Court documents show that the company, Tetragon Financial Group, has filed a lawsuit against Ripple after the firm was charged by the U.S. Securities and Exchange Commission. The court filing indicates that Tetragon and Ripple allegedly made an agreement, and the SEC case deeming XRP as an unregistered security should allow them to get funds back. Moreover, weeks after the SEC charges, former Ripple executive Jed McCaleb sold 28.6 million XRP.

Billion-Dollar Asset Manager Sues Ripple Labs

A recent court filing submitted to Delaware’s Chancery Court shows that Tetragon Financial Group (LSE: TFG) is suing the California-based Ripple Labs Inc. over an alleged agreement breach. The UK-based investment firm has $2.35 billion assets under management (AUM) and the company seeks to “enforce its contractual right to require Ripple to redeem” stocks maintained by Tetragon.

Until payment is made, Tetragon wants Ripple blocked from leveraging liquid assets like cash. Following the initial court filing, reports indicate that Delaware’s Chancery Court Vice Chancellor Morgan T. Zurn issued a temporary restraining order against Ripple.

Litigation reports detail that Zurn issued the order after the filing in the first week of January that attempted to seek Tetragon’s alleged contractual right. On January 5, Ripple Labs Inc. issued a statement about the Tetragon Filing. In essence, Ripple claims the lawsuit has “no merit” because the SEC case has not been decided.

“In Ripple’s Series C investment agreement, there is a provision that if XRP is deemed to be a security on a go-forward basis, then Tetragon has the option of having Ripple redeem their Ripple equity,” the company wrote. “Since there has been no such determination, this lawsuit has no merit,” it added.

Ripple further explained:

We are disappointed that Tetragon is seeking to unfairly take advantage of the lack of regulatory clarity here in the U.S. The courts will provide this clarity and we are very confident in our position.

Jed McCaleb Allegedly Dumps 28.6 Million XRP Worth Over $8 Million USD

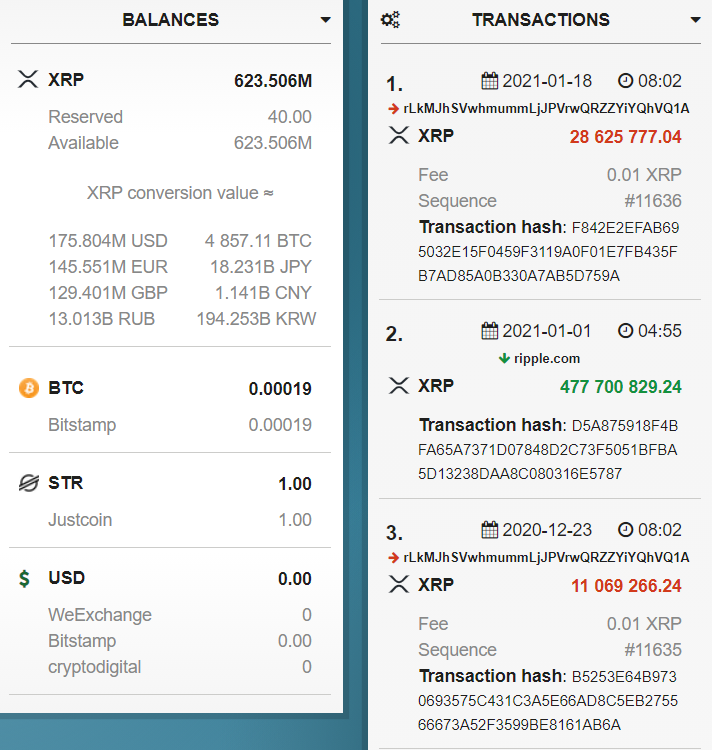

In addition to the recent court filing by Tetragon and Delaware’s Chancery Court’s most recent decision, former Ripple executive Jed McCaleb reportedly sold 28.6 million XRP this week.

The analyst Leonidas Hadjiloizou who has consistently monitored McCaleb’s XRP sales told the public about the most recent million-dollar sale by the Ripple cofounder and the ‘Tacostand’ wallet.

“Jed’s Tacostand had paused XRP sales ever since the SEC lawsuit was announced,” Hadjiloizou said on Monday.

Hadjiloizou continued:

After 25 days of no sales, 28.6 million XRP was sold today.

Meanwhile, XRP’s value has dropped considerably since the initial SEC charges and the delistings that followed afterward. At the time of publication, XRP is trading for $0.28 per unit and has been struggling to stay in the top ten after being dislodged at the end of December.

More recently, polkadot (DOT) and cardano (ADA) have pushed XRP from its former position in terms of market capitalization. During the last seven days, XRP has lost -5.55% and -43% during the last month. Despite these declines, XRP’s 90-day stats (+12.2%) and annual percentage gains (+21.7%) against the USD are still in the green.

What do you think about the Tetragon lawsuit against Ripple and Jed McCaleb alleged 28.6 million XRP sale? Let us know what you think about this subject in the comments section below.

Powered by WPeMatico