After an intense 2017, filled with cryptocurrency market spikes, the following year was loaded with letdowns as a great majority of digital assets plunged well over 80 percent in value since their all-time highs. 2018 was also filled with lots of headlines about digital currency regulations, exchange hacks, and postponed exchange-traded funds.

Also read: Feed 7 Different Species at the River Forest Farm’s ‘Bitcoin Cash Zoo’

2018 Saw Hundreds of Billions Shaved Off the Entire Cryptocurrency Market Cap

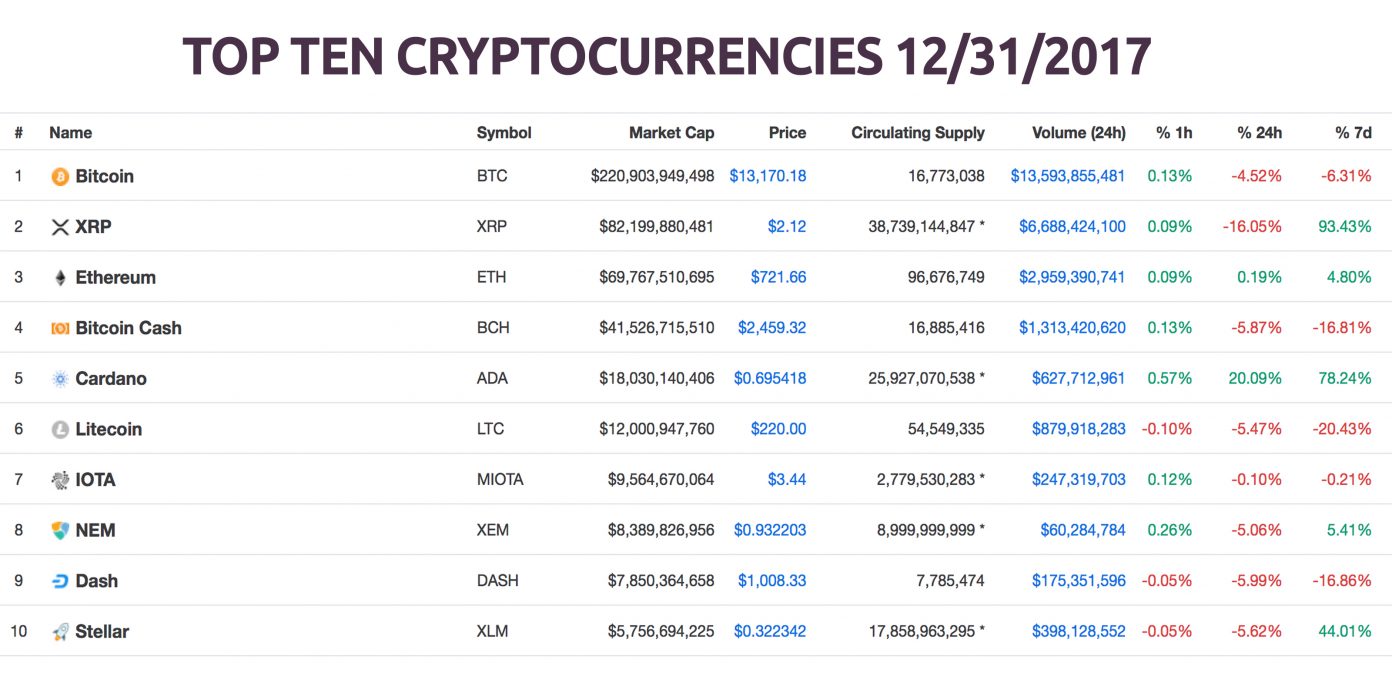

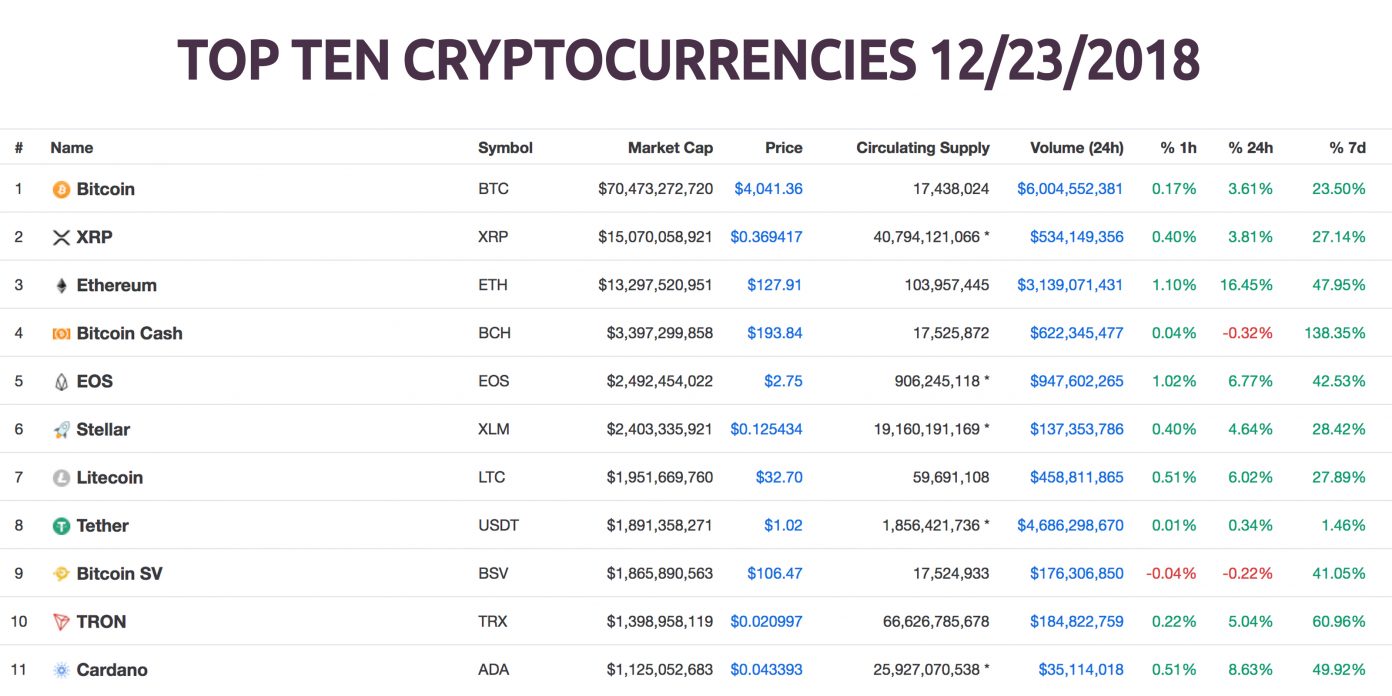

It’s safe to say that 2018 was the exact opposite of 2017 as far as the year-over-year cryptocurrency market price changes. On Dec. 31, 2017, the top ten market capitalizations and the prices of each coin were vastly different than today. The top five coins had considerably more fiat value at the time with bitcoin core (BTC) trading for $13,170 per coin, ripple (XRP) $2.12, ethereum (ETH) $721, bitcoin cash (BCH) $2,459, and cardano (ADA) $0.69.

Throughout the entire year, all of the biggest coins by market valuation have lost more than three-quarters of their net worth since December 2017. The entire ecosystem’s market valuation saw an all-time high of more than half a trillion dollars and today that metric is just above $100 billion.

South Korean Regulation

Throughout most of January and February, talks of digital currency regulation began to heighten across the globe. These two months, in particular, saw a lot of regulatory discussions stemming from South Korea. Headlines deriving from Korean government officials were so frequent and very similar to the countless People’s Bank of China (PBOC) ‘ban’ announcements in the past. At the end of January 2018, for the first time ever a South Korean court ruled that bitcoin has economic value. Moreover, the country introduced a nationwide cryptocurrency account system, which banned the anonymous trading of digital assets in South Korea.

