Darknet market activity hit new highs in 2019, as shown in a new report from blockchain forensics firm Chainalysis. Despite concerted attempts from law enforcement (LE) to crack down on darknet markets (DNMs), coupled with several exit scams, crypto inflows and outflows surpassed $800 million last year.

Also read: Monopoly Is a Tiny Darknet Market With Big Aspirations

Darknet Markets Are Recession-Proof

“What two businesses have traditionally been recession proof since time immemorial?” asks Tony Soprano in an episode of the American crime drama. “Certain aspects of show business…and our thing,” replies his consigliere Silvio Dante. Today “our thing” – namely, organized crime – increasingly takes place on the web, and the darknet in particular. Monitoring its health falls to software companies armed with the tools to analyze the flow of digital assets in and out of known DNMs.

The Chainalysis Crypto Crime Report 2020 focuses heavily on darknet markets, examining which currencies were transacted, where the coins flowed, and what percentage of crypto activity they constituted. In its wake, the inevitable “We told you so” style editorials appeared – the New York Times leading with “Bitcoin Has Lost Steam. But Criminals Still Love It.” While the data published by Chainalysis, which acts as an advisor to various government agencies, makes for interesting reading, it sends a warning to bitcoiners, whose privacy is being gradually eroded.

DNM Business is Booming

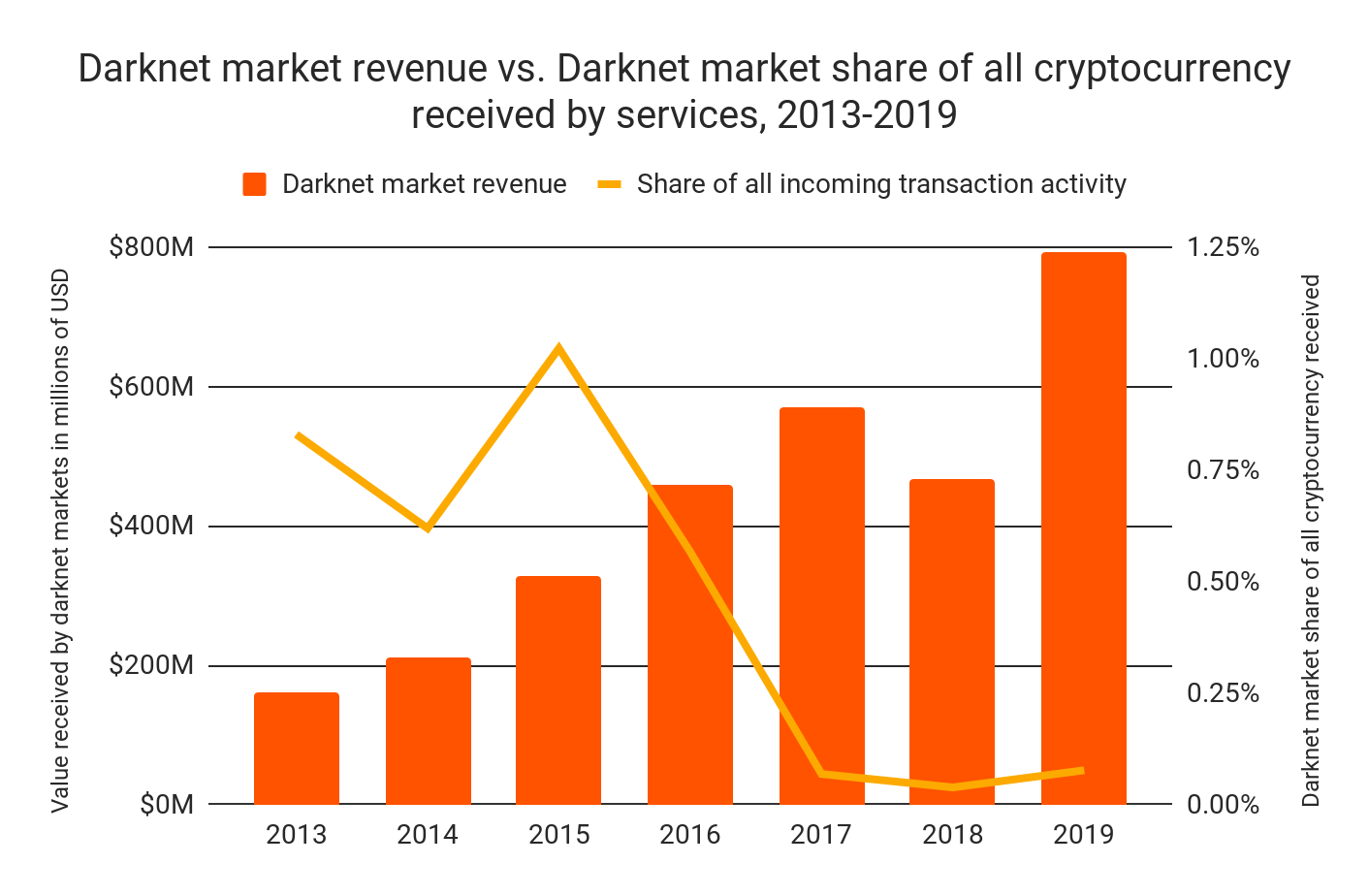

Following a modest decline in 2018, darknet market sales returned to rude health in 2019, rising from 70% to constitute over $790 million worth of cryptocurrencies. The darknet market share of all cryptocurrency received doubled from 0.04% in 2018 to 0.08% in 2019.

While giddy reports from mainstream media would have readers believing that cryptocurrencies (especially bitcoin) are used largely for illicit purposes, it’s vital to remember that less than 1% of crypto usage revolves around darknet marketplaces – a hunting ground for “scoundrels” according to the New York Times.

So where did the crypto spent on darknet markets come from – and where did vendors send their ill-gotten gains? According to the report, the overwhelming majority of funds used to purchase goods on DNMs came from exchanges: 38.6% from P2P exchanges, 31.8% from centralized exchanges, and 8.8% from exchanges deemed “high-risk.” The rest originated from darknet markets themselves or other unnamed services.

It was a similar picture for crypto leaving DNMs: 42.8% of cashed-out currency went to centralized exchanges and 23.2% to P2P exchanges; unnamed services accounted for 11.7%, while darknet markets got 9.1% and high-risk exchanges 4.7%. Only 4% went to mixing services, wherein privacy-minded users can obscure the ties between their BTC addresses and real-world identities by shuffling their coins.

