The overall market capitalization of all 5,700+ cryptocurrencies in existence lost around $10 billion during the overnight trading sessions. Most crypto assets have lost 2-5% in value during the last 12 hours, and a number of speculators blame the recent Twitter hack.

The price of bitcoin (BTC) and a number of other digital assets worldwide slumped in value, a few hours after the massive Twitter breach that took place on Wednesday. Since the incident, the overall valuation of all the coins in existence has lost roughly $10 billion and most of the top coins are down a few percentages. At the time of publication, the market capitalization for every coin market is hovering just above the $270 billion range losing 1.47% during the last 24 hours.

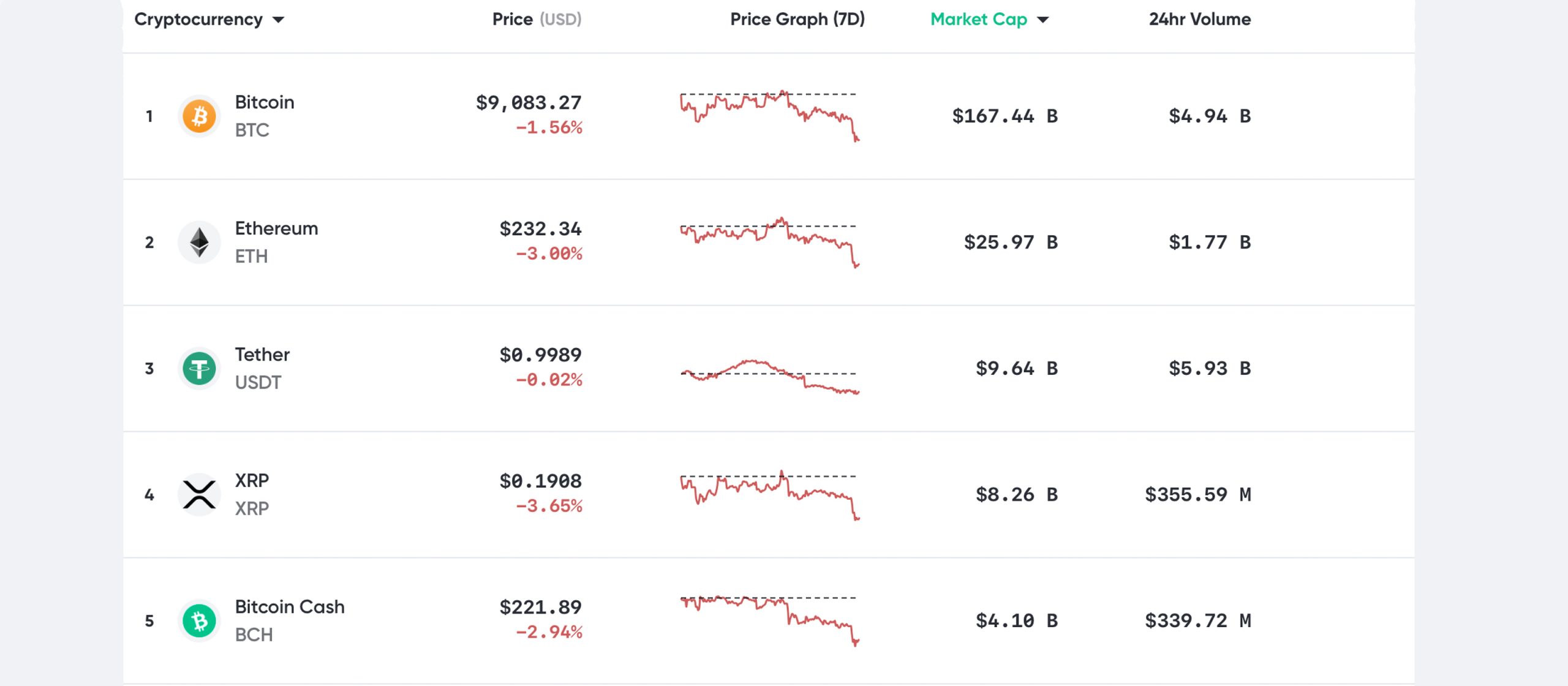

Bitcoin (BTC) is swapping for $9,083 per coin and the market is down 1.56% today. The second-largest market ethereum (ETH) has lost over 3% and each ETH is trading for $232. The stablecoin tether (USDT) is capturing more than two-thirds of the global trades today with nearly every coin as a pair. The USDT market valuation is hovering around $9.64 billion on Thursday and there’s roughly $5.9 billion in global trade volume.

