Digital currency markets have been meandering sideways for a few days as most of the top crypto prices have been consolidating. Some traders believe there will be a big bullish rise after the current slump, while others think crypto prices may sink even lower. Amidst the crypto market uncertainty, economists worldwide are predicting a great recession looming in the backdrop.

Also Read: 10,000 American Cryptocurrency Owners Will Receive Warning Letters From the IRS

Persistent Consolidation

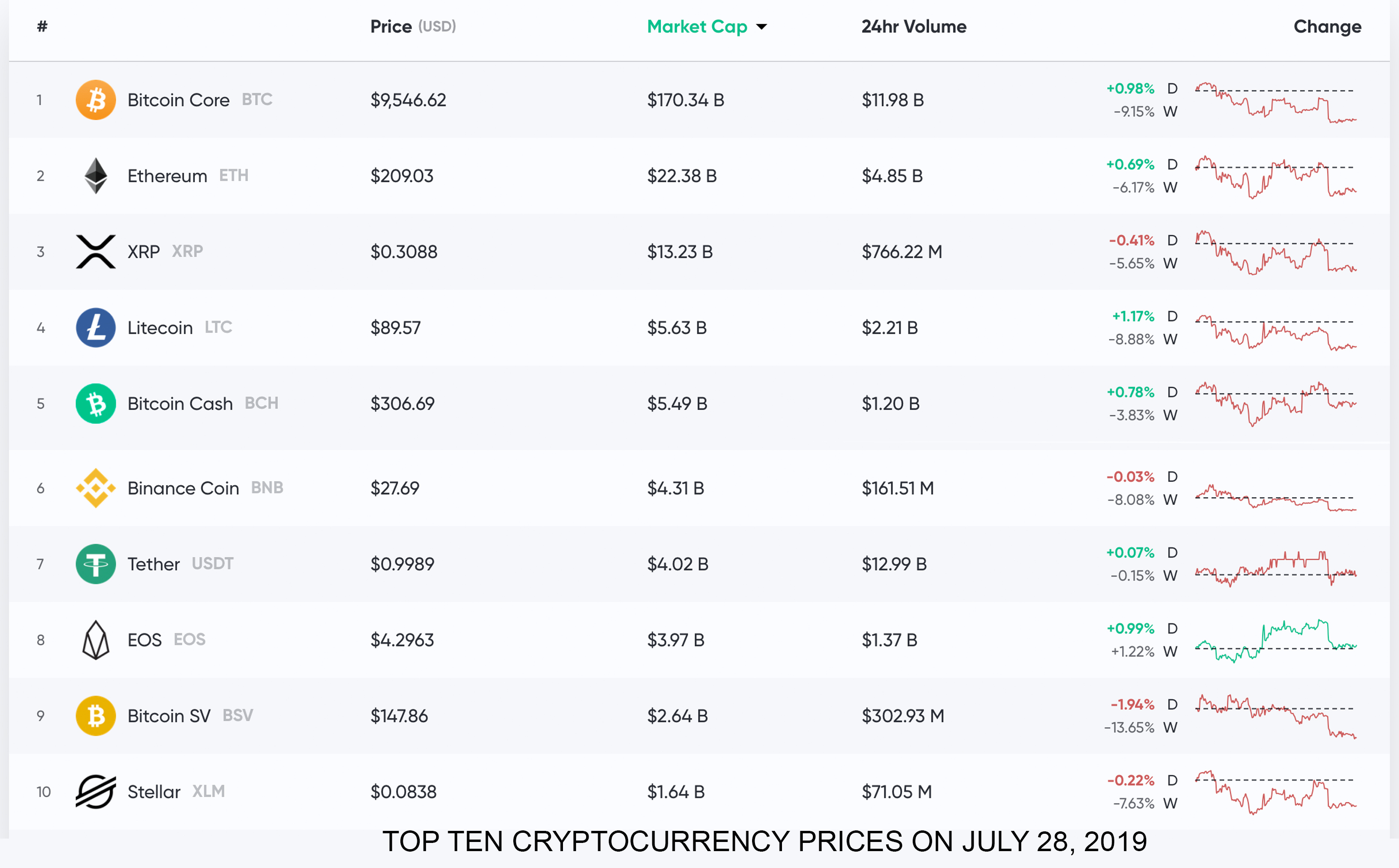

On Sunday, July 28 the entire market capitalization of digital assets is around $263 billion and there’s been $43 billion in 24-hour global trade volume. Digital currency market caps, individual coin prices, and overall global trade volumes have dropped significantly since June. Currently, the price of bitcoin core (BTC) is hovering around $9,500 with around $13 billion in daily trade volume. During the early morning trading sessions on July 28, more than 68% of BTC trades are paired against tether (USDT).