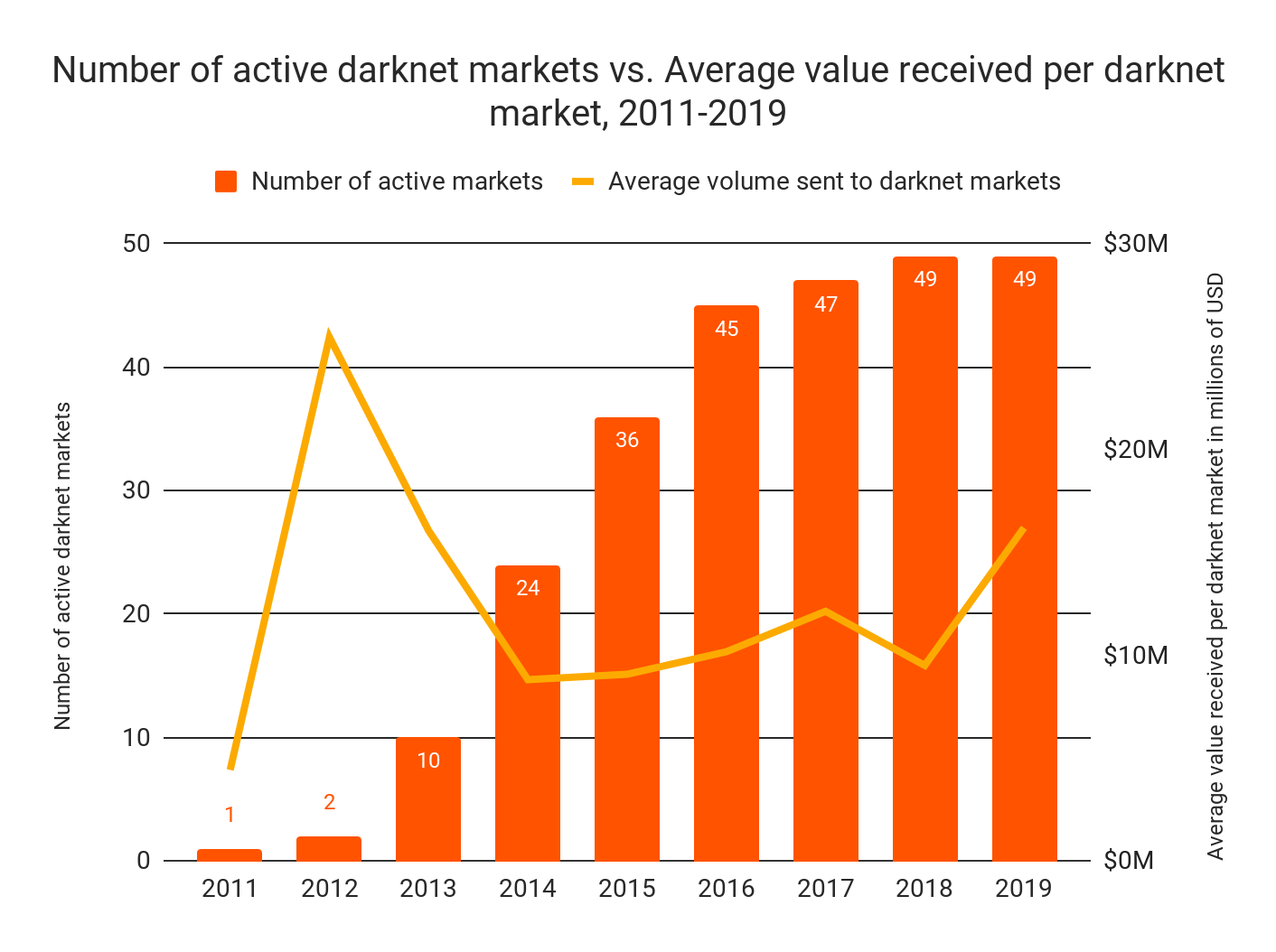

Although darknet market sales are on the up, the report indicates that the number of DNMs has not really grown since 2016. Indeed, the figure of 49 is the same as 2018. However, the fact that eight DNMs were taken down in the past 12 months indicates that replacements soon spring up. On average, each active market generated more revenue in 2019 than those open in any other year, except during the pinnacle of Silk Road in 2012/13, before law enforcement wrapped their heads around the dark web.

Darknet Markets Seem Immune to Market Forces

The success of traditional markets is governed by market forces – the actions of buyers and sellers which cause the price of goods and services to rise or fall. However, darknet markets appear to be relatively invulnerable to such economic forces.

