Sub-zero interest rates have become the norm in some countries, especially in Europe. Nordic nations such as Sweden and Denmark have been in negative territory for a while and a growing number of banks in the region are now charging depositors for keeping their money. Saving in fiat right now, unlike cryptocurrencies lately, leads to losses, although loans and mortgages aren’t free of charge per se. A leading Swedish bank has imposed a negative interest rate of -0.40% on euro accounts, while the ECB is reportedly preparing for a new rate cut.

Also read: As US Expands Subprime Mortgage Program, Is a New Crisis Looming?

Your Euro Savings Will Cost You Money in Sweden

Sveriges Riksbank, the central bank of Sweden which is the largest economy in Scandinavia, cut its interest rate to 0% in late 2014 and introduced negative rates in early 2015. It has kept them there ever since with the aim of fighting deflationary pressures. The Swedish krona, among other currencies in the periphery of the Eurozone, has been appreciating with dangerously low inflation, from a traditional standpoint.

After going down to a record low -0.5% in February 2016, and staying there for a while, Riksbank increased the interest rate to -0.25% towards the end of last year. This July, Riksbank kept its key repo rate at that level. Despite the relatively strong economic activity in the country and inflation staying close to the 2% target, the financial regulator noted the need to proceed with a cautious monetary policy, given the risks to the global outlook.

Skandinaviska Enskilda Banken (SEB), a major Swedish lender, has recently lowered its long-term mortgage rates. Interest on five-year loans has been decreased in July by 0.35% to 1.95% and by 0.41% to 2.99% for the 10-year mortgages. Rates on all savings accounts, except investment accounts, remain at 0%. The same applies to most regular business accounts.

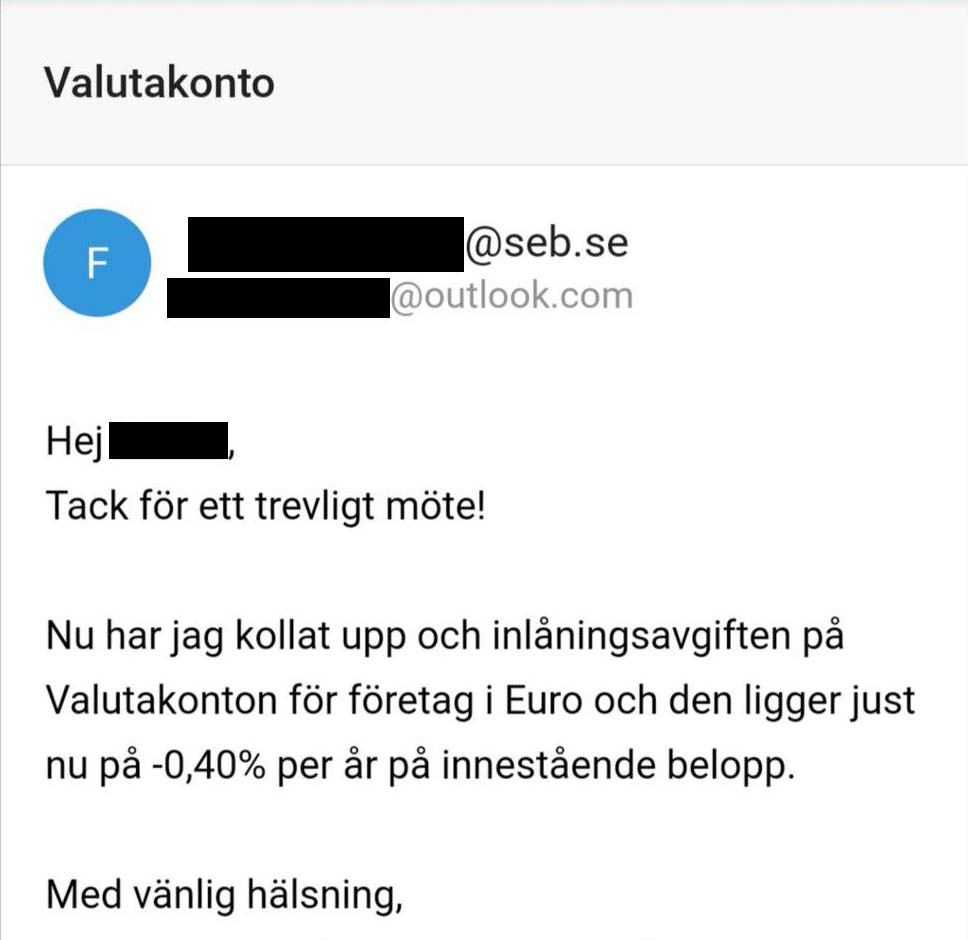

However, SEB recently delivered аn unpleasant surprise to some of its clients. The interest on foreign currency accounts is already in the subzero territory. To be precise, that’s -0.40% on euro holdings, according to correspondence from the bank acquired by news.Bitcoin.com. “…the loan fee on business currency accounts in euro is currently -0.40% per year on the deposited amount,” reads an email sent to a customer.