Following BTC’s lead, ethereum (ETH) holds the second largest valuation as each ETH is swapping for $209. Ethereum markets have roughly $5.7 billion worth of Sunday’s overall trade volumes. Ripple (XRP) is still hanging tight in third position and each XRP is swapping for $0.31. At the time of writing, there’s only $841 million in global trade volume for XRP. The fourth largest market valuation belongs to litecoin (LTC), which has seen around $2.3 billion in daily trades. Each LTC is trading for $89 per coin and a market cap of about $5.6 billion. Lastly, bitcoin cash (BCH) is hovering around $307 and there’s been $1.2 billion swapped in the last day. BCH has a market valuation of around $5.4 billion this Sunday.

Mike Novogratz Predicts BTC Prices Could Surpass $20K by the Year’s End

Despite all the recent red within the crypto charts, many enthusiasts are expecting a return to green in the long run. A number of digital asset supporters suspect that institutional interest has entered the crypto scene and Galaxy Digital CEO Mike Novogratz believes BTC will surpass its all-time highs this year.

During his interview with Bloomberg on July 25, Novogratz opined that there’s a good chance that BTC will consolidate for a while but by the end of 2019 he thinks the price could blow past $20,000. The Galaxy Digital CEO said it was also exciting to see the upcoming launch of Facebook’s Libra project and Telegram’s digital currency as well. Novogratz thinks that because these platforms already have a large user base the experiment will be interesting.

“In about two or three months Telegram is launching their blockchain,” Novogratz explained. “Telegram is about 218 million users — So before Facebook launches we are going to have a real view at an experiment called Telegram, where they also have a user base.”

Bitcoin Cash Market Indicators Show a Possible Breakout Imminent

A few crypto traders eyeing the price of bitcoin cash (BCH) believe that there could be a breakout in the near future. A technical analysis published on July 27 insists that the bullish trend is currently “very strong on bitcoin cash.” “As long as the [BCH/USD] price remains above the support at 312.38 USD, you could try to benefit from the boom — The first bullish objective is located at 318.18 USD — The bullish momentum would be boosted by a break in this resistance. Buyers would then use the next resistance located at 325.51 USD as an objective,” the analysis reads. The technical price examination continues:

Crossing it would then enable buyers to target 332.33 USD — Be careful, given the powerful bullish rally underway, excesses could lead to a possible correction in the short term. If this is the case, remember that trading against the trend may be riskier. It would seem more appropriate to wait for a signal indicating a reversal of the trend.

Another BCH/USD price forecast written by Saad Murtaza on the same day shows similar findings. Murtaza’s data shows that the price of BCH is breaking against BTC. Murtaza emphasizes that the recent BCH price increase has taken the price action above the 10-day moving average (MA). But the price fell short when it reached the 20-day MA and it’s been trading sideways ever since. “This has caused the ten-day MA to increase and is possibly going to push the price for a breakthrough above — The same thing is happening to the MACD and supported by the RSI across all short-term charts up till 12-hour frames.” Murtaza’s analysis noted. “A breakout may occur soon; however, the ascending triangle shows strong resistance. If price breaks above, it will demolish the previous resistance as well as it coincides with the triangle’s resistance.”

