A new research report links a trail of 12 wallets holding Quadrigacx funds worth $90M of ethereum to Kraken, Bitfinex, and Poloniex exchanges. With Kraken confirming that it no longer holds any active Quadriga wallets, the onus is now on the other two exchanges to confirm or deny that the coins are still in their accounts.

Also read: Quadrigacx Cold Wallet Was Stored in a Safety Deposit Box

The Canadian Crypto Drama Continues

Quadrigacx (aka “the curious case of Cotten’s coins,” as Kraken calls it) doesn’t cease making the news. $190M of user funds have disappeared, $150M of which has seemingly been lost in an unretrievable crypto abyss, with conspiracy theories aplenty to match the unfolding real-life mystery of an unseemly death and even more unseemly funds displacement. The latest research doesn’t quite solve the puzzle. To the contrary, it might even add to the complexity surrounding the case.

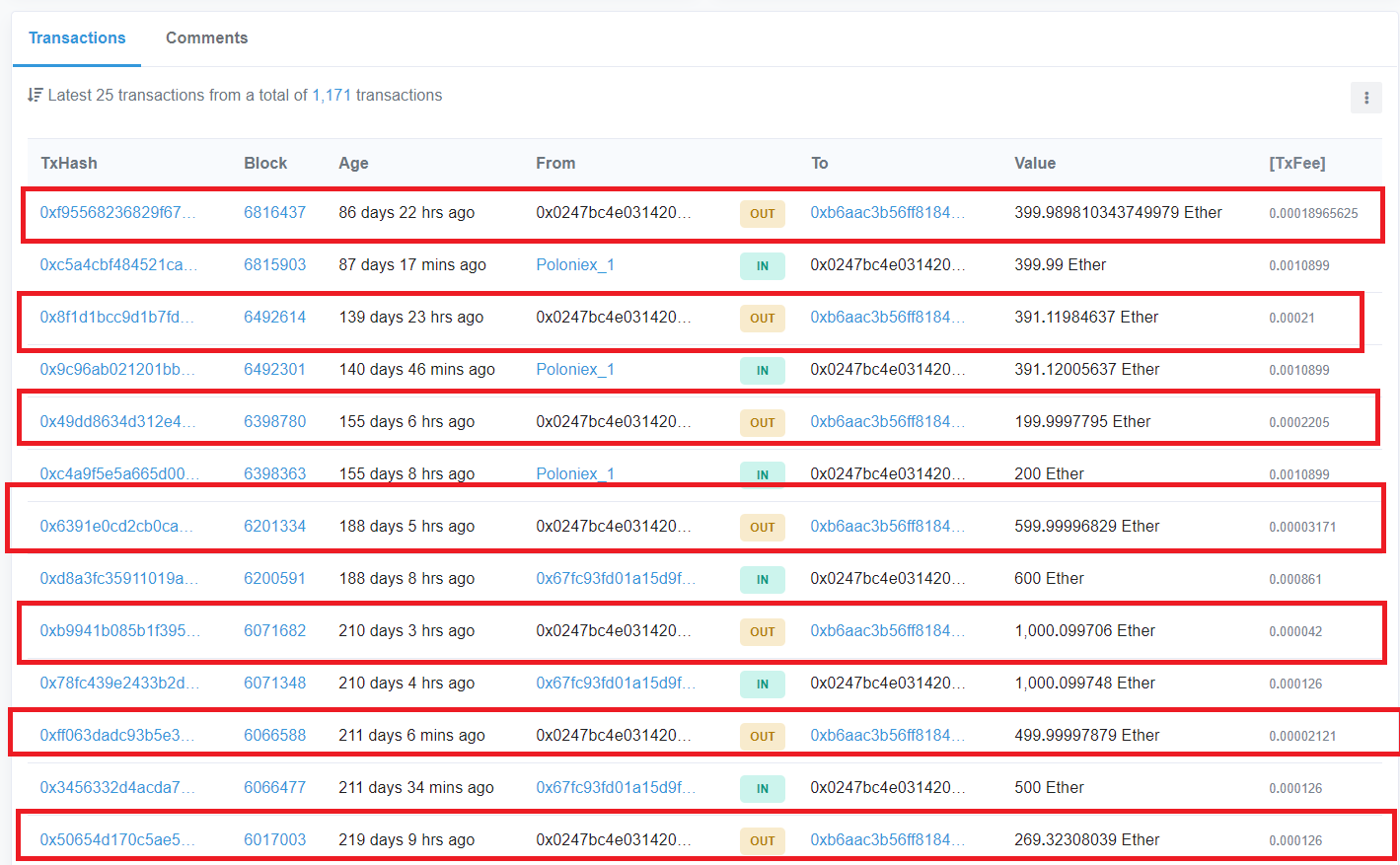

James Edwards, CEO of crypto research and consulting platform Zerononcense, has released a research report detailing the trail he followed to locate the ethereum exit points from Quadrigacx-controlled — thus internal, non-customer-owned — wallets.

Spread across 12 wallets, totalling 649,708 ETH paid into three market-leading exchanges, Edwards speculates that Quadrigacx CEO Cotten might have used these exchange as backup storage for Quadriga funds. At the time of transfer to some of the world’s top exchanges (Kraken, Bitfinex, and Poloniex), these coins were valued at $100,490,150 and are now worth $90.3M. This ties into the affidavit made by Cotten’s wife, Jennifer Robertson, that Cotten might have stored company funds on other exchanges.

More Questions Rather Than Answers

However, whether the funds are still in these accounts remains uncertain. Wallet activity ceased on December 8, 2018, one day before Cotten’s alleged death on December 9. Kraken has already stated that it holds none of Quadrigacx’s funds and, to the contrary, is offering a $100k bounty to anyone forthcoming with information leading to the whereabouts of the missing funds. This leaves only Bitfinex and Poloniex to confirm or deny the continued existence of the respective amounts transferred to their exchanges.

By offering $100k for info on Quadriga’s crypto, @KrakenFX has told us that Quadriga’s account on Kraken is EMPTY. @jespow can see QCX’s balance. If it had 1000s of ETH, he’d assume the rest is on other exchanges and not offer bounty to find it. @tayvano_

