The Chicago Mercantile Exchange (CME Group) has seen a big spike in bitcoin futures volumes according to an internal investors email sent to clients on Feb. 19. CME Group’s note explains that last Tuesday’s BTC-based futures volumes touched a new record with 18,338 contracts traded and the firm says increased volumes may be due to gradually rising institutional interest.

Also Read: This ‘Faketoshi’ Signature Tool Lets Anyone Become Satoshi Nakamoto

Bitcoin Futures Volumes Spike in 2019

Cryptocurrency derivatives kicked into high gear in 2017 when two of the largest FX exchanges in the world, Cboe and CME Group, launched their bitcoin futures products. Initially, interest in these markets was high, but a few months later crypto derivatives volumes on these exchanges started to wane. Then in the summer of 2018, futures contracts from the two regulated exchanges began to rise again and interest in these products started to increase significantly. Last December, futures volumes were lower and spectators saw some signs of backwardation which means the derivatives predictions on the price of BTC are significantly lower than the prices on global spot exchanges. However, there was a shift in 2019 as prices returned to normalcy between both futures and spot values and volumes increased in January.

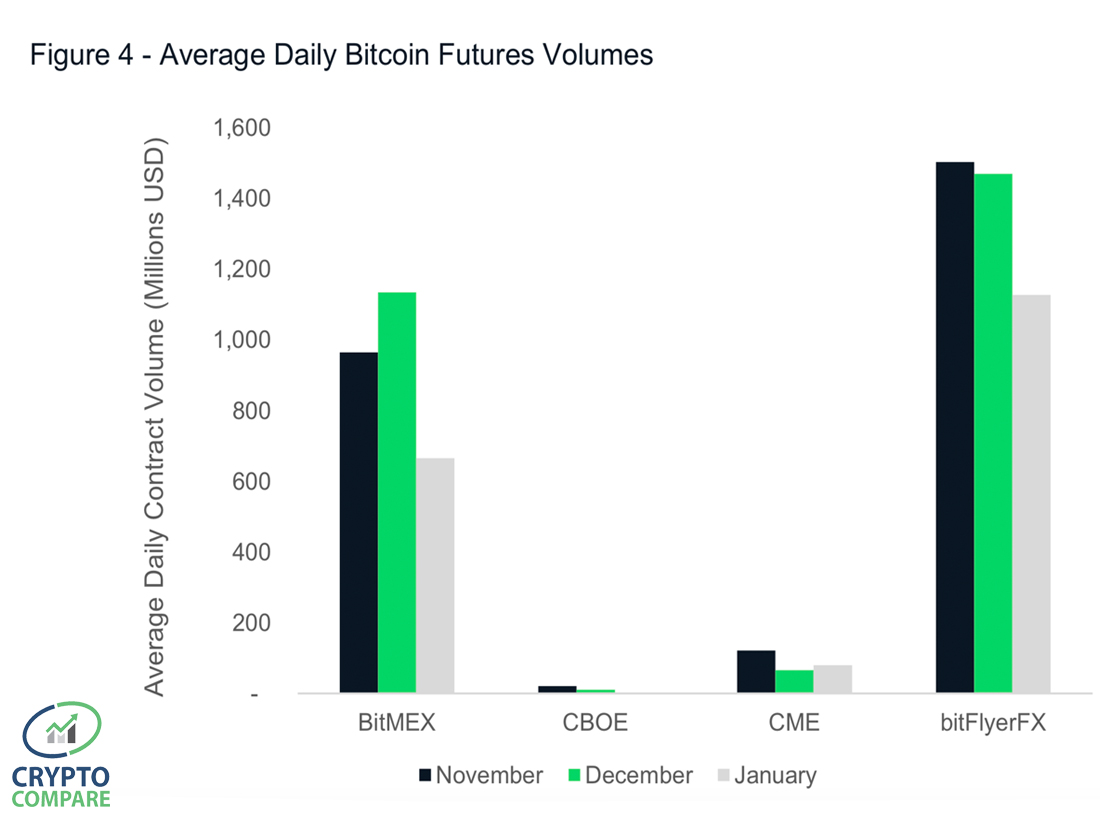

“Futures products from traditionally regulated exchanges (CME and CBOE) represented 11.7% of the Bitcoin to USD futures market in January, up from 6.36% in December,” explains Cryptocompare’s January exchange research.

Cryptocompare’s data shows that CME Group has seen more volume than Cboe in January but non-traditional futures trading platforms stole the show last month. Research reveals that Bitflyer FX traded the most BTC derivatives products in January with a daily average transactional value of $1.13 billion. The analysis also highlights the perpetual futures volume last month offered by Bitmex which was roughly $665 million. Now, as February comes to an end, CME Group’s recent internal email to investors indicates this month has seen an appreciable jump in interest.

“Yesterday [Feb 19] set a new record with 18,338 contracts traded,” the executive’s note explained. “This is equivalent to 91,690 bitcoin or $360 million.”

