With bitcoin prices hovering over a certain handle, a great number of old ASIC mining rigs manufactured years ago are starting to become profitable again. Reports indicate that in China, where the average electricity cost is around $0.06 per kilowatt-hour (kWh), miners are starting to leverage old miners manufactured by Canaan, Bitmain, and others. Chinese bitcoin miners dealing with electronic component price increases have found outdated rigs like the Antminer S9 (10-16 TH/s) are now reaping profits again.

The price of bitcoin (BTC) is making it easier for cryptocurrency miners worldwide to obtain a profit, especially after the recent mining difficulty drop that slid over 16% downwards.

Additionally, BTC prices jumped from a closing price of $11,548 on October 13, 2020, and 30 days later on November 12, the price closed at a high of $16,305 per coin increasing 41.19%. Regional reports from China show that the high BTC prices between $12k to $16k have invoked Chinese miners to start leveraging old miners again.

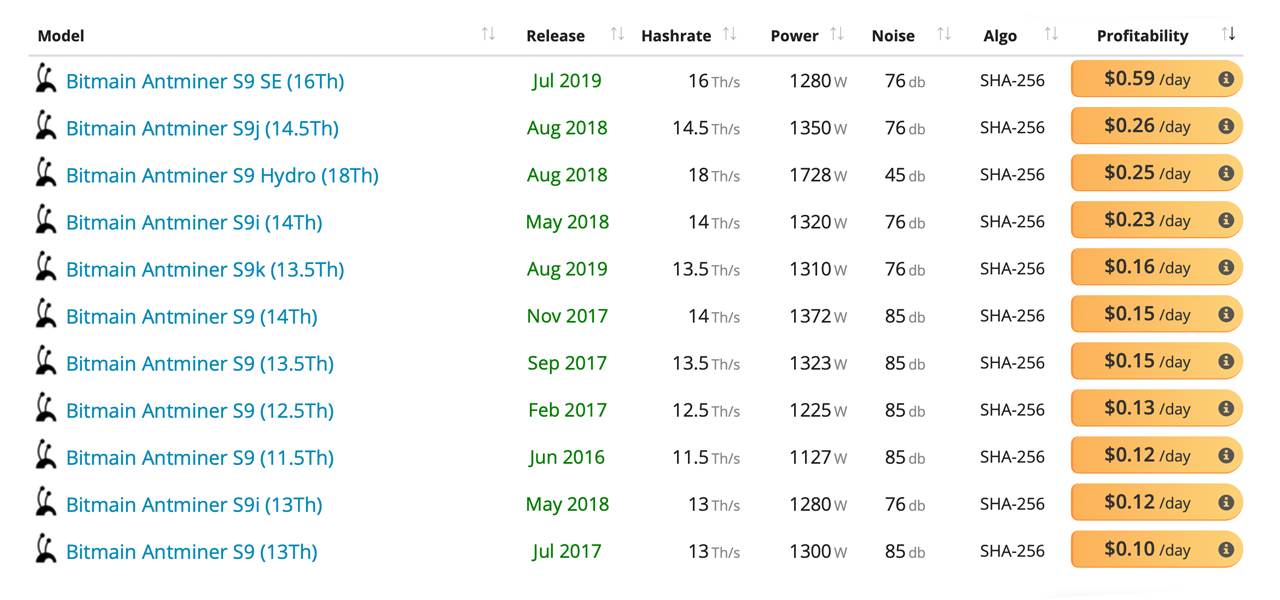

Financial columnist, Vincent He, recently discussed the Bitmain S9 series (10-16 TH/s) and notes that the mining rig is pulling in profits for Chinese miners today. “The price increase of electronic components at the end of the year led to the improvement of S9’s cost performance,” the author noted on November 11.

Old mining rigs are not just pulling in a profit these days with BTC prices so high, the columnist notes. Vincent also says that numerous mining farms are located in desert regions where dust is high, and some are located in regions like Sichuan where humidity is higher than average.

These effects “shorten the life of the machines” and mining rigs like the “S9 has a better stability ratio because of its simple structure and relatively low computing power,” according to the report. Estimates say at one time, the S9 miner (13 TH/s) was so widely used, these four-year-old machines powered around 70% of the BTC hashrate.

