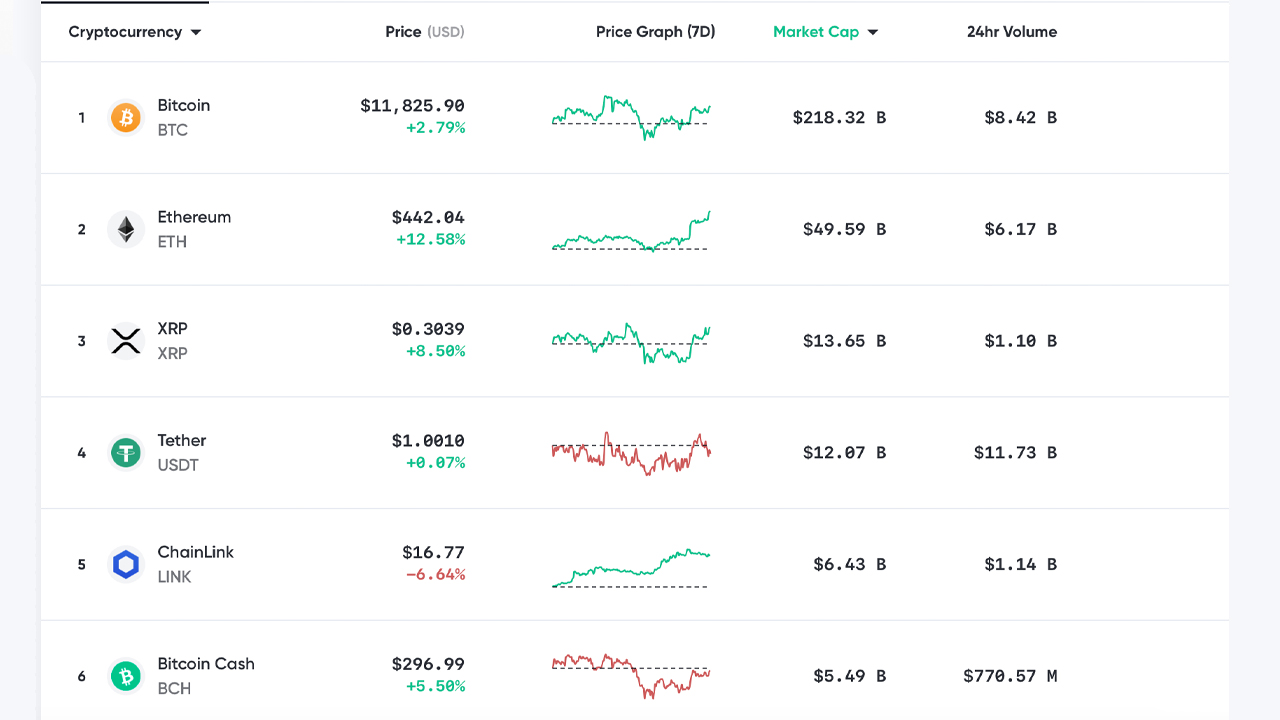

Digital currency markets have increased significantly in value during the last 24 hours as the market capitalization of all 5,700+ coins is up over 2.4% on Friday. Bitcoin has been inching toward the $12k region again and ethereum touched a high over $442 a coin during the afternoon trading sessions.

Crypto Market Cap Crosses $365 Billion

The market valuation of all the crypto assets in existence is around $365 billion on Friday afternoon as a number of coins have seen decent percentage gains. Bitcoin (BTC) is trading just above the 11,800 zone and is up 2.7% today. BTC is also up over 28% in the last 30 days and 26% for the last 90 days. The forerunner in the top ten on Friday is ethereum (ETH), which has gained more than 12% during the last day and ETH is also up 85% during the last 30 days. ETH is currently trading for $442 per coin at the time of publication.

XRP still commands the third-largest market cap and the coin is up over 8% today and trading for $0.30 per coin. The stablecoin tether is still seeing massive trade volume and USDT’s $12 billion market valuation still holds the fourth position.

