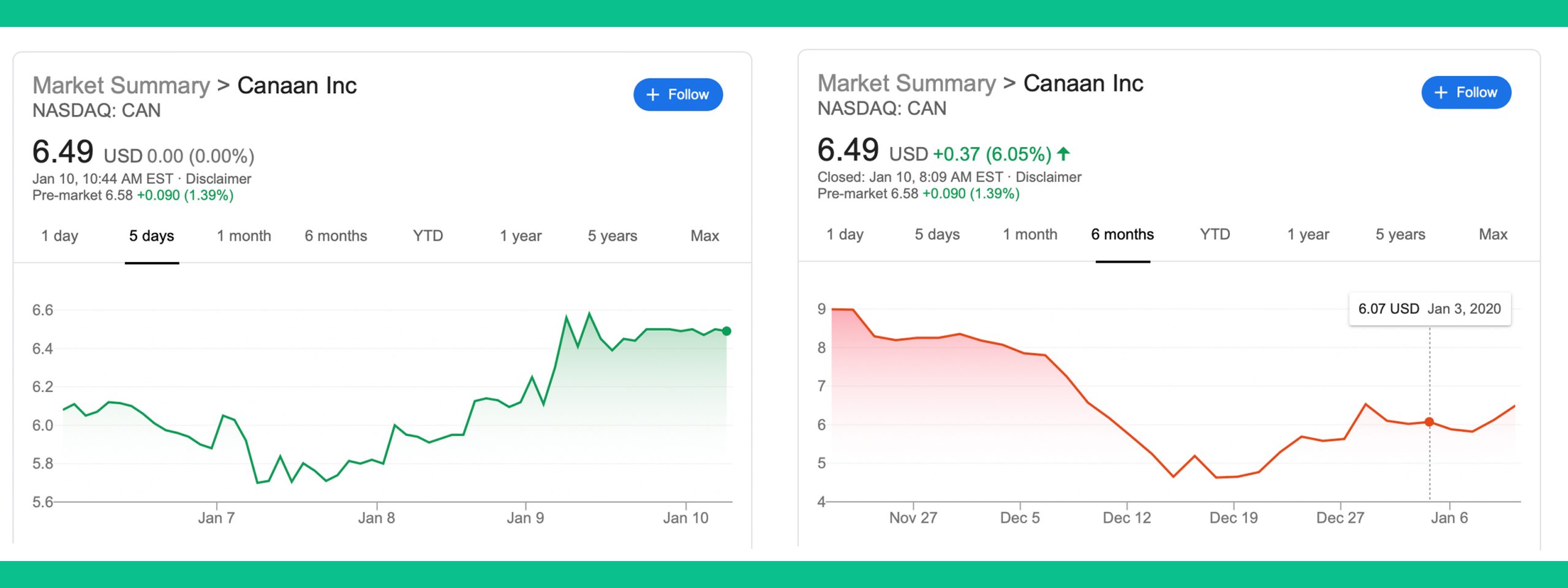

On November 21, the Chinese mining rig manufacturer Canaan Inc. launched its initial public offering (IPO) sale of $90 million worth of U.S. shares. Canaan shares initially sold for $8.99, but plummeted over 48% on December 16 to $4.65 per share. Since then, Canaan has launched a series of five new mining rig batches that process between 48 terahash per second (TH/s) to 68TH/s for January and February delivery periods. Canaan stock sold on the Nasdaq Global Market has also managed to jump back 39% since the significant plunge in mid-December.

Also Read: 2019’s Bitcoin Miners Are 5x Faster Than Predecessors

Canaan’s IPO Shares Lost 48% But Have Regained Much of the Losses in 2020

Months ago, three giant mining rig firms from China, Bitmain, Canaan, and Ebang, failed to IPO on the primary stock exchange in Hong Kong. Then Canaan surprised everyone when the mining rig manufacturer filed for its initial public stock offering in October with the U.S. Securities and Exchange Commission (SEC). Following the IPO filing by Canaan, rumors have been circulating that both Ebang and Bitmain are filing for IPO status in the U.S. as well. Canaan’s stock is called CAN (NASDAQ: CAN) and the shares were added to Nasdaq on November 21 with a standard opening ceremony. During the first day of trading, CAN lost a few pennies per share, but then dropped 7.68% on November 23rd’s trading sessions. By mid-December Canaan’s public shares were down 48% before regaining some ground.

Canaan’s shares jumped from an all-time low of $4.65 on December 16 to rise 11% the very next day. However, after another day of trading on Nasdaq, CAN dropped even lower to $4.63 a share. Canaan’s stock has been seemingly following BTC’s market footsteps and the stock value started to rise alongside BTC’s gradual climb. On January 9, CAN was trading for $6.49 per share and the stock is up 6% today. Market observers can’t pinpoint exactly why Canaan’s stock slumped during its first month out of the gate but it’s not uncommon for nascent shares to slide. However, speculators think that the CAN stock will follow alongside BTC’s price movements and have noted that Canaan has stiff competition. Following the IPO, Canaan has released a total of five high-powered bitcoin miners with 48-68TH/s. Chinese mining rig competitors like Bitmain and Innosilicon have also released a number of miners in the wake of Canaan’s initial IPO upset.