To a certain degree, calling the interest rate ‘loan fee’ is closer to what it has actually become. When a depositor gives their money to a financial institution, they are no longer the owner of the asset, but only retain the right to withdraw under the terms and conditions described in the contract. Nowadays, instead of earning interest on the amount you’ve deposited, you are often paying a fee to lend your funds to the bank. Does that make any sense from a market economy point of view?

Sweden’s commercial banks have been forced to adapt to the continuously negative benchmark rate and have started passing the burden to their clients. Swedbank, the country’s largest lender, offers private customers various opportunities to save but rates are currently set at 0% for several of its products like private, e-savings, and youth accounts. No interest is paid on cash in an investment savings account either. The situation with corporate accounts looks pretty much the same. Current mortgage rates, however, reach over 3% for longer loans.

Danish Bank to Impose -0.60% Rate on €1M Deposits

Denmark, another important economy in the region, was actually the first country on the Old Continent to adopt negative interest rates after the global financial crisis of 2008. Its central bank, Danmarks Nationalbank, introduced them back in 2012 when it lowered its benchmark rate to -0.2%. The institution has consistently kept it around and below zero during the following seven years and it’s currently set at -0.65%.

Banks in the country have had to take its policy into account when deciding about the parameters of their own offers. For some time now, they have been resisting the pressure to pass the losses on to their clients. The largest of them, Danske Bank, recently announced it does not plan to impose negative rates on personal savings or current accounts and vowed not to introduce additional fees for its wealthy account holders. The bank, which is struggling with the consequences of its involvement in a large money laundering scandal, fears that could lead to people withdrawing cash from the banking system.

But according to recent publications, not all banks in the country are managing to avert such a development. Jyske Bank, another leading financial institution in Denmark, is now preparing to impose a negative interest rate of -0.6% on personal accounts holding funds in excess of 7.5 million Danish kroner, or €1 million ($1.12 million). That’s according to the bank’s report for the second quarter of 2019. The measure comes in response to persistently negative interest rates that are affecting its earnings.

Lately, it has become impossible to buy Danish government bonds with a positive interest rate and the market indicates that negative rates will be a fact for several years to come, commented Jyske CEO Anders Dam, quoted by the Swedish business outlet Dagens Industri. Luckily, personal accounts with smaller investments will not be affected by the change. The interest rate on the funds in these accounts will remain at 0%.

The move also follows the announcement of some worrying financial results. For instance, Jyske’s net interest income fell by around 6% year-on-year in the first half of 2019. The decline was registered despite the increase in the bank’s business operations. And in Q2 of 2019, the net interest income was 1.34 million Danish kroner (approx. $200,000), which is only slightly above the expected 1.33 million kroner.

At the same time, profit before tax in the second quarter was 633 million kroner ($94 million), which is below the forecasted 714 million kroner ($106 million). And the core revenue, according to the quarterly report, was 1,948 million kroner, or almost $290 million, below the average estimate of 1.978 million kroner ($295 million). Core profit was 683 million Danish kroner ($101 million), again failing to reach the expected 694 million kroner, or $103 million target.

ECB to Cut Interest Rate to All-Time Low

Other prominent banks in the region include Helsinki-headquartered Nordea, which is also very active in the Baltic States. As of August 2019, its interest rates in Denmark are as low as -0.65%, depending on the product. According to a near-term forecast published on its Danish website, the financial institution believes most of them will remain in negative territory throughout the next year.

Nordea is based in Finland, the only Nordic nation which is a member state of the Eurozone, the club of countries using the common European currency. In its home country, the bank still maintains positive interest rates on both deposits and loans. That’s despite reports that the European Central Bank (ECB) is preparing to further reduce its key rates next month.

With inflation in the Eurozone remaining below the target of 2%, ECB is expected to cut its deposit rate by 10 basis points to -0.5% following its meeting in September. This will be an all-time low for the deposit facility rate which determines the interest banks receive when depositing funds with Europe’s central bank. It’s currently set at -0.4% and it has been negative since the summer of 2014. Analysts quoted by mainstream media think ECB may also resume its quantitative easing efforts in October by buying out assets worth 15 billion euros ($16.6 billion).

But with decentralized alternatives on the table, you are not limited to keeping your money in a fiat currency account. Cryptocurrencies, whose value does not depend on benchmark interest rates set by central banks, offer an opportunity to store value and to profit from the generally positive market trends of late, as demand for these deflationary assets increases. And for those who prefer a more traditional way of saving, keeping your coins with a platform like Cred, a partner of Bitcoin.com, will earn you much higher interest of up to 10% on your BTC and BCH holdings.

Do you think we are going to see more negative interest rates in the Nordic region and Europe as a whole? Share your expectations in the comments section below.

Images courtesy of Shutterstock.

You can now easily buy bitcoin with a credit card. Visit our Purchase Bitcoin page where you can buy BCH and BTC securely, and keep your coins secure by storing them in our free bitcoin mobile wallet.

The post Major Swedish Bank Orders Negative Interest Rate on Euro Deposits appeared first on Bitcoin News.

Powered by WPeMatico