They might not be shouting it from the rooftops, but fiat payment gateways are no longer the enemy of bitcoin. Hostilities have ceased, the bad blood has been let, and today the fiat and crypto worlds are bridged and doing business. Despite the two systems sporting opposing aims and architecture, many centralized payment processors have learned to live with decentralized currency.

Also read: How Fiat Money Fails: Deconstructing the Government’s Paper-Thin Promise

From Enemies to Frenemies

In the early days of Bitcoin, traditional fiat payment systems were an unwitting friend of cryptocurrency. Paypal was the on-ramp for the first bitcoin exchange, bitcoinmarket.com, though it was a short-lived affair. Cold feet on the part of fiat payment systems, once they caught wind of exactly what bitcoin was, saw crypto payments banned altogether, but in the years since, the tide has turned. Today, centralized and decentralized payment systems are more closely aligned than ever.

It would be stretching the truth to claim that the overlords of traditional finance are enamored with crypto, but they have at the very least turned a blind eye to the practice of cashing in and out of crypto using fiat gateways. For most bitcoiners, begrudging acceptance from centralized systems is good enough. Some payment solutions have gone further though, extending a warm embrace to crypto assets, as the following examples show.

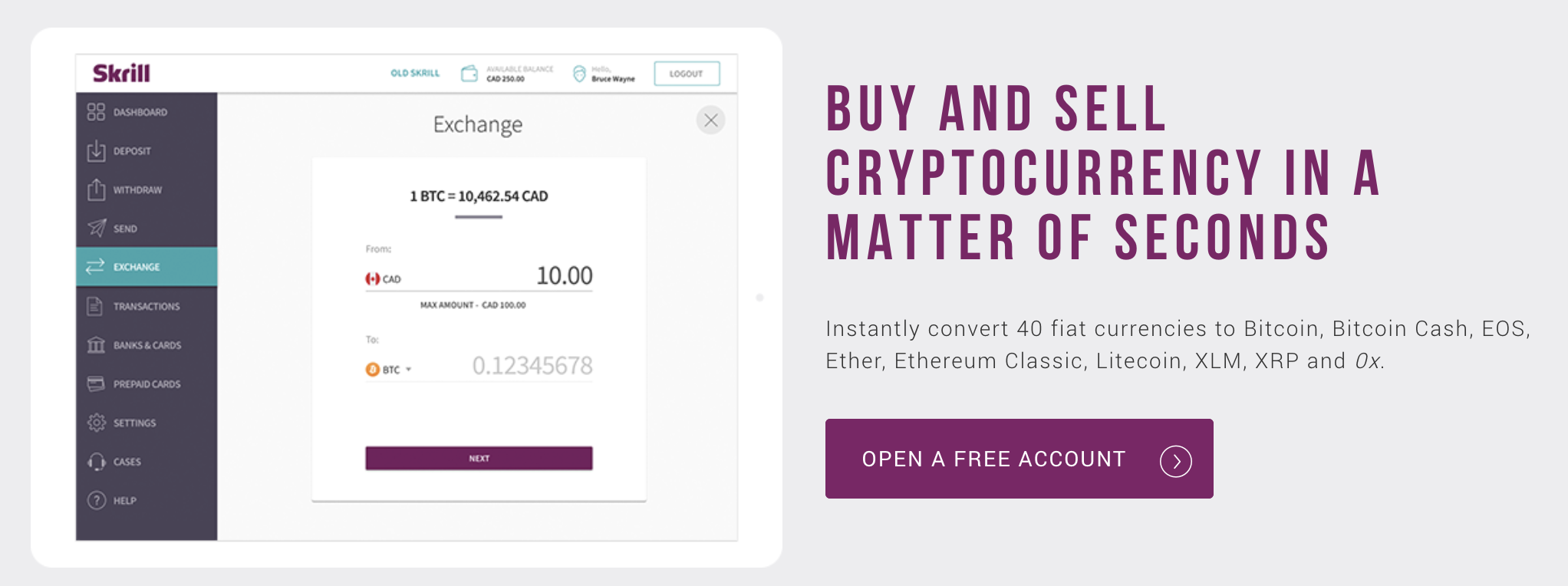

Skrill

Founded in 2001 as Moneybookers Limited, then rebranded a decade later as Skrill, it took the online payment platform a further seven years before it started allowing users to buy and sell cryptocurrency, in the summer of 2018. CEO Lorenzo Pellegrino gushed about crypto when the announcement was made, venturing that cryptocurrency trading was “exciting and dynamic” and that Skrill’s digital wallet service lent itself to the environment.

