A recent report by Consensys says the surge in decentralized exchange (DEX) volumes in Q3 of 2020 is down to their adoption of the automated market maker (AMM). According to the report, DEXs that use AMM, a software that algorithmically creates token trading pairs, now represent 93% of the market.

The good side of AMMs

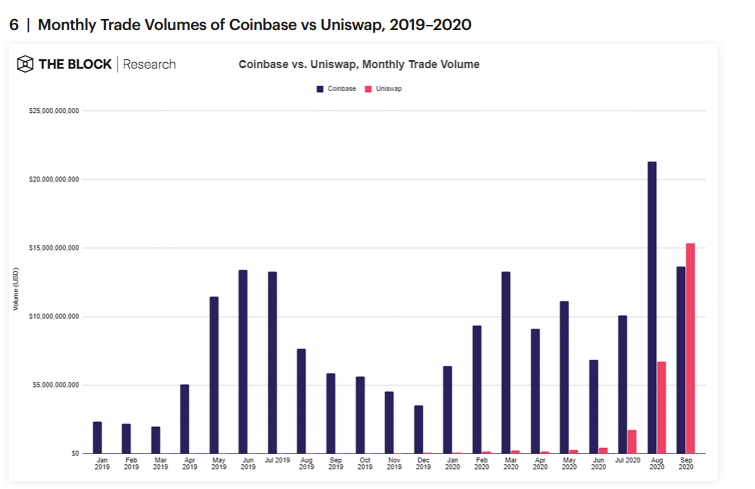

Already, as a consequence of using the AMM, Uniswap’s September traded volume topped $15.4 billion, a figure nearly $2 billion ahead than that of Coinbase’s. Prior to the surge in the use of AMMs, order-books were used instead.

The Consensys Defi report asserts that the increase in use of AMMs is largely down to them being “seen as a valuable way to reduce the chances of human error or manipulation and also to leave a clear audit trail for regulators.”

According to an excerpt from the report, the market maker software’s “success in Q3 proved that AMMs were ready for the mainstream — so much so that the total value of AMMs on Ethereum surpassed $4 billion.”

The key difference between AMMs and order books is that liquidity providers do not compete with each other for order flow. All the liquidity providers avail liquidity only at the prices established by the one algorithm that applies to everyone. The entire order flow is distributed among all the liquidity providers proportionally.

The counter-narrative

However, many within the Defi community space are making the argument against AMMs despite the embrace by DEXs. Expounding on this is Dmytro Volkov, the CTO at CEX.IO who makes one key point:

“(An) AMM creates an inefficient market! Arbitrageurs extract profit from the inefficiencies of liquidity providers, meaning that liquidity providers suffer a loss (or lose profit) to make that possible. This makes such markets very attractive to arbitrageurs because they provide profit basically without risk.”

Volkov also notes that “inefficient liquidity providers are up against arbitrageurs, who are professional or very experienced traders with fast, high-quality arbitrage algorithms.” According to him, the outcome of such a scenario is quite predictable, the professional traders will prevail.

So while the Defi report attributes the increased DEXs volume to use of AMMs, Volkov thinks liquidity providers that currently use this market-making technology, are only using this for the sake of “simplicity” despite the possibility they will incur losses.

Reiterating the same inefficiency point is Sam Bankman Fried (SBF) the CEO at FTX, whose tweet in October makes the argument that “liquidity providers are making a mistake, and bleeding to impermanent loss (IL) but don’t realize it.” The CEO, who says AMMs exist “because blockchains don’t have the throughput to support order-books,” argues that IL is just a “PC euphemism for doing bad trades.”

IL is when a liquidity provider has a temporary loss of funds because of volatility in a trading pair.

No sustainable use case

In his long Twitter thread, SBF ultimately concludes that “AMMs force you to always make two-sided markets at mid. That strategy does not generally do so well. And throwing math at it, or synthetic hedges, or whatever, doesn’t really help.”

In the meantime, John David Salbego, the founder and CEO at Anrkey X praises “the math, algos and initial premise” of AMMs but argues that “there is no real use case or sustainability with AMMs in their current state.”

Salbego, who generally echos the same sentiments as SBF and Volkov, is also concerned with other problems that plague AMMs such as high ETH gas fees, the arbitrage, market price fluctuations and the risk of not filling. Unsurprisingly, IL is cited as another hurdle as Salbego explains:

“Also, I do think having control over your IL is another major challenge holding back this technology, but I see some cool projects working on solutions that seem really promising.”

Dissenting view

However, other players like Viacheslav Akhmetov, the blockchain lead at Mercuryo.io remain hopeful about its prospects. Akhmetov points out that the concept of “AMM is still emerging and there are a lot of new things that could be introduced.”

Others think using a different blockchain could produce better results. Still, they acknowledge that the current popularity of the Ethereum blockchain makes switching between chains difficult.

What are your thoughts on the role of AMMs? Share your views in the comments section below.

The post Decentralized Exchanges That Use Automated Market Makers Now Represent 93% of the Market appeared first on Bitcoin News.

Powered by WPeMatico