitcoin miner, what with sunk costs, rapidly devaluing hardware, market volatility, and the stress of competing against every other entrepreneur in the world with the same idea. When the going’s good, the rewards for mining cryptocurrencies such as BTC can be handsome, but when it’s bad, the only certainty is a huge electricity bill at the end of the month. In its latest report, Bitmex Research has examined the effect that plummeting crypto prices have had on miners. It charts the two recent downward difficulty adjustments, in mid-November and early December, before observing that BTC “mining industry revenue has fallen from around $13 million per day, at the start of November, to around $6 million per day, at the start of December.”

The drop in mining revenue outstripped the drop in the price of BTC during this period. The report notes that “There has been considerable speculation around the causes of the price crash, with some saying miners sold [BTC] in order to finance a costly hashwar in Bitcoin Cash. The cryptocurrency intelligence monitoring platform Boltzmann flagged to us that their platform had detected unusually large miner selling of [BTC] on 12th November, a few days before the Bitcoin Cash split.” The report concludes with an observation that others within the crypto community have also made in recent weeks, to the effect that bitcoin mining will remain cost-effective for sufficient miners to secure the network for the foreseeable future:

This is likely to be a very tough time for the mining industry. However, for miners with lower costs, our basic analysis indicates that the situation may be better than people expect. If the miners acquired their equipment from Bitmain at below-cost prices, they could still be in the green, even when including depreciation and other administrative expenses.

Over 9,000 Decentraland Parcels Go Up for Auction

The second Decentraland auction commenced at 10 a.m. EST today, following on from the initial auction that took place in the virtual city last year. All of the remaining 9,331 parcels of land, currently marked as black squares on the map, will be made available via a Dutch auction in which prices begin at 200,000 mana ($12,000), before dropping gradually to as low as 1,000 mana if required. It is expected that all of the new parcels will have been purchased by the time the bidding price falls to around 5,000 mana, however.

During the past week, Decentraland has announced a number of partnerships and integrations, enabling bidders to purchase land using not only mana, but also ZIL, SNT, ELF, DAI, MKR, KNC, RCN, and BNB. There has been significant interest in the project as the auction date has neared, offsetting some of the gloom that’s pervaded the market at large amidst falling cryptocurrency prices. Bloggers have published guides advising interested parties on where the pick of the unclaimed lands lie on the map, and how to go about obtaining them. Despite Decentraland’s virtual world yet to have launched, interest in trading the parcels, represented as ERC721 non-fungible tokens, has been keen, with land fetching as much as $175,000 a square.

What are your thoughts on today’s news tidbits as featured in The Daily? Let us know in the comments section below.

Images courtesy of Shutterstock, Decentraland, and Bitmex Research.

Need to calculate your bitcoin holdings? Check our tools section.

The post The Daily: Virtual Land Auction Goes Live, How the Crypto Crash Affects Miners appeared first on Bitcoin News.

Powered by WPeMatico