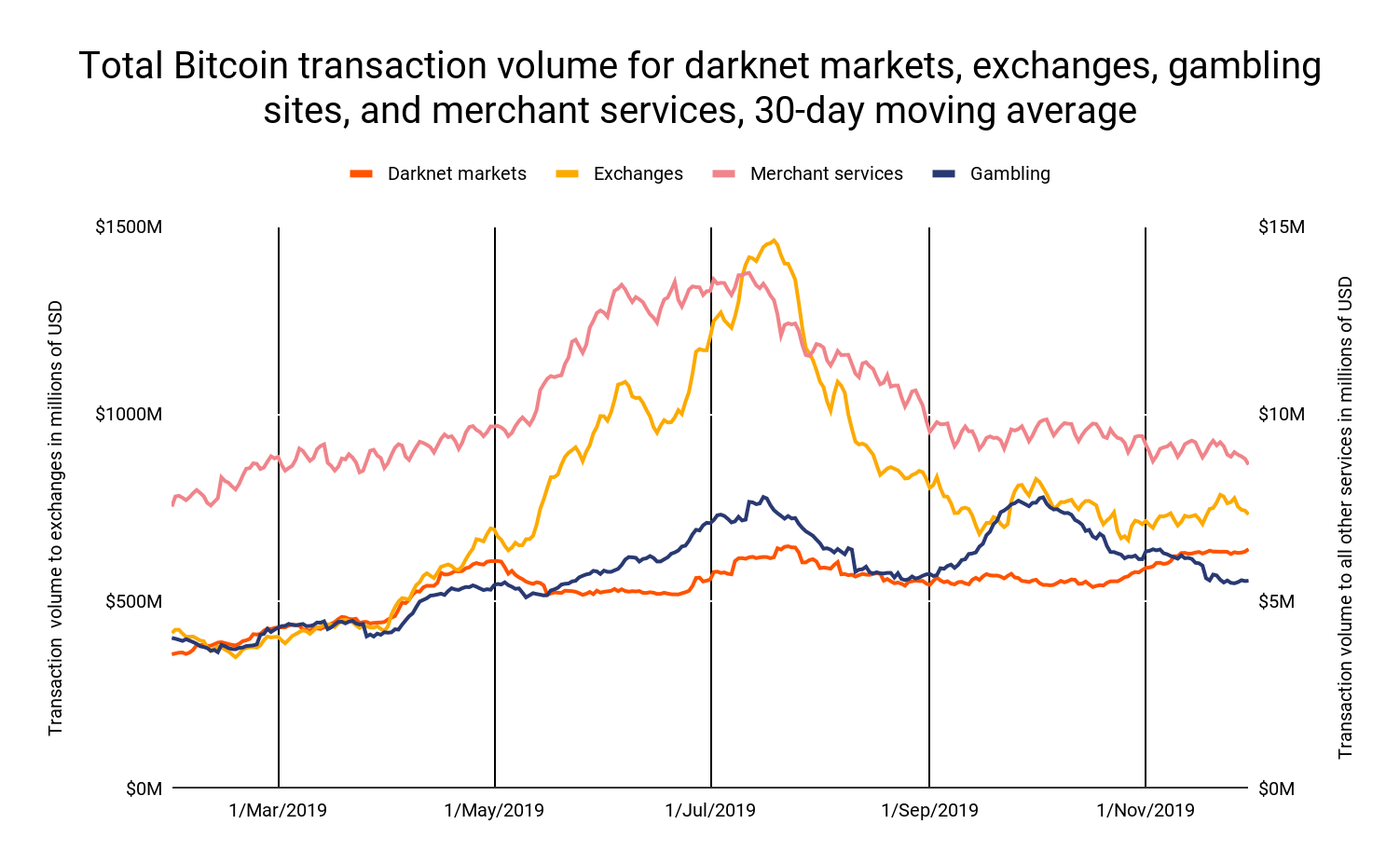

While exchanges, gambling portals and merchant services saw spikes in July, when bitcoin’s price rose, darknet markets demonstrated a much more modest upturn. In fact, a review of bitcoin’s transaction volume across the year indicates that sales remain stable regardless of what the cryptocurrency market is doing.

Crypto Crime Connection Used to Restrict Privacy

Publication of the Chainalysis report occurred in the same week that Paxos sent a threatening message to a user suspected of using a “known bitcoin mixing service.” It would require mental gymnastics not to see the correlation here: tools developed by the Chainalysises of the world erode personal privacy and give rise to nonsense of this nature repeatedly occurring. Heaven forbid anyone would use a coin-mixing service to restore their right to privacy.

Wtf?? Apparently you are not allowed to do what you want with your bitcoin once you own the keys. Fortunately that’s not how Bitcoin works, but the level of chain analysis here is alarming. What is a correct response? @MartyBent @matt_odell @vandrewattycpa pic.twitter.com/BhMDThLHGc

— Ronald McHodled (@RonaldMcHodled) January 28, 2020

The trend that sees centralized crypto companies berating and browbeating users for mixing coins – after they’ve withdrawn them to a noncustodial wallet – is troubling, and in the above case prompted the user in question to respond: “Apparently you are not allowed to do what you want with your bitcoin once you own the keys. Fortunately that’s not how Bitcoin works, but the level of chain analysis here is alarming.”

If you care about your privacy, and don’t fancy being smeared as a criminal, the best idea is to take your business away from centralized exchange before the censorious email hits your inbox.

As for DNMs, they’re not going anywhere. As noted by Chainalysis, many are implementing new decentralized infrastructure to avoid shutdowns, while others are considering mandating the usage of privacy coins like monero, which is already accepted by Empire and enforced on White House Market and Monopoly Market. Defending the work of blockchain forensics firms, one monero advocate urged: “Boycotting services that are taking advantage of Bitcoin’s flaws is futile. All services and governments will eventually take advantage of Bitcoin’s flaws. It’s like walking around nude and blaming everyone for looking at you. Put some pants on. Convert your Bitcoin to Monero.”

What are your thoughts on the Chainalysis darknet market report? Let us know in the comments section below.

Images courtesy of Shutterstock and Chainalysis

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post New Chainalysis Report Sheds Light on Darknet Markets and the Need for Onchain Privacy appeared first on Bitcoin News.

Powered by WPeMatico