Finance company Circle claims its over-the-counter (OTC) cryptocurrency trading desk swapped a notional volume of $24 billion last year. The Boston-based company’s Circle Trade desk reportedly executed more than 10,000 cryptocurrency settlements between 600 unique counterparties in 2018.

Also Read: New Full Node Client ‘Bitcoin Verde’ Joins the BCH Ecosystem

Despite the Crypto Bear Market in 2018, Circle Sees Significant Growth

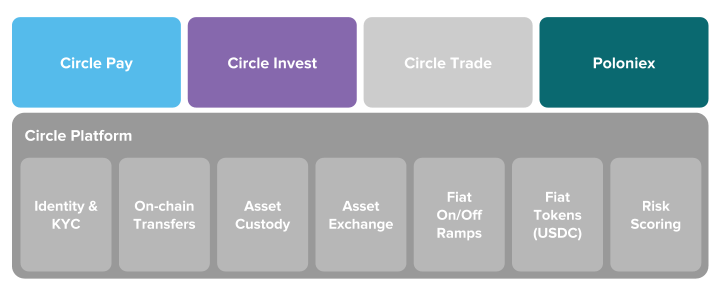

Last year the digital asset company Circle made a lot of moves behind the scenes within the cryptocurrency economy. In a blog post written on Jan. 3, Circle explained how it expanded significantly over the last 12 months and now services over 8 million customers residing in 195 different countries. In 2018, Circle claims to have processed more than 200 million digital asset transactions, adding up to over $75 billion in value. The Boston-based firm says customers stemmed from all over the world, with 30 percent of volume coming from the U.S. This is followed by the EU and U.K. (24%), Asia (24%), and the Middle East, Africa, and Latin America (21%).

Last year the digital asset company Circle made a lot of moves behind the scenes within the cryptocurrency economy. In a blog post written on Jan. 3, Circle explained how it expanded significantly over the last 12 months and now services over 8 million customers residing in 195 different countries. In 2018, Circle claims to have processed more than 200 million digital asset transactions, adding up to over $75 billion in value. The Boston-based firm says customers stemmed from all over the world, with 30 percent of volume coming from the U.S. This is followed by the EU and U.K. (24%), Asia (24%), and the Middle East, Africa, and Latin America (21%).

Additionally, Circle discussed acquiring the cryptocurrency trading platform Poloniex and emphasized that the exchange’s services have improved a great deal over the last 12 months. “Through expansion in support operations and engineering, we helped customers by reducing nearly 200,000 open tickets at the start of 2018 to fewer than 1,000 by year-end,” Circle noted. Circle also remarked that Poloniex now has enhanced risk and compliance operations which allow the company to onboard customers within minutes of enrollment. The parent company detailed that Poloniex would see more UX improvements this year and the “continued launch of new markets.”

More Than 10,000 OTC Swaps Worth Over $24 Billion Last Year

Circle’s retail investment services saw growth last year as well, explained the company’s founders Sean Neville and Jeremy Allaire. More than 30 percent of customers buy unique collections of digital assets regularly the founders noted. Over 30 percent of all purchases on Circle Invest are recurring and repeat purchases like these have doubled since last September. With the company’s OTC operations, even though 2018’s crypto prices were extremely bearish, Circle’s OTC desk still expanded. Circle Trade saw $24 billion in notional OTC cryptocurrency volume, with its 24/7 coverage in the U.S., Europe, and Asia. By utilizing 36 different digital currencies, Circle Trade facilitated 10,000 OTC swaps between 600 different entities. The corporation detailed that Circle’s clients and partners include asset managers, other OTC desks, family offices, high net worth individuals, endowments, token projects, and exchanges.

Circle’s retail investment services saw growth last year as well, explained the company’s founders Sean Neville and Jeremy Allaire. More than 30 percent of customers buy unique collections of digital assets regularly the founders noted. Over 30 percent of all purchases on Circle Invest are recurring and repeat purchases like these have doubled since last September. With the company’s OTC operations, even though 2018’s crypto prices were extremely bearish, Circle’s OTC desk still expanded. Circle Trade saw $24 billion in notional OTC cryptocurrency volume, with its 24/7 coverage in the U.S., Europe, and Asia. By utilizing 36 different digital currencies, Circle Trade facilitated 10,000 OTC swaps between 600 different entities. The corporation detailed that Circle’s clients and partners include asset managers, other OTC desks, family offices, high net worth individuals, endowments, token projects, and exchanges.

The company’s flagship stablecoin offering, USDC, saw “significant penetration” in 2018 and is now supported by 40 exchange platforms. The Circle-backed stablecoin is also being used by over 80 companies like wallets and other types of applications. Despite all the layoffs throughout the crypto economy, Circle’s institutional sales team grew 3x in size. Circle’s 2018 report shows that the ecosystem is still alive and well, but investment providers have somewhat shifted towards catering to institutional clientele. There’s been a huge influx of OTC buyers and institutional customers throughout 2018. Many other large digital currency-based firms like Coinbase, Blockchain and Etoro have announced OTC desks in order to capture these types of customers.

What do you think about Circle processing over $24 billion in cryptocurrency-based OTC volume last year? Let us know what you think about this subject in the comments section below.

Images via Shutterstock, and Circle.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even look up the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post Circle’s Cryptocurrency OTC Desk Swapped More Than $24 Billion in 2018 appeared first on Bitcoin News.

Powered by WPeMatico