Compromised Exchanges

In addition to all the news about South Korea, the Japanese exchange Coincheck was compromised for $400-534 million USD worth of the cryptocurrency NEM, on Jan. 26. While digital asset proponents witnessed yet another historic exchange hack, the platform’s loss didn’t affect markets that much. Another hack took place this past April, when the Indian cryptocurrency exchange Coinsecure’s wallet was breached for $2.7 million worth of BTC. At the time, the company blamed it’s CSO Amitabh Saxena for playing a role in the incident. Last September, Indian law enforcement filed charges against a few suspects and explained that an insider had helped facilitate the crime.

Lots of ICOs Fail Miserably

2018’s Q1 saw the beginning of big initial coin offerings (ICOs) having lots of troubles with special agencies like the U.S. Securities Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). One of the first busts last year was when the Texas Department of Banking Commissioner issued a cease and desist order to an alleged ‘decentralized cryptocurrency-bank.’ The Bitshares-connected Arise Bank was one of the first of many ICOs that started having troubles with the law. In February, the cryptocurrency community had learned that 46 percent of 2017’s ICOs had already failed. All year long, there have been numerous crackdowns throughout the world specifically targeting ICO operations. U.S. regulators charged music producer DJ Khaled and the boxer Floyd Mayweather this past November for failing to disclose payments they took for ICO promotion.