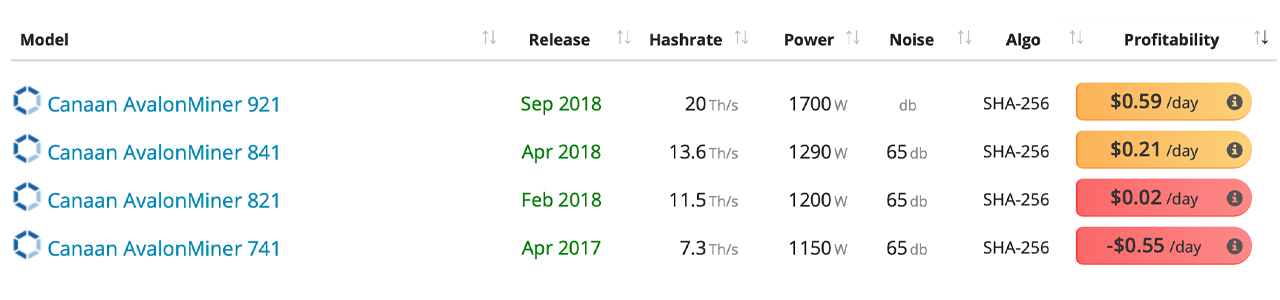

BTC prices have dropped on Friday, November 13, and are a touch lower than the closing price the day prior. But data from Asicminervalue.com indicates that a number of older mining rigs produced by Canaan, Bitmain, and others are profiting at an electricity rate of $0.06 per kWh. Every single Bitmain Antminer S9 with a hashrate between 10 to 16 terahash per second (TH/s) profits today.

Similarly, three old Avalonminers created by Canaan are profiting as well, except for the Avalonminer 821 and 741 series. In addition to the popular S9s and Avalonminers, outdated mining rigs created by Bitfury, GMO, Bitfily, Whatsminer, Halong, Ebang, Pantech, and other ASICs also show profits.

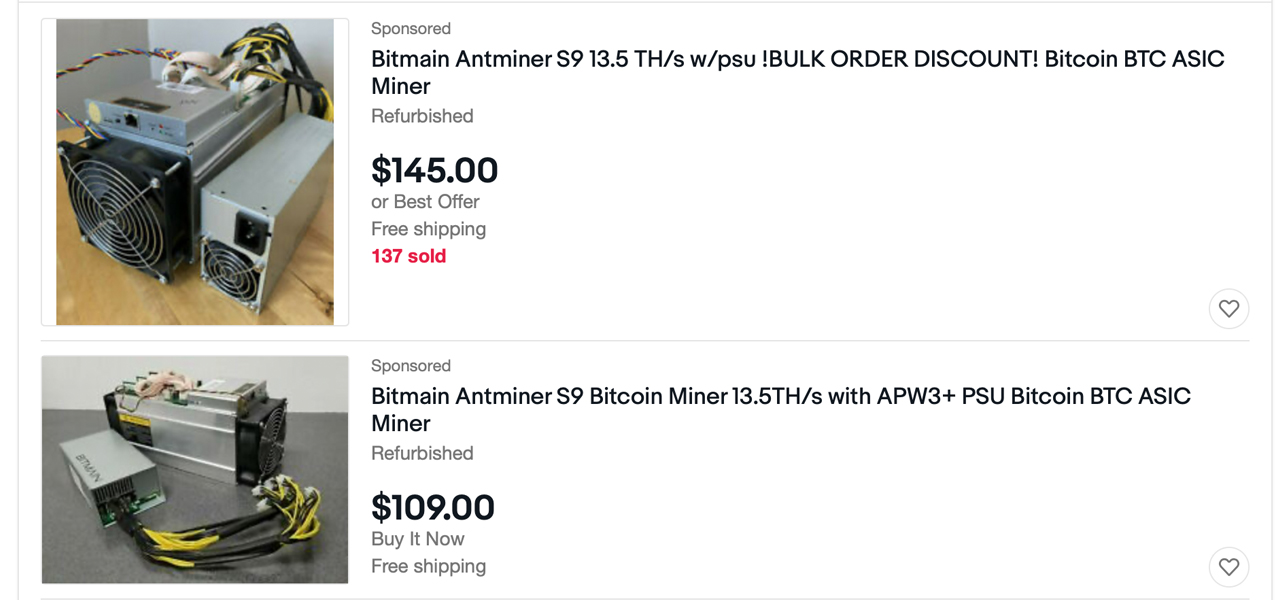

The older mining rigs are also seeing increased prices on second-markets in the U.S. and in Europe on marketplaces like Ebay and Craigslist.

For example, a Whatsminer M3 with 11.5 TH/s is selling on Ebay for $500, while old-school Antminer S9s are selling for $100-$800 per unit. Not too long ago, when BTC prices were lower and the difficulty was higher, outdated ASICs sold for $50-$250 per unit with a terahash output between 10-16 TH/s.

Vincent’s report further notes that next-gen ASIC miners with an output of 70 to 100 TH/s have a greater number of computer boards than older models. The compact design of older mining rigs like the S9 series helps miners in China with warehouse space issues, as well as reducing power consumption the report details.

What do you think about older-generation ASICs like the Antminer S9 making a comeback? Let us know what you think about this subject in the comments section below.

The post S9 Resurrection: Higher Bitcoin Prices Allow Miners to Switch Outdated Mining Rigs Back On appeared first on Bitcoin News.

Powered by WPeMatico