Behind USDT, is XRP and each token is currently trading for $0.19 per coin. XRP has lost over 3.6% during the last 24 hours. Bitcoin cash (BCH) holds the fifth position as far as market valuation is concerned. BCH is swapping for $221 per coin and markets are down over 2.9%. USDT/BCH trades are hovering just above the 58% zone, while BTC is capturing 21% of all bitcoin cash swaps. This is followed by KRW (4.88%), USD (4.82%), GBP (2.74%), ETH (1.41%), and EUR (1.07%).

Selling Pressure and Bitcoin Options

According to a recent tweet from the popular Twitter account @cl207, the range of bid and asks (sellers) is at a “multi-month high.” On July 15, cl207 told his 9,800 Twitter followers: “3% range bids/asks shows that the amount of asks on Bitmex is at a Bitmex multi-month high.” Essentially, it means the price of bitcoin (BTC) has a great number of sell orders to eat through in order to break upper resistance. He added:

Eat through approximately $150,000,000 of sell orders to and we won’t even be at $9,400.

Additionally, data from the market research firm Skew.com indicates that BTC options show traders are expecting a temporary dip. Data from the web portal shows that bitcoin options, specifically one-month put-calls, are leaning toward a bearish downswing in price. On Twitter Skew wrote: “Bitcoin options term structure is record steep. Market pricing-in a quiet summer.” The research team’s official Twitter account also tweeted:

Yesterday is the first day on our record where Okex USDT-margined bitcoin futures had more volumes than BTC-margined bitcoin futures. The shift towards stable coin margining is a big story for crypto markets this year.

Stablecoin Madness

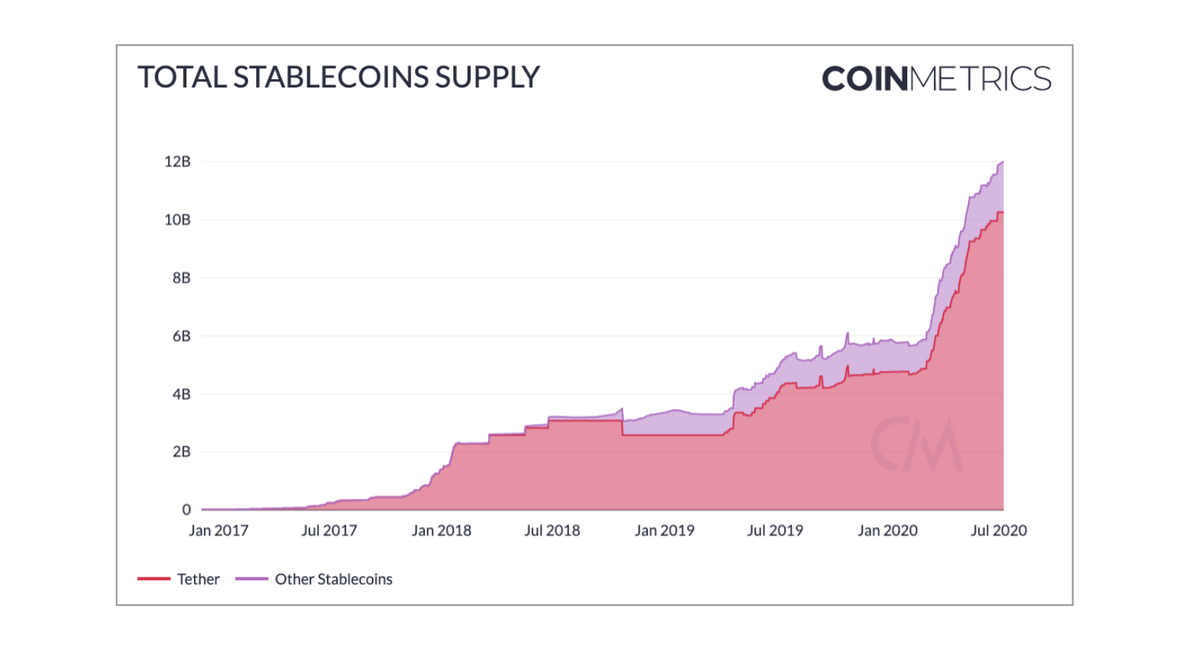

Stablecoins have been extremely popular during the last two years, and the current supply recently crossed $12 billion in value, according to a recent tweet from the cryptocurrency analysis firm Unfolded. Sharing data from the company Coin Metrics, the Unfolded researchers highlighted a quote from a recent Coin Metrics report: “After it took five years for stablecoin supply to reach $6 billion, it only took another four months for it to grow from $6 billion to $12 billion following the March 12th crypto crash.”