2018’s Q1 saw the beginning of big initial coin offerings (ICOs) having lots of troubles with special agencies like the U.S. Securities Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). One of the first busts last year was when the Texas Department of Banking Commissioner issued a cease and desist order to an alleged ‘decentralized cryptocurrency-bank.’ The Bitshares-connected Arise Bank was one of the first of many ICOs that started having troubles with the law. In February, the cryptocurrency community had learned that 46 percent of 2017’s ICOs had already failed. All year long, there have been numerous crackdowns throughout the world specifically targeting ICO operations. U.S. regulators charged music producer DJ Khaled and the boxer Floyd Mayweather this past November for failing to disclose payments they took for ICO promotion.

Maduro’s Petro

Another interesting story this year was the introduction of the world’s first state-issued cryptocurrency in Venezuela. Well, no one’s really sure if the ‘petro’ works yet, but all year long Venezuela’s president Nicolás Maduro has touted the benefits of the ‘oil-backed’ token. This past November, the Ministry for Communication and Information enacted a new law which established the petro for commercial transactions inside the country. Further, just recently, Maduro raised the petro’s price from 3,600 to 9,000 bolivars. The entire world has been watching the Venezuelan people suffer from economic hardships, while Maduro and fellow associates toy around with a so-called ‘multi-asset backed’ cryptocurrency created in secrecy.

Delayed Institutional Trading Products

Even though markets dumped all year long, cryptocurrencies did see a lot of institutional interest this year. Crypto-advocates will remember patiently waiting for a U.S.-based exchange-traded fund (ETF) approval once again in 2018. Back in July, the Chicago Board Options Exchange (Cboe) filed an application for a BTC-based ETF that will be tethered to the Vaneck Solidx Bitcoin Trust. The same month, the SEC postponed its decision concerning five bitcoin-related ETFs filed by NYSE Arca.

This was the case throughout all of 2018, as Bitcoin ETFs were delayed all year long. U.S. regulators had also asked for public opinion concerning Cboe’s ETF filing and received an overwhelming response. On Dec. 6, the SEC delayed its decision again and explained it will decide on the fate of the Vaneck Solidx bitcoin ETF in February 2019. Moreover, bitcoiners have been waiting for the Bakkt bitcoin daily futures contracts offered by the Intercontinental Exchange, which was supposed to start trading this month, but the product was also delayed.

Bitcoin Cash and the Tale of Two Forks

![]() The Bitcoin Cash (BCH) network had an interesting year, to say the least, as it underwent two forks in 2018. The first fork in the spring was quite successful, resulting in a bunch of new features like re-enabled opcodes and a 32MB block size increase. Since the upgrade, BCH saw a huge influx of development, including many new applications like Memo.cash, Blockpress, Joystream, Marco Coino, Coinfundr, Akari, Telescope, Simple Ledger Protocol, Wormhole, and more. In the first week of September, the Bitcoin Cash network processed millions of transactions on a daily basis during a week-long ‘stress test.’

The Bitcoin Cash (BCH) network had an interesting year, to say the least, as it underwent two forks in 2018. The first fork in the spring was quite successful, resulting in a bunch of new features like re-enabled opcodes and a 32MB block size increase. Since the upgrade, BCH saw a huge influx of development, including many new applications like Memo.cash, Blockpress, Joystream, Marco Coino, Coinfundr, Akari, Telescope, Simple Ledger Protocol, Wormhole, and more. In the first week of September, the Bitcoin Cash network processed millions of transactions on a daily basis during a week-long ‘stress test.’

On Sept. 1, BCH miners confirmed 2,060,041 transactions (tx) in 24 hours and statistics showed that the BCH chain had processed 85,835 tx per hour, and 23.8 tx per second.

However, after the stress tests, the planned hard fork for Nov. 15 became contentious and the fork resulted in a blockchain split. After gaining the most proof-of-work and a majority of the infrastructure support, the Bitcoin ABC side of the fork was rewarded with the “BCH” ticker, and the other network’s ticker is listed as “BSV” across global exchanges. The BCH community is steadily moving on from the split, and the decentralized cryptocurrency saw a 140 percent increase in value over the last week.

In 2019 the Crypto-Landscape Is Sure to Be Interesting

Most crypto-markets have done much better during the end of this December, and many enthusiasts are curious about what next year will bring. Of course, most cryptocurrency supporters believe the long haul will pay off in the end, and there will always be some hurdles along the way. There was a whole lot of other interesting events in 2018 and 2019 is sure to be just as intriguing. One thing is for certain, no matter what year it is — There’s never a dull day in Bitcoin-land.

What do you think about 2018 and cryptocurrencies this year? Let us know what you think about this subject in the comments section below.

Images via Shutterstock, Pixabay, and Steemit.

Need to calculate your bitcoin holdings? Check our tools section.

The post Year in Review: 2018’s Top Cryptocurrency Stories appeared first on Bitcoin News.

Powered by WPeMatico