Facebook’s digital currency plans have caused concern among bureaucrats worldwide and members of the U.S. government seem fearful of a giant tech establishing itself as a financial institution. Prior to the U.S. congressional hearings and the upcoming G7 finance meeting, a U.S. discussion draft bill, the Keep Big Tech Out of Finance Act, hopes to stop large tech corporations from “maintaining, or operating a digital asset.”

Also read: How 10 Countries Respond to Facebook’s Libra Cryptocurrency

Members of Congress Want to Keep Big Tech Out of Finance

Immediately after Facebook disclosed that it plans to launch a new digital currency called Libra, politicians around the world began to complain. Currently Facebook’s subsidiary startup Calibra faces the upcoming U.S. Senate Banking Committee on July 16, the House Financial Services Committee on July 17, as well as the G7 Finance Ministers meeting in Chantilly, France on July 17-18. Prior to these hearings on Thursday, President Donald Trump said on Twitter that “Facebook Libra’s ‘virtual currency’ will have little standing or dependability,” adding:

If Facebook and other companies want to become a bank, they must seek a new banking charter and become subject to all banking regulations, just like other banks, both national and international.

The following day, a U.S. draft discussion bill discovered by the publication The Block shows that U.S. leaders may take action against Facebook’s digital currency attempt. The Keep Big Tech Out of Finance Act would be a law enacted by the Senate and House of Representatives to rein in big tech forays into the financial field. “A bill to prohibit large platform utilities from being a financial institution or being affiliated with a person that is a financial institution, and for other purposes,” explains the discussion bill’s header.

“A large platform utility may not establish, maintain, or operate a digital asset that is intended to be widely used as a medium of exchange, a unit of account, store of value, or any other similar function, as defined by the Board of Governors of the Federal Reserve System,” the bill details. The House of Representatives discussion draft also warns of harsh penalties for big tech firms that disobey the congressional statute if it gets enacted into law. The draft bill states:

Any large platform utility or financial institution that violates subsection (a) or (b) shall be subject to a fine of not more than $1,000,000 per each day of such violation, in an action brought by the appropriate Federal financial regulator.

According to The Block’s source who is familiar with the matter, the discussion draft has been making rounds within the House Financial Services Committee. The latest discussion bill follows the House of Democrats request that Facebook stops developing Libra until Congress researches the risks involved.

Skeptics Believe Libra Will be Centralized and Privacy-Invasive

House Democrats are requesting Facebook halt development of its proposed cryptocurrency project Libra. Alongside this, congressional leaders want the company to stop developing its digital wallet Calibra until Congress and regulators have time to investigate the possible risks it poses to the global financial system. Rep. Maxine Waters (D-CA), the chairwoman of the House Financial Services Committee, wrote a letter with other members of Congress asking Facebook to pause operations. Senator Sherrod Brown, the top Democrat on the Senate Banking Committee, emphasized in a statement:

Facebook is already too big and too powerful, and it has used that power to exploit users’ data without protecting their privacy. We cannot allow Facebook to run a risky new cryptocurrency out of a Swiss bank account without oversight.

There’s no doubt that Facebook’s proposed digital asset scares U.S. leaders as some of them wholeheartedly believe: “[Libra] could pose systemic risks that endanger the U.S. and global financial stability.” Mihai Alisie, cofounder of Ethereum, thinks Facebook is trying to dupe financial regulators by pushing a centralized digital currency into the economy. Alisie explained in an interview that the social media giant is claiming the new coin will not be centrally controlled, but he thinks they are misleading regulators and the general public with these promises.

“[Facebook plans] to mislead the regulators who have learned in the last few years that blockchain is not something that can easily be regulated … It should be treated as an entity trying to create a centralized currency,” Alisie insisted. “This has implications on so many areas, from the economic to the political to the technological to surveillance and data privacy — [Facebook] is actively manipulating the behavior of people on a global scale.”

Blow to “Bitcoin” as Fed warns about Libra??? There is no fv[https://t.co/YiE1amUjdk

