Singapore-based crypto bank Vauld is working hard to elevate crypto to the status of a separate, viable asset class. It combines the functionality of an exchange with all the essential offerings of a bank, except it’s for cryptocurrencies.

Vauld Raises $2 Million

The Vauld team just raised USD 2 million from Pantera, Coinbase Ventures, and CMT digital among others, over the last four months. “The investors loved that we were building to solve for banking with cryptocurrencies,” says CEO, Darshan Bathija.

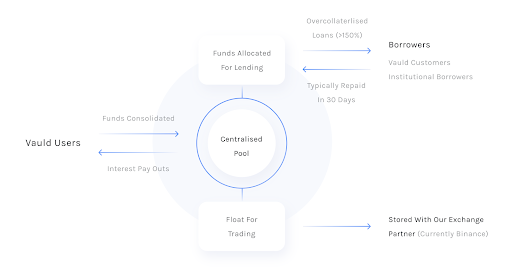

As the crypto market dominates financial news and gears up for what could be its best year in 2021, the Vauld team plans to use the funds to expand its team from 7 to over 20, and initiate an active presence in new markets. The crypto bank currently offers fairly high yields – ranging from 3% to 11% on its customers’ crypto deposits, while simultaneously offering crypto loans and exchange functionality.

Now, the Vauld team expects to double down on these offerings, with higher yields, an OTC desk, and more fiat pairings on its exchange. Vauld’s primary audience is high net worth individuals who, Darshan says, “want to earn yield but would rather not incur capital gains liability as well”.

The team does state that it will continue to be beginner-friendly, inviting new investors to participate in the market. On a related note, Vauld is also quick to recognize that amongst the first concerns in early crypto adopters is the security and safety of their funds. Addressing that rather emphatically is Vauld’s partnership with BitGo, a fairly trusted, leading custodian brand in the crypto world. BitGo’s wallets are insured by Lloyd’s London for a sum of $100 Million.

As for the often ambiguous legal perspective on cryptocurrencies across markets, Vauld says they will “work closely with the commodities and banking regulators to ensure that we and [their] partners are and remain fully compliant through the changing regulatory landscape.”

Vauld is led by Darshan Bhatija and Sanju Sony Kurian, both bringing rich experience in building and scaling startups past their Series A rounds. Darshan has also worked as the head of business of TapChief. Sanju has served as the CTO of Kings Learning, a scaled product of 25 million users.

Vauld’s Offerings

Vauld is an evolved idea of a bank, combined with the potential of cryptocurrencies. Using Vauld, users can lend, borrow, and trade in crypto assets just like fiat currency or conventional assets.

Vauld ticks off the four traditional objectives of a banking institution:

- Store of Value – Ensuring that crypto assets are preserved with adequate levels of security.

- Easy Spending – High liquidity, both on and off its exchange (more on that below).

- Capital Growth – Regular interest payouts on deposits (APY of upto 12% currently offered)

- Exchange – Trade a wide range of crypto assets with each other and the Indian Rupee. (with other fiat currencies coming soon!)

With its products and partnerships, there’s strong potential for Vauld to be a leading player in this newly emerging crypto banking space. The crypto banking concept itself holds considerable potential, and almost heralds the coming of age of the crypto world. If you’re a crypto enthusiast wanting to participate in the industry, Vauld’s referral program probably deserves your attention. The platform promises 40% of the trading fees and 5% of all interest paid or earned, to all its users successfully referring friends. Coupled with its rather active and engaging Telegram community, it’s an enviable user base the brand is building for itself.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

The post Vauld Raises $2 Million to Establish Stronghold in India appeared first on Bitcoin News.

Powered by WPeMatico