Since our last markets update, cryptocurrency markets consolidated within a tight range and have been less volatile over the last few days. The market capitalization of the entire cryptocurrency economy has gained about $5.7 billion and a few of the top coins have seen some price jumps this week.

Also Read: Embracing Utility in 2019: Unreliable Crypto Networks Will Lose to Hyperbitcoinization

Crypto Markets Consolidate, But Some Coins See Gains

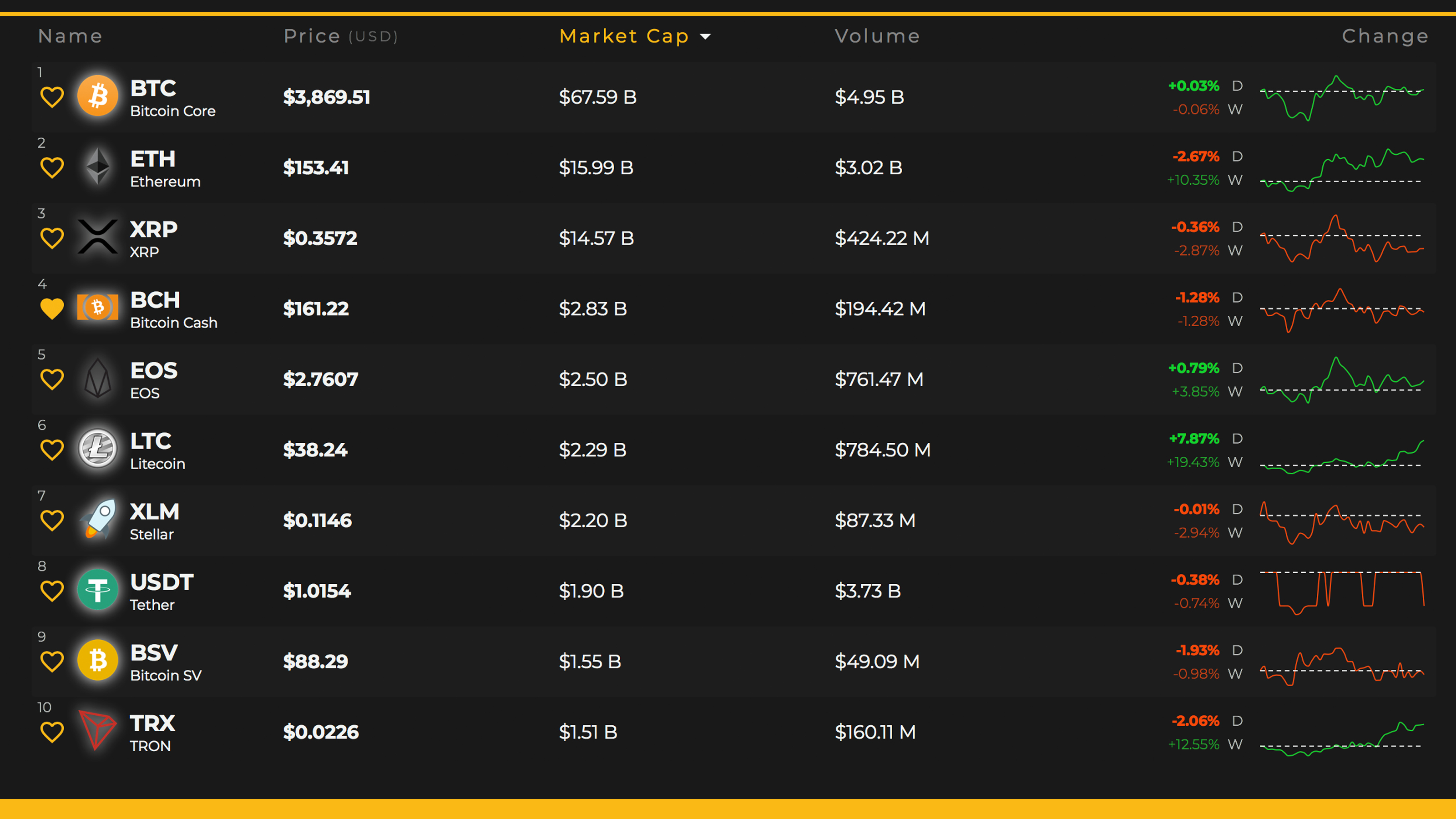

As the first week of 2019 comes to an end, digital currency prices this Sunday are far less volatile than the last two months of 2018. At the time of publication the entire cryptocurrency market valuation of all 2000+ digital coins is roughly $131.7 billion. Since the holidays and the first annual “Proof-of-Keys” day has passed global trade volume has steadily increased. There’s about $15.8 billion worth of cryptocurrency global trade volume today across popular exchanges and ripple, litecoin, and stellar are this weekend’s top performers. Currently, the digital asset bitcoin core (BTC) is trading for $3,869 and market prices are up 0.03% over the last 24 hours. BTC captures around $4.9 billion of the world’s crypto-trades and has a market valuation of around $67.5 billion.

