The digital currency asset manager Grayscale told investors on Thursday that the firm has publicly filed a Registration Statement on Form 10 with the Securities and Exchange Commission (SEC) for the company’s Ethereum Trust.

The recent filing is voluntary and if the SEC approves the registration, the Ethereum Trust will be the second crypto asset investment vehicle to obtain the status of a reporting company by the SEC.

Established in 2013 by Digital Currency Group, Grayscale Investments has been around for quite some time now. The firm manages a number of investment vehicles that allow investors to gain exposure to crypto assets like bitcoin, bitcoin cash, ether, horizen, XRP, zcash, ethereum classic, litecoin, and stellar.

In September 2013, Grayscale introduced the Bitcoin Investment Trust which originally was only available to accredited investors. Then the trust got the Financial Industry Regulatory Authority’s (FINRA) approval and Grayscale was allowed to offer shares publicly.

Then on January 21, 2020, the Bitcoin Trust had its shares registered with the SEC and it was the first crypto-based trust to obtain a reporting status from the SEC. On Thursday, Grayscale told investors that it was attempting to get the Ethereum Trust established with the Commission as well.

“If the Registration Statement becomes effective, it would designate Grayscale Ethereum Trust as the second digital currency investment vehicle to attain the status of a reporting company by the SEC, following Grayscale Bitcoin Trust as the first,” Grayscale noted in an investor’s email. Grayscale added:

Furthermore, if the Registration Statement becomes effective, accredited investors who purchased shares in Grayscale Ethereum Trust’s private placement would have an earlier liquidity opportunity, as the statutory holding period would be reduced from twelve months to six months under Rule 144 of the Securities Act of 1933.

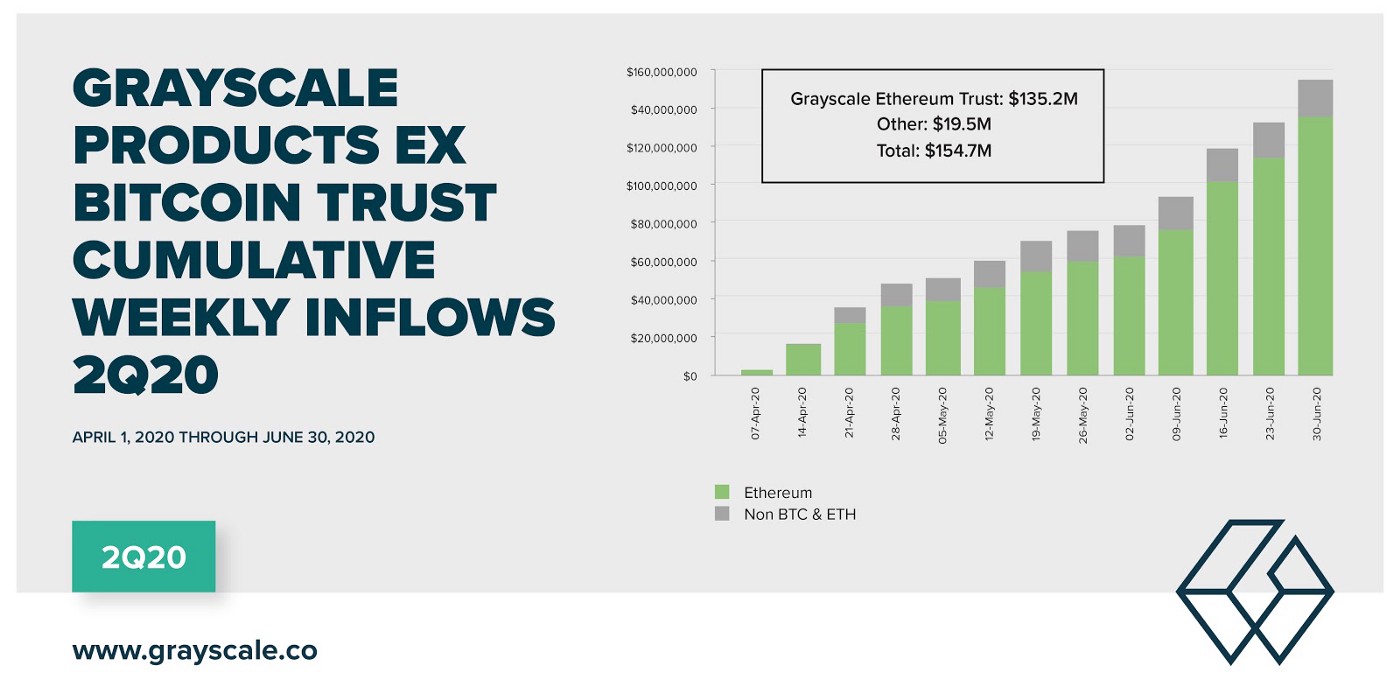

In an announcement post on Medium, Grayscale said that Q2 2020 statistics show that investment into the Grayscale Ethereum Trust hit $10.4 million. “In fact, demand for Grayscale Ethereum Trust accounted for almost 15% of total inflows into Grayscale products during our biggest quarter yet,” the company said. Grayscale’s filing announcement continued:

Today, it’s clearer than ever that there is strong demand for an Ethereum access product.

Both the Medium blog post announcement and the email to investors says that the firm must stress that the filing is completely voluntary.

However, Grayscale does not want the recent Ethereum Trust filing to be confused as an “effort to classify the Trust as an exchange-traded fund (ETF).”

Grayscale’s Registration Statement attempt follows the recent approval by FINRA for the company’s investment vehicles, the Litecoin Trust and the Bitcoin Cash Trust. After the Ethereum Trust registration announcement, Digital Currency Group founder Barry Silbert tweeted that the attempt is a “milestone.”

What do you think about Grayscale’s Ethereum Trust registering with the SEC? Let us know what you think about this subject in the comments section below.

The post Grayscale Investments’ Ethereum Trust Filed With the SEC to Obtain Reporting Status appeared first on Bitcoin News.

Powered by WPeMatico