— John McAfee (@officialmcafee) July 13, 2019

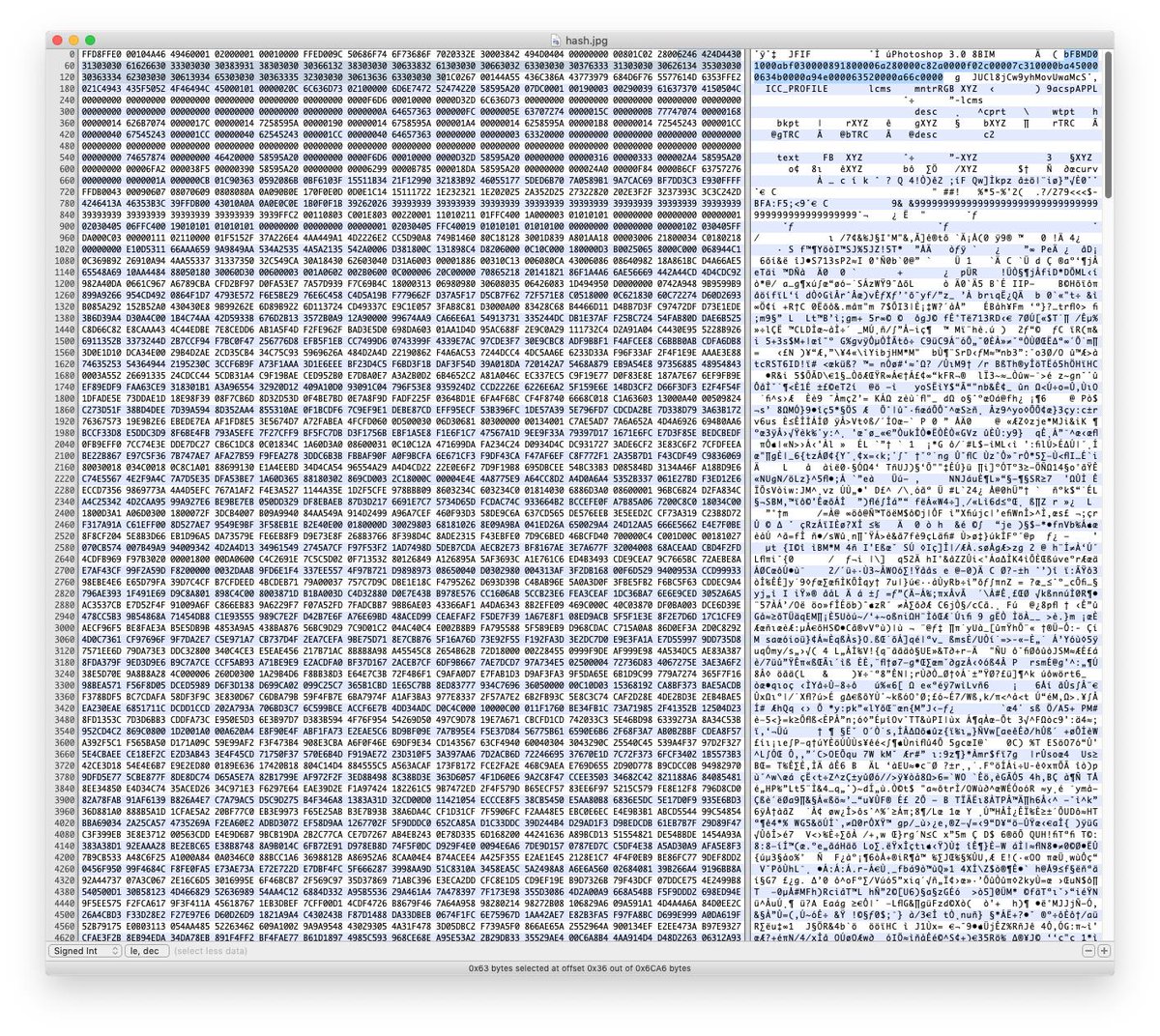

There are some pretty alarming tactics that Facebook uses to track the website’s visitors. Many people believe that adding a digital asset into the mix with 2.38 billion active Facebook users is dangerous. For instance, Edin Jusupovic, a programmer and CSIS certified cybersecurity researcher, demonstrated on July 10 how Facebook embeds tracking data inside photos you download. Jusupovic called his findings a “shocking level of tracking” and asserted that Facebook could “potentially track photos outside of their own platform with a disturbing level of precision about who originally uploaded the photo (and much more).” To many Libra skeptics, privacy-invasive tactics like Jusupovic’s example beg the question: If Facebook can track pictures with extreme precision then what stops them from tracking a digital currency’s movements in the same manner?

The Possibility of Stimulating Fedcoin

Libra’s attempt also follows other large blockchain projects and crypto consortiums like Hyperledger, R3, and the Enterprise Ethereum Alliance which have yet to produce any meaningful products. Facebook’s digital currency is aiming to be a stablecoin backed by U.S. dollars, but a few people are skeptical of how long the backing will last. Galaxy Digital CEO Mike Novogratz foresees the possibility of Libra dropping the USD peg at some point in the future. Despite the fear U.S. government officials and worldwide leaders have toward Libra, some pundits believe the project could spark a Federal Reserve-backed cryptocurrency. Stanford Law professor Joseph Grundfest thinks it would be quite ironic if the U.S. government copied Libra’s solution it becomes successful.

[It would be a] delicious irony if Facebook’s Libra proposal stimulates the United States government to develop functionality that operates like Libra, backed by U.S. dollar deposits, but operated by the U.S. government.

The drafted discussion bill involving the House Financial Services Committee indicates that certain bureaucrats are determined to stop big tech companies before they even start a crypto project. If the act were to become law, a fine of $1 million per day for starting a digital currency project would make any corporation think twice.

What do you think about the discussion draft bill floating around the House Financial Services Committee? Why do you think the U.S. government wants to keep big tech out of finance? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Scribd/the Block, Twitter, Edin Jusupovic, Facebook, and Libra.

Are you feeling lucky? Visit our official Bitcoin casino where you can play BCH slots, BCH poker, and many more BCH games. Every game has a progressive Bitcoin Cash jackpot to be won!

The post How US ‘Keep Big Tech Out of Finance’ Draft Bill Targets Facebook’s Libra appeared first on Bitcoin News.

Powered by WPeMatico