Bahrain’s regulatory sandbox has become increasingly crypto-friendly as half of the companies approved are now either crypto exchanges or other crypto businesses including ATMs. There are currently 30 companies approved for the regulatory sandbox by the central bank.

Also read: Indian Supreme Court Postpones Crypto Case at Government’s Request

Regulatory Sandbox

Thirty companies are currently approved by the Central Bank of Bahrain (CBB) for its regulatory sandbox, half of which are crypto service providers including exchanges.

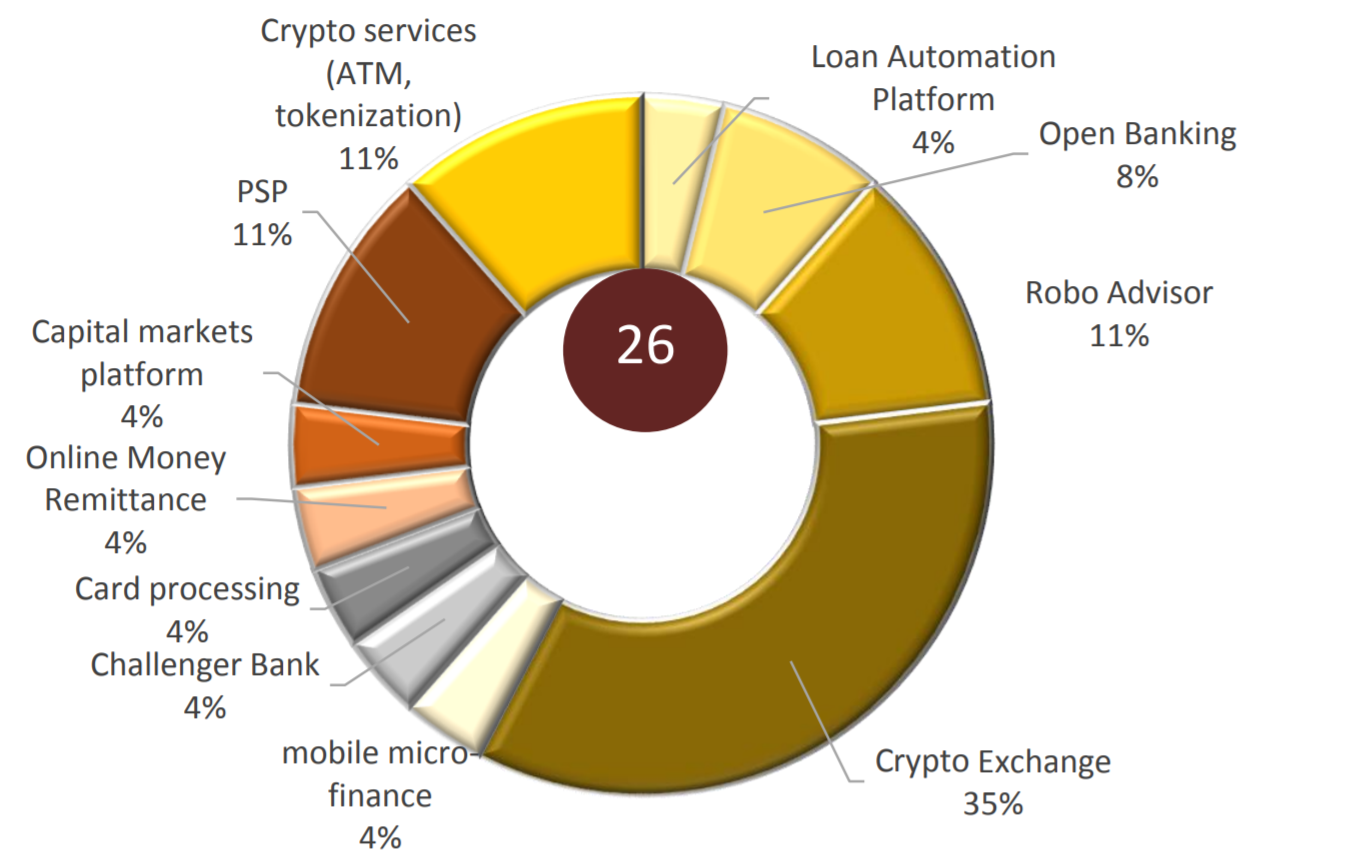

Four companies have been approved this year and three of them (AT Payments Llc, Zpx Pte Ltd., and Bitcove Bahrain) are crypto service providers. In addition, the central bank’s 2018 annual report published last week details that 26 companies were approved between the introduction of the regulatory sandbox and the end of last year.

According to the CBB report, up until the end of 2018, 35% of the companies approved for the regulatory sandbox were crypto exchanges and 11% were other provider crypto services such as ATMs and tokenization. When including the three companies approved this year, the number of crypto companies that have joined the regulatory sandbox reaches 50% of the total.

The Bahraini regulatory sandbox allows firms to “test their technology-based innovative solutions relevant to fintech or the financial sector in general,” the CBB detailed, noting that the duration of the sandbox is up to nine months with a maximum extension of three months. In December last year, the central bank announced that Tarabut Gateway, a subsidiary of Almoayed Technologies, became “the first company to successfully complete the regulatory sandbox stage and to receive the CBB’s in-principle confirmation under the Open Banking regulatory framework.”

Bahrain has been trying to attract businesses to its crypto-friendly environment. In March, news.Bitcoin.com reported that the Bahrain Economic Development Board invited Indian firms to take advantage of the opportunities its country has to offer. Meanwhile, the Reserve Bank of India recently published draft rules on its regulatory sandbox which excludes crypto companies.

Bahrain’s Crypto Regulation

The central bank issued a consultation paper on directives for services provided by “crypto-asset platform operators” on Dec. 13 last year. It provides “a regulatory framework for licensing and supervision of crypto-asset services to fall under CBB Rulebook Volume 6,” the bank explained. The final rules on a range of activities relevant to crypto assets were published on Feb. 25.

“The CBB crypto-asset rules deal with the rules for licensing, governance, minimum capital, control environment, risk management, AML/CFT, standards of business conduct, avoidance of conflicts of interest, reporting, and cyber security for crypto-asset services,” the CBB described. “They also cover supervision and enforcement standards including those provided by a platform operator as a principal, agent, portfolio manager, adviser and as a custodian within or from the Kingdom of Bahrain,” the central bank clarified, adding:

For those licensed by the CBB as crypto-asset exchanges, the regulatory framework also contains rules relevant to order matching, pre and post trade transparency, measures to avoid market manipulation and market abuse, and conflicts of interest.

What do you think of Bahrain’s crypto-friendly regulatory sandbox? Let us know in the comments section below.

Images courtesy of Shutterstock and the Central Bank of Bahrain.

Are you feeling lucky? Visit our official Bitcoin casino where you can play BCH slots, BCH poker, and many more BCH games. Every game has a progressive Bitcoin Cash jackpot to be won!

Need to calculate your bitcoin holdings? Check our tools section.

The post Bahrain’s Regulatory Sandbox Teeming With Crypto Companies appeared first on Bitcoin News.

Powered by WPeMatico