With exchanges controlling so much of the industry inflows, and accounting for more than 40% of the jobs, any review of the year has to start and end there. An analysis of the dominant trends driving trading platforms serves as a proxy for measuring the cryptosphere’s overall health. From initial exchange offerings to staking as a service, 2019 was the year that crypto exchanges expanded and diversified.

Also read: Bitcoin Emits Less Carbon Than Previously Claimed, New Study Finds

Exchanges Double Down on Partnerships and Referrals

Forging partnerships with existing businesses and ramping up referral programs are two ways in which exchanges have refined their service this year in a bid to capture more of the market. In the case of partnerships, it’s an opportunity to tap into the user base of crypto companies that have a strong presence in the space, while referral schemes are useful for incentivizing users to leverage their reputation to onboard friends and associates.

Referral schemes have seen a revival, with exchanges rolling out solutions that promise more lucrative commission than previously. This week, Kraken revamped its referral scheme, promising a 20% kickback, up to a maximum of $1,000 per client. Elsewhere, Nominex has seen success with a referral scheme that is not limited in terms of levels, giving an incentive for early adopters to spread the word and reap the rewards – a binary affiliate is the technical term for it. It’s combined this with a native token, NMX, that is awarded to early adopters, to further multiply adoption and build loyalty.

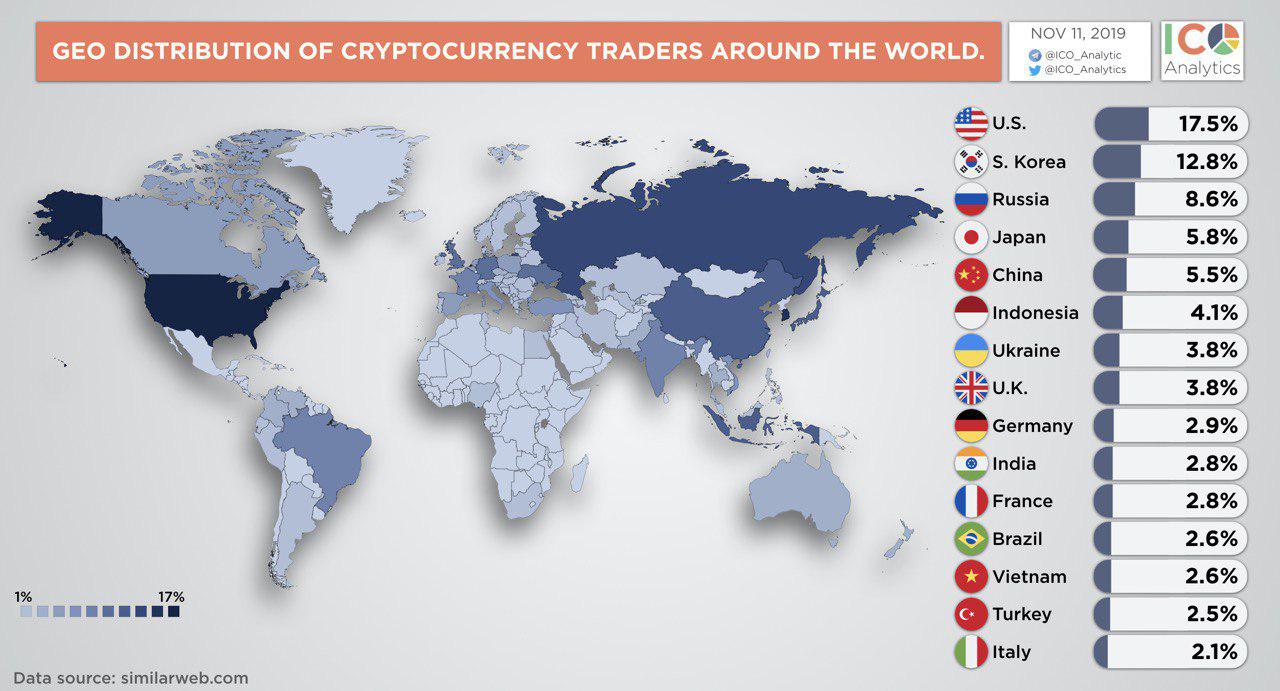

As for the trend towards partnerships, the past month alone has seen Indian exchange Wazirx acquired by Binance, and Poland’s OAAM Consulting form a strategic partnership with IDAX. As a result of the arrangement, any European teams and blockchain projects that intend to be listed on IDAX or launch an IEO on the platform will work with OAAM. Arrangements such as these are evidence of how exchanges are expanding their reach into territories where they lack a presence. Through combining their existing brand and user base with localized knowledge from specialist companies, exchanges have been able to grow their global user base.

