Germany, the locomotive of Europe’s huge economy, is entering a difficult period, various indicators suggest. And when the Federal Republic sneezes, the Old Continent usually catches cold. This time, Germany may infect the rest of the world as well. An economic and financial crisis there would be a seismic event of global proportions. The main question now seems to be when it will happen, not if.

Also read: Liquidity Difficulties in China: Second Bank Bail-Out Now Reality

German Industry Is Hurting

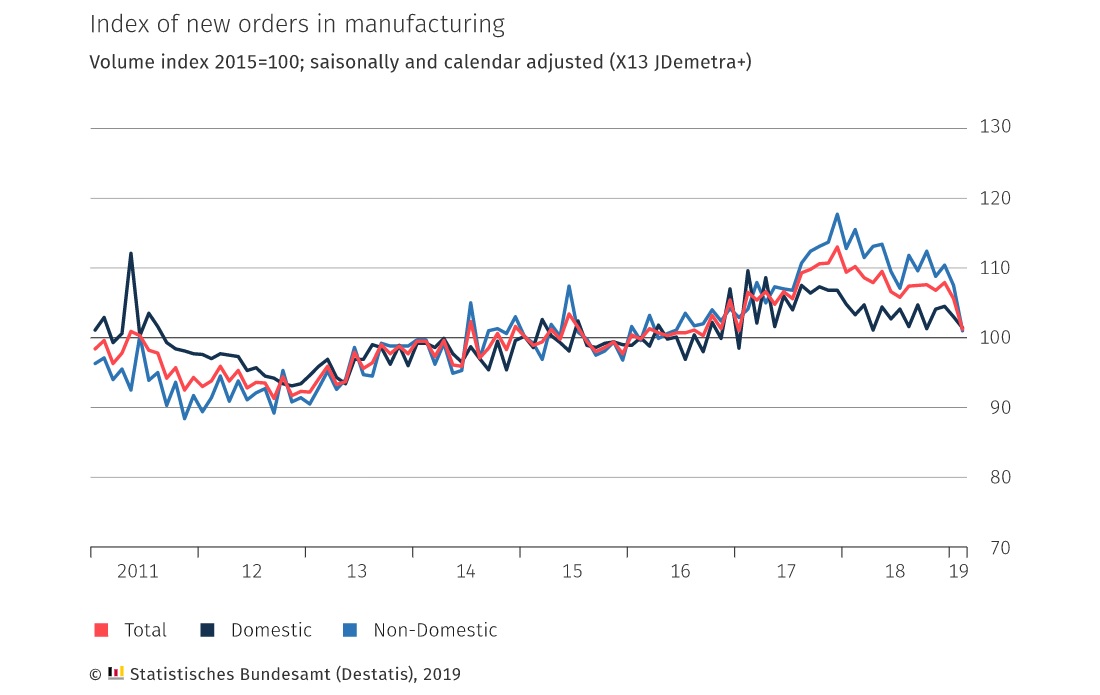

The industrial powerhouse of the Eurozone and the greater European Union is now seeing a significant decline in production – by 2.7% year-on-year in January and 1.9% in April compared to the previous month. Then in May, factory orders declined 2.2% from a month ago and registered an 8.6% annual drop, the biggest in a decade. In the first half of 2019, even beer sales were down 2.7%, according to Destatis, the Federal Statistical Office.

International trade wars and geopolitical uncertainty in the region and beyond are negatively affecting the German economy, which relies heavily on exports. They form almost half of the country’s annual economic output. Germany is Europe’s leading exporter of goods and it ranks third among the largest exporters in the world, after China and the United States.

Several factors have been hurting German exports which registered an annual decrease of 0.5% in April. Demand from China, which is a major market for German products, has been weakening due to slowing growth. U.S. tariffs on steel and aluminum are also a major concern and the Trump administration is now considering whether to impose tariffs on European cars. The steepest slide in orders has been in the auto industry. Then there’s the upcoming Brexit divorce Germany has to deal with as well.

Short Working Weeks Are Back

Against this backdrop, a growing number of German companies are reintroducing short-time work schemes, the kind that were implemented during the last global financial crisis to mitigate its impact on industrial enterprises and their workforce. According to a survey conducted by the Munich-based Ifo Institute for Economic Research, 8.5% of the companies in Germany’s manufacturing sector expect to introduce short-time work programs over the next three months.

This is the highest percentage since 2013, Deutsche Welle reported, as last year only 2.6% of industrial entities were considering shorter working weeks for their employees. Germany still has one of the lowest unemployment rates among developed nations. In 2018, only 3.4% of its citizens between 15 and 74 years old had no job. Unemployment in the Euro area remains much higher at 7.9% at the end of December. Shorter working hours are definitely helping keep the indicator as low as possible.

The negative trends forced the nation’s central bank to revise its economic forecast, taking into account the outlook for the global commerce hit hard by the trade disputes between major players on the world scene. Bundesbank now thinks the German economy will grow only around 0.6% this year. The number represents a significant retreat from its previous prediction of 1.6% which was announced in December.

Financial Meltdown Brewing in Europe

The EU as a whole and the Eurozone in particular remain very diverse clubs of nations in terms of economic status. Some countries, particularly from the Southern flank, continue to register double-digit unemployment rates, 18% in Greece for example. While Spain’s economy is doing relatively well, Italy is practically in recession. Rome never managed to overcome its slow growth and a decade after the 2008 crash the Italian economy remains smaller than before the global financial crisis.

In May, a senior adviser to the German government shared with the BBC his fears that another European financial crisis could be brewing. Dr. Lars Feld, a member of the German Council of Economic Experts, singled out Italy. He noted that the country, which has the third largest economy in the single currency area, is struggling to stay out of recession as it has to deal with both a banking crisis that can affect the euro and a very high government debt, which reached a record high 132.2% of GDP in 2018.