— Alex Firmani (@AlexFirmani) March 1, 2019

It’s not 100 percent evident that the funds in question form part of Quadriga’s own wallets as opposed to that of their users, although Edwards — with a corroborating statement from Kraken head Jesse Powell — is fairly convinced, saying there’s “a 99% chance” it is a wallet owned and controlled by Quadriga.

According to Powell:

“If he [Kraken Customer] is sending from his accounts at other exchanges, he almost certainly does not have control of the sending address.”

Mycrypto.com CEO Taylor Monahan also previously released a research pile analyzing Quadriga’s ETH movement:

QuadrigaCX on a normal day vs laundry day

Red: weird addresses that send exclusively between a ton of exchanges. *Suspect* they are QCX.

Yellow: ShapeShift deposit addresses

Orange: Known QCX Polo deposit addresses

Green/Blue: QCX main wallets pic.twitter.com/WIrwOvQCmH— Taylor Monahan (@tayvano_) February 9, 2019

Show Us the Money or This Doesn’t Mean Much

Edwards draws his report to a close stating that “this report should serve as a helpful addition to the Quadrigacx narrative, rather than a conspiratorial piece that speculates on whether the exchange or its owners have been honest.” But does it?

The Quadrigacx case brings to light the significance of entrusting one’s crypto assets to an exchange. A single person entrusted with safeguarding the private keys holding 115,000 customers’ funds. An exchange relying on other exchanges to store funds instead of keeping them in cold storage. A trail that doesn’t quite answer any questions, but instead leaves a hot mess even hotter. Thus, speculation of gross incompetence, elaborate money laundering — or both — continues.

Unless Bitfinex and/or Poloniex can positively confirm that Quadrigacx funds are still available — and thus retrievable — this latest twist in the tale leaves the victims of the Canadian exchange no closer to a happy ending.

Do you attach any significance to the findings of this report? Let us know in the comments below.

Images courtesy of Shutterstock and Zerononcense.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH, and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

The post Researcher Claims to Have Sleuthed $90M of Quadrigacx Funds appeared first on Bitcoin News.

Powered by WPeMatico