Digital currency markets have had a few lackluster days, as the entire crypto market valuation has dropped below the $200 billion mark on Monday. The following day on April 14, a number of cryptocurrencies have seen some slight gains between 2-9%. Meanwhile, global markets are reacting positively as many are starting to feel like the covid-19 pandemic is dwindling down in numbers.

Also read: Crypto Exchanges See Bitcoin Reserves Drop by 70% Since Black Thursday’s Market Rout

The Crypto Market’s Ups and Downs

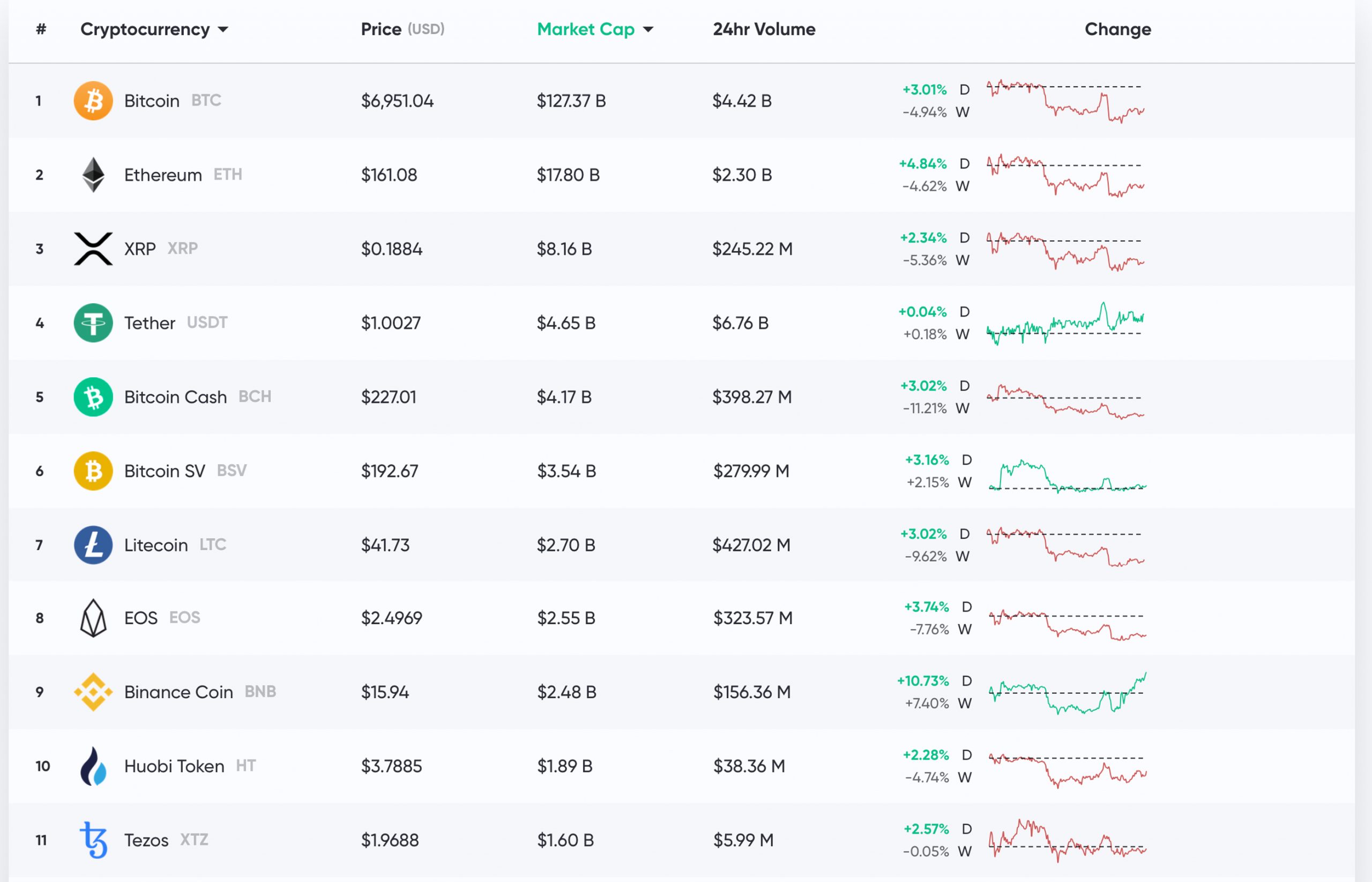

24 hours ago, crypto markets looked bullish as BTC prices jumped above the $7K zone for a short period of time but not too long afterward, the price dumped to the $6,600 range. Since Monday’s trading sessions and into Tuesday, the crypto economy’s market valuation is hovering around $199 billion. At the time of publication, BTC is swapping for $6,950 and has a market capitalization of around $127 billion. The second-largest market cap is held by ethereum (ETH) and each coin is trading for $161.