A recession in Italy, which is also the world’s eighth largest economy by nominal GDP, sounds bad enough, but a slowdown in Germany would be even more damaging. A full-blown recession in the Federal Republic could definitely trigger a global crisis. Last year, Dr. Feld was one of the first to warn that the largest European economy is slowing down. It actually shrank in the second quarter of this year. But while the government adviser is worried, the executive power in Berlin seems to be in a state of denial.

‘We Are Not in Crisis’ Finance Minister Insists

In a recent interview with Bloomberg, German Finance Minister Olaf Scholz downplayed warnings about the negative outlook for the German economy and revealed that the federal government has no plans to stimulate economic growth. He believes that resolving man-made crises, such as the ongoing trade wars and Brexit, would increase growth rates in 2020, the year many now point to as the start of the next big crash. Insisting that more government spending now would rather lead to inflation than growth, Scholz stated:

We are not in a situation that makes it necessary or wise to act as if we were in a crisis, we are not.

Germany’s finance minister made these comments right after the European Central Bank indicated its intentions to increase its monetary support for the Eurozone economy in the coming months. Speaking to media in Frankfurt, ECB President Mario Draghi stressed that manufacturing in Germany and elsewhere in Europe may need increased government spending.

In June, the European Central Bank indicated its ultra-low interest rates are likely to remain in place until at least mid-2020, six months longer than the previously stated goal. ECB’s management is also preparing for further cuts that will take interest rates into negative territory. In the Eurozone, they have been going down for seven years and have been at 0% since 2016. More quantitative easing is also on the horizon, which means printing more money.

Such policies would have a hard time winning support from the German coalition government lead by Angela Merkel. Olaf Scholz, who is also her deputy, believes the tax cuts that have been made so far and the infrastructure spending are working fine and additional stimulus would not be a wise idea. In essence, Frankfurt wants to bolster economic growth with QE and negative interest rates, while Berlin sees only rising prices as a result of these measures.

Too Big to Fail

If there’s one thing Germany fears, that’s inflation. Being a leading exporter of high value added, quality products, inflation of the euro would decrease its revenues. And that’s one of the biggest contradictions of the Eurozone as countries like Italy actually need higher inflation so that their exports remain at least price competitive in relation to the German exports.

Berlin has gotten itself, and the rest of Europe, into an almost hopeless situation. The Eurozone is tuned in a way that benefits its largest economy. That, however, leads to the concentration of money in Germany whose banks have been lending it back to the weaker partners in the Eurozone and the EU to sustain them and their markets. Sooner or later, the poor borrowers won’t be able to take any more debt. It’s already happened with Greece, for example.

Germany has become a lender, supplier and consumer that’s too big to fail. A German crisis would surely drag the rest of the Eurozone and hurt the global economy. So now Europe is basically financing Germany through low and subzero interest rates. Things are nearing a point where normal economic logic isn’t part of the equation anymore. Investors are literary paying more and more to lend money to Germany, as Welt business editor Holger Zschaepitz remarked in a tweet this week. Berlin recently sold €2.345 billion of 10-year debt at a record low yield of -0.41%.

Totally absurd: Investors are paying #Germany more and more to lend the country money. Berlin sold €2.345bn of 10y debt at fresh record low yield of -0.41% vs -0.26% at Jul auction. Bid-to-cover rose to 2 from 1.2 at July 10 auction. pic.twitter.com/PHF2tiU5f0

— Holger Zschaepitz (@Schuldensuehner) July 31, 2019

Whatever the German finance minister says and does, there’s a well-grounded feeling that the next big crisis is looming. The troubles of Deutsche Bank, Germany’s largest financial institution and top banking services provider, are proof that something is wrong with the traditional financial system. The fact that central banks bought a record $15.7 billion of gold in the first half of the year and German investors piled into gold-backed exchange traded funds, as Financial Times reported, is a strong indication of efforts to diversify away from fiat currencies.

“In Europe we have a dysfunctional monetary union,” German finance strategy consultant Marc Friedrich told news.Bitcoin.com. “The South suffers with the euro and will never get better within the euro,” the economist emphasized. Friedrich thinks the recession is already coming and believes that in its aftermath a new monetary system will be born, a digital one, in which societies will need decentralized currencies like bitcoin.

Unfortunately, German regulators are making it harder for crypto businesses to operate freely in the Bundesrepublik. Companies from the industry, such as exchanges, payment providers and custodians, will have to apply for a special license from Bafin, the Federal Financial Supervisory Authority. They have to do so by the end of the year with the introduction of new AML rules based on EU’s Fifth Anti-Money Laundering Directive which must be transposed into German law by January 2020.

According to information shared on crypto forums, the new regulations are already affecting platforms dealing with cryptocurrencies. For example, Germany is no longer on the list of countries supported by Bitpay, a leading payment processor that allows many businesses outside the industry to accept coins through conversion to fiat.

Of course, direct crypto payments remain a viable alternative. You can process bitcoin cash payments using the Bitcoin Cash Register app for iOS and Android. The simple Point of Sale software developed by Bitcoin.com allows merchants to accept BCH at any retail location. Payments are easy, safe and no account or registration is needed to install and use it.

Do you expect the next financial and economic crisis to begin in Germany? Share your thoughts on the subject in the comments section below.

Images courtesy of Shutterstock, Destatis.

Do you need a reliable bitcoin mobile wallet to send, receive, and store your coins? Download one for free from us and then head to our Purchase Bitcoin page where you can quickly buy bitcoin with a credit card.

The post More Signs the Next Big Financial Crisis May Begin in Germany appeared first on Bitcoin News.

Powered by WPeMatico