Canaan Reveals January and February Mining Rig Batches Aiming to Compete With Other Market Leaders

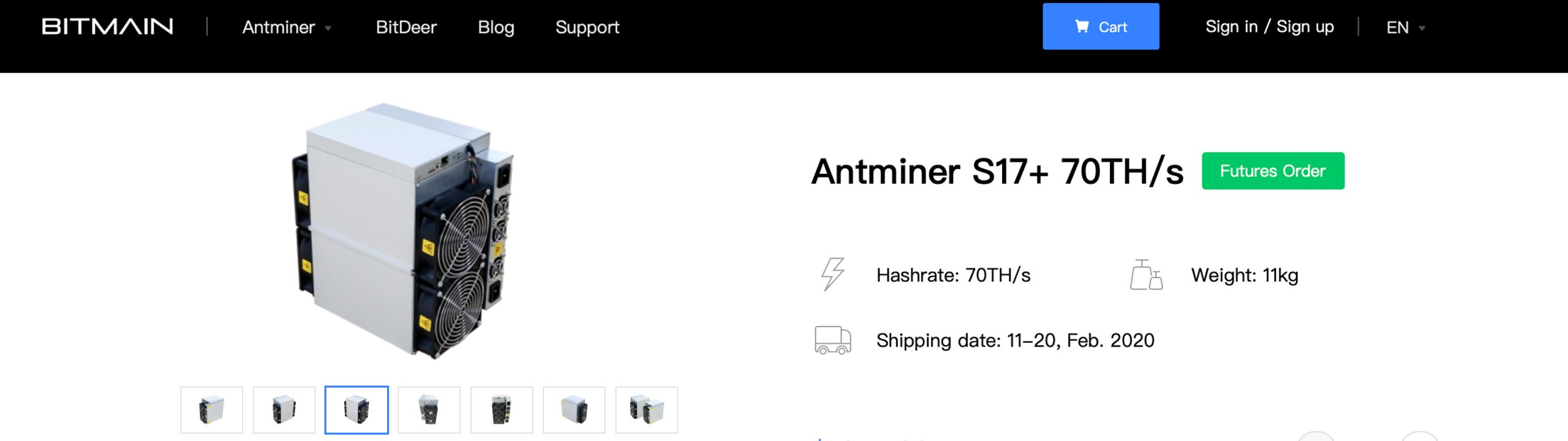

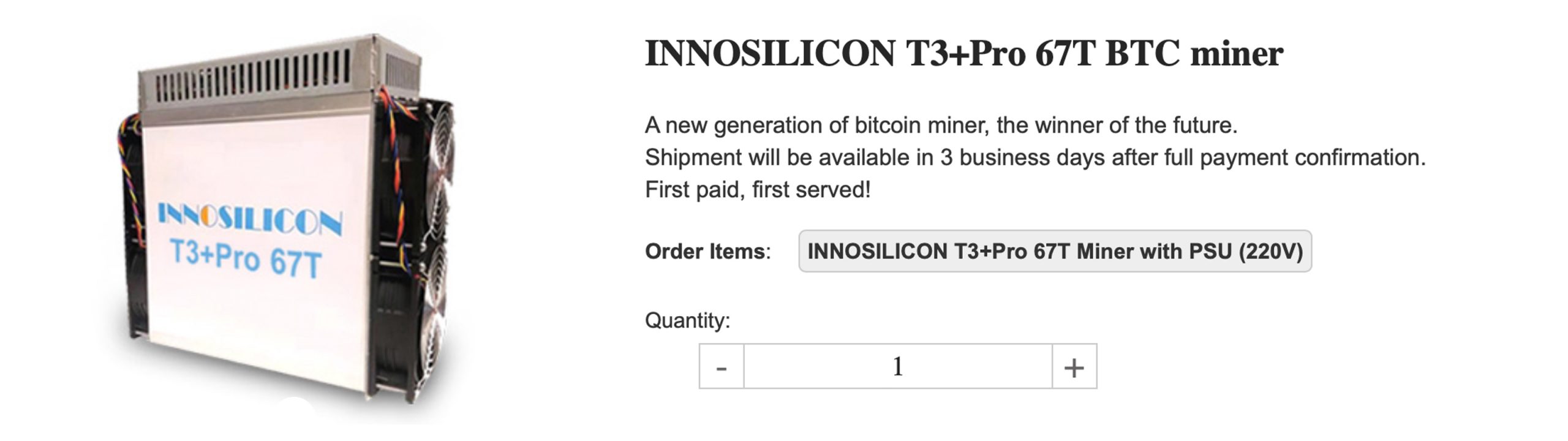

Canaan’s store is now selling February batches of the new Avalonminer 1166 series (68TH/s) at $1,978 per unit. The next generation Avalonminer is roughly the same price as Innosilicon’s Terminator 3+ Pro 67TH/s machine at $1,999 per unit. Canaan also has a lower model machine, the Avalonminer 1146 ($1,204 per unit with 56TH/s), as both the 1166 and 1146 are scheduled for February delivery. Now Canaan patrons can purchase miners that will deliver in January as the company is selling three versions of the Avalonminer 1066 series. These three miners process between 48-50TH/s and sell for $1,032 to $1,075 per unit. However, Bitmain shoppers can get January shipping for mining rigs that produce between 40-64TH/s and prices are a couple hundred less.

