Few crypto assets have outperformed bitcoin this year, but the handful that have are predominantly exchange tokens. Their success attests to that of the token sale launchpads they have hosted, which have in turn driven demand for exchange tokens. But as IEOs start to wind down, can exchanges sustain the momentum, or will BTC recapture the lead and finish 2019 on a high?

Also read: China Ranks 35 Crypto Projects as President Xi Pushes Blockchain

2019 Was the Year of the Exchange Token

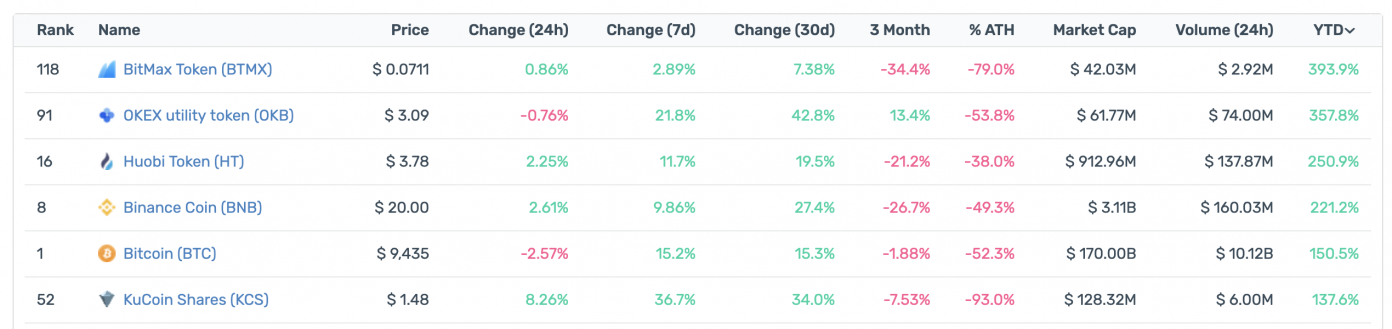

Bitcoin has had a good week, but despite putting a dent in every major crypto asset, thanks to Friday’s paint-melting rocket ride, it’s still got some catching up to do. Within the top 50 cryptocurrencies by market cap, aside from chainlink, which has recorded an 816% gain for the year, the only notable tokens to have bested BTC are huobi token (247%) and binance coin (235%). Just behind BTC (148%) is another exchange token, kucoin shares (138%).

Move outside of the top 50, and lurking at 118 by market cap is this year’s best performing exchange token, belonging to Bitmax. BTMX is up an impressive 394% for the year, just ahead of Okex’s OKB, which sits 91st by market cap with yearly gains of 358%. While there’s plenty to critique about the utility of exchange tokens, and their ability to sustain their new price levels, there’s no disputing that 2019 has been their year.

Can Exchange Tokens Escape the Fate of ETH?

Anyone who was hanging around the crypto space in 2017 will recall the meteoric rise of all crypto assets, ETH especially, which peaked at $1,400 on January 13, 2018, propelled there by the ICO craze. What came next is well documented, with ETH among the hardest hit when the crypto market receded. It has taken almost two years for ETH to recover its sense of purpose – which is now defi, apparently – and to start recouping its heavy losses.

Q4 tends to be a quiet time of year for token sales, and given the lackluster performance of the IEOs that have launched to date, there is evidence that the public’s appetite for exchange-hosted token sales is diminishing. ICOspeaks, which records forthcoming token sales, lists just two scheduled IEOs and ICOs apiece. Save for the long tail of pay-to-play IEOs listed on smaller and less salubrious exchanges like Exmarkets and Latoken, there’s not much on the horizon.

Ben Zhou, CEO of Bybit exchange, told news.Bitcoin.com: “Platform tokens were originally designed as a customer reward program, while being pumped up because of IEO hype over the last year. As what happened after the ICO retreat, investors will definitely revisit the intrinsic value of platform tokens – the success of the platform and the willingness of the platform to reward its customers.” Zhou went on to explain that there are ways to reward users without reliance on a token; in Bybit’s case, for instance, through issuing bonuses to users upon registration and for various campaigns. Bybit’s CEO claims that “This has been met by widespread approval by our customers.”

It would be as premature to call the demise of IEOs as it would be to predict the downfall of native exchange tokens. Crypto exchanges are one of the most profitable sectors in the industry to date, and are not about to slip away quietly into the night just because the whole IEO game has tapered off. As Binance has shown, the token launchpad is merely the first in a string of features to mandate native token usage, with subsequent products, including futures markets, also drawing heavily upon the exchange token. Kucoin is busy replicating this formula to a tee, with its Kumex derivatives platform due to launch in a few weeks.

Where There Are Exchanges, There Are Exchange Tokens

As gatekeepers to the cryptoconomy, exchanges can effectively force usage of their native tokens, through baking in trading discounts, IEO airdrop participation, and other incentives that make it advantageous to hold exchange tokens. For the leading proponents of this business model, such as Binance and Huobi, increasing the value of the token provides another revenue stream in itself. Rather than dumping their own stash of tokens onto the market, however, it is in the interests of these giants to support the value of their native token through whatever means they can, while monetizing in other ways.

Increasing the utility of exchange tokens allows the exchanges to portray themselves as more than merely a conduit for speculating on shitcoins, but rather as vital cogs in the cryptosphere. Their token is the yardstick by which their health is signaled to the world. As a result, exchanges will stop at nothing to see the price sustained. The only thing that could conceivably put a stop to that is a rampant bitcoin. Should BTC go on another run, as it did last Friday, no crypto asset will be safe.

Do you think exchange tokens can sustain their momentum? Let us know in the comments section below.

Images courtesy of Shutterstock.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post Exchange Tokens Have Outperformed BTC This Year appeared first on Bitcoin News.

Powered by WPeMatico