The second highest valued market capitalization this Sunday is held by ethereum (ETH) which is down 2.6% today. However, over the last seven days, ETH has gained 10.3% and one ETH is trading for $153. Ripple (XRP) is up a hair today with 0.36% gained over the last 24 hours but the week shows a loss of around 2.8%. One XRP is swapping for $0.35 and holds about $424 million of the world’s digital asset trade volume. The token eos (EOS) is still holding the fifth largest capitalization, but litecoin (LTC) is not too far behind. One EOS is trading for $2.76 and markets have risen 3.8% this week. EOS markets are up today 0.79% and markets are also capturing $761 million in trades. As mentioned above LTC has spiked considerably jumping 7.8% today and 19% over the last seven days. LTC has managed to commandeer the sixth largest market valuation this week.

Bitcoin Cash (BCH) Market Action

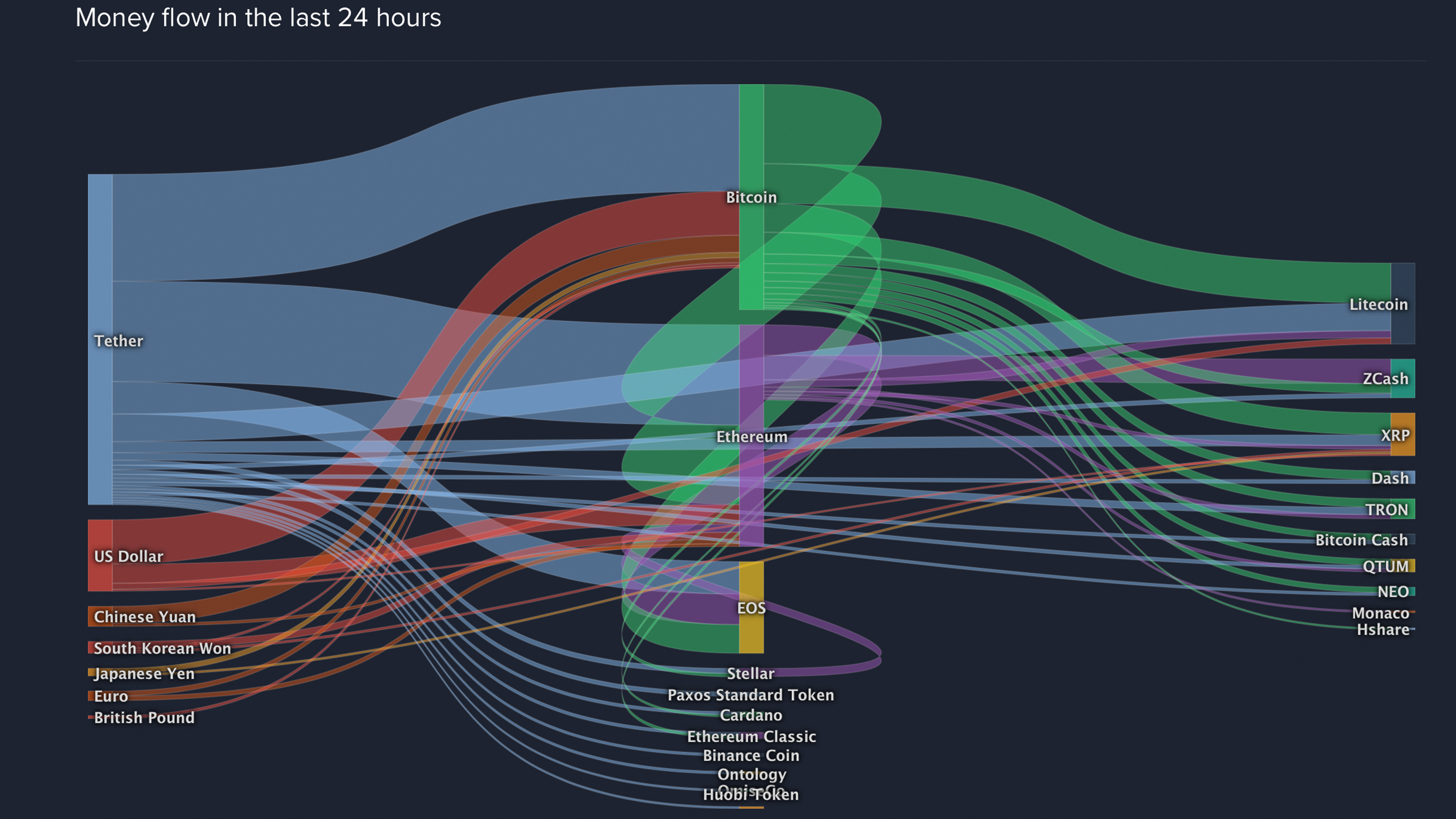

Bitcoin cash (BCH) markets had it much better last week and prices have consolidated into a pretty tight range. At the moment one BCH is trading for $160 per coin and markets are down 1.4% over the last 24 hours and down 1.2% for the week. The top cryptocurrency exchanges swapping the most bitcoin cash today includes Lbank, Hitbtc, Binance, Huobi, and Coinbase. Currency pair statistics show tether (USDT) captures 48.3% of the global trades with BCH. This is followed by BTC (18.5%), ETH (16.9%), USD (8.9%), EUR (3%), JPY (2%), and KRW (1.3%). The EUR has spiked a great deal which is traditionally a sign of bullish movements ahead. BCH holds the eighth largest trade volume today below zcash (ZEC) and just above tron (TRX) markets.

Bitcoin cash (BCH) markets had it much better last week and prices have consolidated into a pretty tight range. At the moment one BCH is trading for $160 per coin and markets are down 1.4% over the last 24 hours and down 1.2% for the week. The top cryptocurrency exchanges swapping the most bitcoin cash today includes Lbank, Hitbtc, Binance, Huobi, and Coinbase. Currency pair statistics show tether (USDT) captures 48.3% of the global trades with BCH. This is followed by BTC (18.5%), ETH (16.9%), USD (8.9%), EUR (3%), JPY (2%), and KRW (1.3%). The EUR has spiked a great deal which is traditionally a sign of bullish movements ahead. BCH holds the eighth largest trade volume today below zcash (ZEC) and just above tron (TRX) markets.

BCH/USD Technical Indicators