If a customer wanted to wait the same timeframe for the Avalonminer 1166 series (68TH/s) but purchase Bitmain’s Antminer S17+ (70TH/s) they would save $323 per unit. Miners should also keep in mind that the Avalonminer 1166 takes around 3196W off the wall, while the Antminer S17+ takes 2800W. That’s a reference power efficiency difference of 40 joules per terahash (J/TH) for the Antminer S17+ to the 47J/TH for Canaan 68TH/s model.

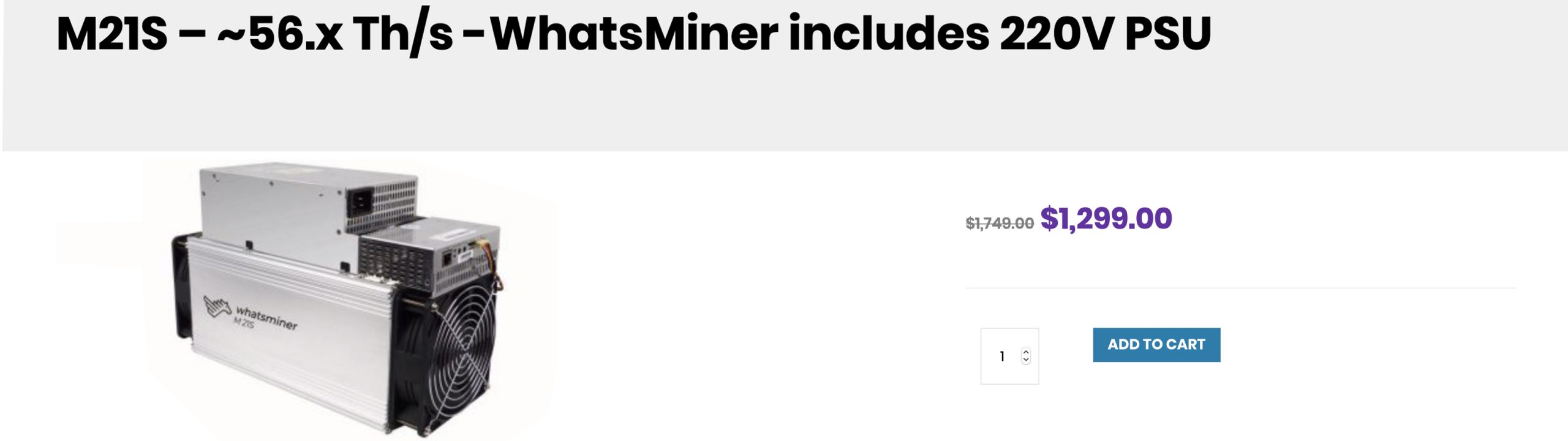

The Avalonminer 1166 power consumption is similar to Innosilicon’s Terminator 3+ Pro 67TH/s device which uses 3300W. Another competitor Canaan has to deal with is the Chinese firm Microbt which is selling the Whatsminer M21S ($1,299 per unit with 56TH/s). Microbt recently slashed the M21S price after initially charging $1,749 per mining rig and the company claims items ship 1-2 business days after the payment is settled.

The rising BTC prices might help Canaan’s shares sell better, but as far as manufacturing sales, the company has stiff competition. All of the Chinese mining rig manufacturers seem to be well-stocked with devices and are betting on investors ‘arming their farms’ with high-powered miners. Canaan’s public shares, however, could help the company a touch longer if the bull run doesn’t happen right away. Right now as far as 50TH/s to 70TH/s next-generation miners are concerned, there’s a high supply thanks to Canaan, Bitmain, Innosilicon, and Microbt. Out of all the competitors, Bitmain and Canaan have more choices as far as the mining rigs available for people looking for hashrates between 40-70TH/s.

What do you think about Canaan’s public stock performance over the last month? What do you think about Canaan’s new mining rigs and the stiff competition the company faces? Let us know what you think about this topic in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, mining rigs, services, mining rig manufacturers or companies. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any ideas, software, mining rigs, mining rig manufacturers, websites, concepts, content, goods or services mentioned in this article.

Image credits: Shutterstock, Canaan, Bitmain, Microbt, Innosilicon, Wiki Commons, Fair Use, and Pixabay.

Did you know you can earn BTC and BCH through Bitcoin Mining? If you already own hardware, connect it to our powerful Bitcoin mining pool. If not, you can easily get started through one of our flexible Bitcoin cloud mining contracts.

The post Mining Giant Canaan Faces Stiff Competition After IPO Shares Slump appeared first on Bitcoin News.

Powered by WPeMatico