The U.S. Internal Revenue Service (IRS) released a new report and infographic on Thursday illustrating unpaid or underpaid taxes for the years 2011 – 2013. The numbers reflect estimates based on the last such findings, for the years 2008 – 2010. With commissioner Chuck Rettig citing the importance of voluntary compliance, and crypto’s popularity on the rise, the IRS is growing increasingly concerned with opportunities for tax evasion afforded by the new digital money.

Also Read: Bitcoin Is a Viable Way to Remove the State From Your Life

Voluntary Compliance

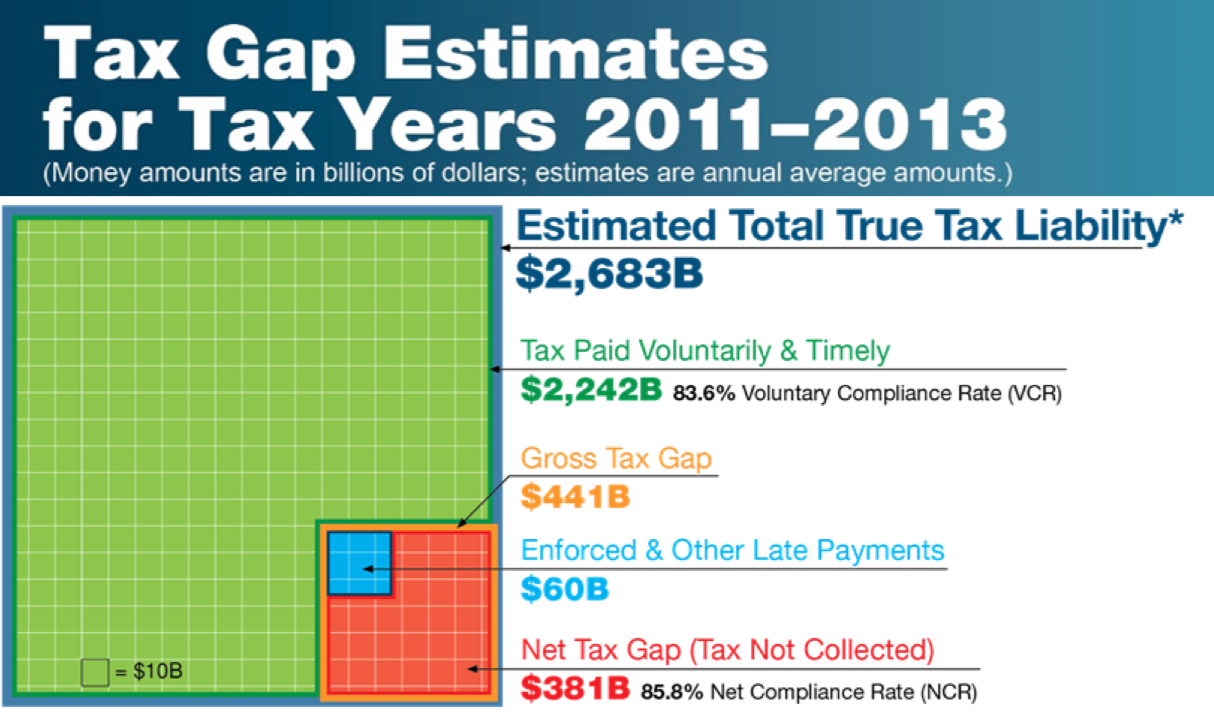

The new report and colorful, accompanying infographic don’t show anything out of range from the agency’s estimates last go-round, which found that 83.8% of taxes were paid “voluntarily and on time” for the years 2008 – 2010. The new data shows an 83.6% rate, which is basically unchanged, but also doesn’t show any marked improvement, either. The gross tax gap for the current data has $441 billion in taxes unpaid and/or underreported, with an expected net gap of $381 billion to remain after predicted payments and enforcement results come in. IRS commissioner Chuck Rettig stated:

Voluntary compliance is the bedrock of our tax system, and it’s important it is holding steady.

Those who are familiar with the IRS’s collection methods may question the idea of “voluntary compliance,” with some Americans even viewing the entire scheme as immoral. That notwithstanding, the agency wants its money, and is increasingly concerned with a free radical called crypto that has since entered the scene, facilitating non-compliance.

Thanks to Bitcoin, tax gap data for the next few years will be interesting to see. The years 2011 – 2013 represent a slice of time when crypto was still basically a cultural obscurity. That obviously no longer is the case, and growing IRS concern with tax evasion via crypto is all too palpable in the current climate.

Decentralized, permissionless digital assets afford knowledgeable users the ability to barter, trade and transact in relative anonymity. Given the masses of taxpayers required to keep the current U.S. Keynesian debt-liner afloat, and not come crashing into the iceberg of economic reality, the understaffed and underfunded agency is forced to resort to what some see as fear-mongering in place of logical, well-organized policy. Supporting this thesis is Rettig’s almost desperate proclamation that:

Maintaining the highest possible voluntary compliance rate also helps ensure that taxpayers believe our system is fair.

Hopefully it is more than belief upholding an expected $3.4 trillion-yielding federal tax collection drive for 2019, much of which will be spent on policies and actions large slices of the populace view as objectionable, inefficient, or immoral.

The Global Crypto Threat

The IRS’s concern with tax evasion via crypto doesn’t end at the U.S. border. The recently formed J5 (Joint Chiefs of Global Tax Enforcement) is a coalition of enforcement agencies around the world comprised of the IRS’s criminal investigation division (IRS-CID), the “Australian Criminal Intelligence Commission (ACIC) and Australian Taxation Office (ATO), the Canada Revenue Agency (CRA), the Fiscale Inlichtingen- en Opsporingsdienst (FIOD), HM Revenue & Customs (HMRC).” The goal of the coalition is “combatting transnational tax crime through increased enforcement collaboration.” The J5 declares:

We will work together to gather information, share intelligence, conduct operations and build the capacity of tax crime enforcement officials.

Regarding tax evasion and money laundering via cryptocurrencies, the group maintains “We will also collaborate internationally to reduce the growing threat to tax administrations posed by cryptocurrencies and cybercrime and to make the most of data and technology.”

In light of the not-so-subtle language coming from the IRS and related agencies, many crypto traders are turning to groups and services aimed at making the murky waters of crypto tax reporting more navigable. These services include actual CPAs as well as DIY software, some of which is guided by professional advice. Whatever one’s path, the age of crypto has arrived, and the next “hard fork” may be between those who wish to leverage the full capabilities of crypto as permissionless digital asset, and those whom the IRS succeeds in pressuring to voluntarily comply, completely. The next tax gap report will likely tell the tale.

What are your thoughts on the new IRS data? Let us know in the comments section below.

Image credits: Shutterstock, fair use.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post IRS Releases ‘Tax Cheat’ Info Raising Concerns About Crypto Theft appeared first on Bitcoin News.

Powered by WPeMatico