ETH is up 4% today, but weekly losses show ETH is still down over 4%. XRP holds the third position today, and each XRP is trading for $0.18 per coin. The stablecoin tether (USDT) has managed to recapture the fourth-largest market valuation since Monday’s price drop. USDT still commands a touch less than two-thirds of the entire crypto economy’s global pairs.

Bitcoin Cash (BCH/USD) Market Action

Bitcoin cash (BCH) is trading for $226 per coin on Tuesday and BCH is up 3% during the last 24 hours. However, weekly stats show that BCH is still down over 11% during the last seven days. USDT commands 50% of today’s bitcoin cash swaps and BTC has around 19.2% of BCH trades. These pairs are followed by a big jump from GBP (12.3%), USD (10.3%), and KRW (2.2%). Bitcoin cash has an overall market valuation of $4.1 billion on Tuesday and there’s $522 million in global trade volume. BCH recently halved and BCH miners now get 6.25 coins per block rather than 12.5.

Coronavirus Shows Signs of Slowing

There’s a number of global participants worldwide who are starting to think that the covid-19 outbreak is starting to slow down. This has caused optimism in equity markets and digital currencies have shown resilience, even after Monday’s price drop. Crypto market strategist, Simon Peters from Etoro, thinks that global markets have reacted to “positive numbers out of coronavirus centre.”

“Although traditional markets have been edging up higher thanks to some positive news coming out of coronavirus-hit countries such as Italy and Spain, many commentators are talking of the risk of a global recession,” Peters wrote in a note to investors on Tuesday. “The US and the UK are still yet to hit a peak in terms of infections and deaths, while even President Trump has been taking an uncharacteristically somber tone in his recent statements,” the Etoro analyst added. Peters continued:

Crypto asset markets, on the other hand, have been performing well and some major developments from last week are sure to have a positive impact in the short and medium-term.

The $3,500 CME Gap

On crypto forums and social media, a great number of traders are discussing a CME Bitcoin futures gap that could send BTC spot prices back to that region. A futures gap typically occurs when spot prices continue to trend upwards, while the CME derivatives market is closed. Just a few weeks ago a CME Bitcoin futures gap was blamed for an unexplainable price drop.

“Yesterday target hit of $6,900 next $7,000 n some change — Then dropped — CME gap maybe scam wick,” explained the bitcoin trader Cryptohulk this week. “Bitcoin chart below with rising wedge within the new channel… just play what you see don’t complicate things — Remember the channel is your friend until it breaks,” he added. In fact when BTC slid on Monday from the $7,100 high to $6,600 the dip was blamed on a CME price gap.

“Do you know why bitcoin dumped?” asked the crypto trader Basheer Firozbahary. “It filled the CME gap. Look at this. Bitcoin closed at $6900+ on Friday so it had to be filled.”

Head and Shoulders

A number of digital currency market analysts have also been talking about BTC’s chart showing a bearish or inverse head and shoulders pattern. The head and shoulder (H&S) pattern is considered one of the most reliable technical analysis patterns available. However, some people don’t find the current inverse H&S indicator to be very special.

“What’s so special about a ‘head & shoulders’ pattern, and how it isn’t just a retest of broken support?” tweeted the Twitter account @Wealthseekr. “Moreover, these diagonal HnS…why not just completely ignore the LS/H/RS and look at shorting the retest into the swing low (e.g. the low after the LS)?” he further asked. The crypto analyst called ‘Flood’ noted: “I hate planning out multileg trades, but probably something like in the next few days. I’m bull biased here unless we dump below 6.5k — Then it would be pretty clear invalidation.”

The Verdict: Uncertainty Remains

Overall most traders are still uncertain and there are various different price predictions across the board. Some people think the price of BTC and many other crypto assets will remain steady and not much lower than today’s price. While others believe the upcoming BTC halving will make bitcoin prices skyrocket. Although, there are those who think the price of BTC will drop back to the $3-3.5K region, causing despair among investors. Most traders understand that the slowing coronavirus and slight rebound from global markets doesn’t mean crypto assets are out of the woods. Despite, Tuesday’s crypto market gains, uncertainty remains.

What do you think about crypto asset prices today? Let us know what you think in the comments below.

The post Market Outlook: Bitcoin’s Inverse Head and Shoulders, Covid-19 Fears Decline, CME Futures Gaps appeared first on Bitcoin News.

Powered by WPeMatico