After bitcoin prices dropped below the $5K region on Monday morning, gold also slid significantly. It saw a small spike in value after the Federal Reserve announced slashing the benchmark rate by 100 bps, but gold prices subsequently dropped below $1,500 per ounce hours later. The current sentiment has led people to question why gold hasn’t been a safe haven during the economic crisis. However, patterns from history and statements from analysts today indicate that central banks are offloading gold reserves in order to keep the economy afloat.

Also read: Edward Snowden ‘Felt Like Buying Bitcoin’ While Traders Hunt for the Market Bottom

Analysts Speculate Central Banks Are Offloading Gold Reserves

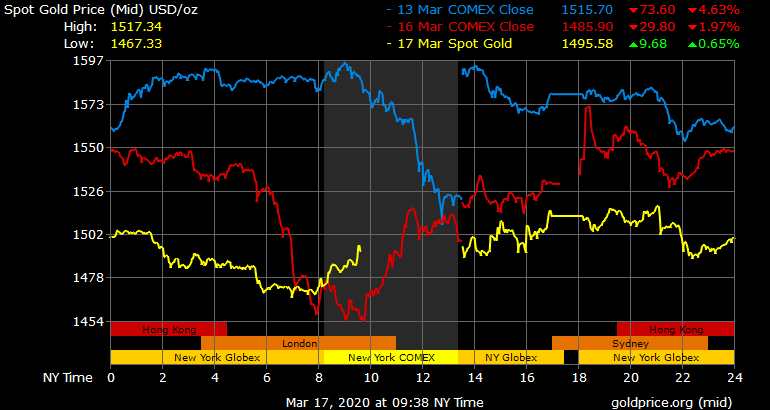

Gold bug Peter Schiff has had a bone to pick with bitcoin lately as he’s taken the opportunity to remind everyone that the cryptocurrency is not a safe haven. Even though digital assets have seen a significant decline in fiat value, gold prices have been soft as well, losing considerable value during the last week. Since March 12, gold’s spot price per troy ounce lost around 6.2% when it was $1,574 and at press time the price is roughly $1,476 per ounce.

Gold’s value jumped right after the Fed dropped the interest rate to 0% and cryptocurrencies like bitcoin followed the same pattern. But by Monday morning, both gold and digital currencies saw more losses and dropped below the support levels seen the day before. Since then, various gold news outlets have been reporting that market participants are being cautious about buying into a falling knife situation with gold. Additionally, speculators and analysts suspect that central banks are dumping their gold reserves to save their economies.

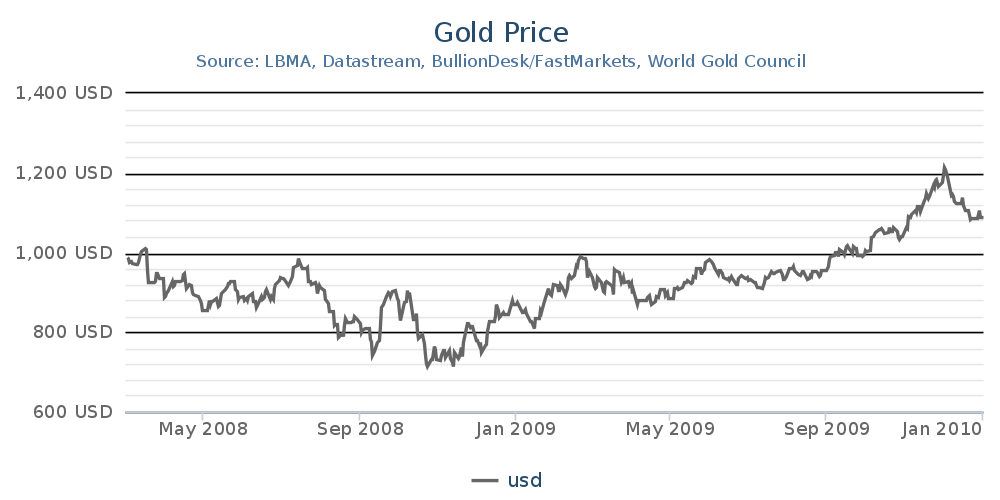

On March 16, senior market analyst at Price Futures Group Phil Flynn noted there might be a small gold spike but investors were shaken by the market rout. “If there is any support coming into the [stock] market, there might be a bid [in gold]. But right now, people are running scared, so they’re afraid to step in,” Flynn told Kitco news. Flynn also told the news outlet there’s speculation that central banks are offloading their gold. The analyst believes “central banks will have to sell some of their gold reserves.” A number of hardcore gold bugs like Peter Schiff won’t tell you that central banks did the same thing throughout 2007 and 2008. Back when the Fed bailed out the corporate bank Bear Stearns, gold spot prices jumped considerably over $1,000 per troy ounce. Precious metal proponents at the time would have told you the sky was falling and that everyone should move their money into gold. But instead, central banks offloaded their gold reserves through the monetary easing process using bullion banks.

Gold Was Supposed to Be a Safe Haven After the 2007 Bear Stearns Emergency Bailout, But Central Banks Dumped Gold to Provide Liquidity

Gold dropped to a low of $730 per troy ounce and at the year’s end it did rise to $870 an ounce. But the asset lost roughly 13% after a great number of investors were told that gold would see a ridiculous bull run after the Bear Stearns bailout. Most people do not realize that quantitative easing (QE) policy can stretch its tentacles into gold markets. QE represents large scale asset purchases and when Bloomberg or the Wall Street Journal publish stories on this matter they only report on Treasury and securities purchases.