Another forerunner this week is chainlink (LINK), which saw it’s price peak at $18.00 per LINK, but the coin is down over 6.6% at press time. Currently, LINK holds the fifth-largest market cap and each token is swapping for $16.77 a piece.

Bitcoin cash is swapping for $296 per BCH and the peer-to-peer digital asset is up over 4% on Friday. During the last 30 days, BCH has gained 30% and for the last 90 days, BCH is up over 25%.

The coin has a $5.4 billion market valuation and $767 million in global trade volume. The top seven pairs trading with bitcoin cash (BCH) on Friday include tether (64.3%), BTC (16.6%), KRW (4.43%), USD (4.15%), TWD (4.08%), GBP (1.4%) and ETH (1.31%).

Trader Believes Bitcoin Could Target $14k Next

The popular trader and analyst Jacob Canfield told his 59,000 followers that he can envision the price of BTC hitting $14,800 per coin in the near future. On August 12, Canfield tweeted: “As long as BTC can hold $10,500 support, I think we continue to move up to test the 1.618 extension 1.618 is at $13k and 2.618 is around $14,800 Yesterday’s drop was possibly price suppression and re-accumulation of longs and a bear trap on shorts to fuel the next push up.”

After Canfield made his statement an individual replied “It’s happening.”

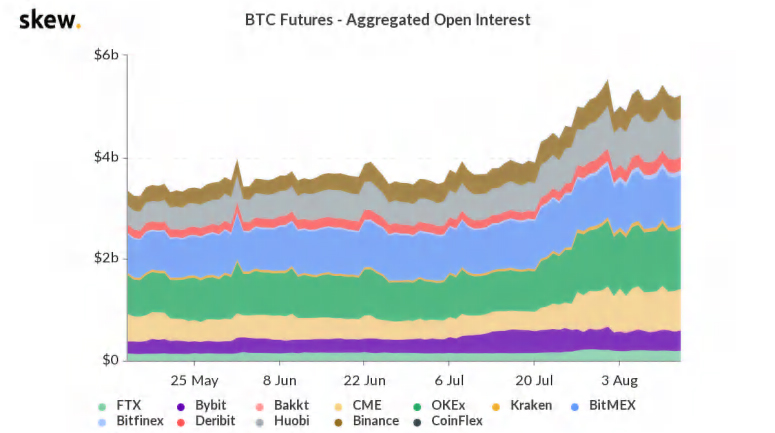

Regulated Futures Exchange CME Group Becomes Third-Largest Bitcoin Futures Mover

This week the Chicago Mercantile Exchange (CME) joined the ranks as one of the largest bitcoin futures providers by order of open interest. On August 13, CME Group posted roughly $800 million becoming the third-largest derivatives exchange. More than $840 million in open interest was recorded on Monday according to the data analytics provider Skew.com.

In fact, the biggest derivatives exchanges worldwide have shuffled in order as far as volumes provided during the last two weeks. The top bitcoin futures movers besides CME Group include Okex, Bitfinex, and Huobi.

LINK May See Rough Seas Ahead

There is no doubt that chainlink (LINK) has jumped massively in value during the last few weeks and even bumped bitcoin cash (BCH) from the fourth position. At press time LINK is down after touching an all-time high of $18 per token. The coin is down 6% today but it is slowly recovering from its prior wounds. However, the research and analysis firm Santiment says that chainlink (LINK) may see “rough waters ahead.”

“LINK is up a whopping +68.7% in the last week,” Santiment tweeted. “However, we are seeing signs that investors are becoming increasingly uncertain in its prolonged rally. Speculative interest has exploded, and we’ve looked into some concerning signs for the #1 trending coin.” The firm also published an analytical report describing why LINK may see some volatile market action.

What do you think about the market action this week? Let us know in the comments section below.

The post Market Update: BTC Inches Toward $12K, ETH Jumps 12%, Report Says LINK May See ‘Rough Waters’ appeared first on Bitcoin News.

Powered by WPeMatico