Skrill’s cryptocurrency offering lets users from over 30 countries trade digital tokens including BTC, ETH, LTC, BCH, XRP, and ZRX, after partnering with an unnamed exchange to facilitate the service. Conversion from 40 fiat currencies into crypto is swift, and requires no additional verification. It’s a far cry from the company’s circumspect attitude to crypto in the years since bitcoin launched in 2008. A Skrill blog from earlier this year demonstrated the company’s evolving outlook: “If the past decade was cryptocurrencies’ proof of concept stage, the next decade will see them become rooted in the everyday fabric of life.” Bullish words.

Paypal

It’s possible to deposit and withdraw from crypto exchanges such as Coinbase and Gocoin using Paypal, and has been since Paypal formed a partnership with the companies in mid-2015. The online payments giant was also on board with Facebook’s new Libra cryptocurrency, and although it withdrew from the project earlier this month, it’s evident that Paypal is now pro-blockchain.

Consider, for example, the company’s filing of a patent last year to increase cryptocurrency payment speed by utilizing secondary private keys, thereby cutting wait times for transactions between merchants and consumers. Although bitcoin isn’t a major focus at Paypal, Chief Financial Officer John Rainey notes that the company “have teams clearly working on blockchain and cryptocurrency” and “want to take part in whatever form that takes in the future.”

Credit Card

Credit card giants Visa and Mastercard have blown hot and cold on crypto, and a number of banks that issue their cards have banned cryptocurrency purchases altogether. Through third parties that operate on the financial rails controlled by the credit card giants, however, bitcoiners can cash in and out of crypto using credit and debit cards. Companies like Simplex are also helping in this respect. The Israeli-based payment processor allows crypto merchants to accept payments via credit card, backed by machine-learning algorithms that eliminate fraud, providing protection against chargebacks.

Earlier this year, Binance – the world’s largest cryptocurrency exchange by trade volume – linked up with Simplex to enable purchases with credit and debit cards. Bitcoin.com also has a similar deal in place, allowing BCH and BTC to be bought directly from the homepage with the aid of Simplex.

Debit Card

The last two years have seen the emergence of crypto debit cards that combine a cryptocurrency wallet with a conventional debit card that can be funded through liquidating cryptocurrency directly within the app. There have been speed bumps along the way, such as when Visa subsidiary Wavecrest withdrew service for several crypto card companies, but the sector has flourished since that upset. Centralized crypto wallet services such as Wirex and Revolut are now joined by a decentralized counterpart in Monolith. It enables users to retain custody of their crypto right up until the point that they liquidate it to load it onto their debit card.

News.Bitcoin.com spoke to Monolith’s CEO Mel Gelderman about the challenges of maintaining a decentralized wallet service with a centralized component. He explained how the U.K.-based Monolith took part in the Financial Conduct Authority’s regulatory sandbox and runs a Visa approved card program through its partners. “It has not been easy to develop the compliance and operational capabilities required to run crypto-fiat gateways,” Gelderman conceded. “However, crypto is steadily becoming more palatable to traditional financial services players.”

The New Norm

Today it’s much easier to purchase cryptocurrency than it was 10, five or even two years ago. The aforementioned firms are not the only payment processors keen to satisfy their customers by integrating with decentralized finance, incidentally. Last year, Square, best known for its payment-processing hardware such as chip and PIN readers, was licensed to offer New York residents the ability to transact bitcoin on its Cash App, causing shares of the company to hit a 52-week high.

There are still concerns over excessive KYC, financial surveillance on both the fiat and blockchain sides, and the propensity of fiat gateways to withdraw service at the drop of a hat. Nevertheless, the cryptosphere finds itself in a far stronger position than at any time in its short history. If centralized and decentralized payment systems can learn to co-exist, everyone stands to benefit.

Do you think traditional payment processors are more accepting of cryptocurrency these days? Let us know in the comments section below.

Images courtesy of Shutterstock.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post How Centralized Payment Systems Learned to Accept Decentralized Cryptocurrency appeared first on Bitcoin News.

Powered by WPeMatico