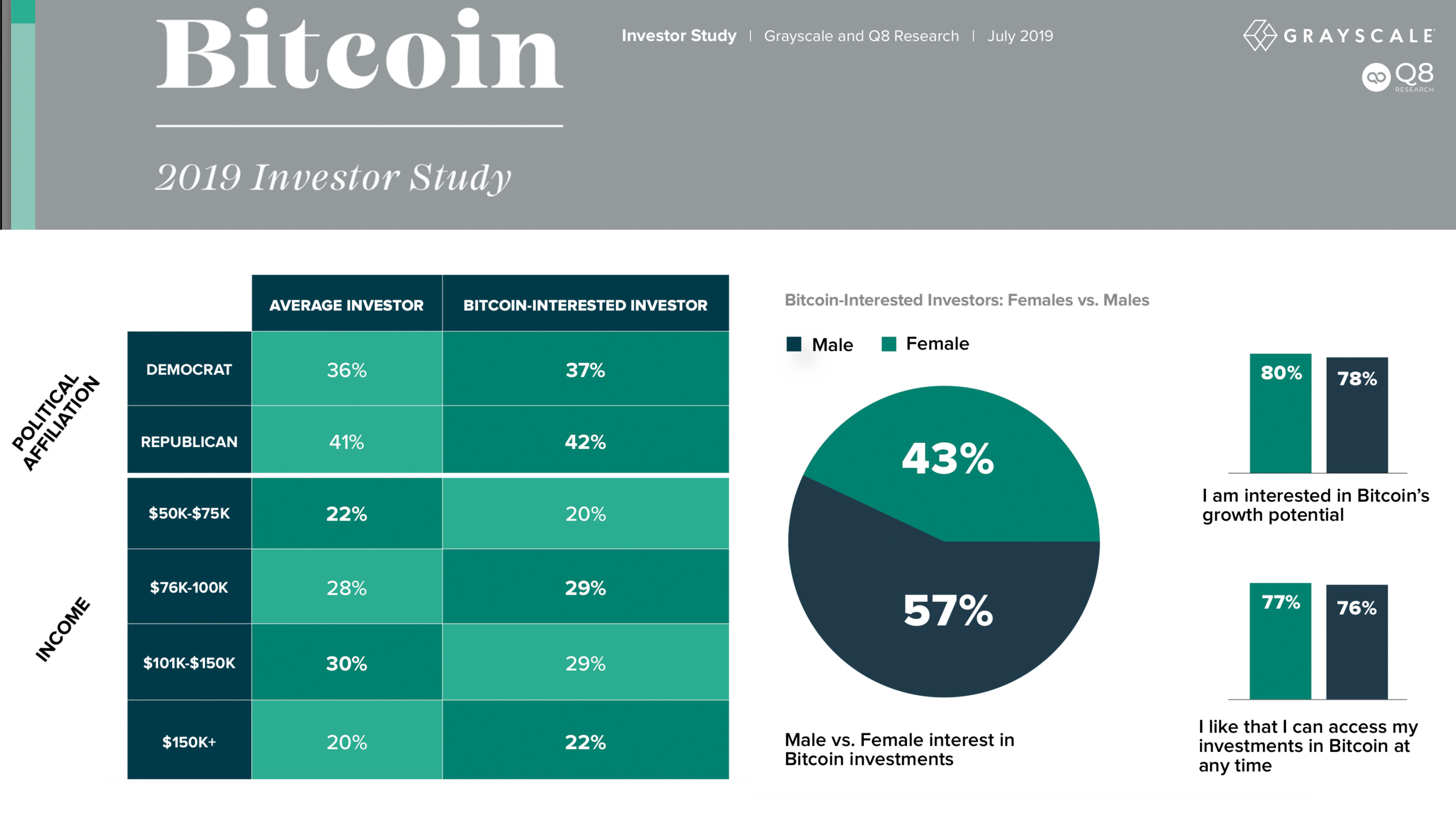

Grayscale Research Finds 36% of American Investors Consider Buying Bitcoin

Grayscale Investments and Q8 Research released a study this month which surveyed a group of 1,100 U.S. investors. Within this portion of the investment community, the survey found that more than a third (36%) of investors would consider an investment in bitcoin. The study reveals the majority of the investors who participated (83%) were “strongly motivated by the idea that they could invest small amounts in bitcoin today.” “Since its introduction in 2009, bitcoin has steadily grown in popularity and today has expanded its reach to a broad mainstream audience,” the research report explains. The Grayscale and Q8 Research study adds:

Investors are constantly looking for new ways to diversify their portfolios as traditional assets and markets have begun to move more closely in sync with one another. Increasingly, savvy investors recognize that bitcoin and other digital currencies may have unique investment characteristics that provide diversification far beyond the basic 60% stock/40% bond portfolio allocation.

Global Economists Fear Recession Is Looming in the Backdrop

Headlines concerning the world economy continue to hint at an impending recession and economic turmoil. In Hong Kong during the protests, the country’s Finance Secretary Paul Chan told the public this week the protesting has caused unemployment and hurt local businesses. “For foreign tourists and enterprises, the unrest in Hong Kong dampens their appetite for traveling and investment,” Chan’s translated statements detail.

In the U.S., economists fear the American economy is on the brink of recession despite the nation’s gross domestic product increases. This is because economists believe the Federal Reserve is poised to lower interest rates soon. Meanwhile, in the U.K., political economists think a no-deal Brexit is on the horizon according to U.K. Prime Minister Boris Johnson’s statements. Reports state that the region is preparing a no-deal Brexit because the European Union does not plan to renegotiate the prior withdrawal agreement. The looming global recession has fueled the spot gold markets as having consolidated above $1,400 per troy ounce of .999 fine gold.

Similarly, cryptocurrencies touched 2019 all-time highs in June and most have consolidated after a slight correction. Digital asset prices are still far higher than they were in January and many top coins have steadily increased month after month. No one really knows how the predicted global economy’s recession will affect digital currency markets, but typically during these times of hardship, the price benefits. This was the case for bitcoin markets during the crisis in Cyprus, Greece, and the last Brexit. So far, most of the top assets are moving sideways and it’s likely big players are finding new positions. Besides the last few days of sideways action, over the last few weeks, digital asset markets have been awfully volatile, playing out a crypto game of musical chairs. Depending on who you ask, traders predict BTC prices could drop to between $7,000-8,000, while others believe markets will see an upward trajectory toward $14K.

Where do you see the price of bitcoin cash and the rest of the crypto markets heading from here? Let us know what you think about this subject in the comments section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.” Prices and data were recorded on Sunday, July 28, 2019 at

Images via Shutterstock, Trading View, Bitcoin.com Markets, Grayscale, and Pixabay.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

The post Market Outlook: Crypto Prices Consolidate as Economic Uncertainty Looms appeared first on Bitcoin News.

Powered by WPeMatico