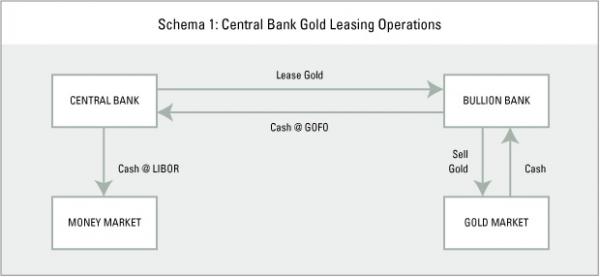

Central banks also use overnight repo markets to acquire predetermined amounts of government bonds, but central banks like the Fed can do the same thing, but with bullion banks using gold liquidity. So in 2007 and 2008 when the economy was on the brink of collapse people wondered why gold wasn’t a great safe haven. This was because the Fed and various other central banks leased their gold reserves to bullion banks which then found its way into spot and futures markets causing a price decline or oversaturated market.

Central Bank Gold Hoarding in 2019 Touched a 50-Year High – New York’s Elite Demand Cold Hard Cash

Bitcoin participants do have to worry about early investors dumping large amounts of coins and cryptos being sold on the market that stem from hacked exchanges. This is definitely a concern for bitcoin holders but it’s not nearly as problematic as the world’s central banks offloading their gold reserves. The cryptocurrency market cap did lose a considerable amount of value during the last week but the 6.2% decline in the gold market was significantly larger by a long shot.

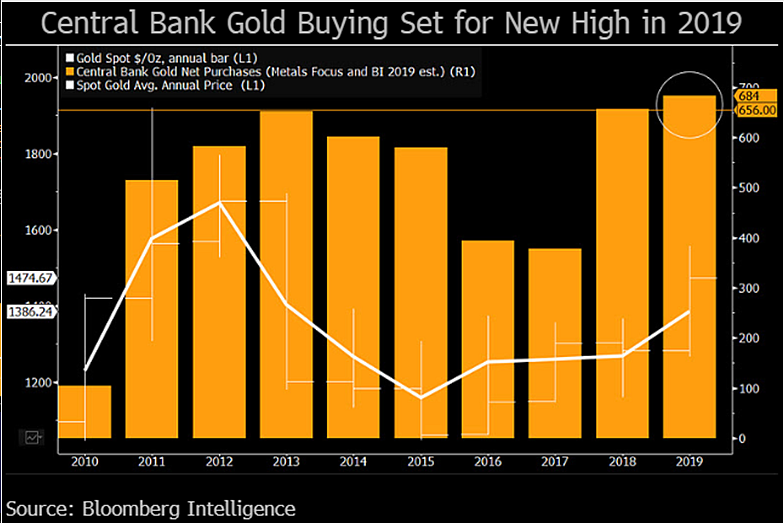

Estimates say that the gold market worldwide is around $3-9 trillion so if the cryptoconomy was hit as hard as gold, the entire coin market cap would be wiped clean. Further, the history of central banks selling gold in 2007 and 2008, plus the speculation from analysts like Phil Flynn, shows that gold might not be the best safe haven asset during the current economic crisis. What’s even more frightening for gold investors is the fact that central bank gold hoarding worldwide touched a 50-year high in 2019.

At the moment banks are facing a crisis and will need to attend to dollar liquidity as cash is being depleted. An example of this issue can be seen in New York where the coronavirus outbreak is much worse than most areas in America. In the Hamptons, where hedge fund managers and Wall Street’s elite own summer homes, there’s great demand for cold hard cash right now. Reports note issues with ATMs and certain banks like Chase and Bank of America have been limiting withdrawals to $5-10K amounts. This is because New York’s affluent members are demanding cash withdrawals between $30-50K.

The last time banks faced a crisis was when the subprime mortgage disaster made banks realize they had little collateral so they begged the Fed for emergency funds. But it was far too much for the Fed and the current interbank market system, so they resorted to solutions like leasing gold so private banks could acquire USD liquidity. The patterns of the past indicate that gold might not be the safe haven answer to the current economic hardship. Even Peter Schiff’s news publication schiffgold.com reported on March 16 that central bank gold purchasing was high in January 2020, but “the rate of purchases slowed somewhat.” And even January’s net gold purchases by central banking authorities that month “represented a 57% decline year-on-year.” Central banks do buy lots of gold, but they offload it and saturate the markets whenever they want as well.

What do you think about gold prices during the current economic situation? Do you think gold will be a good safe haven? Or do you think gold prices will follow a similar pattern with banks over-saturating the market with bullion? Let us know what you think about this topic in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Price articles and market updates are intended for informational purposes only and should not be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Cryptocurrency and gold prices referenced in this article were recorded on Tuesday, March 17, 2020.

Image credits: Shutterstock, Kitco, Goldrepublic, Wolf of Wall Street, Bloomberg Intelligence, Markets.Bitcoin.com, Goldprice.org, Fair Use, Wiki Commons, Twitter, and Pixabay.

Do you want to maximize your Bitcoin Mining potential? Plug your own hardware into the world’s most profitable Bitcoin mining pool or get started without having to own hardware through one of our competitive Bitcoin cloud mining contracts.

The post Analysts Question Gold’s Safe Haven Status – 2008 Data Shows Central Banks Oversaturated Bullion Markets appeared first on Bitcoin News.

Powered by WPeMatico