Initial Exchange Offerings Intensify

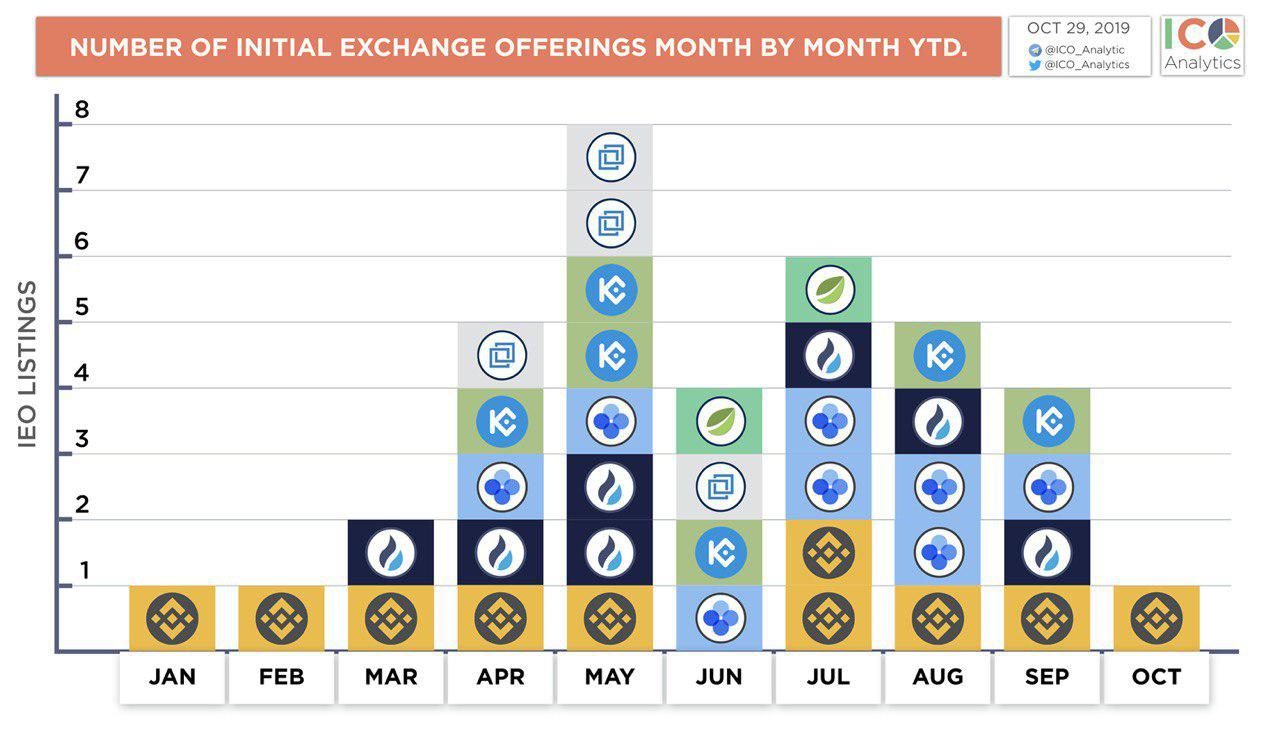

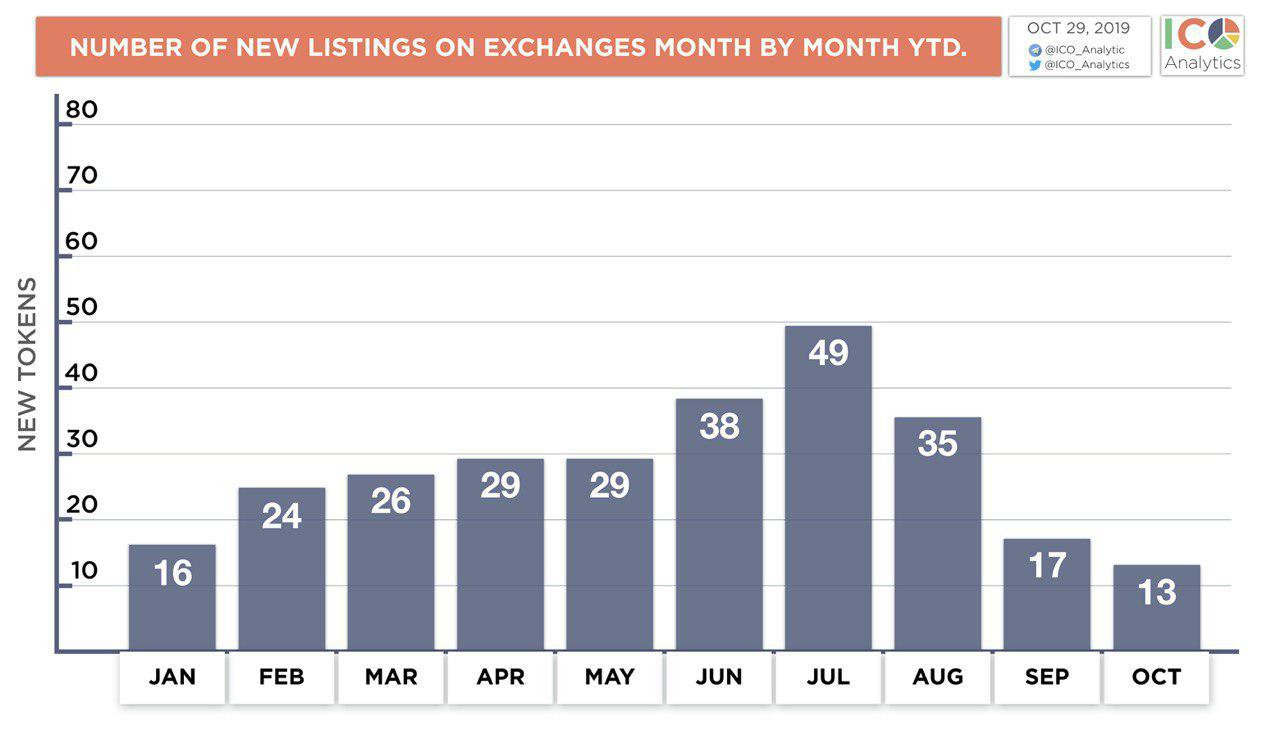

It would be impossible to assess the evolution of exchanges this year without considering initial exchange offerings. The public’s appetite for exchange-hosted token sales is showing no signs of abating, with tier one exchanges still seeing retail investor FOMO for their carefully curated token sales. The number of exchanges providing token launchpads has proliferated in 2019, with Binance, Bittrex International, Kucoin, Okex, Huobi and a host of smaller exchanges laying on IEOs. In terms of returns on the projects listed, results have been mixed. Matic is currently sitting at a healthy ROI of 5.2x and Wirex at 3x, along with a handful of other winners that have sustained their price on the secondary market.

Wirex CEO Pavel Matveev told news.Bitcoin.com that “the development of the IEO offering gave us the opportunity to break into new markets in Asia, introducing there the benefits of our newly issued WXT utility token together with the Wirex app’s payment and exchange functionalities.”

2019’s Key Exchange Trends

Three other trends that have dominated the exchange landscape this year are staking as a service, lending, and increased fiat gateways. As with so many of the events that have defined the industry, the shadow of Binance has loomed large over proceedings. Its lending platform, which is currently oversubscribed for BNB and BTC, also allows lenders to lock up USDT in exchange for a 3% return. Its staking platform, meanwhile, is one of several such exchange products to have gained traction in 2019 alongside the likes of Huobi and Coinbase, and Binance is on a mission to add fiat pairings for every major global currency.

Reflecting on the evolution of cryptocurrency exchanges over the past 10 months, Wirex CEO Pavel Matveev told news.Bitcoin.com: “Crypto exchanges are now extremely sophisticated. They’ve integrated a rich profusion of markets, from cash, margin products (CFDs, futures), lending, staking, IEOs… everything has been consolidated within the same venues.”

Paul Doron Rosenblum is the Managing Director of Etorox, a wallet and exchange version of Etoro for advanced traders which holds a wider range of assets. “This diversification reflects the maturing of the crypto sector,” Rosenblum told news.Bitcoin.com. “The price volatility of 2017 and 2018 led to more people talking about crypto assets, which in turn led to growing interest from retail investors for this new asset class.