Looking at the daily and 4 hour charts on Bitstamp shows some tight Bollinger Bands and signs of deep consolidation. At the moment on the 4 hour chart, the Relative Strength Index (RSI) is meandering in the middle between oversold and overbought regions at -47.8. Stochastic and the MACd show similar readings and it seems as though traders are uncertain of which direction the next wave will take them.

The two Simple Moving Averages (SMA) are still showing a decent gap between the short term 100 SMA and the long-term 200 SMA. The 100 SMA is well above the 200 SMA indicating the path toward the least resistance is still the upside. Order books on some of the most popular exchanges show BCH bulls need to surpass the $170 range in order to gain some better momentum. On the backside, there is plenty of foundational support between the current vantage point and the $140 region.

The Verdict: While Some Analysts See Positive Signs, Others Are Not so Optimistic

It is safe to say that most traders are waiting on the sidelines for some more confirmations of a bearish-to-bullish trend change, or another big drop in crypto prices. Some people believe they have noticed a positive trend change among crypto asset prices and the validation of some bullish divergence over the last few weeks. Mati Greenspan, senior market analyst at Etoro gave his thoughts on the current cryptocurrency market trends on Jan. 3. “Gains across most of the popular crypto assets have been rather mild lately,” Greenspan emphasized. “While it’s good to see bitcoin holding steady, we’re actually starting to see a side of the market that is more typical during a bull run.”

However, digital currency market analyst Willy Woo explained on Jan. 5 that the bears still may be holding the reigns. “The initial volume spike false signaled a faster detox and an earlier end to the bear market, but in fact, it was a volatility side effect — That move from $6k to $3k created immense trade volume, but it was in no way a signal that accumulation volume had begun,” Woo told his Twitter followers.

The analyst continued by stating:

That volume has since subsided. Leaving the NVT chart on the high side of its oscillation around the main move downwards — The key thing here, in my interpretation, is it’s on the high side of its band, so I think an up move is limited, bears will win the longer term trade.

Where do you see the price of BCH, BTC and other coins heading from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, Coinlib.io, Bitstamp, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Crypto Analysts Remain Uncertain After 2019’s First Week of Trading appeared first on Bitcoin News.

Powered by WPeMatico