The note continued:

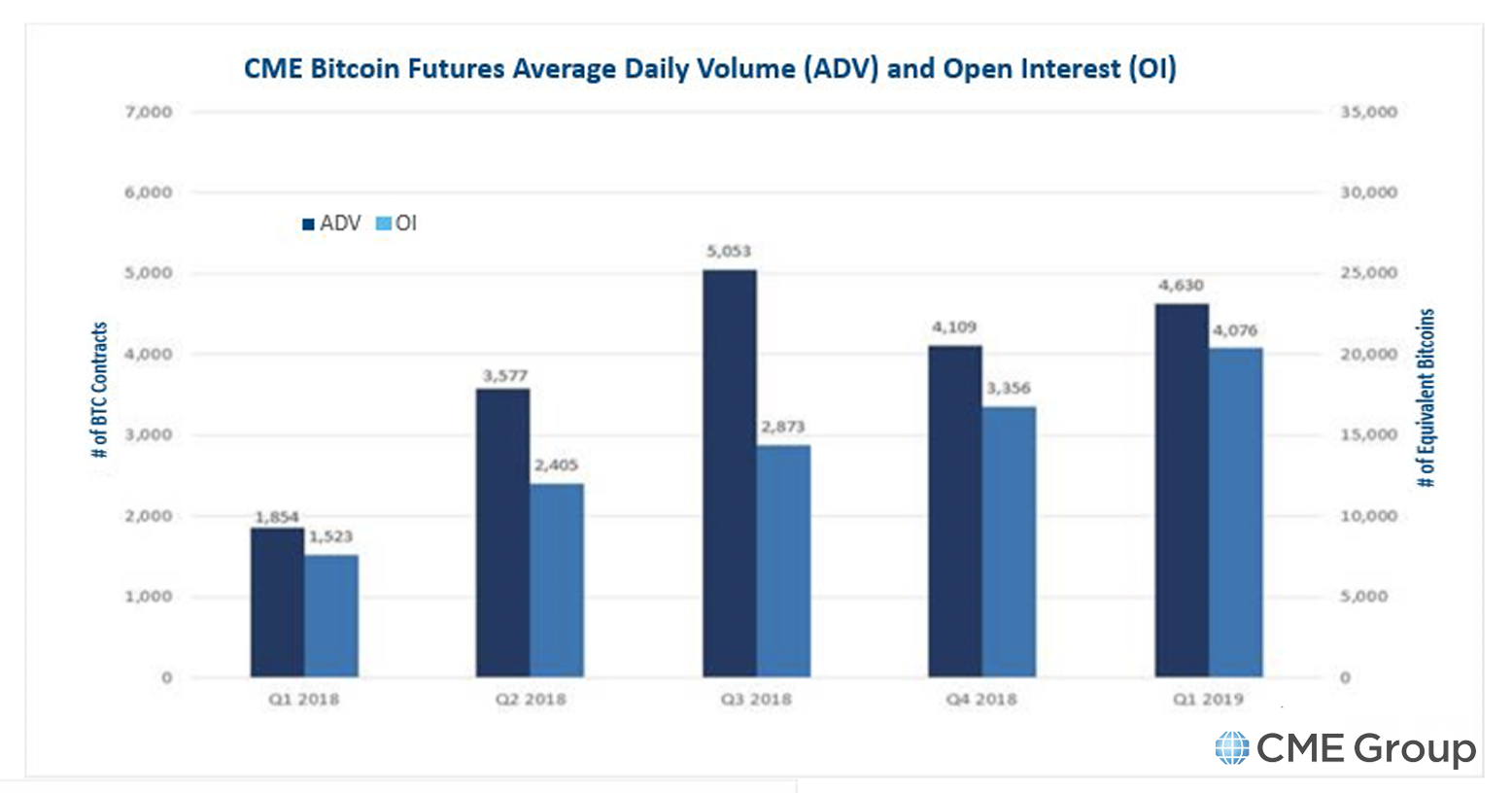

Q1 2019 is off to a strong start, average daily volume (ADV) has improved to 4,630 contracts (23,150 equivalent bitcoin), up ~13% from Q4 2018 while open interest rose to 4,076 contracts, an improvement of 21.5% over Q4 2018.

Large Open Interest Holders Seek Bitcoin Futures

CME Group’s volume statistics show a gradual rise in the last two months compared to the slight slump in Q4 2018. Moreover, last Tuesday’s futures spike also took place on Cboe’s exchange as the XBT futures daily market statistics show a higher than usual 4,945 contracts. The spike is a big jump from the typical daily average of 700-1500 Cboe-based XBT contract volumes. CME Group’s investors note details that the February rise in volume stems from large open interest holders (LOIHs).

“Institutional interest has gradually risen and the number of LOIHs has been holding steady around 43 holders since November,” the CME Group representative detailed. “A LOIH is an entity that holds at least 25 BTC contracts.”

Over the last year, derivatives and perpetual bitcoin swaps have continued to show growth and spontaneous surges in trading activity. Traditional bitcoin futures products seem to be gaining interest from institutional buyers while leveraged bets with no specific expiration dates continue to see swathes of retail investors playing the market. Even though CME Group, Cboe, and Ledger X products are doing well, they are a long way from matching the volumes executed through perpetual bitcoin swap markets managed by Bitmex, Bitflyer, Bitfinex, Deribit, Crypto Facilities, and Okex.

What do you think about the rise in CME Group’s Bitcoin futures volumes? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, CME Group, Pixabay, and Crypto Compare.

At news.Bitcoin.com all comments containing links are automatically held up for moderation in the Disqus system. That means an editor has to take a look at the comment to approve it. This is due to the many, repetitive, spam and scam links people post under our articles. We do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post CME Group’s Bitcoin Futures See a Surge of Institutional Interest appeared first on Bitcoin News.

Powered by WPeMatico