The largest digital asset by market capitalization, bitcoin has lost a significant share of market dominance during the last few weeks. Bitcoin’s dominance ratio dropped to 61.5% on Thursday, after hovering around 66% for months on end. The last time the crypto asset’s dominance level was around the 61% range was over 12 months ago on June 30, 2019.

Bitcoin has the largest market valuation out of all the digital assets in existence. BTC’s market cap today is around $175 billion out of the grand total of $284 billion that represents the overall worth of all 5,700+ crypto assets.

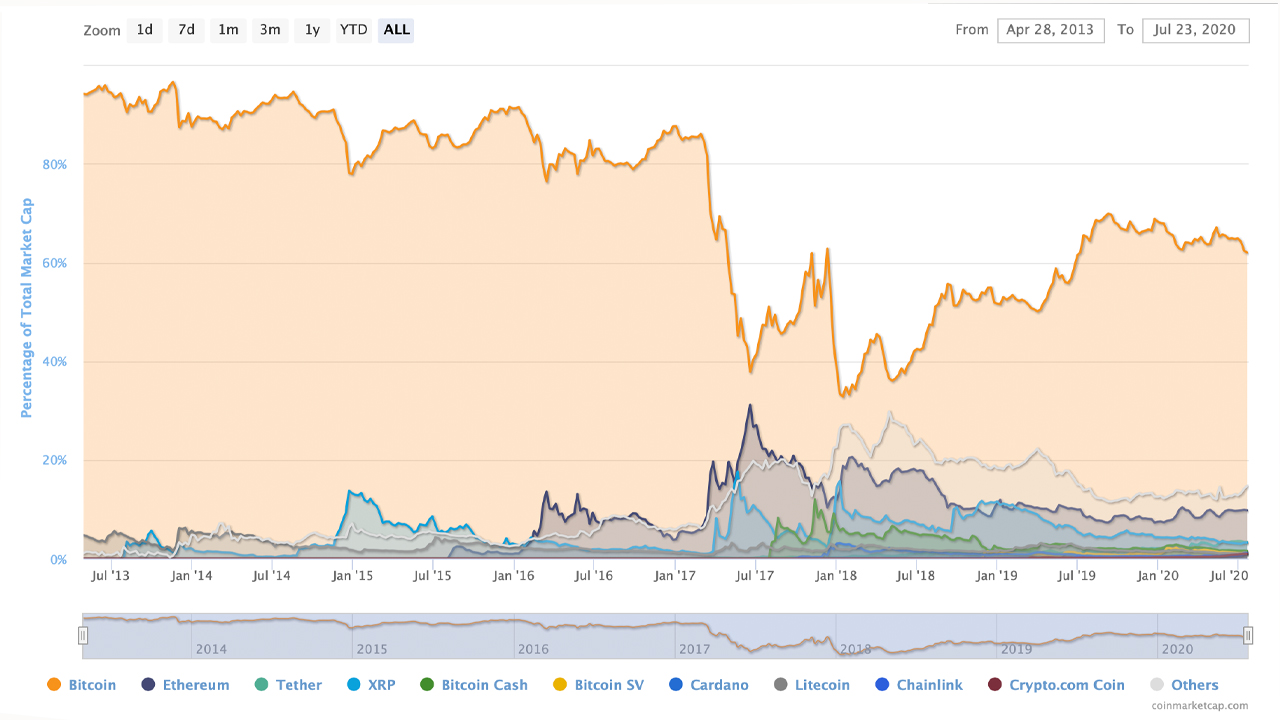

When people refer to the “Bitcoin Dominance Index” (BDI), they are referring to BTC’s market cap compared to the aggregate market cap of all the other coins. Interestingly, BTC’s dominance level stayed consistently above the 77% ratio from 2009 up until March 2017. Most of the time during those six years, BTC’s dominance ratio was between 80-90% on average.

Things certainly changed in 2017, and even though BTC touched an all-time high of $19,600 per coin, dominance continued to drop like a rock. In June 2017, BTC’s market dominance was only 37%, but it regained some of the uptrend capitalization throughout the latter half of 2017 and into 2018.

Bitcoin’s dominance index fell to an all-time low of 32% on January 14, 2018. However, BTC has been able to once again regain some of the capitalization losses, in comparison to the rest of the crypto economy. During the last year, BTC has steadily kept the BDI above the 65% range, but on February 23, 2020, it dropped to 62% for a very short period of time.

Now BTC is below that range again and cryptocurrency proponents are discussing the subject with great fervor. One Redditor from r/cryptocurrency commented on a forum post about the situation and said “Altseason imminent.” The term ‘altseason’ or ‘altcoin season’ is a period of time when alternative digital assets besides bitcoin (BTC), see their market caps increase significantly by undermining BTC’s overall BDI metric.

Of course, altcoin season happened in the summer of 2017 when BTC’s dominance index crashed down to the 37% zone. Just as many speculators assume that BTC prices will grow bullish once again, many also expect an altcoin season to precede the ostensible pending bull run.

Today on July 23, 2020, BTC’s dominance index level at 61.5% indicates that a few high profile digital coins have been gathering bigger gains. The biggest crypto asset market valuation that’s chomping away at BTC’s dominance is Ethereum, as it captures close to 10% of the overall $285 billion crypto coin market cap.

In the past, XRP was a strong contender against BTC’s market dominance, but this isn’t the case so much anymore. XRP does have a touch over 3% of the entire crypto-coin valuation, but tether (USDT) is larger today. The stablecoin tether has managed to become the third-largest market valuation and its ecosystem has been nipping at bitcoin’s heels as of late.

Of course, BTC maximalists have not appreciated the fact that Ethereum’s defi boom is bringing fierce competition to the first cryptocurrency’s dominance levels. Blockstream representative Grubles (@notgrubles) criticized the Ethereum project after ETH saw significant gains on Wednesday.

“So the Ethereum people simultaneously marketed Ethereum as the world computer /and/ knew it wouldn’t scale while they marketed it as such. Am I taking crazy pills or is that just straight-up fraud?” Grubles tweeted.

In response, the popular Twitter account @degenspartan responded to Gruble’s take on Ethereum.

“We need higher ETH/BTC ratio for more takes like this,” Degen Spartan said poking fun at Gruble’s tweet. Blockchair founder Nikita Zhavoronkov also rubbed it in on July 23 and tweeted:

Sorry Bitcoin maxis, but the flippening is in full force now.

Meanwhile, as BTC is up 1.6% today, ETH has spiked over 8% during the last 24-hours. BTC is up a touch over 4% during the last week, while ETH has gained 13% in seven days. 90-day stats show that ETH is wiping the floor with bitcoin’s (BTC) three-month gains, as ETH is up over 41% compared to BTC’s 26% (90-day).

Against the U.S. dollar, BTC is still down 2% for the last 12 months of trading prices, but ETH has gained 22% in the last year. Moreover, there’s a number of other altcoins nipping away at BTC’s dominance levels as well, as coins like ADA, LINK, and CRO have seen significant gains between 119-238% during the last 12 months.

What do you think about Bitcoin’s dominance level dropping to 61.5% on Thursday? Let us know what you think in the comments below.

The post Crypto Race Heats Up: Bitcoin’s Dominance Ratio Drops to Lowest Level in 12 Months appeared first on Bitcoin News.

Powered by WPeMatico