Bitstamp and Coin Metrics published a report recently called “The Rise of Stablecoins,” which highlights that tether (USDT) captures a great majority of the $12 billion aggregate stablecoin valuation.

“As crypto matures, stablecoins will mature as well,” the researchers wrote. “If crypto assets are eventually used at a large scale for purposes like international payments and global remittances, stablecoins are a natural candidate for a true crypto medium of exchange.”

Traders Expect a Bitcoin Price Dip Due to Exchange Inflow Metrics

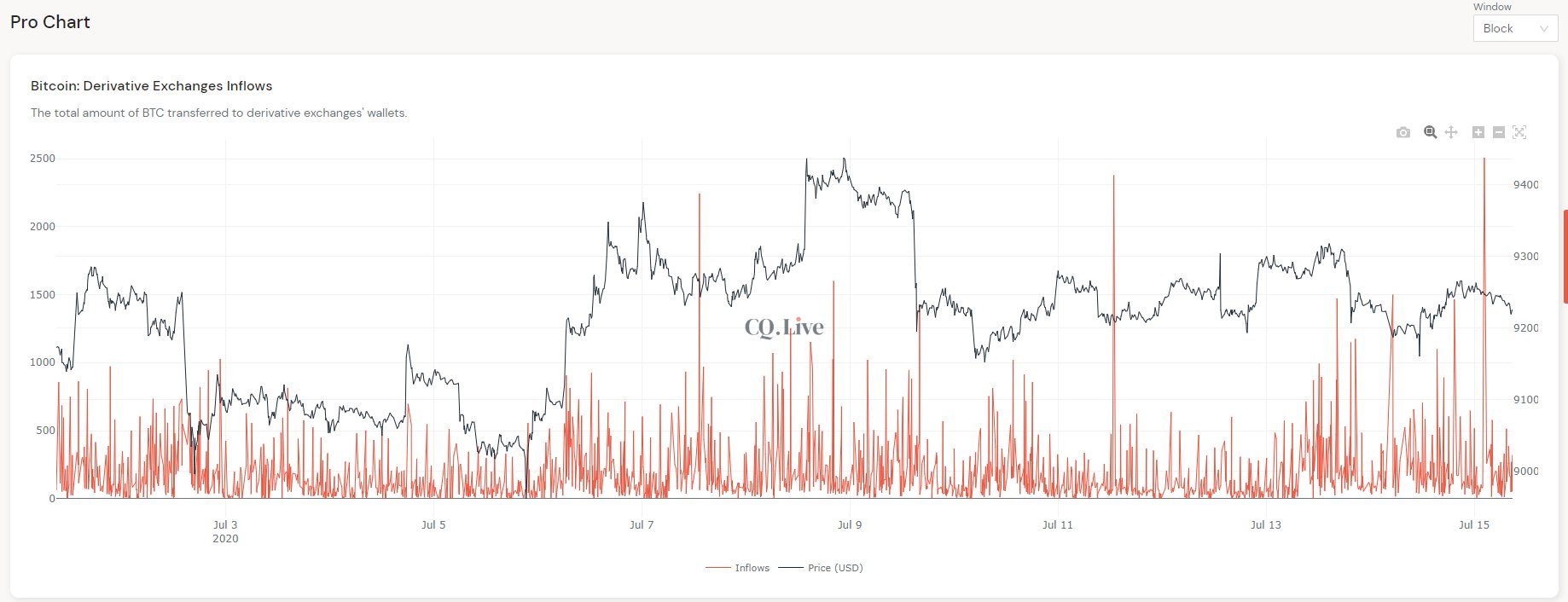

Data from the research and analysis company Cryptoquant and the popular full-time crypto trader on Twitter with 40,000 followers, “Traderxo” (@pandilladeflujo), shows that the price of BTC may see a temporary drop below the $9k range.

Cryptoquant notes that a “small” retracement may take place due to the spike in exchange inflows, which means a great number of traders are depositing coins to possibly sell. Traderxo noted the trend on July 15 when he tweeted:

Inflows showing constant spikes – and some decent amounts being sent to derivatives exchanges. Yet outflows remain relatively flat. Something, something on derivatives while something, something on spot exchanges. Its been a consistent pattern for the last several weeks.

What do you think about the recent cryptocurrency prices on July 16? Let us know what you think in the comments section below.

The post Market Outlook: Crypto Economy Sheds $10B Overnight, Exchange Inflow and Sell Pressure Rises appeared first on Bitcoin News.

Powered by WPeMatico