“But as price volatility has subdued this year, the industry has entered a period of consolidation. It has had time to focus on things like appropriate regulation for the industry rather than this being a knee-jerk reaction during a sustained period of price action. We’ve also seen a greater number of institutional investors coming into the crypto space and developing their own use-cases for blockchain technology.” He added:

Discussions around crypto assets have really entered the mainstream through Facebook’s Libra project. It has helped authorities, regulators and the public at large to take notice and begin to better understand the sector.

Where Next for Crypto Exchanges?

2020 will see the dominant exchanges aim to cement their grip on the market while endeavoring to keep innovating. One trend that can be counted on is the growth of exchange blockchains. This year was all about Binance Chain; next year there will be Huobi and Bithumb’s chains to contend with too. Like it or not, exchange chains, just like exchange tokens, are here to stay.

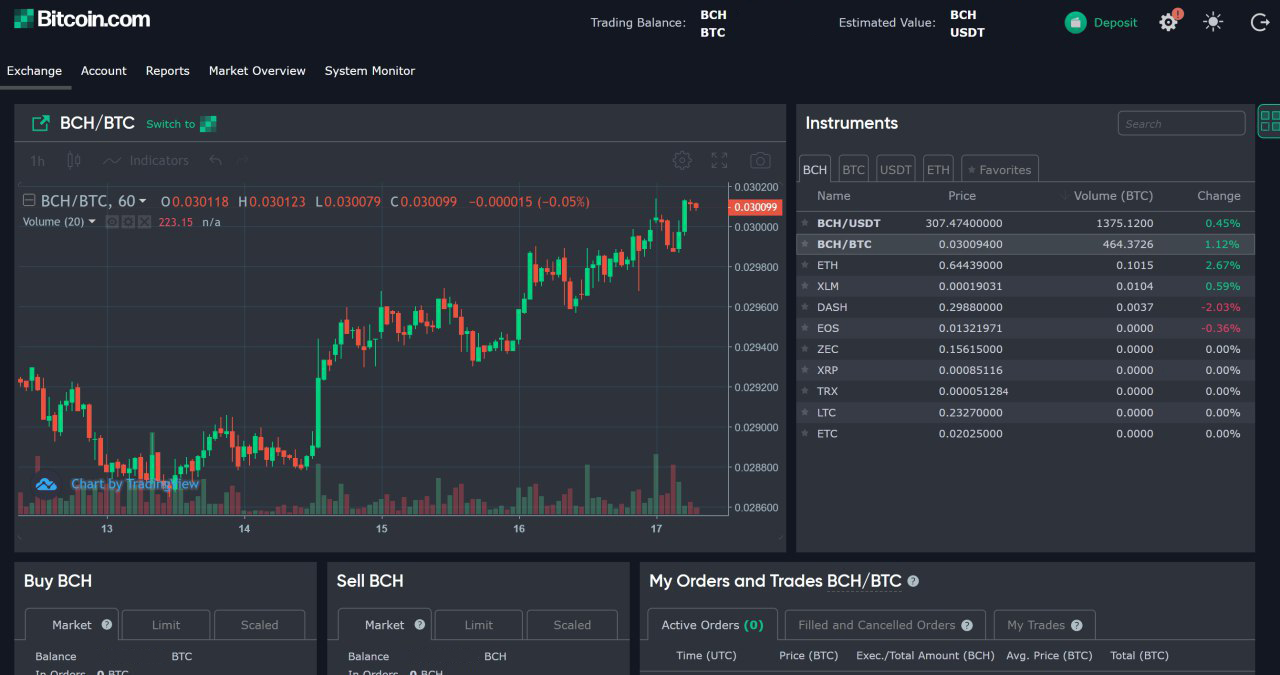

Finally, expect to see plenty more exchanges and crypto swapping platforms competing on price. In September, Bitcoin.com Exchange launched with negative fees, essentially giving users a rakeback for the first three months. Then, on November 20, Shapeshift announced it was offering zero-fee trading for users of its platform who hold its native token. It also shared a price comparison of how Shapeshift compares to the competition. Exchanges can add as many new bells and whistles as they like, but at the end of the day, price will trump everything else. Crypto trading platforms that can slash their fees while remaining solvent are the likeliest to survive 2020.

What other exchange trends have surfaced this year? Let us know in the comments section below.

Images courtesy of Shutterstock and ICO Analytics.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post In 2019, Cryptocurrency Exchanges Diversified appeared first on Bitcoin News.

Powered by WPeMatico